Summary:

- NVIDIA Corporation’s Q3 earnings showcased a 93.6% Y/Y revenue increase, driven by data center growth, indicating continued aggressive business expansion amid the generative AI revolution.

- The generative AI market’s projected growth, with estimates reaching $1.20 trillion by 2032, positions NVIDIA to dominate the AI chips market for years.

- Despite geopolitical risks, NVIDIA’s lack of formidable competition and the ramp-up of Blackwell shipments suggest significant upside potential for its stock.

BING-JHEN HONG

NVIDIA Corporation (NASDAQ:NVDA) (NEOE:NVDA:CA) is at a turning point. The latest successful earnings report for Q3 indicated that despite the impressive performance in the past two years, the company’s growth story is far from being over, and further growth of its business is almost guaranteed at this point. Its business continues to grow at an aggressive rate at a time when the generative AI revolution is still in its infancy. Meanwhile, the lack of formidable competition makes it possible for Nvidia to dominate the AI chips market for years, if not decades, to come. Although geopolitical risks will haunt the company for a while, at this point the upside to Nvidia’s business and its shares remains significant. That is why I’m optimistic about the company’s future and continue to believe that Nvidia is a BUY at this stage.

The Growth Is Not Over Yet

A month before Nvidia reported its Q3 earnings results, I published my latest bullish article on the company, which highlighted the recent results of the company’s suppliers, customers, and competitors. Those results hinted at a possibility that Nvidia would also show an exceptional performance in Q3 as the demand for AI chips remains significant. Since the publication of that article, Nvidia’s shares have appreciated by ~9% and the company indeed reported stellar numbers for Q3.

Nvidia’s Q3 earnings report came out just a couple of weeks ago, and it indicated that its revenues increased by 93.6% Y/Y to $35.08 billion and were above the expectations by $1.95 billion. Such results primarily were achieved by the impressive growth of the company’s data center business, which saw its revenues increase by 112% Y/Y. The non-GAAP EPS of $0.81 was also above the expectations by $0.06. While those results are certainly impressive, we can safely say that Nvidia’s business will continue to grow at an aggressive rate for years to come.

This is primarily because the generative AI revolution is still in its infancy. To this day, enterprises continue to implement various generative AI tools within their organizations to revolutionize their workflows, while governments are also in the middle of building their national AI infrastructure.

The more conservative reports suggest that the generative AI industry will be worth ~$36 billion by the end of this year and over $350 billion by the end of this decade. Bloomberg is more optimistic and believes that the generative AI market will be worth $137 billion by the end of 2024 and $1.20 trillion by 2032. What’s more important is that most of the reports indicate that the generative AI industry will grow at a CAGR greater than 40% in the following years, which suggests that the industry’s golden days are still ahead of it.

This is certainly a positive thing for Nvidia, which is expected to ramp up the shipments of its current flagship AI accelerators from the Blackwell series. In the latest conference call, Nvidia’s management said that the demand for Blackwell is staggering, and the initial revenue estimates for its flagship chips will be exceeded by several billion dollars as the demand greatly exceeds supply.

What’s more significant is that as Nvidia aggressively scales its business, the competition is nowhere near in sight. There are different reports about the release of custom AI chips by hyperscalers such as Amazon (AMZN), but they are unlikely to dethrone Nvidia from its leadership spot anytime soon. After all, Nvidia continued to ship its chips to Microsoft (MSFT), Google (GOOG, GOOGL), Amazon, and other cloud providers in Q3.

At the same time, Intel’s (INTC) AI chip from the Gaudi series is unlikely to reach a goal of $500 million in sales this year, while Advanced Micro Devices (AMD) expects to sell only ~$5 billion worth of GPUs this year.

Those are fairly minuscule numbers when compared to how much Nvidia makes each quarter. As we know from the latest earnings call, the ramp-up of Blackwell in Q4 is expected to drive incremental revenue of several billion dollars, while the overall revenue in Q4 is forecasted to be ~$37.5 billion, above the consensus of $37.04 billion. Therefore, Nvidia will likely continue to scale its business at an aggressive rate without many problems.

It’s also safe to say that after an impressive performance in Q3 and upbeat guidance for Q4, Nvidia’s stock is undervalued at this stage. My latest valuation model from the previous article showed that the company’s fair value is $145.54 per share. However, I noted that some assumptions in that model could be conservative given the aggressive growth of the company in the past.

