Summary:

- Nvidia’s 1Q25 earnings beat expectations, but investor fatigue led to a muted stock response, creating a buying opportunity for long-term investors.

- NVDA’s sales nearly doubled YoY, driven by strong data center GPU demand, with profits growing even faster than sales.

- The upcoming Blackwell-themed data center GPU launch in Q4 is expected to be a significant catalyst for Nvidia’s sales and profit growth in 2025.

- Despite a slight deceleration in sales growth, the Company’s long-term prospects remain strong, supported by robust demand for AI-capable GPUs and high gross margins.

BING-JHEN HONG

Earnings for Nvidia Corp. (NASDAQ:NVDA) beat investor’s expectations with respect to sales and profits, yet the market didn’t really respond as favorably to the company’s earnings as it used to in the past. This, in my view, could indicate some short-term fatigue with regard to Nvidia’s performance, which I think sets investors up for a doubling-down opportunity.

Nvidia’s sales almost doubled YoY in the last quarter, and the GPU pioneer is still seeing a substantial scaling up of profits.

Nvidia’s Blackwell-themed data center GPU is poised for release in the fourth quarter, which should boost the company’s sales moving forward and which could provide a much-needed catalyst for Nvidia’s stock.

In my view, the recent dip is a buying opportunity for long-term investors and I think that with Blackwell sales data soon going to be available, investors will rekindle their love affair with Nvidia.

My Rating History

My bullish view on Nvidia was underscored by a slew of factors including strong sales growth, high gross margins as well as the potential for GPU upscaling, which is the idea that the data center of the future will include substantially more GPUs within each cluster (possibly millions). This presents the GPU pioneer with a catalyst for sales and profit growth at the GPU pioneer.

Even though Nvidia’s business is slowing down a bit, the potential to add substantial sales with regard to Blackwell makes the stock a ‘Buy’.

Nvidia’s 1Q25: Strong Profit Growth, Upcoming Blackwell Launch Is A Catalyst

The primary driver of Nvidia’s outperformance once again was the data center industry, which is ripping GPUs out of Nvidia’s hands as soon as they become available.

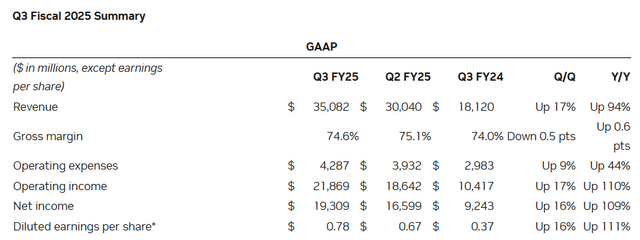

The unfolding revolution in AI, sustained by billions of dollars in investments in large-language models for which Nvidia’s GPUs are needed, is turning out to be sustained growth catalyst for the GPU company: In 1Q25, Nvidia’s sales skyrocketed 94% YoY to $35.1 billion, a quarterly record that has never been achieved before in the company’s history.

The surge in sales is related primarily to Nvidia’s GPUs that are delivered to data centers. This segment produced a whopping $30.8 billion in sales in 1Q25, 88% of the total, and up 112% YoY, reflecting the fastest growth in any of Nvidia’s segments. Sales in the prior quarter were up 122% whereas data center sales climbed 154% YoY in 2Q25.

Unfortunately, Nvidia’s sales have thus decelerated a bit, which may be one explanatory reason why investors have not reacted as positively as they used to in prior quarters.

With that said, it is noteworthy that Nvidia’s profits are growing faster than its sales: Its total sales rose 94% in 1Q25 while its profits, on a per share basis, went up 111% YoY.

Q3 Fiscal 2025 Summary (Nvidia Corp.)

Nvidia’s gross margins, on a GAAP level, presently amount to 75% and edged lower only slightly QoQ, by 0.5 percentage points. Margins are a key indicator of pricing strength for Nvidia, and I anticipate that the shipment ramp of Blackwell GB200 AI servers will have a positive impact on Nvidia’s margins in 2025.

GPU-accelerated computing is obviously providing a big revenue upscaling opportunity for Nvidia and though the GPU company suffered a bit of a deceleration in terms of its sales growth, I am generally bullish on Nvidia’s potential for Blackwell chip sales.

The U.S. data center GPU market is expanding, and this growth is both persistent and accelerating, which is where Nvidia’s Blackwell chip comes in: Blackwell is set to ship in the fourth calendar quarter with sales and shipments anticipated to scale up quickly in the first calendar quarter of 2025.

I anticipate that Nvidia could distribute 2 million Blackwell chips in 2025 (about 500K per quarter) which is poised to yield billions of dollars in incremental sales.

