Summary:

- Nvidia Corporation’s climb has been remarkable, as the company’s stock price nearly tripled in the last seven months.

- However, Nvidia is becoming overvalued now. The company trades at an exceptionally high 25 times sales and 65 times non-GAAP forward EPS estimates.

- Moreover, there are fundamental issues, an economic slowdown, and Nvidia’s profitability could weaken more than anticipated.

- Moreover, the upcoming earnings report better be perfect, or Nvidia stock could reverse sharply due to a shift in sentiment soon.

- Approximately a 25% correction would make Nvidia’s valuation more attractive, and could be an excellent entry point long term.

Justin Sullivan

Nvidia Corporation (NASDAQ:NVDA) stock has exploded since bottoming in mid-October last year. Nvidia’s stock has nearly tripled in the seven months following my $100-120 buy-in range call. After dropping considerably (69%) during the tech bear market phase, Nvidia’s stock has regained most of its lost ground and is nearing its all-time high from the tech blowoff top days in 2021. However, Nvidia’s stock has become increasingly overbought. Perhaps more importantly, Nvidia is overvalued, and the stock could go through a significant correction following its earnings announcement in several days.

Nvidia’s massive market cap of $750 billion may need to be revised here. Nvidia’s stock now trades at a forward P/E (fiscal 2024) of around 65 here, making Nvidia one of the most expensive large-cap stocks globally. Additionally, there are uncertainties regarding Nvidia’s earnings potential because of the economic slowdown, its GPU segment sales decline, and other elements. Nvidia’s sky-high valuation, deteriorating technical posture, and questionable earnings potential could lead to a negative sentiment phase for its stock. Thus, Nvidia’s stock could undergo another significant correction, providing a better entry point in the $230-210 price range.

Nvidia – Wait, How Much is it Worth?

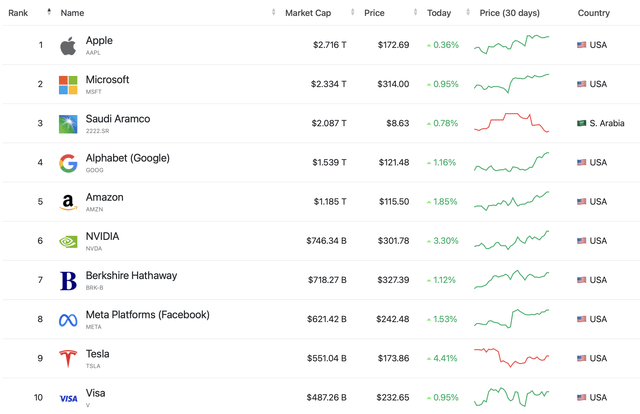

Top Ten Companies by Market Cap (Globally)

Top market caps (companiesmarketcap.com)

About $750 Billion – The company’s revenues will likely come in at about $30 billion in fiscal 2024. So, Nvidia is trading around 25 times forward sales estimates. This valuation appears excessive because, in comparison:

- Tesla, Inc. (TSLA) sells at five times 2023 sales and four times 2024 sales estimates.

- Microsoft Corporation (MSFT), which is at around 11 times, while also expensive, is much cheaper than Nvidia.

- Meta Platforms, Inc. (META) trades at 4-5 times forward sales here.

- Alphabet, Inc. (GOOG, GOOGL) also trades at about the 4-5 times sales range.

The Takeaway

Nvidia has robust growth and profitability potential, but at 25 times sales, the stock is costly. Furthermore, the economic backdrop remains cloudy, and Nvidia’s sales and earnings growth projections may need to adjust lower as the slowdown proceeds. Therefore, Nvidia could have a sharp selloff, primarily because earnings expectations are incredibly high, and investors are paying a massive premium here to own the stock. Thus, there is very little room for error, and with so many new buyers in Nvidia recently, there may be a mass exodus next.

Nvidia’s Earnings – 65 Times Forward P/E Ratio

We see that a 25 P/S valuation is exceptionally high. Yet, Nvidia’s P/E valuation is similar. Nvidia’s stock trades around 65 times fiscal 2024 non-GAAP consensus EPS estimates and at 87 times 2023’s results. We’re now looking at a GAAP P/E of about 120 for Nvidia here. Now that’s more than exceptionally expensive. That’s a tech valuation gone wild. If we take a comparable company like Advanced Micro Devices, Inc. (AMD), the chip maker trades at just six times 2024 sales estimates and a forward P/E of about 25.

