Summary:

- Nvidia Corporation’s quarterly net income surged to $19.3 billion, representing an impressive 55% of revenue, up from $9.2 billion and 50.8% last year.

- Nvidia’s profitability outshines other tech giants like Microsoft (37.6%), Alphabet (29.8%), Apple (24.9%), and Meta Platforms (38.6%).

- This makes Nvidia the most profitable company, maybe, in history.

- And with profitability the most important measure of success, it makes sense to own Nvidia stock.

Ethan Miller

Profitability is the most important measure of success. High profitability reflects the value of a company’s products and services, efficiency, and competitive position. Nvidia Corporation (NASDAQ:NVDA) just announced a quarterly net income of $19.3 billion, an incredible 55% of revenue. This was an increase from a quarterly income of $9.2 billion and an already unbelievable 50.8% in the previous year.

Profitability comparison

Let’s look at how Nvidia’s profit compares to other highly profitable companies in the chart below.

| Company | Symbol | Net Income | NI % | Quarter |

| NVIDIA | NVDA | $19.3 | 55% | 10/27/24 |

| Microsoft | MSFT | $24.7 | 37.6% | 9/30/24 |

| Berkshire Hathaway | BRK.A | $26.5 | 24.8% | 9/30/24 |

| Alphabet | GOOG | $26.3 | 29.8% | 9/30/24 |

| Saudi Aramco | ARMCO | $27.6 | 24.8% | 9/30/24 |

| Apple | AAPL | $14.7$21.4 | 15%24.9% | 9/30/246/30/24 |

| Meta Platforms | META | $15.9 | 38.7% | 9/30/24 |

| Visa | V | $5.3 | 55.2% | 9/30/24 |

A couple of other technology companies—Microsoft (MSFT) and Alphabet (GOOG)—have higher profits, but their profitability is lower: 37.6% for Microsoft (which is still excellent) and 29.8% for Alphabet. Meta Platforms (META) is also highly profitable, at 38.6% and $15.9 billion last quarter, but lower than Nvidia. Apple (AAPL) is very profitable, too, but only has a 25% profitability rate. (Note: Apple had a unique tax payment in its latest quarter that distorted its profitability.)

Berkshire Hathaway (BRK.A) and Saudi Aramco (ARMCO) are also highly profitable in total, but have lower profitability and unique business models. I also want to acknowledge Visa (V), which is highly profitable, at 55%, but has lower profits. It has a unique business model with revenue based on fees, not volume.

Historically, Moderna (MRNA) had some highly profitable quarters, such as 61.7% in the quarter that ended on 3/31/22, but this was a unique situation and not sustained.

So, overall, Nvidia’s profitability stands out.

Nvidia Profitability

As I previously wrote about Nvidia’s Platform Strategy, it is the most critical element to its success. This strategy drives both growth and efficiency. Nvidia’s unique technology platform comprises computing systems, proprietary processing chips, and extensive software. This comprehensive platform drives its growth and competitive advantages that no other company can match.

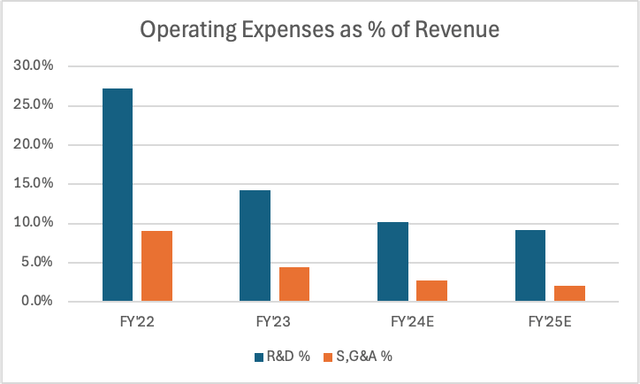

Its growth also continues to increase its profitability rate as it doesn’t need to, and probably can’t, increase its operating expenses at the same rate as its revenue growth. For example, it increased quarterly R&D by almost $1 billion from $2.3 billion to $3.4 billion, a 48% increase. S, G&A expenses increased from $689 million to $897 million. However, since revenue almost doubled, total operating expenses decreased as a percentage of revenue from 16.5% to 12.3%!

Nvidia’s operating expenses have dramatically decreased as a percentage of revenue, with estimates for the remainder of this year and projections for FY ’26 (from Merrill Lynch). This illustrates the leverage advantage of a platform strategy. Expenses don’t need to increase proportionally to revenue.

Operating Expenses as a % of Revenue (NVIDIA financial statements, BofA estimates and projections. )

Nvidia’s guidance for next quarter, which could be conservative, shows operating expenses increasing more than revenue, so its profitability could decline but still be above 50%.

Most Profitable Company?

Is Nvidia the most profitable company? I believe so. The most profitable in history? Maybe. There are valid investment arguments about Nvidia Corporation’s valuation and P/E ratio of 49X, but owning stock in the most profitable company makes sense to me. Nvidia should be able to retain an unbelievable net income in the range of 50%-55% while, at the same time, it continues to grow based on what appears to be an insatiable demand for data center systems. Beyond that, it also has some other opportunities, such as automotive.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.