Summary:

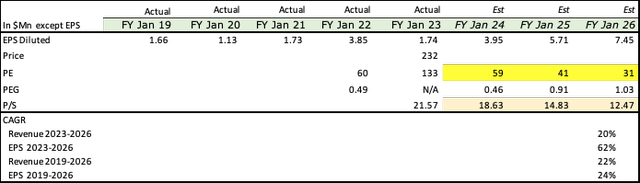

- Nvidia sports an expensive P/S ratio but a reasonable P/E given its excellent profit margins.

- Nvidia had a rough year, let’s take a deeper dive into its financials.

- AI growth may be hyped and definitely not a panacea, but it will gain traction as use cases expand beyond ChatGPT.

- Its Auto segment is doing extremely well, gaming rebounding, and data center still growing.

- Nvidia’s new product innovation and exceptional R&D spend allow it to keep its pole position.

Ethan Miller/Getty Images News

I had recommended NVIDIA (NASDAQ:NVDA) at $116 in Oct 2022 as the best in its class on strong product innovations such as the new RTX gaming series, and the Hopper and the Grace in data center. Since then, its price has doubled to $232, helped initially by the disinflation rally of January 2023, the expected growth from artificial intelligence or Nvidia’s A100, AI chips that are being used for Microsoft (MSFT) and AI C3.ai, Inc. (AI) for ChatGPT and then better than expected Q1-FY24 guidance. Those factors from the October article are equally important today; and further growth from autos and AI will sustain the company for several years. I’m still recommending the company even at today’s higher price. Let’s take a deeper dive.

Nvidia – A deeper dive into the financials

With Nvidia’s Q4-FY23 beat and higher guidance for Q1-FY24 let’s take a deeper dive into a tumultuous year for Nvidia.

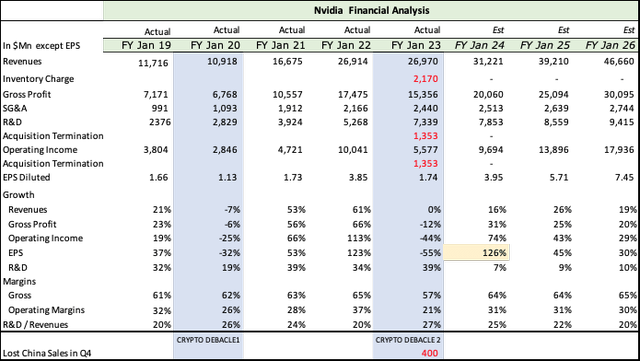

Nvidia’s financials (Seeking Alpha, Nvidia, Fountainhead, Wall Street Journal, Barrons)

Non Recurring Charges – In FY23, NVIDIA booked two charges; $2.1Bn for excessive inventories of gaming and visualization chips used for Ethereum mining, which moved from proof of work to proof of state after September 2022, resulting in a huge glut of chips. The second was a fee of $1.35Bn for the failed attempt to buy ARM Holdings, an effort nixed by regulators worldwide. Totally, this knocked off $3.7Bn off Nvidia’s finances and led to a stagnant year of $26.9Bn in revenues, a massive drop of 44% in operating earnings and a decline of 55% in EPS to $1.74!

Unfortunately, Nvidia didn’t really learn anything from its first Crypto debacle in FY2020, which saw similar drops of 7% in revenues and 32% in earnings. At that time, it was the collapse in Crypto prices which rendered mining below cost. The second time around, it should have had the foresight to manage inventory and demand better, as the change in Ethereum mining had been known for more than a year.

Gross Margins – Nvidia has one of the best gross margins in the industry of about 62 to 65%, because of its higher ASP’s and constant innovation and introduction of new products every two – three years. Given the introduction of the RTX 4090 series for gaming, the Hopper and Grace in data center, solutions for the Omniverse, and the $11Bn pipeline in Auto I’m confident that Nvidia should manage 64 to 65% gross margins from FY 24 to FY26, the same as its average from FY 2019 to FY 2023, after smoothing out the bumps from the two crypto debacle years. In its recent Q4-FY23 earnings call, CFO Colette Kress spoke of a return to margins of 64.5%.

R&D – R&D spend grew 39% in a FY 2023, much higher than its average of 31% of the past 5 years, clear evidence of a company barreling forward, confident in its ability to constantly innovate even in a terribly adverse year. Over the last 5 years, R&D has stayed at an average of 23% of revenues, another outstanding number, and I’m forecasting an average of 22% for the next 3 years.

Operating Margins – Nvidia’s has averaged 29% of operating margins over the last 5 years. Given the lack of crypto cyclicality due to the loss of Ethereum mining, crypto will no longer be a revenue source nor drag down earnings in downturns. I’m expecting operating margins of 30 to 31% in the next 3 years.

