Summary:

- Despite Nvidia Corporation’s strong financial performance, we maintain a cautious stance due to potential overinvestment in AI data centers and historical precedents of market saturation.

- Nvidia’s recent rally is driven by data center revenue, with significant revenue concentration from three major customers, posing a risk.

- AI hardware spending may stabilize by 2025, and Nvidia’s current valuation seems to have most future growth priced in, reducing the margin of safety.

- Potential competition from hyperscalers and other players like Advanced Micro Devices could challenge Nvidia’s dominance, making the stock less attractive at current high multiples.

J Studios/DigitalVision via Getty Images

Allow us to preface this article with the admission that as contrarians, we have found ourselves oddly on both sides of the recent AI rally. We rated NVIDIA Corporation (NASDAQ:NVDA) a Buy and Strong Buy when the stock traded at just $16.04, before ChatGPT existed. We held the belief that Nvidia’s AI prospects were likely undervalued when sentiment was low, and only recently decided to take a more cautious approach after the 700%+ rally, despite continued strong sentiment from Wall Street and among Seeking Alpha analysts.

Therefore, in our contrarian spirit, we want to question some key factors underpinning Nvidia’s recent rally and fundamentals, and explain why we maintain our cautious stance despite the strong results announced this quarter, which we discuss in detail. Specifically, we delve into the game theory behind the hyperscaler’s AI CapEx boom, drawing parallels to historical precedents that Nvidia may align with. Then, we look at where we see AI going in terms of AI adoption, and the long-term implications for AI data center spending.

Datacenter Dominance

As the AI revolution is in full swing, this can definitely be seen in Nvidia’s share of revenue in the datacenter segment. This figure amounted to $30.77BN in the third quarter, of which $27.64BN came from Compute and $3.13BN from Networking.

Interestingly, we can see that the recent rally is practically only driven by the increase in datacenter revenue, as most other categories have remained virtually unchanged in comparison. Nonetheless, Nvidia remains a virtual monopoly in the GPU datacenter market, with estimates of Nvidia’s dominance typically exceeding 90%, with some reports putting its market share as high as 98%.

Even Nvidia’s second-largest category, Gaming, came in at $3.28BN in the third quarter, which is virtually the same as the same quarter three years ago when this figure was $3.22BN. Professional visualization revenue is actually down slightly compared to the same quarter three years ago, with revenue in all categories outside datacenter. The automotive category is the only to increase slightly at the margin from $135M in the third quarter of 2021 to $449M in the third quarter of 2024.

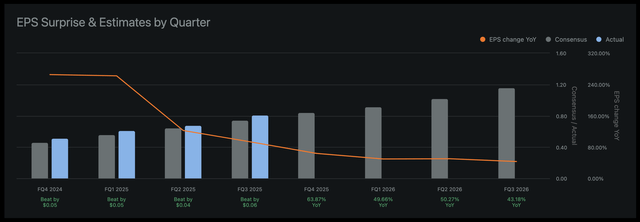

Nonetheless, Nvidia continues to beat estimates in both top and bottom-line results, as has been the case over the last few quarters, despite the market becoming less anemic to positive revisions. Positive results appear to have been priced into Nvidia’s share price last quarter, compared to earlier quarters, when demand for AI datacenter began to increase.

As can be seen in the chart above, earnings per share growth on an annualized basis is also slowly starting to decline to a more sustainable growth rate after previously experiencing triple-digit growth. In addition, demand for GPUs should remain very strong over the coming quarters and EPS growth should remain in the 40-60% range, meaning Nvidia’s financial performance is likely to continue over the coming quarters.

Gross margins on a GAAP basis for the quarter remained strong at 74.6%. However, they declined slightly from 78.4% at the peak two quarters ago, primarily due to a shift in product mix and higher costs within the data center segment. They will likely settle in the low 70s as Blackwell continues to ramp, according to management. On a positive note, operating margins and free cash flow margins remain strong at 62.3% and 47.9% respectively.

This brings Nvidia’s third quarter annualized run rate to a staggering $87.48BN in terms of operating income, while free cash flow stands at $67.26BN. In addition, balance sheet trends also remain healthy, with net debt improving from -$25.04BN to -$28.26BN. Similarly, Nvidia used $12.68BN of excess free cash flow to repurchase shares as part of its $50BN buyback program.

Can’t Spell Hyperscaler Without Hype

This leads us to the question: if Nvidia’s financial results are so fantastic and likely to continue over the coming quarters, why are we taking such a cautious stance?

In our view, a cautious stance is warranted. We are looking beyond the upcoming quarters to what happens to demand for AI data center hardware when things settle down again, as well as some key drivers underpinning this massive rally. In some ways, the recent AI renaissance is one that is currently being driven almost entirely by communications equipment, computing equipment and semiconductors, while the rest of the market is seeing less buoyant industrial production.

