Summary:

- Nvidia Corporation’s Q2 earnings exceeded expectations with revenues up 122.4% Y/Y, driven by strong demand for AI GPUs, indicating continued growth potential.

- Despite a temporary stock depreciation, Nvidia’s long-term bullish story remains intact, supported by high market share and upcoming product releases.

- My updated discounted cash flow model suggests Nvidia is undervalued, with potential for even higher upside due to conservative revenue assumptions.

- Nvidia’s stock is priced for perfection, requiring consistent outperformance, but it remains a solid BUY given its strong growth catalysts and lack of real competitors.

BING-JHEN HONG

Nvidia Corporation (NASDAQ:NVDA) has once again reported stellar earnings results, and once again its shares depreciated right after those results were revealed. Despite this, I believe Nvidia will likely continue to exceed expectations in the coming quarters. This is thanks to the continued high demand for its existing AI GPUs and thanks to the release of new AI GPUs that should help the company create additional shareholder value along the way.

Another Exceptional Quarter

My latest article on Nvidia was published in June, where I noted that the company’s growth story appears to be far from over because the demand for its flagship AI GPUs is not slowing down. Since that time, Nvidia’s shares depreciated, but later recovered, and currently trade around the same levels from June.

However, the release of the successful Q2 earnings report could push the company’s shares higher over time. The Q2 earnings report indicated that Nvidia has once again exceeded expectations as its revenues increased by 122.4% Y/Y to $30.04 billion and were above the estimates by $1.31 billion. In addition to that, its non-GAAP EPS of $0.68 was above the expectations by $0.04.

Such a successful performance was possible thanks to the continuous demand for Nvidia’s flagship H200 AI GPUs, which data centers are currently buying in droves to power the ongoing generative AI revolution. What’s more, is that Nvidia expects the shipments of its flagship GPUs to increase in the second half of the year. This indicates that the company will likely retain its momentum and will continue to perform successfully in the following quarters.

Add to all of this the fact that the company already owns ~90% of the expanding AI processors market, and it becomes obvious that Nvidia is likely to continue to exceed expectations and outperform its peers at the same time. After all, Nvidia already generates more revenues from selling its AI GPUs in a single quarter than its closest competitor Advanced Micro Devices (AMD) expects to sell in a whole fiscal year.

The only major issue with Nvidia is that earlier this month, there were fears that the company would delay the release of its more powerful Blackwell AI GPU line-up. This was due to a change of the mask to improve the production yield. However, UBS a few weeks ago noted that the delay will be only a few weeks at most. Nvidia itself announced that it has started shipping Blackwell samples to its clients, and the production ramp is expected to start in Q4.

All of this indicates that Nvidia’s bullish story remains intact. The company already announced that it expects to generate $32.5 billion in revenues in Q3, which is above the consensus of $31.75 billion. At the same time, a few days ago, its Board of Directors authorized a $50 billion share repurchase plan.

While even after such a performance and guidance, Nvidia’s shares have depreciated, I believe that this is a temporary overreaction by the market. A similar thing happened in the past when Nvidia’s shares depreciated after a successful earnings report but later recovered and appreciated even more once the downside risks were minimized.

What Is Nvidia’s Real Value?

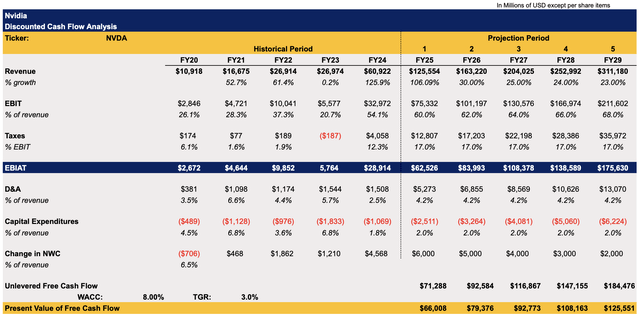

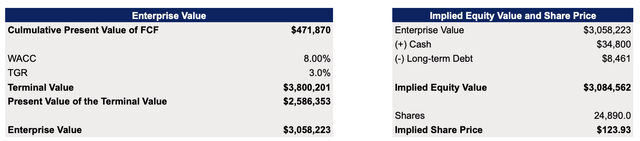

When it comes to valuation, it appears that Nvidia is also undervalued, especially after the recent post-market depreciation. Back in June, when my latest article on the company was published, my DCF model showed that Nvidia’s pre-split fair value was $1202.15 per share, which translates to a post-split fair value of $120.22 per share. Given that the expectations were once again raised after the newest earnings report, I decided to change some assumptions in my model as well to better reflect the reality.

