Summary:

- Nvidia Corporation continues to show dramatic YOY declines in both revenues and profits.

- While sequential results are more promising, data center revenues may show shockingly slow growth this year.

- Nvidia Corporation stock is up big over the past quarter and valuations are over-heated.

- I show why the Nvidia Corporation stock valuation is stretched even based on aggressive assumptions.

Antonio Bordunovi

Nvidia Corporation (NASDAQ:NVDA) has been a strong performer amidst the recovery in the tech sector, but has the rally gone too far? NVDA is showing signs of a recovery in its growth rates, but that kind of narrative does not fit the expectations demanded by the current valuation. Nvidia Corporation still has a strong balance sheet, positive cash flow generation, and attractive secular growth story, but its 60x earnings multiple has already priced this in. I explain why the valuation is overheated as it cannot be justified unless using overly-aggressive assumptions. I am now moving to the sidelines – I rate Nvidia Corporation stock a hold.

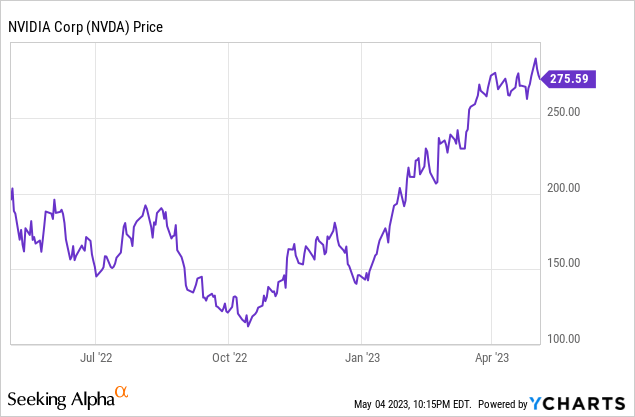

NVDA Stock Price

NVDA is one of the few tech stocks still trading somewhat close to their all-time highs.

I last covered NVDA in October, where I rated the stock a buy on account of the data center growth opportunity. The stock has since returned over 100%, reflecting a dramatic shift in sentiment. At these higher prices, my bullishness wanes.