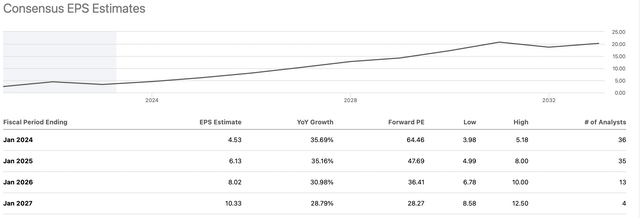

What About Nvidia’s Future Earnings?

Future earnings are complicated, as they are projections, and no one knows precisely what the economic landscape will look like in the coming years. Nevertheless, Nvidia’s fiscal 2025 EPS estimates vary dramatically. The EPS estimates range from about $5-8, with the average EPS projection around $6. Also, we’re discussing non-GAAP figures here, and Nvidia still trades around a 50 P/E ratio relative to its fiscal 2025 projections.

EPS estimates (seekingalpha.com)

We see estimates for 30-35% EPS growth in the next few years. However, will Nvidia achieve such extraordinary results in a challenging economic environment? Even if it does, the company trades at a PEG ratio of about 1.86, which is still relatively expensive, even for a growth stock.

So, What Could Go Wrong?

While Nvidia’s prospects remain solid, especially in its data center segment, Nvidia’s gaming GPU segment could continue to struggle due to a slowdown in the general economy and the lost business from cryptocurrency GPU sales. Additionally, Nvidia’s data center revenue growth could slow more than anticipated, worsening sentiment in the company’s stock price as we advance.

The “Ethereum Merge” occurred last September and essentially cut Nvidia GPUs from the mining business. Thus, we saw a significant decline in Nvidia’s GPU sales, a dynamic that could continue plaguing the company as we move on. Also, the company made inadequate disclosures to investors, according to the SEC, regarding the percentage of its GPU sales going toward the cryptocurrency segment. This situation could have been handled differently, but unfortunately, Nvidia managed it the way it did.

Nvidia – Why We Could See a 25-30% Correction

Nvidia is an excellent company, and while I believe in its long-term potential, Nvidia is overbought and overvalued now. Nvidia tends to become highly overbought in some instances, and substantial corrections of 20% or greater are not uncommon for its stock.

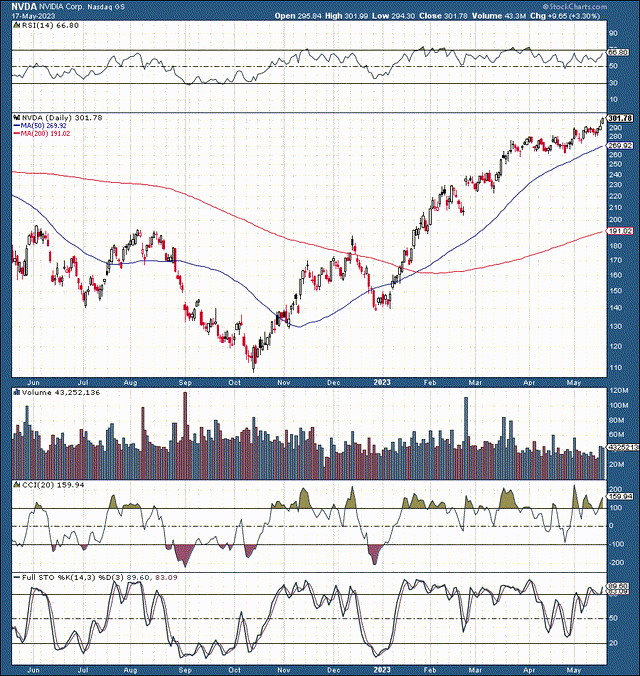

Nvidia: 1-Year Chart

While Nvidia’s stock continues rising, the technical image is worsening as momentum fades. The stock is now about 60% above its 200-day MA. Moreover, we have seen a slowdown in volume lately, and the buy-side volume continues declining, despite a rise in Nvidia shares. Furthermore, the RSI is approaching 70 again, implying that the stock is getting overbought—also, the lower RSI peaks recently, despite the stock price making new highs, suggesting that momentum could be worsening and a correction could arrive at any time.

