Summary:

- Nvidia Corporation’s fiscal Q3 results highlighted its dominance in the AI sector, showcasing strong growth and solidifying its position as a top player.

- Despite not being an industry leader a few years ago, Nvidia has recently traded as the most valuable company in the US market.

- Current valuations reflect Nvidia’s strong performance and potential, with plenty of revenue growth expected in the coming quarters.

BING-JHEN HONG

Perhaps the greatest growth story in the market lately has been Nvidia Corporation (NASDAQ:NVDA). The chipmaker, which wasn’t even thought of as a leader in its industry just a few years ago, has traded as the most valuable company in the US market at times recently. Last week, Nvidia reported its fiscal third quarter results, and the numbers continue to show this is the best way to play the artificial intelligence (“AI”) boom.

Previous coverage on the name:

When I last looked at the chipmaker, the company had just reported its fiscal second quarter results. I mentioned how there seemed to be some growing pains, as investors were not originally happy with the company’s smallest revenue beat in a year. Q3 guidance was also not as rosy as some were hoping for, which put some pressure on shares initially.

While Nvidia’s revenue growth rates were set to come down a bit in the coming quarters, I cautioned how this was more the law of large numbers than a troubling business position. It’s just really difficult to continue doubling sales when your year-ago period goes from $10 billion to $30 billion. Overall, despite last week’s weakness at the end, Nvidia shares have still rallied about 31% since my previous article, while the S&P 500 is up just 8%.

The fiscal Q3 report:

The company reported record revenues of over $35 billion for the period. This number was up 94% over the prior year period, and the nearly $2 billion beat was its largest dollar-wise in a year. The star was again the Data Center segment, with 112% year-over-year revenue growth, while Automotive revenues were up 72%. Gaming and Professional Visualization revenues were up in the mid to high teens each.

Demand for its current generation Hopper architecture remains strong, and the Blackwell launch is upon us. Management said it will take several quarters for the production of Blackwell to fully ramp. This is why Street estimates call for an additional nearly 50% revenue growth in the January 2026 fiscal year, on top of the more than doubling expected for the current fiscal year. In a 10-quarter span, Nvidia could go from delivering $7 billion plus in revenues during a three-month period to over $50 billion in a quarter.

Another thing that separates Nvidia right now from the pack is its profitability. Because demand is sky-high, the company was actually able to hold its non-GAAP gross margins steady year over year at about 75%. With adjusted operating expenses only rising by 50% over the same time, operating income more than doubled the fiscal Q3 2024 figure. Nvidia reported a non-GAAP profit of more than $20 billion for the quarter, with free cash flow of almost $17 billion.

At the end of the October 27th, 2024 period, Nvidia had roughly $38.5 billion in cash and investments on the balance sheet. Total debt stood at roughly $8.5 billion, so there is tremendous financial flexibility here. The company was able to repurchase almost $11 billion in shares during Q3 alone, with nearly $26 billion in the fiscal year to date, and still get its cash pile substantially higher. The only issue somewhat negative here is that the $3 trillion plus market cap is so high right now that we’re not seeing a meaningful decline in the number of shares outstanding. At least the count is not rising much, either.

Guidance a beat, but not enough, perhaps

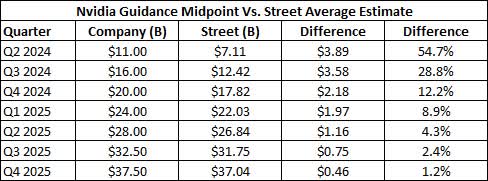

For companies with high expectations, the phrase “what have you done for me lately” is thrown out a lot. Even if you beat nicely like Nvidia did with Q3, it may not matter if Q4 guidance fails to impress. As illustrated by the table below, while the midpoint for Q4 revenue guidance at $37.5 billion was nearly half a billion dollars ahead of the street, it was the lowest guidance beat since the “shock and awe” quarter seen last year.

Nvidia Guidance vs. Estimates (Seeking Alpha)

Most investors would normally be thrilled if a company they owned gave a revenue guidance midpoint that was $460 million ahead of the Street. But when you have provided guidance in previous quarters that was much further ahead of the Street, and you are near being the most valuable company in the US, it’s not enough. In this case, Nvidia’s Q4 2025 average estimate had skyrocketed from $21.23 billion to $37.04 billion over the past year. That’s a high bar to top, which Nvidia did do, but we also have to realize that analysts are getting better with their estimates. Don’t forget that when it came to Q3, actual results came in well ahead of initial guidance.

A look at current valuations:

In early Thursday morning trading, Nvidia shares set an all-time high near $153 a share. Those gains quickly evaporated, however, and by Friday’s close, the stock was under $142. While that about $11 move doesn’t seem like much for shares that two years ago were in the mid-teens, it did bring the valuation down to a slightly more reasonable level.

Currently, Nvidia shares are going for about 32.5 times their January 2026 expected earnings, which is the company’s next fiscal year. Competitor Advanced Micro Devices (AMD) goes for just under 27 times its calendar 2025 expectation, while Intel (INTC) is under 25 times. Nvidia is projected to show the most revenue growth among the three, while AMD is expected to see the most earnings per share growth on a percentage basis. Of course, when you factor in that Nvidia is likely going to see around 130% earnings growth this fiscal year to AMD’s 26%, Nvidia is working off a harder base comparison moving forward.

Final thoughts and recommendation:

Nvidia announced another solid set of results last week, with revenues handily beating the street and guidance showing some upside for the current quarter. Unfortunately, the results weren’t the total blowout that some were expecting, so shares did pull back from their new all-time high late in the week. Now, investors will focus on the Blackwell ramp to see how quickly Nvidia can get its revenues to surpass $50 billion in a quarter.

With a tremendous amount of growth still ahead, I’m upgrading Nvidia shares to a buy today. This is the best pure play on the AI boom currently, and the valuation is quite fair compared to both AMD and Intel for the growth you are getting. With a strong balance sheet and tremendous cash flow that will allow for future acquisitions and/or significant share repurchases, it would not surprise me to see Nvidia hit a $4 trillion market cap sometime in 2025.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from a broker or financial adviser before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.