The chart above from JPMorgan’s monthly Eye on The Market also shows that AI CapEx and R&D investment is reaching astronomical heights, driven primarily by the Magnificent 7. Looking at CapEx and R&D, a strong divergence can be seen from 2021, with spending of the Magnificent 7 far outpacing the rest of the market.

It is this segment that Nvidia benefits from, with the Magnificent 7 and hyperscalers such as Alphabet Inc. (GOOG), (GOOGL), Amazon.com, Inc. (AMZN), Microsoft Corporation (MSFT), Meta Platforms, Inc. (META) and others in particular accounting for a significant portion of revenue. When you consider that Nvidia only reported customers with a revenue share of more than 10% last quarter, you can see that 3 customers are responsible for an incredible 36% of total revenue, highlighting the risk of the concentration of this rally.

Converted to annual revenue, this means that approximately $50.52BN of annual revenue as of Q3 would come from just three customers, not even considering other large customers that account for 10% or less.

And as for Nvidia in particular, while we have clarity on demand for Blackwell through 2025 and early 2026, we have to ask how much further capex spending can increase beyond Blackwell.

A look at history shows that Nvidia’s share of CapEx spend according to 2026 estimates is among the highest ever compared to market-wide CapEx spend. Only IBM in 1969 and Cisco/Lucent & Nortel in 2000 can match current CapEx spending as a share of market-wide spending, which sets a grim precedent for what follows next for both timeframes.

Similar to Cisco Systems, Inc. (CSCO), Nvidia had the fastest rise in terms of market capitalization ever. However, there are some distinct differences between the dotcom bubble and the current rally. The dotcom bubble could be explained by an extreme expansion of multiples, which is not necessarily the case with Nvidia, as earnings per share growth has followed suit.

But as the saying goes, history may not repeat itself, but it often rhymes. And that could very well be the case with Nvidia if hyperscalers invest too much in infrastructure and demand for future end-user applications turns out to be weaker than expected. Below is a great example of how much hyperscalers’ capital spending has increased, as it has virtually doubled in just over a year, from $136BN to $256BN for four companies alone at an annualized run rate.

Sequoia Capital, which is probably one of the companies that is most familiar with the revenue drivers of AI at application level, has also asked itself what the AI revenues of end users would have to be in order to justify the expansion of the infrastructure. They arrived at an estimated $600BN in revenue that would be required to justify the current $150BN annual spend on data centers. Sequoia and Barclays’ estimates, however, only arrive at an estimated turnover of $100BN at maximum utilization rates.

In other words, there is still the question of where the end user demand will come from to close this gap. Microsoft’s AI revenues, for example, are on track to reach $10BN annualized, according to its latest earnings call. This is substantial but still small compared to capital expenditures in the grand scheme of things, not to mention the fact that the company is at the forefront of implementing AI products for end users. This is also merely considering revenue, not to mention operating results, which are also not particularly spectacular for some end-user applications. OpenAI, for example, is expected to lose $5BN this year on revenues of $3.7BN.

We believe hyperscalers are currently front-loading their investments, which could end up leading to a boom-bust cycle if AI implementation continues to lag. On the other hand, hyperscalers’ actions could be justified from a game theory perspective, as the next peak of computing could shift from sequential to parallel computing. Sundar Pichai, the CEO of Google, also alluded to this fact in a recent earnings conference call:

I think the one way I think about it is when we go through a curve like this, the risk of under-investing is dramatically greater than the risk of over-investing for us here, even in scenarios where if it turns out that we are over investing. We clearly — these are infrastructure, which are widely useful for us. They have long useful lives and we can apply it across, and we can work through that. But I think not investing to be at the frontier, I think definitely has much more significant downside. (Google Q2 Earnings Call.)

On the hyperscalers side, it may not just be AI optimism, but also protectionism when it comes to their cloud computing business, which is one of the most profitable models out there from a free cash flow perspective. If hyperscalers participate in the AI CapEx cycle, they could overspend and face a short-term loss of free cash flow and perhaps some write-offs.

However, if they don’t participate, they risk being disrupted in one of their most profitable business segment from their perspective. Add to that Nvidia’s inelastic demand, constrained supply, and hyperscalers’ massive budgets in terms of free cash flow, and we think that pretty much explains how Nvidia became one of the most valuable companies in the world as we speak.

In some ways, we see Nvidia’s greatest strength as being that it currently has the privilege of leveraging the gigantic free cash flow generated by the magnificent 7, especially the hyperscalers.

As far as real-world adoption of AI is concerned, we see that it is currently only being driven forward marginally in certain sectors, many of which are still in the development/pilot phase. While progress is being made, we believe it is slow compared to the expansion of AI hardware. According to some estimates from the US Census Bureau, even in the information sector, which has the highest AI adoption rate, only about 20% of companies have specifically implemented AI.

