Summary:

- Nvidia Corporation has seen rapid growth driven by AI.

- But while everyone seems focused on the short term, there are significant risks in the medium to long term.

- Meanwhile, the stock is priced for perfection.

Vertigo3d

Dear readers,

Nvidia Corporation (NASDAQ:NVDA) has seen a rapid rise in performance fueled by artificial intelligence, or AI, over the past twelve months. And the rise has been so fast that it has left many analysts behind the curve, failing to adjust their forward estimates fast enough.

My coverage on the stock has been mixed. Initially, I was fairly bearish following the jump in price to around $400 per share on aggressive guidance. I wasn’t 100% sold that Nvidia would deliver on the ambitious guidance and didn’t feel comfortable investing at a stretched P/E valuation of 50x+. As an alternative, I recommended shares of ASML Holding (ASML) which traded at a much more reasonable valuation. That trade paid off, but as my understanding of Nvidia grew and the company kept beating its earnings estimates and revising its forward guidance upward, the valuation started to look more reasonable.

Most recently, I published an article on the stock in early January and upgraded it to a HOLD at $536 per share, based on a 39x 2024e P/E and 2024e consensus EPS growth of 66%. I did not go all the way to a buy, because of a number of risk factors which I discussed in detail in my last article – most importantly potential over ordering by Nvidia’s largest customers and competition. Since my last article, the stock has done remarkably well with, an RoR of 67% vs. 9% of the S&P 500 (SP500, SPX).

Q4 results were great, again

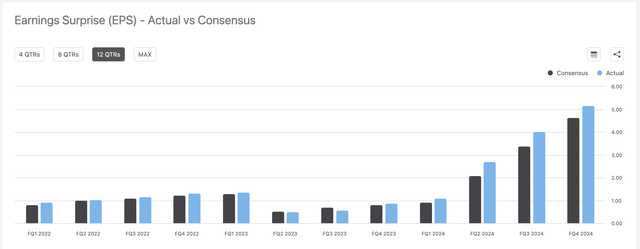

Since the start of the year, the company has reported yet another solid quarter of results on February 26th and delivered a dual beat. Revenue came in at $22 Billion, about 7% above expectations. And earnings came in at $5.16 per share, about 10% above consensus and 28% higher compared to the previous quarter. This quarter represented a fifth major consecutive beat by Nvidia.

These result were primarily driven by strong performance of the data center segment, which is a direct beneficiary of the growth of AI and accounts for the overwhelming majority of Nvidia’s business, and which grew 27% QoQ and 409% YoY during the last quarter. The growth was driven by training and inference of generative AI, as well as large language models (“LLMs”), all of which are in high demand right now.

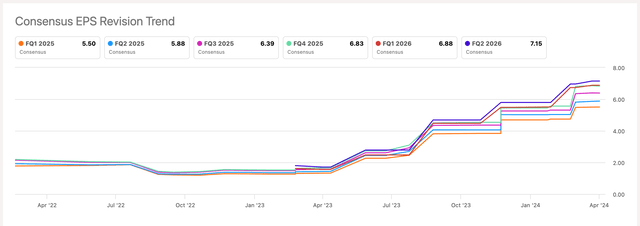

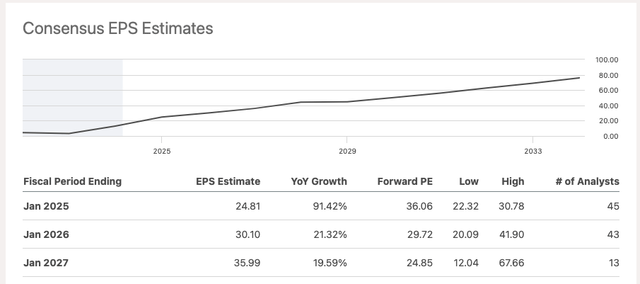

As a result of very good earnings and increased guidance, forward earnings estimates have once again increased. In particular, the Q1 2025e EPS jumped by 16% following the announcement of Q4 earnings and Q4 2025e EPS jumped as much as 22%. Consequently, consensus for overall EPS growth this year increased from 66% to 91%, corresponding to full year EPS of $24.81.

