Summary:

- Nvidia’s 2Q25 results showed strong sales growth and stable gross margins, despite market disappointment with the company’s guidance, presenting a buying opportunity.

- The upcoming Blackwell GPUs, expected to drive sales and margin expansion, are a key catalyst for Nvidia’s future profit growth.

- Nvidia’s data center segment remains robust, contributing significantly to sales and positioning the company well for the Blackwell GPU launch.

- Despite short-term market concerns, Nvidia’s long-term outlook remains positive with substantial profit potential from the new Blackwell architecture.

BING-JHEN HONG

Quarterly results of NVIDIA Corporation (NASDAQ:NVDA) last week weren’t as spectacular as investors have gotten used to over the course of the last year, but they were still pretty darn good.

The chip company said that it continues to robust demand for its data center GPUs, which have been at the core of excitement about Nvidia in the last year or so.

Though Nvidia profited from substantial growth in the second quarter, the market was somewhat disappointed with the company’s guidance. This forecast actually led to Nvidia’s stock tanking 6.9% the day after earnings, suggesting that investors now have an opportunity to double down on Nvidia.

The chip company has a strong ace up its sleeve with the new Blackwell-theme data center GPU, and I think the investors have turned a bit too bearish on Nvidia last week.

Rating History

My piece ‘Nvidia Stock Is Still A Gift At $130‘ drew considerable attention from readers as my thoughts on the chip company were published just at a time when the stock peaked. I pointed to the upscaling in GPU clusters as an opportunity for Nvidia to grow its sales moving forward, and the chip company is on track to release its Blackwell GPUs later this year. The outlook for 3Q25 was also better than I think the chip company gets credit for.

In addition, Nvidia’s gross margins were steady in the last quarter, suggesting that the company is not losing any of its pricing power in the market.

Nvidia’s 2Q25 Results, Stable Gross Margins And Blackwell Catalyst

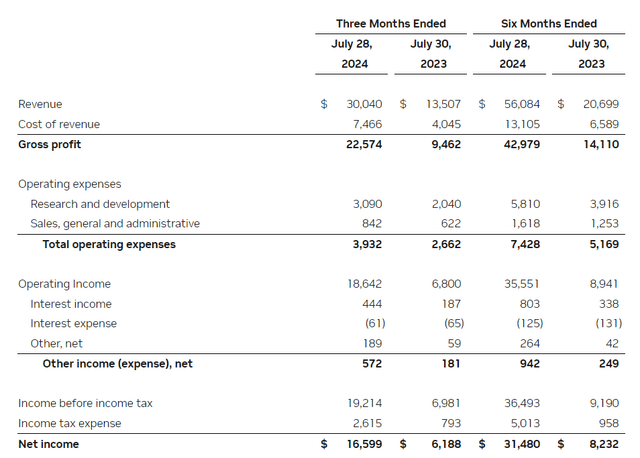

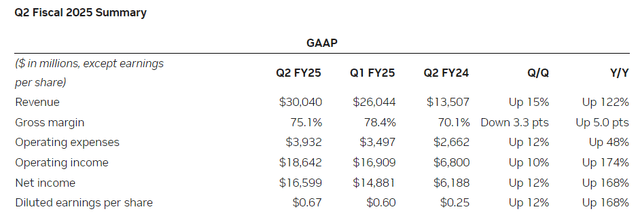

Nvidia’s sales skyrocketed 122% YoY to a record $30.04 billion in 2Q25, as well as 15% jump QoQ as customers continued to chase Nvidia’s data center GPUs.

Nvidia also reported strength in margins, with second quarter gross margins being reported at 75.1% in 2Q25. Compared to 2Q24, Nvidia enjoyed a healthy 5 percentage point growth in its gross margins, and this growth is primarily due to the market’s demand for high-priced H100 GPUs.

Q2 Fiscal 2025 Summary (Nvidia Corp.)

Nvidia obviously still sees favorable supply and demand dynamics in its core market, data centers. In the last year, Nvidia has profited from skyrocketing demand for GPUs from large data centers, causing its sales to increasingly skewing to this particular segment, data centers.

In 2Q25, $26.3 billion in sales were completed in the data center segment, which equates to a sales percentage of 87%. Last year and the year before that, these sales percentages stood at 76% (2Q24) and 57% (2Q23).

With sales skewing more to data centers, Nvidia is well-positioned to profit from the market introduction of Nvidia’s newest GPU, the Blackwell, which is slated for shipment in 4Q25. Blackwell is a next-generation GPU that specifically targets AI models that are being applied in data centers at scale.

Nvidia’s newest GPU, according to Nvidia, proposes to deliver ‘25x less cost and energy consumption than its predecessor’. Based on reports from Extremetech, Blackwell GPUs could be costing up to $70,000 per super-chip which indicates that the ramp of volume shipments (after 4Q25) could have a positive gross margin effect on Nvidia. According to Tom’s Hardware, fully-customized, high-end server racks could go for $3 million or more which lends substantial sales upside to Nvidia.