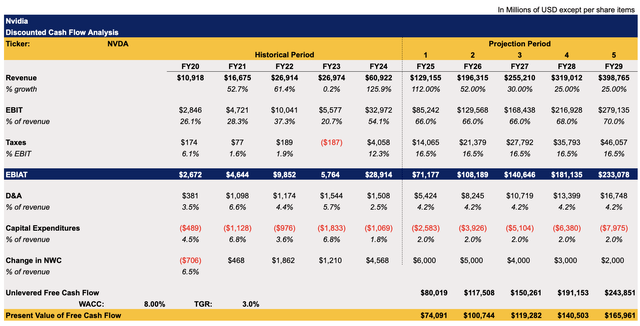

Below is the updated model, which better reflects Nvidia’s current state of affairs. The revenue growth assumptions for FY25 and FY26 have been increased and now closely mirror the overall Street estimates. The ramping of Blackwell shipments in the upcoming quarters should greatly scale the company’s sales and result in better growth in the foreseeable future. For FY27 and beyond, the growth rate remained the same as before. The EBIT as a percentage of revenue also hasn’t changed much and closely correlates with the overall expectations. The tax rate has been slightly decreased as the management guided for an effective tax rate of 16.5% in the last earnings call, while the potential Trump tax reform could also decrease corporate taxes. All the other assumptions remained the same as before.

Nvidia’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

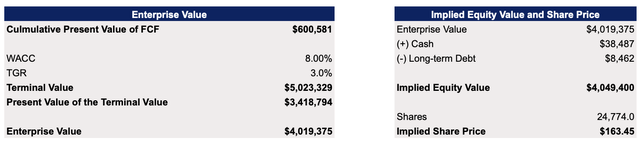

The updated model shows that Nvidia’s fair value is $163.45 per share, which is above the previous calculations and the current market price.

Nvidia’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

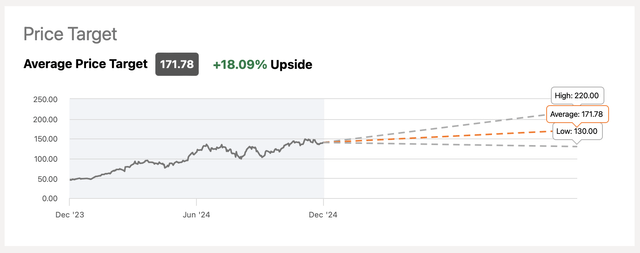

The street is even more optimistic and gives Nvidia a consensus price target of $171.18 per share. Therefore, it’s safe to say that Nvidia’s stock still has an upside at the current price.

Nvidia’s Consensus Price Target (Seeking Alpha)

Risks To Consider

One of the biggest issues with Nvidia is that its stock is priced for perfection. The company needs to constantly provide significant ‘beat and raise’ results to satisfy the market. Although the Q3 results were impressive, the Street expected a greater outlook for Q4. This is one of the reasons why Nvidia’s shares have depreciated after the Q3 results were revealed two weeks ago. Although the long-term picture looks solid and there’s a possibility that the stock will rebound once Nvidia scales the shipments of Blackwell, investors nevertheless should not expect a straightforward appreciation of the company’s shares even if earnings results are impressive.

There’s also a possibility that the escalation of the ongoing Sino-American trade war could affect Nvidia’s performance. Recently, the United States revealed new chip-related export restrictions that are targeting China, which prompted Beijing to retaliate and ban exports of some microchip elements. Considering that the supply of advanced chips is already constrained, the creation of additional supply issues as a result of new export restrictions could prevent Nvidia from ramping up shipments and meeting its sales outlook in the future.

Finally, if the trade war escalates even further after President-elect Trump is sworn in as the President of the United States in January and implements new tariffs, then the global economy could contract. This would negatively impact the demand side as well. This is something that investors need to keep in mind before deciding whether to invest in Nvidia or not.

The Bottom Line

Although some challenges and issues will haunt Nvidia for years to come, the company at this point has plenty of growth opportunities that outweigh major risks. It has a formidable lineup of AI chips that are dominating the market. The lack of major competition at this stage creates an opportunity for the company to benefit the most from the ever-increasing demand for accelerators that power the ongoing generative AI revolution.

Nvidia’s stock also has plenty of upside at the current price, as the business seems to be undervalued. The potential ramp-up of Blackwell in Q4 could help the company once again exceed expectations and result in a major appreciation of Nvidia’s shares, as was the case plenty of times in the past two years. That is why Nvidia remains a solid BUY for me, and I have no plans to unwind my long position in the company anytime soon.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Bohdan Kucheriavyi is not a financial/investment advisor, broker, or dealer. He's solely sharing personal experience and opinion; therefore, all strategies, tips, suggestions, and recommendations shared are solely for informational purposes. There are risks associated with investing in securities. Investing in stocks, bonds, options, exchange-traded funds, mutual funds, and money market funds involves the risk of loss. Loss of principal is possible. Some high-risk investments may use leverage, which will accentuate gains & losses. Foreign investing involves special risks, including greater volatility and political, economic, and currency risks and differences in accounting methods. A security’s or a firm’s past investment performance is not a guarantee or predictor of future investment performance.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.