Summary:

- Nvidia Corporation’s stock has dropped by about 20% from its recent all-time high, presenting a potential buying opportunity.

- Nvidia remains the most lucrative AI stock globally, with a dominant position in GPU technologies and the data center segment.

- Nvidia’s recent earnings results have been exceptional, surpassing estimates and indicating significant growth potential.

- Nvidia should continue outpacing consensus estimates, leading to a considerably higher stock price in future years.

Justin Sullivan

Nvidia Corporation (NASDAQ:NVDA), the “godfather” of artificial intelligence (“AI”) stocks, has dropped by about 20% from its recent all-time high as the rolling correction ravages the stock market. However, we should see more transitory downside in Nvidia as the selloff continues, and there is a high probability that we will have a considerable buying opportunity soon.

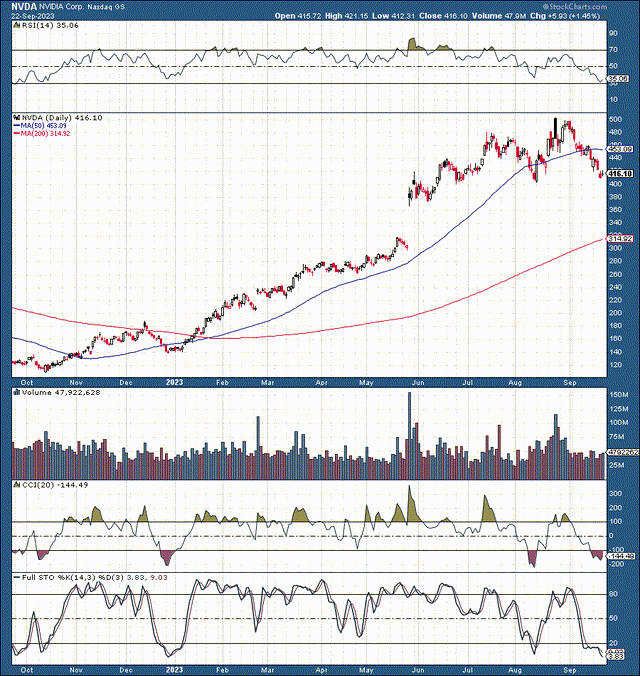

Nvidia: 1-Year Chart

Nvidia could break through critical support in the $400-380 range, leading to an accelerated selloff into my $370-320 buy-in rage, coinciding with a crucial gap-fill around the $320 level.

Nvidia remains the most lucrative AI stock globally. Nvidia produces the most powerful GPUs, enabling it to do much of the “heavy lifting” in the burgeoning AI field. Moreover, Nvidia’s data center segment continues to expand rapidly and should continue gaining market share and increasing revenues.

Nvidia’s recent earnings announcements were excellent, and it should continue surpassing analysts’ estimates as we advance. Furthermore, despite Nvidia’s substantial run-up since the bear market bottom, its forward P/E ratio (fiscal 2025) is relatively low (25 consensus estimate). Moreover, Nvidia’s valuation should become even cheaper as its stock price drops in the coming sessions. Also, we should continue seeing revenue and EPS growth outperformance, suggesting that Nvidia’s stock is cheaper than it seems.

We should have an extraordinary long-term buying opportunity as Nvidia’s stock enters my $370-320 buy-in range.

Nvidia: “The Godfather” Of AI That Does The Heavy Lifting

“Companies in every industry are racing to adopt generative AI.” – Jensen Huang, founder and CEO of Nvidia.

Nvidia’s world-leading technologies power the leading systems manufacturers’ servers, enabling companies in any industry to ready their business for generative AI. Nvidia-powered generative AI could allow hundreds of thousands of firms to implement applications like intelligent chatbots, assistants, search and summarization, and more.

Estimates suggest that Nvidia-powered generative AI cloud may add up to $4.4 trillion to the global economy annually. Generative AI cloud benefits for enterprises include privacy, choice, performance, data center scale, lower cost, accelerated storage, “accelerated” networking, rapid deployment, and more.

Nvidia offers the most advanced AI solutions ready for enterprises today. Nvidia’s advanced AI program provides the “whole package.” With Nvidia, organizations get the latest cutting-edge technologies. Moreover, Nvidia provides a whole spectrum of AI models and services, AI platform software, and the AI supercomputer.

Nvidia offers advanced AI services, software, and hardware solutions simultaneously. Moreover, Nvidia possesses the most advanced GPU technologies required to do the “heavy lifting” powering AI. Therefore, Nvidia is the “Godfather” of AI and should continue benefiting as the AI revolution takes off.

Nvidia’s spectacular revenue growth should continue, and the company has an exceptionally long growth runway due to its dominant position in GPU technologies and its market-leading position in the data center segment and AI. Furthermore, Nvidia should become increasingly profitable, leading to a much higher stock price in the coming years.

Best Earnings I’ve Seen In Over 20 Years

Nvidia’s results speak for themselves, and its recent earnings results are the best I’ve seen in my 20-plus years of investing. It all started earlier this year when Nvidia reported its blowout fiscal Q1 2024 earnings results. Nvidia crushed the estimated revenue figure, delivering approximately $7.2 billion vs. the expected $6.5 billion. While the 10% revenue beat was highly impressive, Nvidia’s Q2 2024 guidance shocked the world, opening my eyes to the enormous AI opportunity in Nvidia’s stock.