NVDA Stock Key Metrics

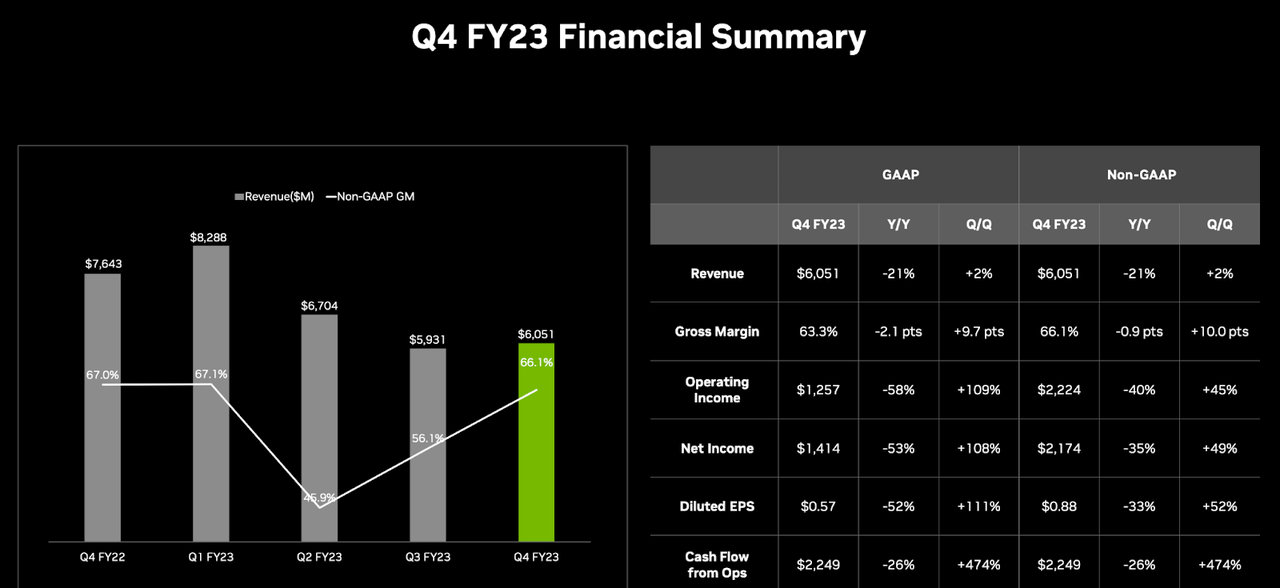

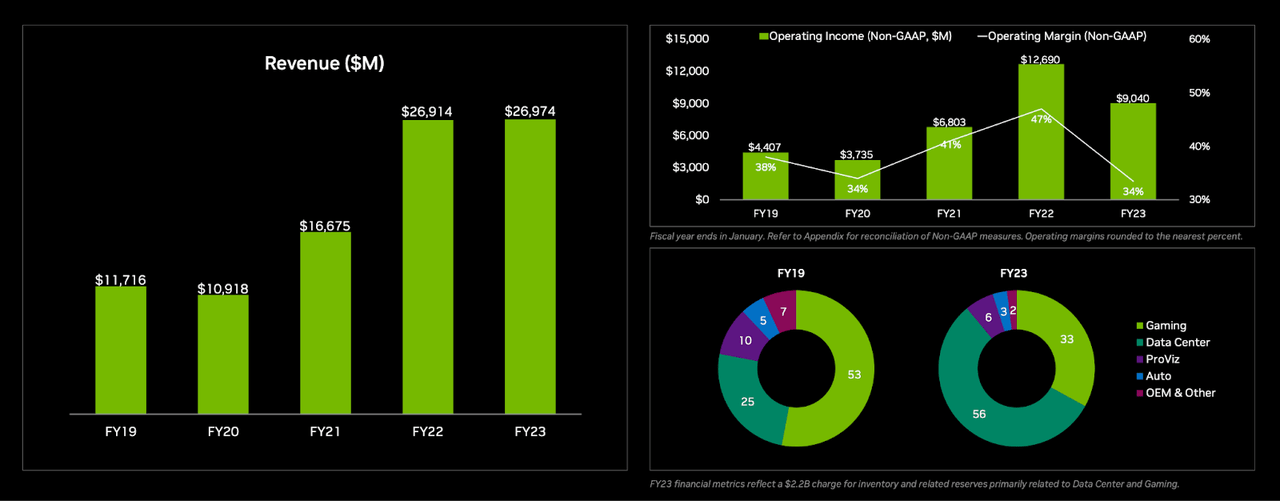

The latest quarter saw another year of YOY declines in revenue and profits, but some sequential improvement. Revenue declined 21% YOY but grew 2% sequentially. Adjusted earnings declined 35% YOY but grew 49% sequentially.