The company’s CEO said earlier this year that he expects to sell the chip to data centers for $30-40K a piece, which would equate to $60-80 billion in incremental sales that Blackwell alone could contribute to Nvidia’s bank accounts next year. Some of these sales, however, replace existing H100 sales, which are Nvidia’s main GPU product so far.

With that said, Nvidia is poised to see a considerable boost in its sales and profits in 2025 and though investors have been well aware of this, the company’s stock price has shown a lackluster response to Nvidia’s earnings. This, on the flip side, creates a buying opportunity.

Technical Chart Situation

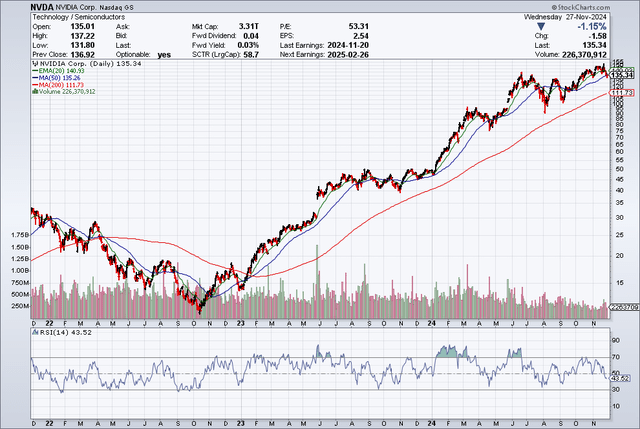

Nvidia’s stock hardly reacted to the company’s 1Q25 earnings a week ago, which could possibly indicate higher levels of investor fatigue when it comes to semiconductor companies. Nvidia’s stock, technically speaking, is in fairly neutral territory, with the Relative Strength Index showcasing a value of 43.5 which makes NVDA neither overbought nor oversold.

NVDA, most recently, fell through both the 20-day and 50-day moving average trend lines, which creates a bit of bearish pressure for the stock in the short term, and I would not be surprised to see Nvidia fall towards 111.73 which is where the 200-day moving average line presently sits. This level should provide considerable support, however, and I would consider doubling down at this price level.

Moving Averages (Stockcharts.com)

How Cheap Is Nvidia?

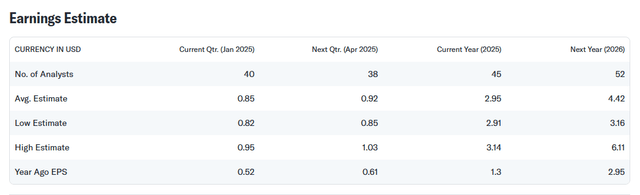

The market models $2.95 per share in profits for Nvidia in 2024, which reflects 127% profit growth YoY. In terms of sales, the market anticipates $129.1B which reflects sales growth YoY of 112%, so Nvidia is projected to continue to grow its profits at a quicker pace than its sales.

Since Nvidia’s stock is presently changing hands for $136, the valuation implies a 2024 profit multiple of 46x. With profits again anticipated to grow 50% next year, the leading 2025 profit multiple decreases to 31x.

Advanced Micro Devices, Inc. (AMD) is selling for profit multiples of 41x (2024) and 27x (2025) and I just explained why AMD is a gift at its present price. I think that Nvidia is not necessarily cheap here with a leading profit multiple of 31x, but the semiconductor company has rarely been a real bargain.

Nvidia’s stock is also considerable more expensive than Advanced Micro Devices, but AMD does not have a Blackwell chip, which, according to Nvidia, is already sold out.

Earnings Estimate (Yahoo Finance)

Why The Investment Thesis Might Be Wrong

The investment thesis hinges primarily on the assumption that demand for GPUs will remain sky-high, and that companies will continue to allocate large chunks of their capital budgets to the purchase of AI-capable GPUs.

If those companies, which are mostly the biggest tech companies in the world, like Microsoft and Google, fail to achieve an adequate ROI on their investments, we could possibly see a retracement in spending on GPUs. Such a retracement could do considerable damage to Nvidia’s margins and valuation.

My Conclusion

Nvidia’s 1Q25 earnings were great on a variety of fronts, but investors seem to display some kind of fatigue, which translates into lackluster interest in the semiconductor company despite robust results.

Nvidia did well in terms of sales, gross margins and profits, and the earnings presentation painted the picture of a company that is moving forward on all fronts, particularly in data centers. Nvidia’s profit growth is something that I was particularly impressed by, as its profits grew even quicker than its sales. Nvidia is seeing a deceleration of its sales growth right now, which might explain why Nvidia’s stock dipped after earnings.

With that said, the long-term trajectory of Nvidia favors the company greatly and with the Blackwell GB200 AI servers shipping in the fourth quarter, I think Nvidia has a catalyst for sales and profit growth in 2025 that the market ultimately will want to reward.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.