Summary:

- A rather tepid Nvidia Corporation forecast for Q4, which failed to meet Wall Street’s relatively high expectations, is one of the main reasons behind the recent decline in NVDA’s share price.

- At this point, Nvidia’s stock could be considered overvalued and overhyped at the same time.

- Nvidia remains a SELL for us, since we believe that its stock has more room to fall.

JHVEPhoto

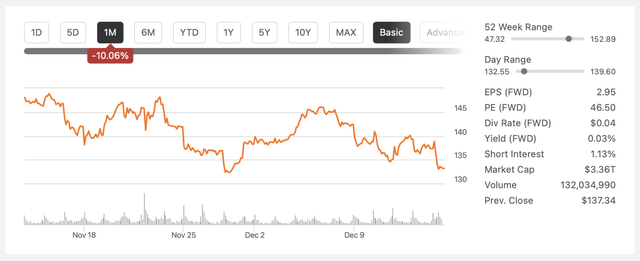

Nvidia Corporation (NASDAQ:NVDA) stock is up 14% since we last covered it a couple of months ago, but also down 7% since the release of its Q3 earnings report last month. Although the earnings report was successful, the market is not satisfied with the guidance that the management announced.

In our previous coverage on Nvidia, we said that the company’s stock is priced for perfection and the inability of the management to constantly increase the outlook significantly above the consensus could kill Nvidia’s momentum. That is precisely what is happening right now. We believe that because of the rising challenges that the company is facing, the future guidance for the upcoming quarters might disappoint as well and lead to a further depreciation of Nvidia’s share price.

Reality Fails To Meet Expectations

The Q3 numbers themselves weren’t that bad. The revenues were up 93.6% Y/Y to $35.08 billion, above the consensus by nearly $2 billion. The bottom-line performance was also relatively good, as it was above the consensus as well. But because Nvidia was priced for perfection already, the relatively weak guidance killed the stock’s momentum, and the share price is currently on a downward trend.

Nvidia’s stock price (Seeking Alpha)

In Q4, the management expects Nvidia to make $37.5 billion in revenues, which is not that far away from the street consensus of $37.1 billion. Some analysts guided for the revenue goal of as high as $41 billion before the management’s outlook was released. But overall, the guidance mainly disappointed Wall Street and became one of the main reasons behind the latest depreciation. At the same time, Nvidia faces some major challenges that could prevent the company from aggressively increasing the outlook that could impress Wall Street in the upcoming quarters as well.

The AI accelerators from the Blackwell series are currently one of the most talked about accelerators in the world, with an insane demand according to Nvidia’s management. However, some issues associated with them have already affected Nvidia’s release plans. In October, Blackwell encountered a design flaw that resulted in lower yield rates and delayed their shipping to first clients. Then last month, it was reported that Blackwell chips were overheating in servers.

Although it appears that those issues have now been fixed and the ramp-up of Blackwell is expected in Q4, Nvidia’s guidance suggests that revenue of $37.5 billion for the upcoming quarter will translate to a Q/Q growth rate of only 7%. This might indicate that despite all the hype surrounding Blackwell, the AI chip buying cycle could be coming off the peak right now. That doesn’t mean that the growth will disappear. However, the growth rate itself should normalize and the aggressive double and triple-digit revenue growth rate that fueled the rise of Nvidia’s stock could become a thing of the past.

The ramp-up of Blackwell in the upcoming quarters is also expected to affect Nvidia’s margins and could result in a poorer bottom-line performance. The gross margins are expected to decline to the low 70s, and the margin pressure could persist throughout the first part of FY26. This creates additional pressure on Nvidia, as Blackwell needs to perform well for the company to not release another relatively disappointing guidance that further kills the stock of its momentum. Considering that the networking revenues were down sequentially in Q3, and the gaming revenues in Q4 are expected to be down sequentially as well, Nvidia’s upside could be limited in the foreseeable future if Blackwell doesn’t perform well.

Nvidia also faces additional pressure from hyperscalers, who at the same time are its major clients. They are currently in the middle of designing their own AI chips for their data centers, which over time could undermine Nvidia’s dominant position in the AI accelerator market. We already know that Amazon (AMZN) is working with Intel (INTC) to produce a fabric AI chip, while Apple (AAPL) recently confirmed that it now also uses Amazon’s custom AI chips. Other companies like Microsoft (MSFT), Meta Platforms (META), Google (GOOGL, GOOG), Tesla (TSLA) and OpenAI are also in the middle of designing their own AI chips and could become direct competitors of Nvidia over time.

All of those developments make us question Nvidia’s market capitalization of $3.4 trillion. The whole generative AI market is not expected to generate as much revenue over the following years. Thus, it doesn’t make a lot of sense for Nvidia to be worth so much today, given the number of issues that it faces.