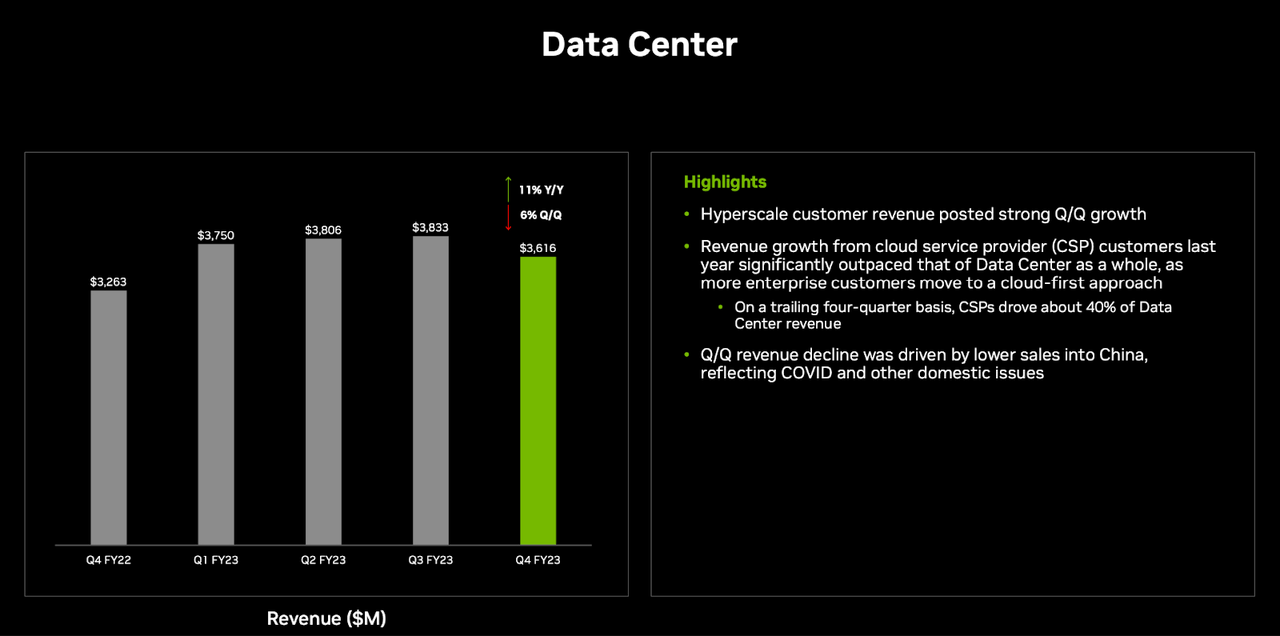

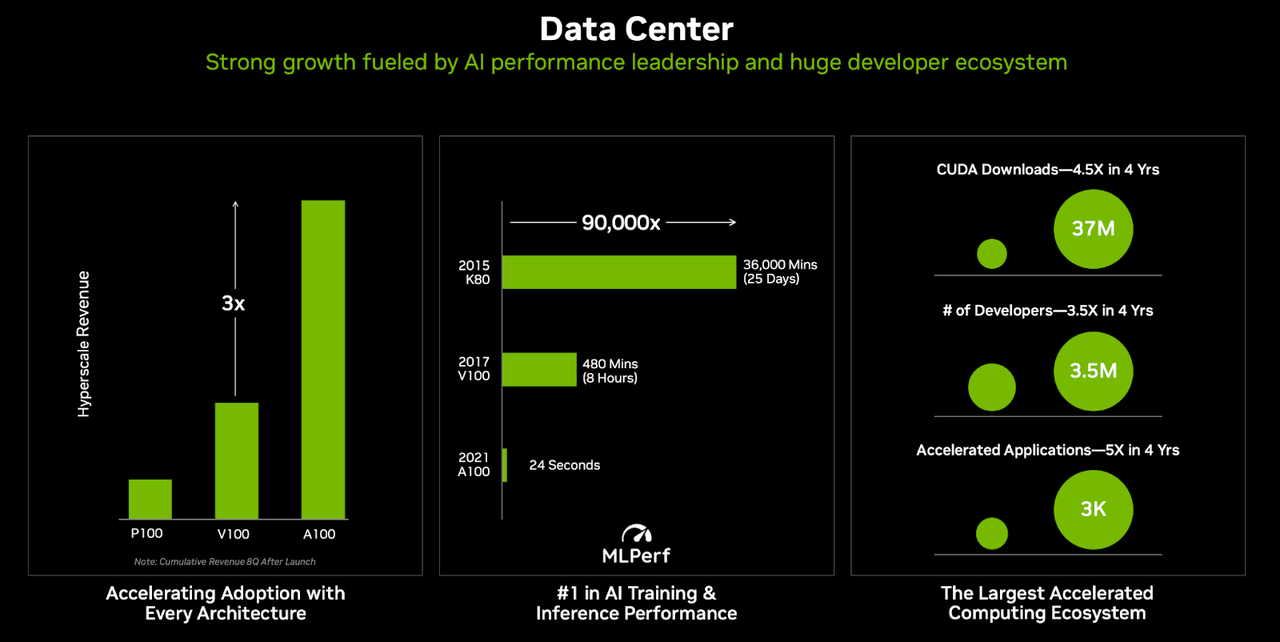

As has been the case over the past several quarters, the data center business segment remained the primary growth driver. Data center revenues grew 11% YOY but declined sequentially. On the conference call, management cited the weakness as being due to lower sales in China but expects growth to recover alongside a recovering Chinese economy (China has recently completely lifted pandemic restrictions). Management noted that cloud service providers (“CSPs”) accounted for 40% of data center revenues in the quarter. Management did not give explicit guidance for data center revenues but instead guided for strong sequential growth in the first quarter with accelerating YOY growth throughout the year. That seems to imply mid-single-digit revenue growth for the segment this year.