The major thing that was changed in the updated model below is the revenue expectations for the current fiscal year from $121.84 billion before to $125.55 billion now. The reason behind the change is fairly simple. In Q1 and Q2, Nvidia generated $26.04 billion and $30.04 billion in revenues, respectively. In Q3, under the new guidance, it expects to generate $32.5 billion in revenues, while in Q4 the Street expects the company to generate $34.97 billion in revenues. That brings us to a total of $123.55 billion in revenues. Considering that in recent quarters Nvidia fairly easily exceeded its revenue expectations by over $1 billion per quarter, I decided to assume that in Q3 and Q4 the company will also exceed expectations by $1 billion per quarter. This is how I arrived at the forecast of $125.55 billion in revenues in the current fiscal year. The assumptions for other metrics remained the same as before. The cash and long-term debt data was updated.

Nvidia’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

This model shows that Nvidia’s fair value is $123.93 per share, which is above the fair value from the previous model and above the current market price. This indicates that Nvidia is fundamentally undervalued right now.

Nvidia’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

However, I would argue that even the updated revenue assumptions in my model are fairly conservative and the upside for Nvidia’s shares could be even more significant.

First, there’s a possibility that the FY25 revenues will be much higher. After all, the management itself noted that the shipments for its Hopper series GPUs are expected to increase in the second half of the year, and the company also expects to generate several billions by shipping Blackwell GPUs in Q4. At the same time, the growth in FY26 could also be greater since this is the year when the production of Blackwell is expected to continue to ramp up. Moreover, the release of an even more powerful Rubin AI GPU line-up in FY27 could help Nvidia stay ahead of its competitors and retain its momentum, which could improve its growth rates at the same time.

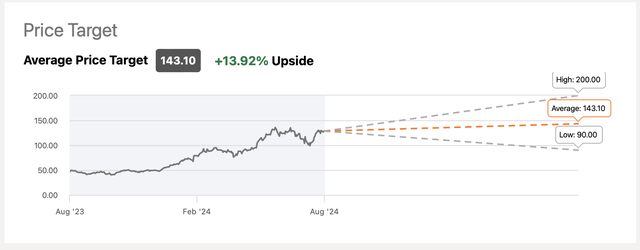

Therefore, with Nvidia’s bullish story remaining intact, it makes sense to assume that the upside to the company’s stock could be even greater than I assume. The consensus on the Street is that Nvidia’s fair value is $143.10 per share, which shows that the company is indeed undervalued, especially after the recent selloff.

Nvidia’s Consensus Price Target (Seeking Alpha)

The Biggest Downside

The biggest downside of Nvidia is that its stock is currently priced for perfection. The company needs to constantly exceed expectations and raise its guidance to ensure that a major selloff doesn’t happen. It has plenty of growth catalysts for the upcoming years to ensure that it’s on track to perform successfully. However, there’s nevertheless a risk that a potential further delay of Blackwell could make it more challenging for Nvidia to meet its guidance.

Even though it appears that that’s not the case right now, it’s still something that investors will be monitoring closely to make sure that there are no surprises in the upcoming quarters.

Where Do We Go From Here?

Nvidia Corporation’s long-term thesis remains intact for now. The company has plenty of catalysts to ensure that it continues to perform successfully in the second half of the year and finishes FY25 on a high note. The following years also look promising, given that the demand for AI GPUs is not slowing down and Nvidia doesn’t have a real competitor on the horizon. As such, I believe that Nvidia remains a solid BUY, as its growth story appears to be far from over.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Bohdan Kucheriavyi is not a financial/investment advisor, broker, or dealer. He's solely sharing personal experience and opinion; therefore, all strategies, tips, suggestions, and recommendations shared are solely for informational purposes. There are risks associated with investing in securities. Investing in stocks, bonds, options, exchange-traded funds, mutual funds, and money market funds involves the risk of loss. Loss of principal is possible. Some high-risk investments may use leverage, which will accentuate gains & losses. Foreign investing involves special risks, including greater volatility and political, economic, and currency risks and differences in accounting methods. A security’s or a firm’s past investment performance is not a guarantee or predictor of future investment performance.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.