Summary:

- The market has negatively reacted to Nvidia’s latest earnings report.

- Nvidia faces several risks that will likely undermine its efforts to grow its sales across the globe.

- We also believe that Nvidia is overvalued, its upside is limited, and its stock is a SELL for us.

peshkov

Nvidia Disappoints The Market

Two weeks ago, Nvidia (NASDAQ:NVDA) released its Q2’25 earnings report, which showed that the revenues during the quarter were $30.04 billion, up 122.4% Y/Y and above the consensus by $1.29 billion. Despite such results, the company’s shares initially declined after the results were revealed.

In part, the decline was caused by the expectations that Nvidia’s growth rate is about to normalize in the upcoming quarters, which means that the triple-digit growth rate is likely to be a thing of the past next year and beyond.

If we look closely at the performance of Nvidia’s stock, we’ll see that it started to gain momentum in May 2023. That is when the Q1’24 report was released, which showed that while the company’s revenues declined Y/Y, major growth was expected in the following quarter thanks to the increased demand for its first generative AI GPUs from the H100 series that started to gain traction back then. As the generative AI revolution began to gather steam, the sales for the company’s AI GPUs were accelerating, which made Nvidia trade at excessive multiples that are mostly far beyond the sector’s median multiples.

Ever since that report came in, the market’s perception was that the company needed to significantly beat the consensus estimates and meaningfully increase its guidance all the time for the shares to continue to trade at those high multiples. This has been the case in recent quarters so far. In Q3’24, Q4’24, and Q1’25, Nvidia beat the revenue consensus by a wide margin and announced a major guidance increase that was above the street expectations by a significant margin as well. Thanks to this, Nvidia’s shares rallied, and the company was able to become one of the most valuable businesses in the world in less than two years.

However, after the recent Q2’25 report came in, there’s a sign that the pace of growth appears to be slowing down, and it’s one of the main reasons why the stock has been declining recently. CNN reported that investors were likely disappointed that Nvidia didn’t beat the estimates by a wider margin. Another Seeking Alpha contributor Jonathan Weber also noted that while the revenue estimates were beaten by around 4%, it’s not as great when compared to a year ago when revenue estimates were beaten by around 20%. If we look at Nvidia’s earnings history, we’ll see that the revenue beat in absolute numbers has been shrinking during each consecutive quarter starting from Q2’24. Professor Aswath Damodaran noted that there are clear signs of more slowing to come, as scaling will continue to push revenue growth down.

Earnings History (Seeking Alpha)

In addition to that, the guidance also was relatively weak and contributed to the decline in share price as well. In Q3, Nvidia expects to generate $32.5 billion in revenues, which is less than a billion dollars from the consensus of $31.71 billion. This was one of the biggest disappointments of the recent earnings report, as the market expected a better guidance. Professor Aswath Damodaran also explained what to make from this guidance and what’s to come next, and we fully share his point of view:

As a company that has played the expectations game well, it should come as no surprise that Nvidia provided guidance for future quarters in its second quarter report, and here too, there were reminders that comparisons would get more challenging in future quarters, as they predicted that revenue growth rates would come back to earth, and that margins would, at best, level off or perhaps even decline.

Additional Issues To Consider

While the guidance has been rather disappointing, there’s also a possibility that it would be more challenging for Nvidia to meet it, and especially exceed it, as it faces some additional challenges right now. Last month, news came in that Nvidia’s upcoming Blackwell GPUs will be delayed, which resulted in a short-term selloff of the company’s shares. Nvidia in the recent conference call hinted that the potential delay was due to the technical change to improve the production yields of Blackwell and the production ramp-up is expected only in Q4. As such, there’s a possibility that the overall performance in Q3 could also disappoint investors when the next earnings report comes out in November.

There’s also a risk that the guidance in the next earnings report could also disappoint investors, since the company faces some external risks that are outside of its control. In the Q1 earnings call, the management admitted that their data center revenue in China is down significantly due to the American chip export restrictions that were implemented last year. In the recent Q2 earnings call, they repeated that their current sales in China are below the previous levels. Since the China-USA relations are not expected to significantly improve anytime soon and Beijing has recently retaliated by imposing its export restrictions as well, the macro risks will remain and will likely continue to undermine Nvidia’s efforts to grow revenues across the globe.

As a result of all of that, we believe that Nvidia is not a good investment right now and its shares have a decent chance of continuing to depreciate or trade sideways in the upcoming months.

The Intrinsic Value of Nvidia

Right now, we believe that Nvidia’s stock is also overvalued, especially since it trades at a forward P/E of 38x, while the sector’s median P/E is only 23x. Seeking Alpha’s Quant system also gives Nvidia a rating of D- for valuation. To figure out Nvidia’s intrinsic value and how big is its downside, we created our valuation model.