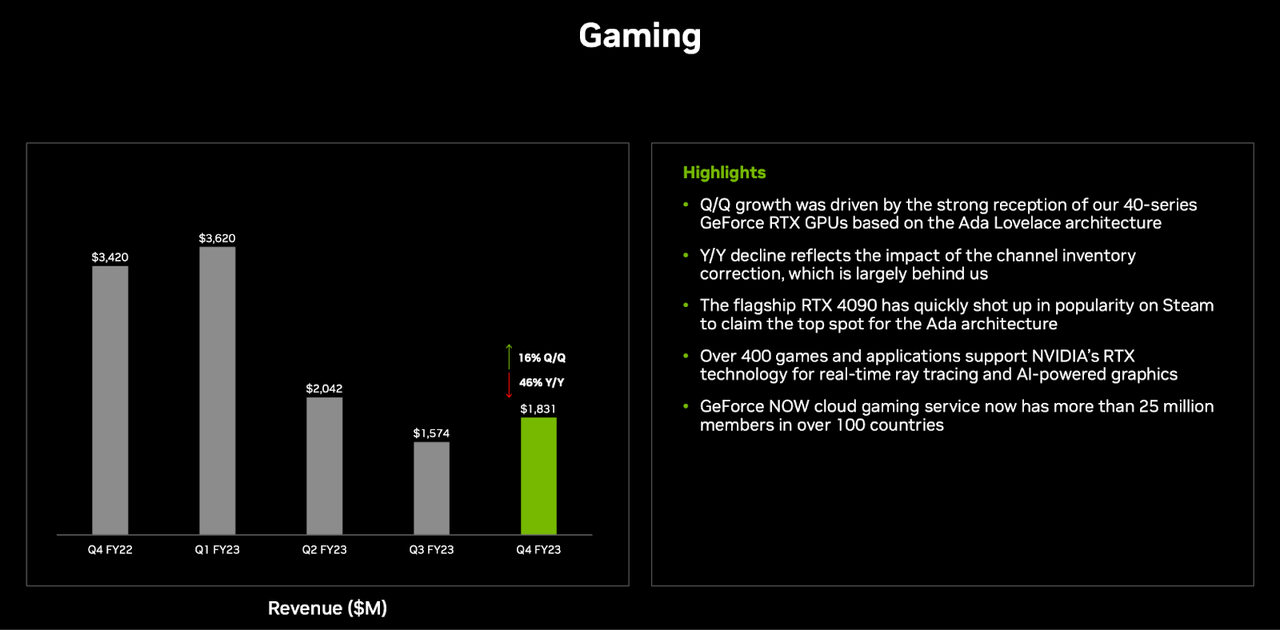

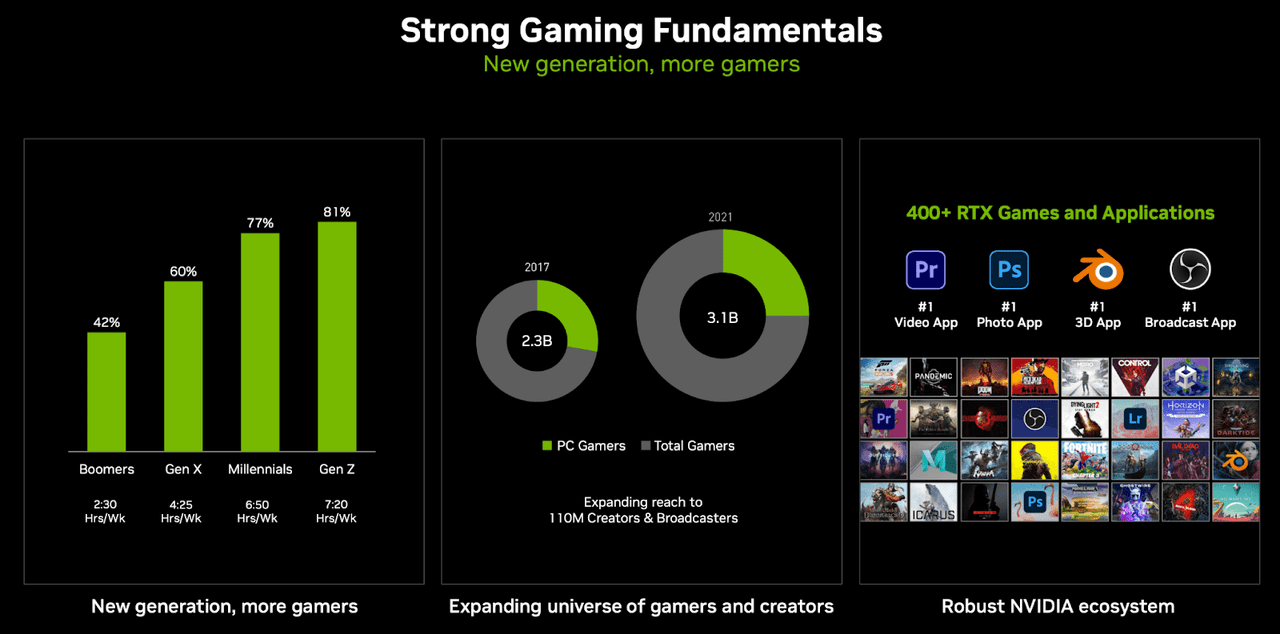

NVDA had been experiencing material weakness in its gaming business segment, but management noted that the “channel inventory correction is largely behind” them. I expect any revenue surprises this year to come from a faster-than-expected recovery in gaming.

NVDA ended the quarter with $13.3 billion in cash versus $11 billion in debt, representing $2.3 billion in net cash. The company returned $1.15 