The geopolitical issues are also not going anywhere away. The implementation of Trump’s protectionist tariff policy next year could damage global growth, which could result in lower demand for AI chips since businesses could be forced to hoard resources in the face of macroeconomic uncertainty. Nvidia already suffers from the ongoing chip war between China and the United States, as its revenues in China are currently below historically high levels due to chip export restrictions. An uncertain macro environment will only make it harder for it to aggressively increase its outlook to satisfy the market’s needs.

The Intrinsic Value of Nvidia

At the current market price, we also believe that Nvidia is overvalued. Our valuation model from the previous article showed that Nvidia’s intrinsic value is $79.33 per share. Since Nvidia released a new outlook last month, we decided to update our model and make several revisions.

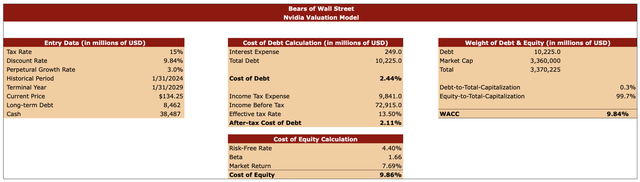

In the model, we decrease Nvidia’s effective tax rate from 21% to 15%. The 15% is closer to Nvidia’s current rate, and there’s a possibility that the standard corporate tax rate in the United States will be decreased under the Trump administration. The perpetual growth rate remains at 3%, and our valuation model forecasts Nvidia’s performance for the next five years. The long-term debt and cash data have been taken from the latest earnings report, and we update this model when Nvidia is trading at $134.25 per share.

The discount rate in our valuation model is 9.84%. We figured it out by calculating Nvidia’s after-tax cost of debt and cost of equity. To figure out the cost of debt, we mostly used Nvidia’s TTM data. To figure out the cost of equity, we used the risk-free rate of 4.40%, beta of 1.66, and the market-return rate of 7.69%. We then weighted Nvidia’s debt and equity to arrive at the discount rate.

Nvidia’s valuation model (Bears of Wall Street)

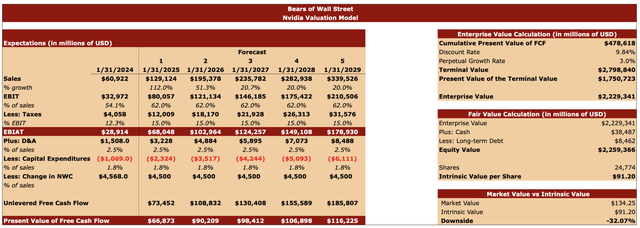

For the forecast table below, we updated the sales growth rate, which is now similar to the overall expectations for the next couple of years. As the table shows, we expect a normalization of the sales growth rate in the following years. The EBIT rate remained the same as before and is similar to the current TTM rate. The tax rate was decreased, and the bottom part of the forecast table mostly remained the same.

The assumptions in our forecast table helped us to figure out Nvidia’s enterprise value, which in our case is $2.23 trillion. We then added cash and subtracted debt to arrive at the equity value of $2.26 trillion. Thereafter, we divided Nvidia’s equity value by the number of its outstanding shares and figured out that Nvidia’s intrinsic value is $91.20 per share. The lower tax rate in this updated model is one of the main reasons why the intrinsic value has been higher in comparison to our previous model. However, under the new assumptions, Nvidia’s stock is overvalued by around 32%.

Nvidia’s valuation model (Bears of Wall Street)

Risks To Our Bearish Thesis

Although we believe that Nvidia’s stock has likely reached its top for now, there are still a couple of potential developments that can undermine our bearish outlook for the company. While we are unlikely to see an aggressive Y/Y growth of sales in the future since the base for comparison has been significantly raised in the last year and a half, that doesn’t mean that the growth will stop. Since there’s a possibility that a chip shortage could last for the next couple of years, there’s a potential that the demand for AI chips will remain for a while. This could result in sales that are higher than the current consensus once the production of Blackwell is ramped up. This could push Nvidia’s stock price higher, like it was a year ago, even if the Y/Y growth rate won’t be as impressive as before.

The macro risks could also be overblown, and there’s a possibility that the American economy will grow next year despite the geopolitical uncertainty. This could result in a boost in demand for AI chips and also lead to the growth of Nvidia’s share price.

Final Thoughts

Is Nvidia a great business? Yes. Will it continue to grow for years to come? Most likely yes. But the biggest issue at this point is that the rate at which Nvidia is growing is unlikely to be as impressive as before. We believe that a rather tepid forecast for Q4, which failed to meet Wall Street’s relatively high expectations, is one of the main reasons behind the recent decline of Nvidia’s share price.

Considering that the stock is already overvalued while challenges for Nvidia continue to increase, it would be tough for the stock to continue to trade at the current relatively high multiples. That is why Nvidia remains a SELL for us, since we believe that its stock has more room to fall.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.