Summary:

- Chipmakers including Nvidia Corporation and AMD experienced a correction lately, sparking concerns over investors’ AI fatigue.

- Nvidia’s upcoming earnings report and Blackwell launch make it a solid buy.

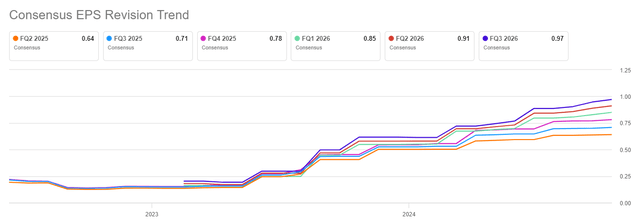

- Nvidia’s EPS may see positive revisions post-earnings, with Blackwell set to drive growth in FY 2025.

- EPS revision momentum is widely positive. Shares have recovered to $130 lately.

- Large corporations are still spending a ton of money on AI products, leading to further Data Center-related upside potential.

BING-JHEN HONG

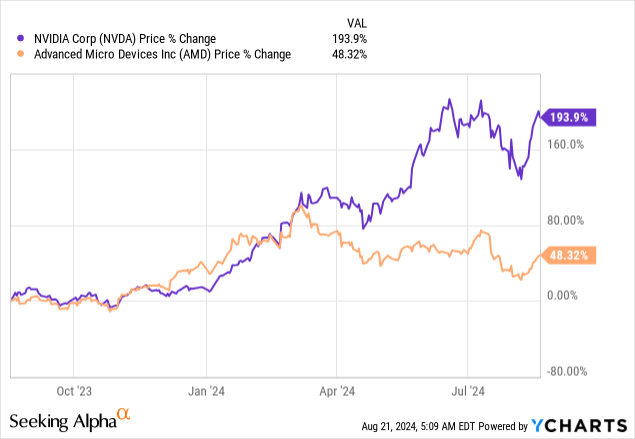

Nvidia Corporation (NASDAQ:NVDA), as well as other semiconductor companies, including Advanced Micro Devices (AMD) and Taiwan Semiconductor Manufacturing Company (TSM), recently went into a correction, causing escalating worries about a bursting AI bubble. Nvidia dropped from $141 in June to about $90 per-share in early July, but shares have now rebounded to about $130 today, reflecting growing investor confidence ahead of the Q2 report.

In my opinion, “AI fatigue” is a myth and Nvidia could be a promising buy a week before the company is set to face a big catalyst with its upcoming earnings release for the second fiscal quarter. Given the company’s history of outperformance, positive EPS revision trend as well as the upcoming Blackwell launch, the risk profile remains widely favorable. While shares are not a total bargain, they are not expensive either, and there is plenty of evidence that suggests that AI will remain a fundamental business driver for Nvidia going forward!

Previous rating

I rated shares of Nvidia a buy after the chipmaker presented results for its first fiscal quarter due to what I considered was an attractive catalyst landscape as well as a dramatically improved earnings picture: “Profit Explosion And Stock Split Are Game-Changers.”

In relation to this, I upgraded shares of AMD to strong buy as well in “The AI Boom Is Just Getting Started For AMD.” The company experienced a significant boost to its Data Center growth (+115% Y/Y) in the last quarter. In my opinion, this will allow the company to generate significant free cash flow gains in the second half of the year as well as in FY 2025. For Nvidia, I see several catalysts as well, including continual AI spending, and EPS revision momentum indicates that analysts continue to expect big things from Nvidia next week.

Nvidia’s attractive catalyst landscape

In my past work on Nvidia, I said that the chipmaker’s core competitive advantages relate to two factors:

- Nvidia owned the majority of the Data Center GPU market, which positioned the chipmaker as a dominant force just when the corporate sector scaled up its AI spending to train and power large language models,

- Nvidia was moving to a faster GPU product release cycle (down to one product launch per year) which creates a favorable catalyst landscape for Nvidia.

Together, both factors have already led to significant momentum in the Data Center business, and the next upcoming catalyst for Nvidia is the Blackwell launch.

Blackwell AI chips are set to succeed the H100 flagship product and will ship later this year. Nvidia is also set to release RTX 50-Series graphics processing units in the coming quarters, creating an additional non-Data Center catalyst for revenue growth. The launch of Blackwell chips could give new impulses to Nvidia’s Data Center business.

