Summary:

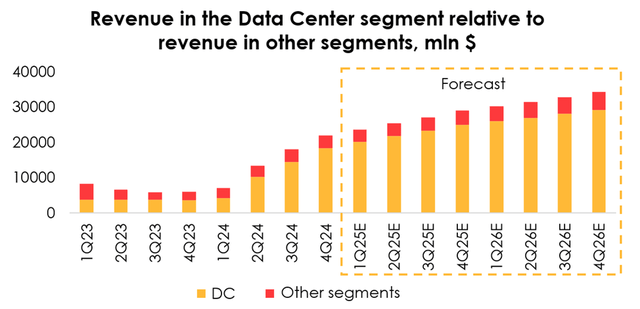

- Nvidia Corporation’s data center segment continues to be the company’s revenue driver, with revenue totaling $18.4 billion in Q4 2024.

- The company faces risks related to supply shortages, competition from big tech companies making their own chips, and new chips from competitors like AMD.

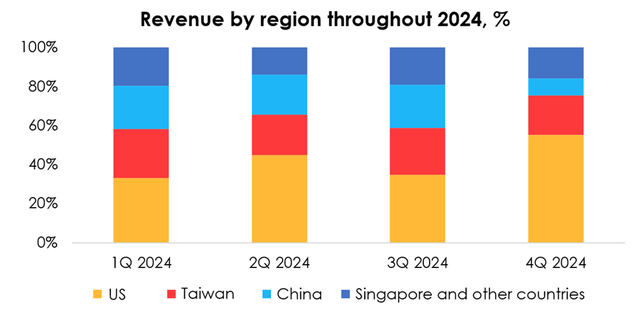

- Revenue from the Chinese market in the data center segment declined significantly, but the rest of the world’s regions, especially the U.S., compensated for this decline.

Justin Sullivan

Investment thesis

Nvidia Corporation (NASDAQ:NVDA) revenue in the data center segment totaled $18.4 bln in 4Q 2024 (+409% y/y and +27 q/q), topping expectations of company’s analysts and investors and continuing being the company’s revenue driver. The company raised guidance for 1Q 2025 and now expects a revenue of $24 bln +/-2%, which will be largely driven by the data center segment.

The huge demand for NVIDIA’s data center equipment shows no signs of slowing, but the company faces risks related to:

- not enough supply;

- big technology companies making their own chips to reduce costs and the lead time for their orders;

- new chips from competitors (e.g., Advanced Micro Devices’ (AMD) refreshed MI300).

In this report, we’ll focus on these concerns, China’s share of Nvidia’s data center revenue and the gaming segment update. Based on our estimates, we are assigning a HOLD rating to NVDA stock.

We hadn’t previously published an analysis on this stock, but we’ve been covering it for more than 3 years.

Data centers continue to drive Nvidia’s revenue, even as share of China’s market falls

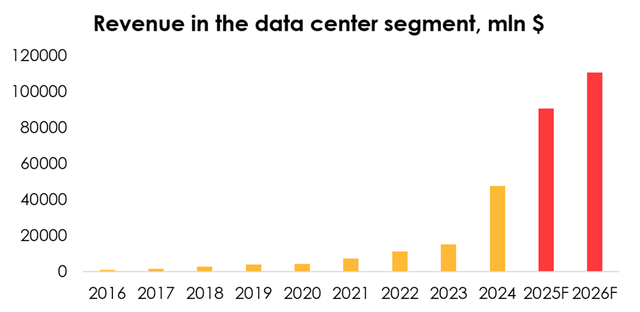

Revenue in the data center segment totaled $18.4 bln in Q4 2024 (+409% y/y and +27 q/q), making up 83% of Nvidia’s total revenue. Equipment that Nvidia makes for data centers continues to enjoy huge demand, while supply hasn’t been able to catch up, even as production is ramping up at a rapid clip. This issue was also raised at the recent Morgan Stanley Technology, Media & Telecom Conference.

Demand for the Hopper series continues to grow, especially in anticipation of the release of the Hopper H200, with initial shipments expected in Q2 of this calendar year. The next major release (tentatively in Q4 of calendar year 2024) is set to be the Blackwell B100 GPU, which will substantially increase performance capabilities per watt over the H200 by utilizing a chiplet design. Nvidia will likely release a new type of chip every year, which will smooth out the volatility of its financial results from product to product, as well as help bolster the company’s position relative to its competition. As for competitors, the updated AMD Instinct MI300 (expected to be announced later this year) could be powerful enough to compete with the Nvidia Blackwell B100. Both of these chips will feature HBM3e memory.

As part of the InfiniBand business, it is expected that in Q1 of calendar year 2024 there will be a start of production of Spectrum-X, an Ethernet networking platform for artificial intelligence (“AI”) that will deliver higher network performance for data processing, compared with traditional Ethernet.