Furthermore, the fundamental backdrop remains challenging and uncertain for Nvidia. The economy continues slowing, and Nvidia’s gaming unit, data center business, and other segments could slow more. This dynamic could lead to lower-than-expected revenues and earnings, putting additional pressure on Nvidia shares. Nvidia’s valuation remains exceptionally high, and multiple compression may be required before the next move higher begins.

Also, Nvidia should report Q1 earnings soon (May 24th post-market). Due to the extraordinary run-up, exactions are incredibly high, and this stock has almost no room for error. If the company misses estimates or provides worse-than-expected guidance, Nvidia’s share price could experience another fall. On the other hand, if the company reports in line or beats estimates, the announcement could lead to a sell-the-news event.

The Nvidia Corporation Q1 earnings report needs to be perfect, and even then, it’s not guaranteed that Nvidia’s wild valuation will be sustained. Therefore, sentiment could sour quickly, leading to a significant pullback in the coming months. My new buy-in target range for Nvidia is around $230-210, roughly 25-30% below its current share price.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOG, TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long a diversified portfolio with hedges.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

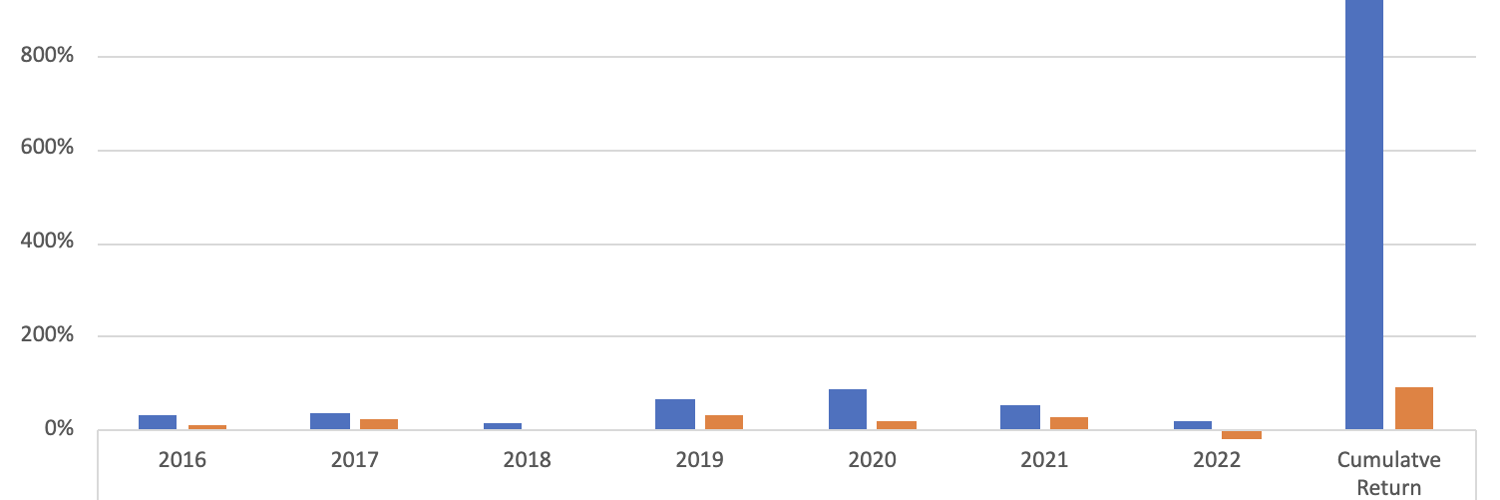

Are You Getting The Returns You Want?

- Invest alongside the Financial Prophet’s All-Weather Portfolio (2022 17% return), and achieve optimal results in any market.

- Our Daily Prophet Report provides crucial information before the opening bell rings each morning.

- Implement our Covered Call Dividend Plan and earn an extra 40-60% on some of your investments.

All-Weather Portfolio vs. The S&P 500

Don’t Wait! Unlock Your Own Financial Prophet!

Take advantage of the 2-week free trial and receive this limited-time 20% discount with your subscription. Sign up now, and start beating the market for less than $1 a day!