Nvidia is set to release Q2 ’25 earnings on August 28, 2024, and it is likely that the company will see another sequential revenue deceleration given its lack of new product releases. But the Blackwell chips are set to change this, and any new management remarks about the order status of Blackwell products would likely be a major positive catalyst for Nvidia’s shares.

I expect to see a revenue deceleration in Nvidia’s Data Centers for Q2 ’25, but expect revenues to accelerate again when Nvidia’s Blackwell timeline becomes clear and its newest flagship product launches later this year. In total, I expect Nvidia to report $28.8B in revenue for the second-quarter and therefore beat its baseline guidance by $800M (my estimates for Nvidia’s Q2 ’25 are in the right-most column in the table below).

| Nvidia vs. AMD | |||||

| AMD | Q2’23 | Q3’23 | Q4’23 | Q1’24 | Q2’24 |

| Data Center Revenues | $1,321 | $1,598 | $2,282 | $2,337 | $2,834 |

| Q/Q Growth | 2% | 21% | 43% | 2% | 21% |

| Total Revenues | $5,359 | $5,800 | $6,168 | $5,473 | $5,835 |

| Data Center Revenue Share | 25% | 28% | 37% | 43% | 49% |

| Nvidia | FQ2’24 | FQ3’24 | FQ4’24 | FQ1’25 | FQ2’25E |

| Data Center Revenues | $10,323 | $14,514 | $18,404 | $22,563 | $25,780 |

| Q/Q Growth | 141% | 41% | 27% | 23% | 14% |

| Total Revenues | $13,507 | $18,120 | $22,103 | $26,044 | $28,800 |

| Data Center Revenue Share | 76% | 80% | 83% | 87% | 90% |

(Source: Author)

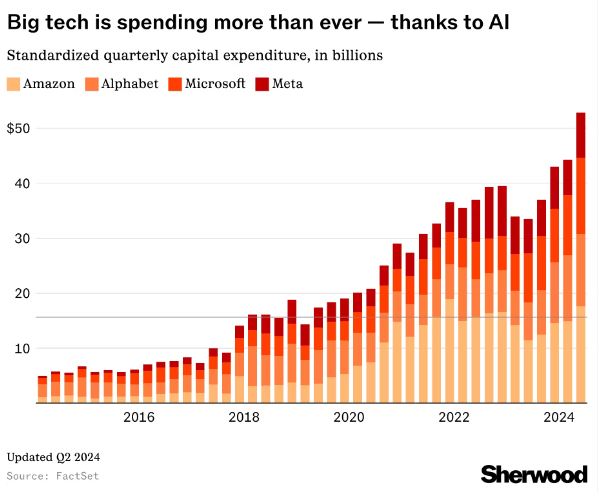

One factor why I believe Nvidia is set to crush expectations is because big corporations don’t show any signs of slowing down their AI spending.

AI spending trends are fully intact. Companies like Alphabet (GOOGL) (GOOG), Meta Platforms (META) and Microsoft (MSFT) are set to continue to spend billions of dollars per quarter on AI technology… which is set to benefit all AI hardware companies, but especially Nvidia, which dominates the GPU market. That large corporations are not cutting back on AI spending further debunks the notion that the market has cooled on AI-themed investments like Nvidia.

Sherwood

Get ready for significant EPS revisions ahead of Blackwell launch

In my opinion, Nvidia is set to see positive EPS upside revisions after the release of second-quarter earnings on August 28th. The company will likely submit a strong guidance for the next quarter as well as give an update about its Blackwell expectations.

Nvidia is expected to report $0.64 per-share in earnings for Q2 ’25, as per consensus, for its second fiscal quarter, implying 137% year-over-year growth. Importantly, the EPS trend is very positive ahead of the earnings release, with Nvidia receiving 37 EPS upside estimate revisions compared to just 2 downside estimate revisions. The market is clearly expecting a blockbuster earnings release for Nvidia. The EPS revision trend also strongly shows that the market does not expect an AI fatigue to impact Nvidia’s second-quarter earnings.