Return to growth on sustainable earnings – Nvidia doesn’t suffer from equity dilution like other tech companies and with its constant buybacks usually reduces its share count every year. On a diluted basis, I expect EPS to grow 126%, 45% and 30% in the next 3 years or at a CAGR of 62%. Over a 7 period from FY19 to FY26, smoothening out the cyclicality from crypto, EPS grows at a strong clip of 24%.

I expect revenues to rebound in the next 3 years, growing at a CAGR of 20%. This is without any crypto at all; importantly, based entirely on sustainable, high quality gaming ray tracing chips, new H100 and A100 data center semis, and autos which have grown 60% in FY 2023. On a seven year basis the CAGR is 22% – which means, that even though crypto added a huge chunk to revenues for Nvidia, it can and will keep up with historic averages without crypto on the strength of its products.

Nvidia Earnings and Sales Growth (Seeking Alpha, Nvidia, Fountainhead)

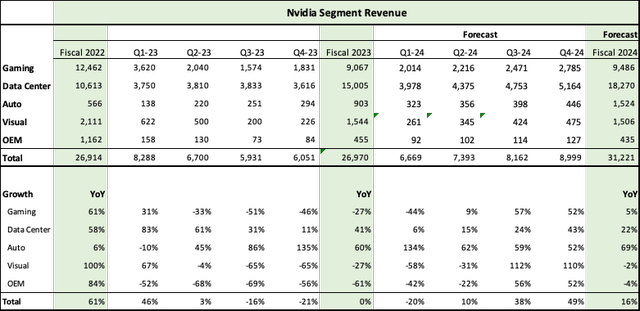

Autos – The Fastest Growing Segment

There has been a lot of focus on AI (Artificial Intelligence) – with Microsoft teaming up with AI C3.ai, Inc to roll out ChatGPT on its search engine, Bing. With Nvidia being the largest supplier of A100 chips for this endeavor, much of Nvidia’s meteoric rise from $139 in early January to today’s price of $232 has been attributed to growth in that segment. Quietly, though Autos’ was the star performer in FY 2023, growing 60%. NVDA’s management was very confident of sequential growth for all segments in Q1-24 and based on Nvidia’s $11Bn auto pipeline from two years back, I’m expecting auto to grow 69% in FY 2024.

Nvidia Segment Revenues (Nvidia, Seeking Alpha, Creative Strategy, Fountainhead)

One of the larger and more lucrative growth drivers, in my opinion, will be software licensing revenue. This is a great opportunity a 50% revenue share with OEMS and manufacturers adds high quality earnings to Nvidia’s bottom line.

The Mercedes announcement, which CEO, Jensen Huang referred to is going to be one of them. From the Q4-FY23 earnings call.

If you could just imagine what it looks like if the entire Mercedes fleet that is on the road today were completely programmable, that you can OTA, it would represent tens of millions of Mercedeses that would represent revenue-generating opportunity.

During the same call, CFO Colette Kress spoke about the software and other OEM opportunities in the auto segment.

They did talk about the software opportunity. They talked about their software opportunity in 2 phases, about what they can do with Drive as well as what they can also do with Connect. They extended out to a position of probably about 10 years looking at the opportunity that they see in front of us. So it aligns with what our thoughts are with a long-term partner of that and sharing that revenue over time.

At CES, we announced a strategic partnership with Foxconn to develop automated and autonomous vehicle platforms. This partnership will provide scale for volume, manufacturing to meet growing demand for the NVIDIA Drive platform. Foxconn will use NVIDIA Drive, Hyperion compute and sensor architecture for its electric vehicles. Foxconn will be a Tier 1 manufacturer producing electronic control units based on NVIDIA Drive Orin for the global.

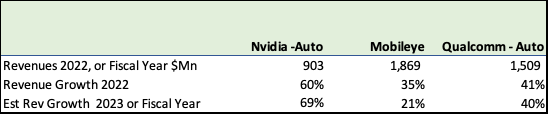

The auto industry for semiconductors is dominated by three large players, Mobileye Global Inc.(MBLY), QUALCOMM Incorporated (QCOM) and Nvidia with different strategies, according to Oliver Blanchard of Creative Strategies.

Qualcomm: With its strengths in connectivity, Qualcomm’s strategy is focused on trying to be a one stop shop with seamless solutions for ADAS, Infotainment, Car to Cloud Services and Connectivity. It has a very large roster of auto clients and allowing them to combine several services or components, with the additional flexibility of mixing and matching other vendors gives it a very strong foothold.

Mobileye: Mobileye’s strategy like Nvidia’s has been focused on software, getting auto makers to customize solutions on their platforms. Mobileye has a greater focus on ADAS than others with solutions across price points and levels of ADAS support. This is a good, scalable strategy and it has an early mover advantage in the robotaxi segment. 13 of the world’s largest automakers use their ADAS products.