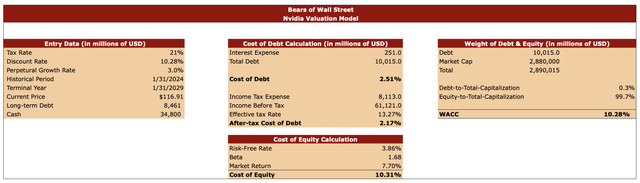

To create a model, we added some initial data that can be seen on the left side of the table below. The tax rate in our model is 21%. This is the current corporate tax rate in the United States. While Nvidia’s effective tax rate was lower in the last year, our model covers a period of the next five years where the tax rate might increase. This is why it makes sense to assume a higher rate in the model. We made this model at a time when Nvidia was trading at $116.91 per share, and the long-term debt and the cash reserves data was added from the latest earnings report. The perpetual growth rate is 3%, which is close to the historical inflation and GDP rate.

The discount rate in our model is 10.28%. The calculation for the discount rate is presented in the middle and right columns of the table, which can be seen below. First, we calculated the cost of debt and the after-tax cost of debt by using Nvidia’s TTM financial data. Then we calculated the cost of equity by using the risk-free rate of 3.86%, the beta of 1.68, and the inflation-adjusted market-return rate of 7.70%. In the end, we weighted Nvidia’s debt profile with its equity and figured out the discount rate.

Nvidia’s Valuation (Bears of Wall Street)

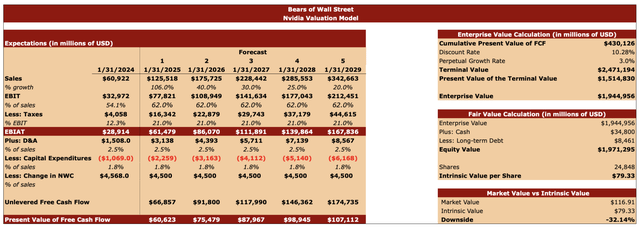

Once we filled in the entry data, we moved on to forecasting Nvidia’s growth in the upcoming years. The sales growth rate of 106% in the model is similar to the overall expectations for the current fiscal year. While the pace of growth is expected to subside going forward, the company still had strong growth at the beginning of this fiscal year, which is why in FY25 we’ll still see a triple-digit rate for sales. After that, a normalization of the growth rate is expected to happen and is reflected in our model. The EBIT as a percentage of sales is 62% in the model, which is close to the company’s historical performance in recent months. The tax rate is 21%, while the assumptions for the rest of the metrics closely match up with Nvidia’s historical performance.

Our forecast helped us figure out the present value of Nvidia’s FCF in the upcoming years. We were then able to calculate the cumulative value of Nvidia’s FCF, apply the discount and perpetual growth rates, and figure out the terminal value and the present value of Nvidia’s terminal value. We then added Nvidia’s present value of the terminal value to the cumulative present value of its FCF to calculate the company’s enterprise value, which in our case is $1.94 trillion.

Once the enterprise value was found, we then added Nvidia’s cash, subtracted the long-term debt from it, and arrived at an equity value of $1.97 trillion. After that, we divided Nvidia’s equity value by the number of its shares and arrived at the intrinsic value of $79.33 per share. This means that Nvidia’s stock is overvalued by around 32%. That’s why we believe that Nvidia is a SELL right now.

Nvidia’s Valuation (Bears of Wall Street)

It’s also important to note that at a market cap of nearly ~$2. 65 trillion, it’s hard to justify Nvidia’s current price, even after the recent decline caused by the latest earnings report. The whole generative AI market under one of the most optimistic assumptions is expected to be worth $1.3 trillion in 2032. In addition, the overall cloud market could be worth only as much as $1.8 trillion by 2029. Considering this, Nvidia’s current valuation today simply doesn’t make a lot of sense to us.

Risks To Our Bearish Thesis

Despite all the negativity, several risks could undermine our bearish thesis. The most obvious is the potential greater ramp-up of sales in the second half of the year, which would make the market excited again about Nvidia’s growth prospects. The potential delay of Blackwell shipments could be offset by the potential increase of the company’s Hopper series GPUs, especially since their supply and availability have improved. This could ensure that Nvidia performs well in Q3, and makes investors once again excited about investing into its shares if the beat is significant.

We also know from the latest conference call that the demand for Blackwell is above supply. If no further delays are announced, then when the Q3 report comes out, Nvidia could also announce a far more optimistic guidance for Q4, which could help revive the stock’s momentum later this year.

Final Thoughts

Nvidia’s biggest issue is that its stock is priced for perfection, and any earnings report that includes an earnings beat without an impressive margin and relatively disappointing guidance would likely prevent a further appreciation of shares. This has been the case with the latest earnings report and the subsequent reaction of the market to it.

The macro challenges are also not going anywhere away, and potential catalysts might not even materialize in the end if the company fails to grow its sales due to potential supply issues or delays. That is why Nvidia’s upside is not guaranteed and until the Q3 numbers come out, its shares could continue to experience weakness. This is why at the current price, Nvidia stock is a SELL for us.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.