billion to shareholders in the quarter through share repurchases and dividends. The strong balance sheet and solid profit margins in spite of macro headwinds are a clear positive for this company.

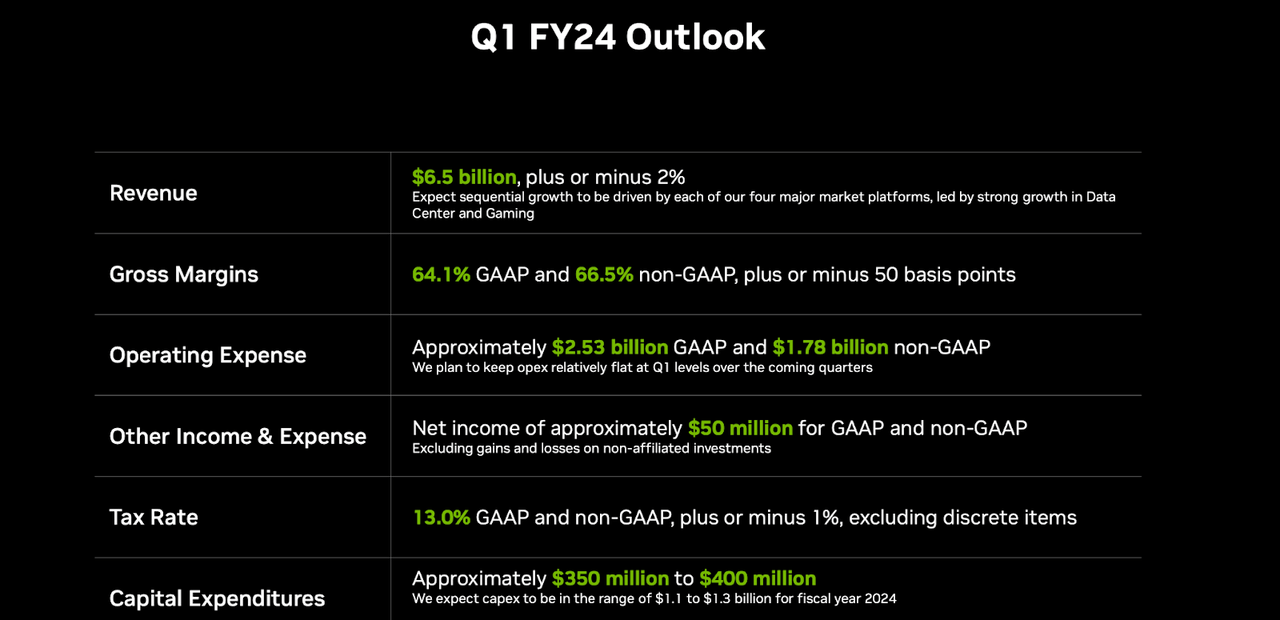

Looking ahead, NVDA has guided for around $6.5 billion in revenues, representing a 21.6% YOY decline – consistent with this past quarter but representing some sequential growth. Adjusted net income is expected to come in at around $2.2 billion.