Nvidia: Nvidia’s strength is in its somewhat hybrid approach between Qualcomm and Mobileye. Its platform, Drive Hyperion is agnostic and easily adaptable and integrated with other vehicle solutions and because of its wider range of solutions like the Omniverse, it addresses several aspects of cockpit functionality as well, making it a very serious contender if and when ADAS move to fully automated levels. Here is Oliver Blanchard’s take

One way to look at this is that Nvidia is leveraging ADAS as the springboard from which to launch and scale additional connected automotive platforms, much in the way that Qualcomm approaches its own Digital Chassis strategy. Another way to look at it is that ADAS will simply morph into an AI-first automotive platform model that encompasses autonomous driving, assistant/concierge/chauffeur features, adaptive connectivity, power management, and the management of infotainment and telematics. The latter would essentially transcend the “software-defined” vehicle concept that we are discussing today and evolve into a more intentional “AI-defined” vehicle design approach. Nvidia looks to be on that evolutionary path, and that is an exciting prospect for car owners and robotaxi operators.

Nvidia, Qualcomm and Mobileye (Nvidia, Qualcomm, Mobileye, Seeking Alpha, Fountainhead)

All three had excellent revenue growth in their previous fiscal year of 60, 35 and 41% respectively; Nvidia’s growth being the highest on the smallest base.

Democratizing Artificial Intelligence

When CEO, Jensen Huang was talking about an inflection point during the 4th quarter earnings call, he was referring glowingly to the sea change in demand/enquiries from smaller players who earlier did not realize or see how Nvidia’s higher artificial computing power could improve their own products. Offering it as a cloud based solution for those who cannot afford the infrastructure is a brilliant way of expanding the market in size and scope. This is the crux of the AI breakthrough that we saw Microsoft demonstrate with ChatGPT. It is most definitely not a panacea, instead it’s the ability to be a foundation and backbone for more advances and improvements. What I’m very confident is the expansion of use cases and scope, which will lead to higher revenues down the road. The strategy of expanding use cases by providing it to a wider audience through cloud based solutions with their existing hyper scale relationships and CSP relationships is absolutely spot on and very likely to keep their first mover advantages for longer. I also realize that 90% of market share cannot be sustained but 60% of a market size that has doubled or tripled is worth a lot more! A symbiotic relationship with CSP’s is beneficial to all everyone and the most cost effective solution for smaller players.

CEO Jensen Huang From the Q4-FY23 earnings call

By using NVIDIA AI, your entire machine learning operations is more efficient, and it is more cost effective. You save money by using accelerated software. Our announcement today of putting NVIDIA’s infrastructure and have it be hosted from within the world’s leading cloud service providers accelerates the enterprise’s ability to utilize NVIDIA AI enterprise. We really believe that it will accelerate the adoption of software.

A huge advantage to new entrants wanting to adopt AI tools would be the infrastructure and scalability of the cloud, which they would not have had access to earlier.

In Jensen’s own words from the Q4-FY23 earnings transcript, emphasis mine.

We now realize — the world now realizes that maybe human language is a perfectly good computer programming language, and that we’ve democratized computer programming for everyone, almost anyone who could explain in human language a particular task to be performed. And the thing that the cloud service providers are really excited about is by hosting our infrastructure for NVIDIA to offer because we have so many companies that we work directly with. And so by having NVIDIA DGX and NVIDIA’s infrastructure are full stack in their cloud, we’re effectively attracting customers to the CSPs. And we’re going to be the best AI salespeople for the world’s clouds. And for the customers, they now have an instantaneous infrastructure that is the most advanced.

Using Nvidia’s automobile and omniverse segments as an example, AI revenues will take some time to fruition and I’m not forecasting extra immediate revenues within data center in FY 2024; my forecast for data center revenues growth in FY 2024 is only 22%. What I’m very confident is the expansion of use cases and scope, which will lead to higher revenues down the road.

Further buttressing my optimism and belief in the widening of AI applications is a quote from CEO Thomas Seibel of AI C3.ai, Inc, from AI’s third quarter financial results, which is in the forefront of the AI spectrum with the $10Bn Microsoft investment. Emphasis mine.

As we enter Q4 FY 23, we are seeing tailwinds from improved business optimism and increased interest in applying C3 AI solutions to address an increasing range of applications across a broad range of industries. The overall business sentiment appears to be improving. This is a dramatic change from what we experienced in mid 2022.

Challenges

As we saw from the disastrous drop in earnings and revenues in FY 2023, Nvidia does have a lot of challenges.

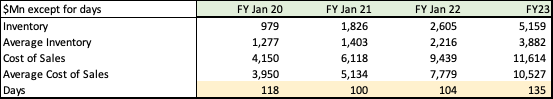

Nvidia Inventories (Nvidia, Seeking Alpha, Fountainhead)

High Inventory: Last fiscal, Nvidia finished with $5.2Bn of inventory, a pretty whopping number especially after taking the $2.2Bn charge. This was higher than the previous quarter’s inventory of $4.54Bn, clearly not a step in the right direction. The vast majority of these are gaming chips, plus some from subdued data center sales in Q4, which actually fell sequentially with buyers postponing purchases.