Large consumer Internet companies and cloud service providers continue to make up as much as 50% of demand for data center equipment, but the management has made a particular mention of the widespread adoption of generative AI by other sectors, including healthcare, the automotive industry and financial services.

Over time, government agencies could become an additional driver of demand for the company’s products, but currently there is no material contribution to revenue from that segment.

In Q4 2024, revenue from the Chinese market in the data center segment declined significantly, making up 9% (-13 pp q/q) of the company’s total revenue, which was compensated more than enough by the expansion of the data center segment in the rest of the world’s regions, especially the U.S., which accounted for 55% (+20 pp q/q) of revenue in Q4. The trend of revenue distribution by geographic regions was inevitable due to due to the expanded export restrictions announced in October 2023.

According to Nvidia’s CEO, the company is currently offering Chinese customers samples of its two new AI chips designed to meet export requirements. As for the most powerful AI chip designed for China, the H20, production will begin in 2Q of calendar year 2024. In early February 2024, it was reported that the company was taking pre-orders for the chip, and distributors were pricing the H20 on par with the 910B Ascend, a rival product from Huawei (the H20 costs up to 110 thousand CNY, while the 910B Ascend costs 120 thousand CNY).

Despite Nvidia’s desire to defend its previously dominant position in the Chinese market with chips that do not require an export license, we do not expect China to continue to be a significant contributor to the company’s revenue, as was the case in the past. Chinese companies are testing products from local manufacturers, and the fairly late planned start of H20 sales, as we expect, will not trigger increased demand as demand will already be met by local alternatives. In addition, according to Reuters, despite the H20’s label as the most powerful of the three China-focused chips, in some respects it is inferior to the Huawei 910B Ascend, which among other things, will hurt its chances to be embraced by the Chinese market.

One of the potential areas for the development of the segment producing data-center equipment is the production of bespoke AI chips for cloud service providers and other companies that need accelerated computing capabilities for AI. Here’s why a business unit like this could be a good idea:

- there is a risk that big technology companies, which are some of Nvidia’s largest customers, will develop their own high-performance chips;

- It could attract new customers that can’t afford to buy Nvidia’s expensive chips, but have a specific need in accelerated computing.

Although the specifications of chips that are produced by big technology companies are currently inferior to the industry’s benchmarks in terms of performance, they still allow customer companies to reduce costs associated with the price of chips and the lead time for their orders (which can be as long as a year, as demand for AI chips exceeds supply).

According to Reuters, Nvidia officials have met with representatives from Amazon, Microsoft, Google and OpenAI to discuss making custom AI chips for them.

In our forecast, we assume that production of custom AI chips will develop steadily, which, however, will not have a significant impact on revenue in the data center segment in 2024 and will only make a solid contribution to revenue (potentially making up as much as 7% of revenue in the data center segment) in 2025 in the event the business will develop according to a positive scenario.

With respect to total revenue in the data center segment, given that demand for Nvidia’s equipment for data centers surpasses supply and new products are scheduled to be rolled out in the next one or two quarters, we expect Nvidia’s data center revenue to reach $90.6 bln (+91% y/y) in 2025, and $110.6 bln (+22% y/y) in 2026. We expect revenue in the data center segment to total $20.2 bln in 1Q 2025.

Gaming and other segments

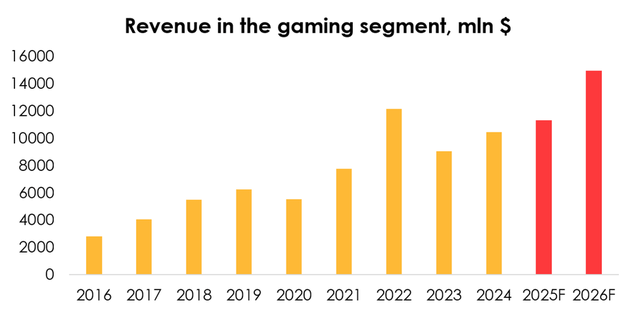

At CES 2024, Nvidia announced three new products in the GeForce RTX 40 SUPER lineup, namely the GeForce RTX 4080 SUPER, GeForce RTX 4070 Ti SUPER and GeForce RTX 4070 SUPER, which feature more powerful GPUs than the RTX 4080, RTX 4070 Ti and RTX 4070 models, respectively. In collaboration with major notebook manufacturers, this series of chips continues to be developed to power AI PCs.

In Q4 of fiscal year 2024, revenue in Nvidia gaming segment totaled $2.87 bln (+56% y/y) and +0% q/q). Worldwide PC shipments continue to recover, and shipments of PC GPUs climbed to 76 mln units (+6% q/q and +20% y/y) in Q4 of calendar year 2023, rising at a slower rate than last quarter, although still showing positive momentum.