Is NVDA Stock A Buy, Sell, or Hold?

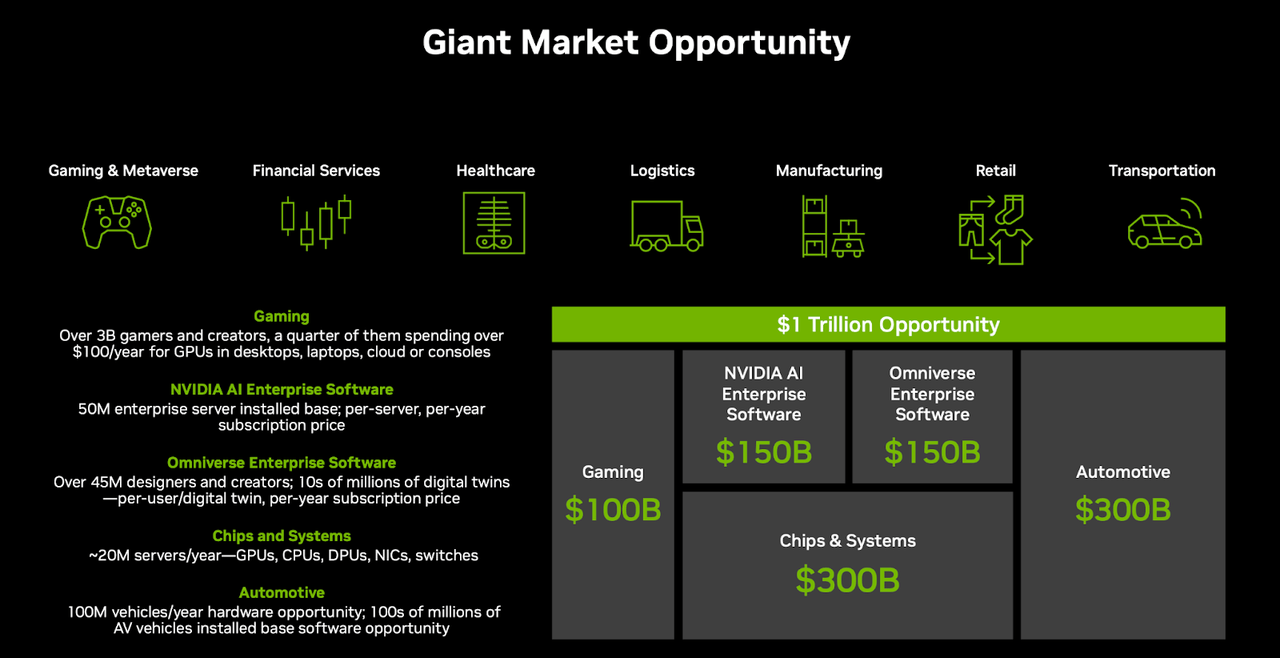

NVDA has long been a popular stock among growth investors due to its positioning as a “picks and shovels” company for digital transformation. With digital transformation happening in virtually every sector, the market opportunity is enormous.

Management has suggested that the increased enthusiasm for artificial intelligence as a result of ChatGPT may bode well for their data center business, as their products are specifically catered to optimize for AI performance.

While the gaming segment has faced unfavorable supply-demand imbalances following the pandemic, NVDA remains positioned to benefit from the ongoing growth in the gaming community.

Over the past several years, NVDA has shown an ability to drive strong secular growth while maintaining robust profit margins through cyclical troughs.

