Summary:

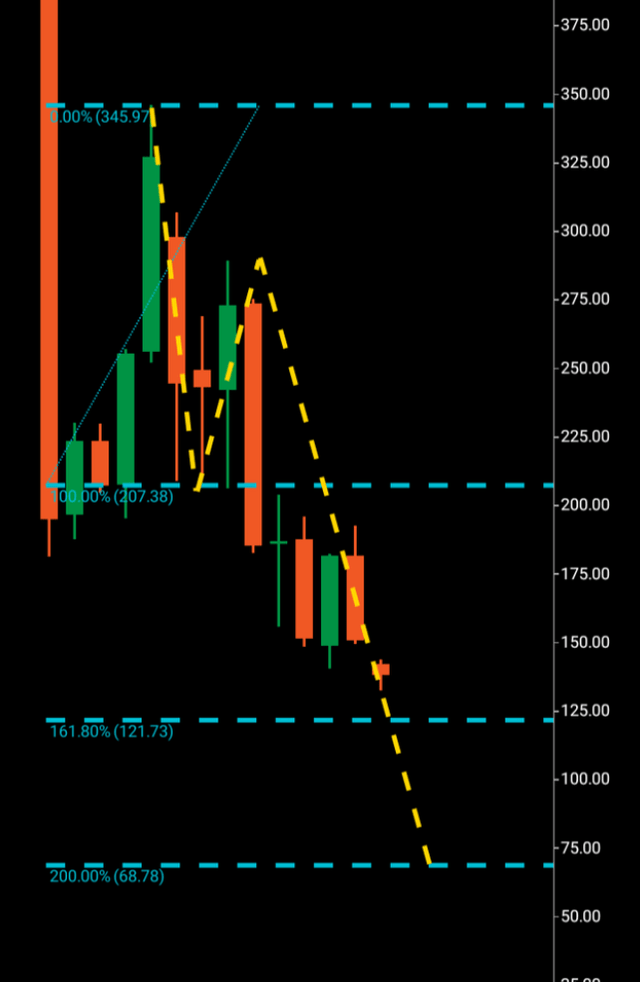

- A dreadful 2022 for Nvidia Corporation saw me issue a sell signal based on technical analysis with an initial $121 target.

- Advances in Nvidia’s cloud gaming product line that has targeted mass appeal at an excellent price point have helped turn the fortunes of Nvidia stock around in an ever-growing sector.

- With Nvidia stock forming bullish wave patterns on high time frames, we will go through Nvidia’s incredible attempt at a turnaround and why investors are buying this equity long term.

Astragal/iStock via Getty Images

This article will look into both how my September 2022 NVIDIA Corporation (NASDAQ:NVDA) sell rating performed along with the latest news from the company before switching to analysis about Nvidia’s potential macro wave pattern in play.

2022 was not a great year for Nvidia. Q2 earnings reported in August were a whopping 17% miss on analysts’ expectations along with supply chain issues and gaming revenue concerns. An SEC fine of $5.5 Million over inadequate crypto disclosures didn’t help, either.

I initiated a sell signal for Nvidia at $143 in September with an immediate target of $121. So far, Nvidia has achieved this target, bottoming at $108. So has this equity shown signs of a turnaround in price and fortunes, yes is the answer.

After two years of steady growth, demand for graphics cards for personal computers plummeted in 2022, but a recent announcement that Nvidia is bringing its RTX 4080 graphics card to GeForce, which is Nvidia’s cloud gaming service, will be a welcome addition to the company and investors long term.

In short, the RTX 4080, which launched in November 2022, should be universally popular as it is a big step up from the RTX 3080 and enables users to play high-end games without the expense accustomed to this type of product.

On the aspect of subscriber growth, Nvidia had 12 million GeForce Now subscribers before the launch of the RTX 3080. Within twelve months of its launch, the subscriber figures grew to 20 million and Nvidia will be looking to capitalize on the growth figures for its GeForce Now subscriber base with the launch of the RTX 4080 and maintain and grow these figures moving forward.

Cloud gaming is expected to grow year-on-year, and Nvidia is well-positioned to control a considerable portion of the market segment as they continue to look to build a dominant position in this sector.

Looking at the reaction of the share price, investors are clearly buoyed by the updated product for this growing niche market, and that is reflected in the performance of this bullish move up.

Now we can move to the charts to look over my sell rating and where Nvidia may be moving towards next.

We can see in the former chart below the gap down bearish candle circa $150 that lies above the Fibionacci 161. This candle bypassed that region and bounced from $108 to eventually end up in bullish formation.

Nvidia former sell signal chart 2022 (C Trader )