Revenue in the company’s gaming segment didn’t decline, although it did so in the comparable segment of AMD, one of the main rivals. But both companies expect to see a seasonal decline in gaming revenue in the next quarter. Given that our expectations for Q1 2025 revenue in the segment were reduced to $2.6 bln, and future revenue growth in the segment is estimated to continue at the same pace, we expect the gaming segment revenue to reach $11.3 bln (+8% y/y) in 2025, and $14.9 bln (+32% y/y) for 2026.

Amid the rapid development of the data center segment, the revenue of professional design visualization solutions, automotive solutions, OEM collaborations combined 4-5% of the company’s total revenue, which is insignificant and does not require a detailed review.

Nvidia financial results

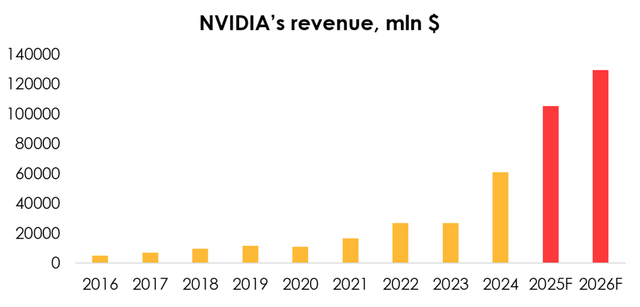

We expect Nvidia revenue to reach $105.4 bln (+73% y/y) in 2025, and $129.3 bln (+23% y/y) in 2026 as the forecast for revenue in Nvidia’s data center segment is expected to grow to $90.6 bln (+91% y/y) in 2025, and $110.6 bln (+22% y/y) in 2026.

The company’s gross and operating costs as a percentage of revenue continue to improve fast, and we forecast them to lower to 24% of revenue and 15.1%, respectively, in 2025 and stay flat for 2026.

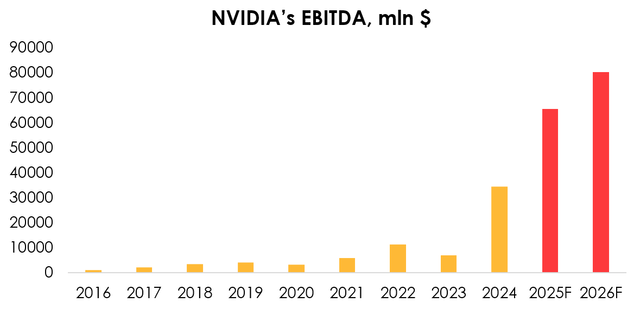

Given the revenue forecast and the forecast for the company’s gross and operating costs as a percentage of revenue, we expect Nvidia EBITDA to reach $65.5 bln (+90% y/y) in 2025, and $80.2 bln (+23% y/y) in 2026.

Valuation

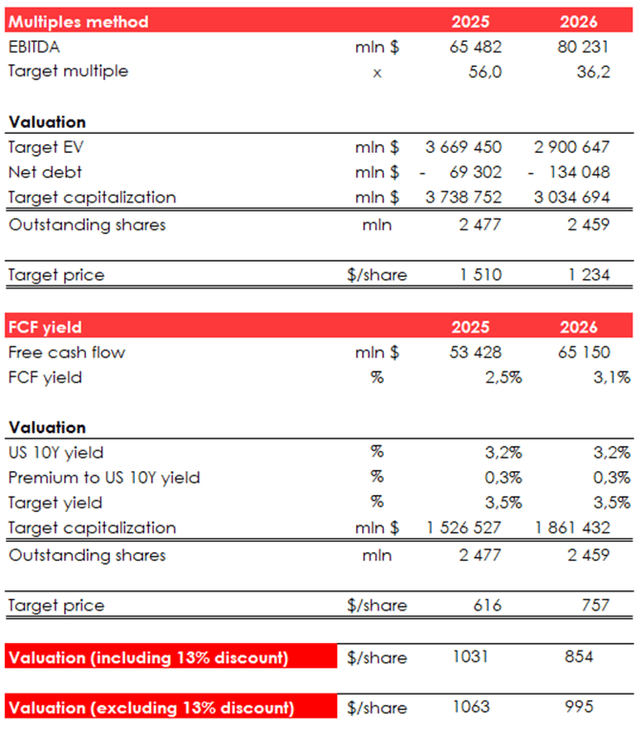

We set the target price of Nvidia shares at $854, which was achieved by computing the target price based on 2026 financial results, which were projected using the EV/EBITDA and FCF Yield methods, and discounting it to the FTM price at the rate of 13% per annum.

Given the new assumptions, we are assigning a HOLD rating to Nvidia shares.

Conclusion

Nvidia Corporation is one of the most prominent participants in the emerging market of artificial intelligence, having become a one-stop developer of everything it needs, ranging from chips (where the company dominates with a market share of more than 80%) to software and other services. The company draws most of its revenue from the data centers segment, which brought in 83% of its total revenue in Q4 2024.

According to our estimates, Nvidia Corporation stock is currently trading at its fair value and buying with such an entry point is not interesting to us.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.