Current H100 GPUs costs about $30,000 per unit, so a substantial price jump for the latest data center GPU in 4Q25 makes sense. I think that the sales opportunity here is not fully understood by the market as investors seemed to focus more on Nvidia’s latest sales results. The Blackwell GPU will be available to customers by the end of the year at which point investors should anticipate a denser more optimistic news flow from Nvidia.

With investors appearing to be overly short-term oriented, I think the present pullback is a solid opportunity to build up a position in the chip company because Blackwell sales data gets reported as part of Nvidia’s earnings releases.

My thinking behind buying the correction here mainly relates to 3 considerations including two of which I already discussed. One, Blackwell GPU availability could possibly drive a sales acceleration. Some companies are holding off buying H100 GPUs as they wait for the most efficient Blackwell which could unleash a new wave of GPU upgrades towards the end of the year.

Two, with higher-priced GPUs set to hit the shelves later this year, I anticipate a gross margin expansion. Third, with sales possibly accelerating and margins growing, investors may be underestimating Nvidia’s profit upside which, in my view, is going to remain phenomenal.

Nvidia produced $16.6 billion in profits in 2Q25, up 168% YoY. In the last year, Nvidia added $10.4 billion in pure profits to its business, almost all of it thanks to its data center GPUs. I think that with the Blackwell shipment start later this year, Nvidia has another ace up its sleeve in terms of escalating its profit growth.

Forecast Disappoints, Or Does It?

Nvidia forecasted sales of $32.5 billion (plus or minus 2%) and GAAP gross margins of 74.4% (plus or minus 50 basis points). The outlook was met with disappointment as the market did not see a QoQ sales acceleration.

However, Nvidia’s forecast still implies a rather substantial 8% jump in sales compared to 2Q25 all the while the chip company anticipates to defend non-GAAP gross margins around 75%.

In my view, the gross margin trend is very resilient and, in all likelihood, Nvidia is poised to see a sales acceleration toward the end of the year as its Blackwell GPUs hits the shelves.

Nvidia May Not Be That Expensive

The market models $3.59 per share in profits for Nvidia’s profits next year, which reflects back to us an estimated profit growth rate of 41%. But as the market is presently still digesting the company’s 2Q25 earnings, there is reason to suspect that we are going to see at least some estimate corrections moving forward.

As I said above, the market did not respond to Nvidia’s 2Q25 earnings kindly which suggests to me that there is a potential buying opportunity to capitalize on before the news flow can be anticipated to improve ahead of the Blackwell shipment start.

Based on Nvidia’s present stock price of $119.24, Nvidia’s stock is selling for 33x leading profits. This does not strike me to be a particularly rich sales multiple when taking into account that Nvidia’s sales skyrocketed 122% in the last quarter and that the outlook, generally speaking, is quite favorable.

Nvidia’s Blackwell architecture is poised to ramp up shipping shortly and management said that it expects a positive sales contribution here of several billion dollars in 4Q25.

Earnings Estimate (Yahoo Finance)

Advanced Micro Devices, Inc. (AMD) is selling for a leading profit multiple of 30x which isn’t that far removed from Nvidia.

With that said, though, AMD is anticipated to grow its profits 60% next year, predominantly because the chip company has brought the AMD Instinct™ MI300X Accelerators to market for which sales projections are favorable. AMD also enjoyed a surge in data center sales growth in the last quarter. Given that Advanced Micro Devices and Nvidia sell for fairly similar profit multiples, my obvious choice to invest would be Nvidia, mostly due to the anticipated Blackwell ramp.

Why The Investment Thesis Might Disappoint

Some doubts have crept up in the market as to whether or not the eye-popping surge in spending on AI will have a positive ROI for companies.

Companies like Alphabet, Meta Platforms, Amazon or Elon Musk’s xAI are spending billions on GPUs, but they have so far very little to show for it. I think that the risk of missing out on the Blackwell opportunity is presently the biggest risk for investors.

My Conclusion

The market clearly expected more of Nvidia last week, though I am not exactly sure what: Nvidia reported sales above guidance and gross margins remained in the 75% range and didn’t show any signs of softening. Even substantial sales growth, strong margins and a robust outlook for 3Q25 could not sway investors last week, a clear sign that investors are too demanding.

With that said, though, Nvidia has a strong profit catalyst with the Blackwell GPU and I think that investors should strongly consider buying the drop after earnings.

If Nvidia’s 2Q25 results have shown anything, it was that Nvidia’s business continues to fire on all cylinders and investors have every reason to stay optimistic with the Blackwell ace up Nvidia’s sleeve.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.