Management did express confidence that inventories would be reduced in gaming in the next two quarters and also CEO Jensen Huang indicated that gaming would recover to a more “normal” $2.5Bn run rate in Quarters 3 and 4 of this year.

One of the key factors of high inventory is committed purchases and obligations, which is included in Nvidia’s inventory number – this was about $1Bn in FY2023.

I do want to reiterate that the Ethereum switch from proof of work to proof of stake was announced a year before Nvidia took its $2.2Bn charge; it clearly had the time to prepare for the eventual glut in gaming chips, which couldn’t be used for Ethereum mining any more. This was a clear misstep of careless or overconfident management and reflects poorly on the company; hopefully they’ll have learnt something from this.

Gaming will take a while to recover: I’ve conservatively forecasted that gaming will recover to $2Bn in Q1-FY24 and $2.2Bn in Q2-FY24 and for the full year to $9.4Bn, a small increase over FY23 of only 5%. While the RTX 4090 is always sold out, RTX 4080 and RTX 4070 are not doing as well, with channel sources indicating that both are overpriced compared to their performance.

AI will also take a while to show growth: The performance of Nvidia’s two segments, Omniverse and Autos are good examples of why over hyped growth is never easy to get, while its share price is bid up too fast in anticipation.

Nvidia’s share price shot up to an all-time high of $340 in Nov 2021, after Meta Platforms (META) announced its foray into the Metaverse. A year later, Nvidia was available for $109 and even now the Metaverse is yet to find legs. Similarly, Nvidia predicted huge growth in auto’s as early as 2018-2019. Instead, auto segment sales which crossed $700Mn in FY 2020, floundered for two years at $536Mn and $566Mn in sales before resuming growth to $903Mn in FY23.

Conservatively, I’m predicted only 22% growth for data center in FY24 and any extra growth from AI will be a positive surprise.

Investment Case

Is Nvidia stock still a Buy given the run up in 2023 from $138 to $232? I believe it is.

Nvidia has an expensive P/S ratio of 21 and given that I expect it to grow at a CAGR of only 20% in the next 3 years the P/S really doesn’t come down much – it’s still a pretty high 12.4 in FY 2026. However, for an extremely profitable company, a high P/S multiple in isolation is not enough to make a good decision. Market leadership will always have high multiples and Nvidia is a market leader in gaming and data center GPU’s by a mile, and one of the top three platforms in autos.

Nvidia is a long term story with tremendous growth ahead and switching from a buy to hold, hoping to buy it a bit cheaper is not good advice, we’ll end up missing the woods for the trees.

I’m recommending a buy based on the following reasons:

AI will add upside in the long term: I am very confident in AI’s ability to be a foundation and backbone for more advances and improvements for Nvidia’s clients. And its strategy to widen usage by bringing cloud level scalability to new users is a great one. There will be expansion of use cases and scope besides ChatGPT, which will lead to higher revenues down the road.

Pricing power allows it have to the best operating margins: Nvidia has the best operating margins of about 30% in the industry, given its high ASP’s and tight lid on operating expenses. With gross margins returning to over 64% from FY24, I expect operating margins to stay between 30 and 31% and earnings to grow at a CAGR of 62% from $1.74 to $7.45 by FY26, where the P/E drops from 59 to 31.

Sustainable earnings: Going forward, revenues and earnings will be without crypto cyclicality, Nvidia had little if any exposure to crypto besides Ethereum. Gaming is coming back slowly on the strength over 400 titles with ray tracing, GeForce NOW has more than 25Mn subscribers and Microsoft has teamed up with a ten year deal for XBOX PC games on GeForce NOW. Autos have turned to be a sleeper hit and will grow the fastest on a comparatively small base. Interestingly, Mobileye has a P/S ratio of about 16 and not much by way of profits.

Constant innovation for best in class solutions: I’m also always impressed with the massive R&D spend which has always grown more than 25% year over year and always been in excess of 20% of revenues. Their commitment to product improvement and innovation is a huge plus to me as an investor.

I had recommended Nvidia at $116 in Oct 2022, as the best in its class, and on strong product innovations such as the new RTX gaming series, and the Hopper and the Grace in data center. Those factors are equally important today and will sustain the company for several years.

Last month I wrote about expecting the markets to correct after the massive disinflation rally and took some profits in Nvidia around $220 hoping to buy back at $180! That was clearly a mistake and that limit has now been revised to $220-$230 and I plan to continue accumulating.

Disclosure: I/we have a beneficial long position in the shares of NVDA, MSFT, AI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.