A recent survey by New Street Research also indicates that most companies surveyed in most industries are only seeing a 10% or less reduction in costs from using AI. This raises questions about the viability of AI implementation, at least for now.

Some predictions, such as those of Nobel Prize winner Daron Acemoglu from MIT, are perhaps the gloomiest. In his very interesting paper “The Simple Macroeconomics of AI”, he estimates that the impact of AI on productivity will be modest at best. He estimates that the total increase in annual factor productivity growth due to AI advances is likely to be only 0.07% over the next 10 years. His calculations suggest that GDP growth over the next 10 years is also likely to be modest, in the order of 0.9-1.1% overall over 10 years in total.

Not A “Fat Pitch” Anymore

Another key variable in our cautious stance on Nvidia is the safety we have historically found in investing in Nvidia based on current fundamentals and projected earnings. There have been times when Nvidia could actually be considered expensive looking at trailing 12-month earnings. We could find safety in the fact that the stock actually remained cheap based on forward guidance driven by predictable demand, with multiples often in the low 20s.

This no longer appears to be the case, as we believe most expectations for future growth are now priced into the stock. We still see significant demand for Blackwell from hyperscalers and large-cap tech companies beyond EOY 2025 and perhaps even into 2026, but looking at EOY 2026 estimates, i.e., fiscal 2027 for Nvidia, the stock still trades at 24.97 times projected EPS estimates.

We broadly agree with Sequoia’s prediction that AI hardware spending is likely to stabilize from 2025 onwards, and would therefore apply a more cautious multiple of no more than 20x to FY2027 estimates. This would put the stock at $111.6 per share, as the demand outlook could change rapidly due to the factors mentioned above.

We must not forget some risks associated with this argumentative AI surplus in terms of game theory that we are currently seeing. These include such possibilities as these trends reversing as the AI hardware gold rush begins to saturate and perhaps competitors enter the space attempting to break Nvidia’s 90 percent dominance in the AI data center space. It could even be that competition is starting to come from its own customers. These include such as Amazon AWS, which is currently already using silicon specifically for inferencing, or other players such as Advanced Micro Devices, Inc. (AMD), which is trying to catch up to Nvidia’s lead with its upcoming Instinct MI325X.

If history is any precedent, very few companies have managed to maintain such market dominance in one area over a long period of time, except perhaps in lithography with ASML Holding N.V. (ASML). Remember that it wasn’t long ago that Intel Corporation (INTC) dominated almost 100% of the server CPU market in 2016, which has since shifted to 75%, with AMD successfully driving a 25% wedge into that market.

However, coming back to fundamentals and future earnings, we see to some extent that our margin of safety is mostly eroded at current prices. Nvidia trades at a forward EV/EBITDA of 40.22x. This is is at the high end of the historical range over the past two years, even though the year-over-year change in EPS growth is down significantly from the immense triple-digit gains of recent quarters. However, on a TTM basis, EV/EBITDA estimates remain relatively anchored and at the lower end of the range, but still expensive at 45.17x in our view.

From a technical perspective, we would also not be surprised to see Nvidia test the bottom of the trading range, where it currently sits at our Fibonacci retracement. This would be at $116 and closer to our target of $111.6 per share based on an 18x P/E for fiscal 2027. We would also take due note of the recent decline in volume as this could signal a decline in speculative buying, signaling an end to the recent rally.

Tradingview, Wright’s Research

The Bottom Line

As we now enter what, we believe, is the final stage of the initial AI gold rush, it will be interesting to see how the CapEx cycle for AI hardware evolves from a game-theoretic perspective among hyperscalers. Personally, we believe that the current overinvestment in hardware will taper off starting in 2025, which means we could be wrong and there could be a bit more upside going forward than we expect.

However, we continue to be cautious as we believe there is a lot of fragility behind the demand for AI hardware, which, we believe, is concentrated and likely to follow a boom-bust cycle. At present, we do not yet see enough evidence of large-scale adoption at the end-user level when looking at surveys on adoption rates and cost reductions to justify the current CapEx spending.

Similarly, we believe that Nvidia’s previous margin of safety, which trades favorably considering future multiples, is largely priced into the stock at current levels. Furthermore, it is difficult to gauge how the competitive landscape will evolve as competition from AMD slowly increases and hyperscalers themselves develop their own silicon. Another thing to bear in mind are the risks highlighted in our previous articles, including geopolitical risks such as Taiwan and China as well as insider selling, which has been increasing.

In conclusion, while Nvidia’s performance has been phenomenal, we want investors to remember that however optimistic things may appear, there are natural limits to growth, which is why there is a saying that trees don’t grow to the sky.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.