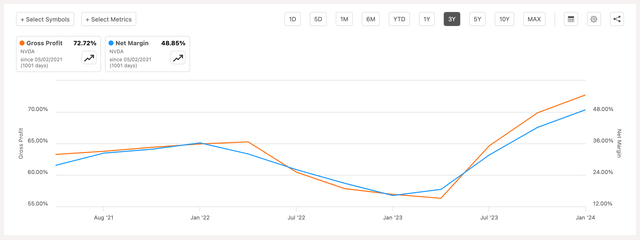

Apart from exceptionally high demand for Nvidia’s chips, earnings growth has been supported by margin expansion with gross margin reaching 72.7% and net income margin at 49%. These are already incredibly high and industry-leading margins, but management guides towards further improvements in Q1 as the gross margin is expected to reach 77%, driven mainly by component cost declines due to favorable commodity prices.

What’s next?

Nvidia has fairly good visibility for this year, because it already has a lot of orders. The general expectation is for the vast majority of growth to come from data centers, with about a 40% contribution from inference. Gaming is expected to decline in Q2 on seasonality, but should pick up in the latter half of the year.

If earnings continue at the current run rate, the stock is a no-brainer buy, but the real question is what happens beyond this year. I have no doubt that AI is here to stay, with an ever-growing number of use cases. Management also spent a fair amount of time talking about the adoption of AI on the earnings call, saying that:

Building and deploying AI solutions has reached virtually every industry.

And cited emerging trends of AI adoption across industry verticals such as autonomous driving in automotive, drug discovery in healthcare, and/or fraud detection in financial services.

But the fear is that companies, and especially big tech, have already stocked up on chips for future projects. This is a fairly common tendency when there’s hype around a new technology. Moreover, it’s only been amplified by high inflation which incentives companies that have cash to spend it. And nobody has more cash than big tech. As a result, it’s very likely that EPS growth will slow substantially beyond this year.

Analysts are optimistic and see EPS growing by 20% per year beyond 2024.

But I fear that if Nvidia’s customer have truly over-ordered and may not need nearly as many chips over the next two years or so, and EPS may even decline from today’s levels. Of course, only time will tell, but I want to be cautious in my forward earnings prediction for this reason. Especially considering the increasing competition from Advanced Micro Devices (AMD) and its Mi300x chip and some of the strongest companies in the world such as Alphabet/Google (GOOGL) and Microsoft (MSFT) which are now developing their own chips, both of which will try to capture some of Nvidia’s market share.

Why Nvidia is not a buy?

Nvidia trades at 36x earnings and 30x forward earnings. But given the risks we’ve discussed, I don’t think investors should put too much emphasis on this. Short-term growth prospects of Nvidia are extremely good, but these are also already priced in.

What truly matters is what will happen beyond this year.

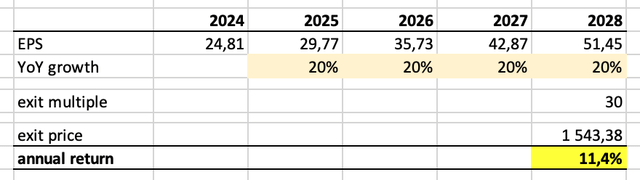

First, let’s consider that consensus estimates hold. This implies 91% EPS growth this year and 20% beyond. This would roughly double Nvidia’s EPS between 2024 and 2028.

Now, the question is whether a double in size is likely.