Nvidia guided fiscal Q2 2024 revenues of $11 billion vs. the anticipated $7.11 billion. This result was a staggering 55% revenue increase over the consensus estimate. This guidance was on top of Nvidia’s Q1 record data center revenues, illustrating its enormous potential in AI.

Fast-forward to fiscal Q2 2024 – Nvidia reported $13.51 billion in revenues vs. the anticipated $11.22 billion estimate. Therefore, Nvidia’s Q2 revenues were 90% above the initial estimate, a 102% YoY increase. Additionally, Nvidia reported surging data center sales of $10.32 billion, 29% above estimates. Moreover, data center revenues skyrocketed by 171% YoY.

Again, Nvidia provided shocking revenue guidance of $16 billion for fiscal Q3 2024, 28% above the $12.5 billion estimate. Nvidia’s stellar results and extraordinary guidance illustrate the jaw-dropping demand in the data center space. Furthermore, we must recognize Nvidia’s market-leading position in AI. Its data center sales growth significantly surpasses its rivals like Advanced Micro Devices, Inc. (AMD) and Intel (INTC).

In addition, Nvidia approved a $25 billion buyback program and recently introduced a dividend. Furthermore, Nvidia’s profitability is improving considerably, as it provided $2.70 in EPS last quarter vs. the expected $2.07 per share.

“Nvidia Is Expensive” – It’s A Myth

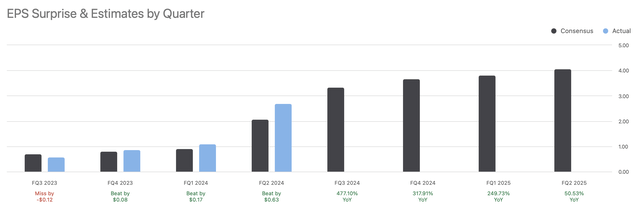

EPS vs estimates (Seeking Alpha)

I often hear that Nvidia is expensive. Unfortunately, I used this excuse to sell Nvidia before its stellar run-up above $300. On the contrary, Nvidia’s earnings growth potential illustrates that its stock is inexpensive. Next year’s (fiscal 2025) EPS estimates are $16.27, suggesting that Nvidia trades at only 25 times forward earnings here (consensus estimates). Nonetheless, we saw Nvidia’s EPS skyrocket recently, substantially surpassing the consensus estimates. Last quarter, Nvidia beat consensus EPS estimates by over 30%. Therefore, there is a high probability that Nvidia will continue outperforming the consensus estimate figures in the coming quarters.

We could see Nvidia outperform EPS estimates by around 20% in fiscal 2025, implying Nvidia may earn approximately $20 instead of the $16.27 consensus mark. With its stock around $400, Nvidia trades around 20 times forward EPS, exceptionally cheap for a company in Nvidia’s dominant, market-leading position and substantial growth potential ahead. Due to Nvidia’s leading role in AI, it could continue exceeding analysts’ estimates, enabling its share price to go substantially higher in the years ahead.

Where Nvidia’s stock could be in future years:

| Year (fiscal) | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 |

| Revenue Bs | $90 | $123 | $154 | $184 | $217 | $250 | $280 |

| Revenue growth | 63% | 37% | 25% | 20% | 18% | 15% | 12% |

| EPS | $20 | $29 | $36 | $44 | $53 | $62 | $70 |

| EPS growth | 82% | 44% | 25% | 22% | 20% | 18% | 15% |

| Forward P/E | 25 | 27 | 28 | 27 | 26 | 25 | 24 |

| Stock price | $750 | $972 | $1232 | $1431 | $1612 | $1750 | $1828 |

Source: The Financial Prophet

Risks to Nvidia

Despite my bullish projections, Nvidia faces several risks. While Nvidia is the market leader in GPU technologies and AI, AMD, Intel, and others are worthy competitors and could take market share from Nvidia as we advance. Also, Nvidia’s revenues could expand slower than projected, and its profitability may be less prominent than my expectations project. It’s also plausible that Nvidia’s data center segment demand slows more significantly than anticipated, leading to revenues and EPS declines instead of providing steady growth in the years ahead. We could also see a lower P/E multiple for Nvidia, suggesting its share price may climb slower than my estimates suggest. Investors should examine these and other risks before committing capital to an investment in Nvidia’s stock.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA, AMD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long a diversified portfolio with hedges.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Are You Getting The Returns You Want?

- Invest alongside the Financial Prophet’s All-Weather Portfolio (2022 17% return), and achieve optimal results in any market.

- Our Daily Prophet Report provides crucial information before the opening bell rings each morning.

- Implement our Covered Call Dividend Plan and earn an extra 40-60% on some of your investments.

All-Weather Portfolio vs. The S&P 500

Don’t Wait! Unlock Your Own Financial Prophet!

Take advantage of the 2-week free trial and receive this limited-time 20% discount with your subscription. Sign up now, and start beating the market for less than $1 a day!