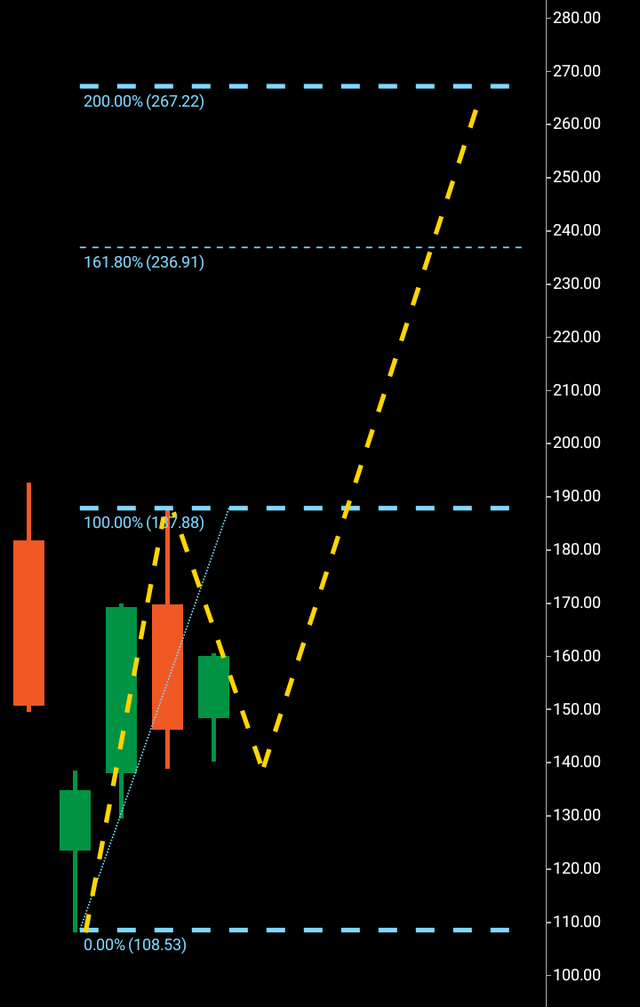

Now, to move onto the current chart, there are actually two NVDA targets from both the weekly and monthly chart. Beginning with the monthly, we can see a potential wave one and a rejection wave two formed, with a bullish candle climbing up to its peak resistance at $187 in an attempt to launch a third wave which would be due to complete at $267 before making a decision on its next directional pattern. But if it transpires and the third wave does break through, it will be again the Fibonacci 161 that will be the immediate target and this price region holds not exact but near confluence with our next chart, the weekly.

Nvidia monthly chart (C Trader )

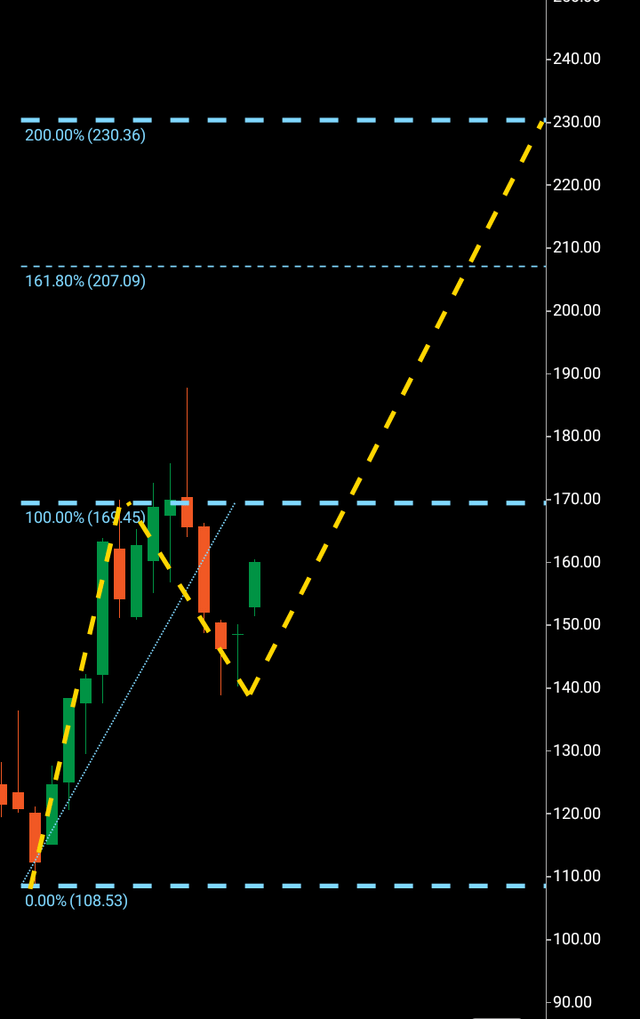

Interestingly, we can see here on the current weekly chart below a three wave pattern has technically broken out, with wave one $198-$169 wave two $169-$138 and a break above $169 to initiate the third wave having been rejected at $187 where the rejection in the monthly chart lies. As far as the weekly third wave completion goes, as long as Nvidia stays above the wave one low of $108, the bullish third wave is still in play.

Nvidia weekly chart (C Trader )

Should this wave complete, it is the near confluence from the Fibonacci 161 from our monthly chart at $230 that would technically close out a numerical replication of the weekly wave one. In this case the monthly wave three to $267 would be in play. If you would like to understand more about waves from lower time-frames overlapping to higher time-frames, you can find the link to my book (The Ward Three Wave Theory) in my bio.

To finalize, I fully expect the Nvidia Corporation weekly third wave to complete at $230, but I am issuing a hold signal until $187 on the monthly chart is broken above. If this transpires to be the case, I will be writing an updated article exclusively with Seeking Alpha should resistance be broken in the near future.

About the Three Wave Theory

The three wave theory was designed to be able to identify exact probable price action of a financial instrument. A financial market cannot navigate its way significantly higher or lower without making waves. Waves are essentially a mismatch between buyers and sellers and print a picture of a probable direction and target for a financial instrument. When waves one and two have been formed, it is the point of higher high/lower low that gives the technical indication of the future direction. A wave one will continue from a low to a high point before it finds significant enough rejection to then form the wave two. When a third wave breaks into a higher high/lower low the only probable numerical target bearing available on a financial chart is the equivalent of the wave one low to high point. It is highly probable that the wave three will look to numerically replicate wave one before it makes its future directional decision. It may continue past its third wave target but it is only the wave one evidence that a price was able to continue before rejection that is available to look to as a probable target for a third wave.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.