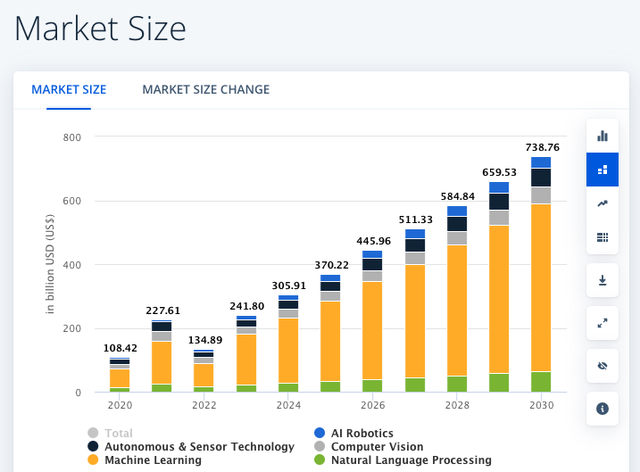

Nvidia now has about a 90% market share in AI-related chips, and frankly (as discussed) its market share will come under pressure from competition. Therefore, more likely than not, all of the growth will have to come from market growth. The AI worldwide market is expected to grow from roughly $300 Billion in 2024 to $580 Billion in 2028. Not quite a double, but close.

So let’s call this our super bull case. Nvidia maintains its market share and fully participates in AI market growth. Then, by 2028, it will be a fully matured company, similar to the way GOOGL or MSFT is today. Assuming a 30x P/E for such a company, we get a price target of $1,500 per share. An annual return of 11.4%. Not bad, but nowhere near what we’ve witnessed in the past.

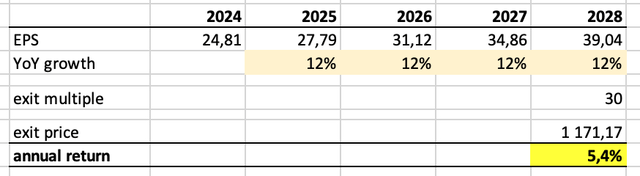

Now, let’s create a more realistic base case. Assume that the AI market will grow in line with expectations, but Nvidia’s market share will decline from 90% to 75% because of competition. An outcome that seems quite possible. In this case, I estimate that EPS will reach $39 by 2028, up about 60% compared to 2024 (not nearly a double, but not bad either). Assuming the same exit P/E multiple, our annual return falls to 5.4%.

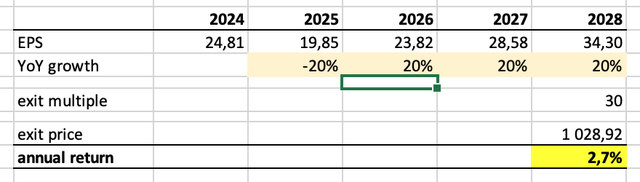

Now, taking this one step further, let’s assume a modestly bearish case. Here, in addition to my base case assumptions, I will assume that Nvidia’s customers did indeed pre-order too much stock and demand will temporarily drop by 20% in 2025 and return to 20% per year beyond. In this case, the price target is barely above today’s price at $1,000 per share, with an expected annual return of just 2.7%.

Note that none of these are doomsday scenarios. But it goes to show that the upside for Nvidia is largely capped at a market level annual return of 11%. A more likely outcome, however, is that if all goes well, investors will earn sub-10% annual returns from the stock over the next 5 years.

Bottom line

Nvidia Corporation is a typical example of a great company, but at a bad price.

The company is doing everything well, but this has led to too much optimism and an expensive valuation. There are risks which should not be ignored, most notably a potential drop in demand due to over-ordering. All things considered, I see Nvidia’s upside as limited. I expect little alpha, but continue to rate the stock a HOLD here at $900 per share.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you want to access my entire Portfolio and all my current Top Picks, feel free to join ‘High Yield Landlord’ for a 2-week free trial.

We are the largest and best-rated community of real estate investors on Seeking Alpha with 2,500+ members on board and a 4.9/5 rating from 500+ reviews:

![]()

You won’t be charged a penny during the free trial, so you have nothing to lose and everything to gain.