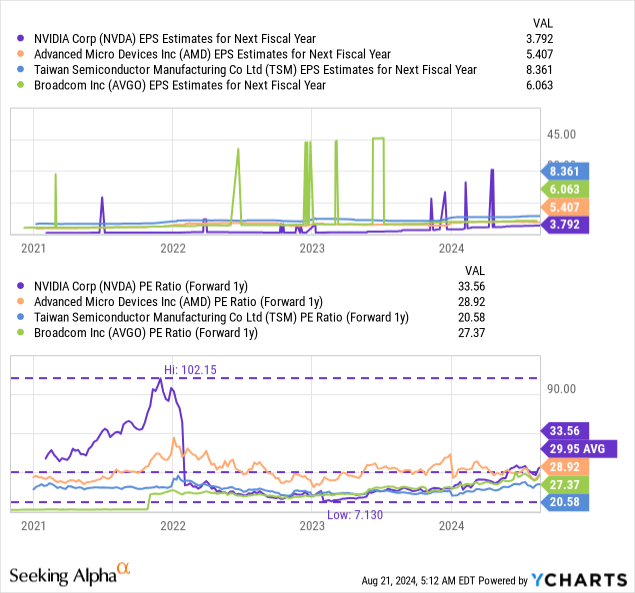

Nvidia really isn’t that expensive…

Nvidia is currently valued at a price-to-earnings ratio of 33.6X, and shares have seen a sharp upside revaluation since the early August sell-off that pushed shares close to $90. AMD, by comparison, is trading at a price-to-earnings ratio of 28.9X. I have aggressively added to my AMD position in the last month, in part because the chipmaker sees massive momentum in its Data Center business after it launched its MI300 chips.

In my last work on Nvidia, I stated that the chipmaker could have a fair value of $122 per-share (post-split), based off a fair value P/E ratio of 35.0X. EPS estimates have reset much higher in the last ninety days, however, as fears over weakening AI spending and a recession subsided.

The consensus EPS estimate for FY 2026 (Nvidia’s next financial year) is $3.81 per-share. Applying a 35X earnings multiplier yields a potential fair value of $133 per-share, but with major EPS revisions likely to take place post-earnings, Nvidia has a serious catalyst to expand its valuation.

The $3.81 per-share EPS estimate also appears conservative to me, considering that it implies a Y/Y growth rate of only 39%. In the last quarter, Nvidia grew its adjusted non-GAAP EPS 461% Y/Y. Therefore, I believe the chipmaker could significantly outperform EPS targets for this year and next year, and new extended EPS revision momentum post-earnings could be a catalyst for shares to revalue higher as well. I expect at least a 50% growth rate in EPS next year, given Nvidia’s upcoming Blackwell and RTX 50-Series GPU launches, which implies a $4.10 EPS baseline and a fair value (based off the 35X multiplier) of at least $144 per-share.

Risks with Nvidia

Nvidia’s risk profile has further improved lately as Intel (INTC) is looking at another major restructuring: Disaster Strikes, What Now? This restructuring could prevent Intel from going on the offensive in the Data Center market, which is where the company is already lagging far behind the competition with the launch of its AI chip, the Gaudi 3 AI accelerator. With Intel more focused on reorganizing its operating portfolio and laying off people, Nvidia’s value proposition for the Data Center GPU market has only further improved, in my opinion. What would change my mind about Nvidia is if the company were to issue a weak revenue guidance for Q3 ’25 or if the corporate sector did a U-turn on AI spending.

Final thoughts

I don’t see any evidence of an AI fatigue ahead of the company’s second-quarter earnings… which are expected to be released on August 28, 2024. In fact, I see the opposite: the EPS revision momentum ahead of Q2 is widely positive, with upside EPS revisions outnumbering downside revisions 18.5:1. Secondly, large enterprises in the technology industry, mainly the big tech companies, are not showing any indication of slowing AI spending. Thirdly, AMD’s earnings for Q2 showed a 115% jump in Data Center revenues, indicating that demand for AI chips remains red-hot. There may be the possibility, however, of companies scaling back H100 purchases in the short term as they wait for the release of the newest Blackwell chip, but once Blackwell launches, Nvidia could potentially see a revenue acceleration again.

With Nvidia likely set to deliver another blow-out earnings report (and guidance) on August 28, 2024, I believe we could see a new wave of EPS estimate upside revisions as well. This could be a potent catalyst for an upside revaluation.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA, AMD, INTC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.