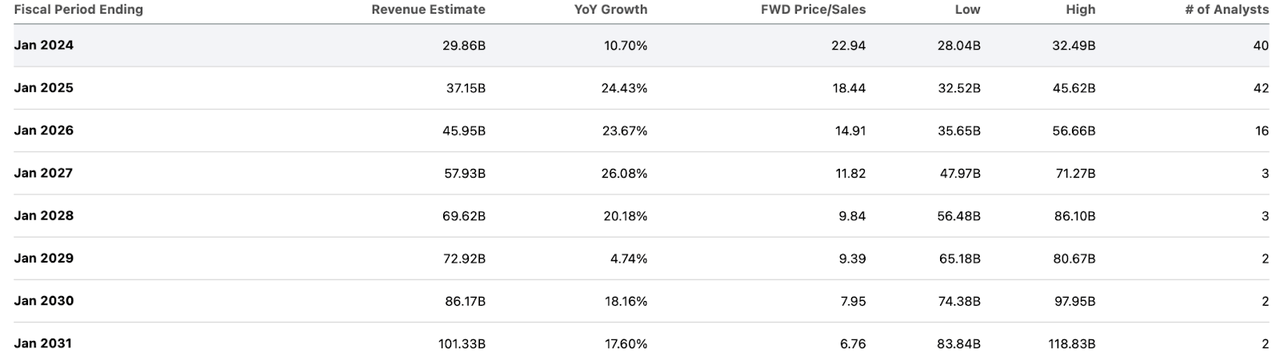

While I do indeed remain bullish on the long-term opportunity, I can not ignore the valuation. NVDA is trading at around 22x sales, an astonishing multiple considering that the company is projected to see revenue growth accelerate to the mid-twenties in any recovery.

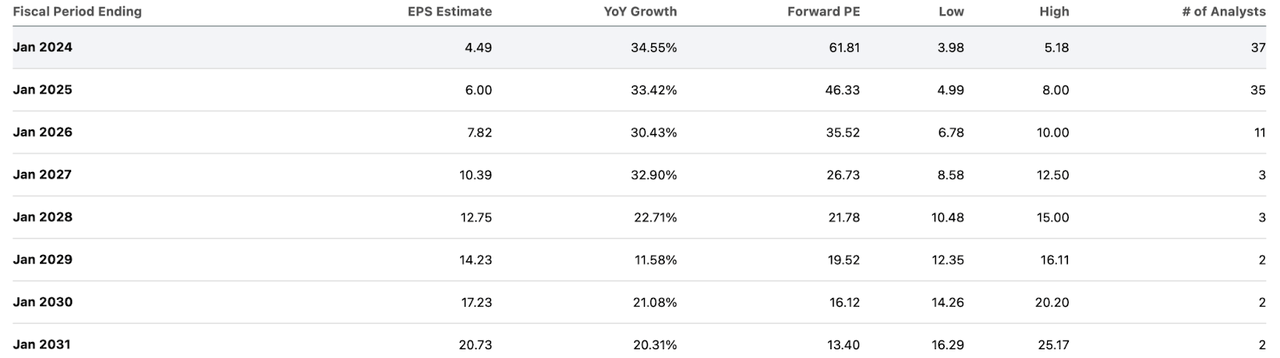

That high P/S multiple appears to be based on expectations for substantial operating leverage, as consensus estimates call for a 50% net margin in 2031. Even then, Nvidia stock is trading at around 13x 2031 estimates.

I could see the stock trading at around 20x earnings in 2031 based on my projection for around 8% revenue growth at that time. That places NVDA at a 2031 stock price of around $400 per share, representing only 5% compounded annual upside potential over the next 8 years. Including earnings yield, that upside potential increases to around 7%. If we instead assume that NVDA can grow at a 12% clip in 2031 and trade at 30x earnings, then the stock might trade at around $623 per share, representing 11% compounded annual upside potential (13% inclusive of earnings yield) over the next 8 years.

Some investors might find such a value proposition to be adequate considering the long-term growth opportunity of the company, but I personally am not of such a view. While NVDA may seem to be a dominant market leader in an attractive secular growth market, there is no guarantee that disruption won’t occur in the future. In early April, Alphabet Inc. (GOOGL) aka Google came out touting their own custom chips. Advanced Micro Devices, Inc. (AMD) has also made great progress in catching up with the competition.

Consensus estimates are already expecting substantial operating leverage based presumably on pricing power, and Nvidia Corporation stock does not look cheap even assuming above-consensus-estimates for exit growth rates. This is looking like yet another case of a high-quality company with a stock price that is risky due to valuation. I rate Nvidia Corporation stock a hold.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long all positions in the Best of Breed Growth Stocks Portfolio.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Sign Up For My Premium Service “Best of Breed Growth Stocks”

After a historic valuation reset, the growth investing landscape has changed. Get my best research at your fingertips today.

Get access to Best of Breed Growth Stocks:

- My portfolio of the highest quality growth stocks.

- My best 6-8 investment reports monthly.

- My top picks in the beaten down tech sector.

- My investing strategy for the current market.

- and much more

Subscribe to Best of Breed Growth Stocks Today!