Summary:

- The market might not be ready enough to see a $4 trillion market cap company, but a mix of bullish catalysts makes NVDA well-prepared to break through the $3 trillion level.

- Valuation analysis reveals Nvidia is attractively valued with a fair capitalization near $5 trillion, offering substantial upside even with conservative growth estimates.

- Nvidia is miles ahead of its closest rivals in terms of capturing AI tailwinds which we can see from its immense pricing power and unparalleled financial position.

- Nvidia’s Q2 earnings showed 122% YoY revenue growth, highlighting its ability to capitalize on AI industry tailwinds, unlike AMD and Intel.

Antonio Bordunovi

Investment thesis

My previous bullish thesis about Nvidia’s stock (NASDAQ:NVDA) did not age well as the stock lagged behind the broader U.S. market over the last three months. On the other hand, NVDA’s price decrease is not significant.

My analysis of recent developments and the valuation update suggest that there are no reasons to be less optimistic about Nvidia’s long-term prospects. Several crucial metrics suggest that Nvidia is the only one among GPU producers to capitalize on massive AI tailwinds, while rivals like AMD (AMD) and Intel (INTC) stagnate across all key metrics. Nvidia is a sought-after AI partner for the largest players across various industries, which also underscores its strategic strength. My valuation analysis suggests that NVDA is worth almost $5 trillion, and even with a very conservative revenue growth scenario, the margin of safety is still solid. All in all, I reiterate a “Strong Buy” rating for NVDA.

Recent developments

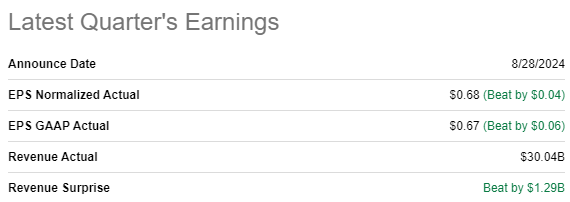

The company shared its Q2 earnings on August 28, confidently beating consensus estimates. Revenue increased YoY by 122% while the adjusted EPS more than doubled. This massive growth in two key financial metrics suggest that the AI momentum is still very strong, and Nvidia efficiently capitalizes on industry tailwinds.

Seeking Alpha

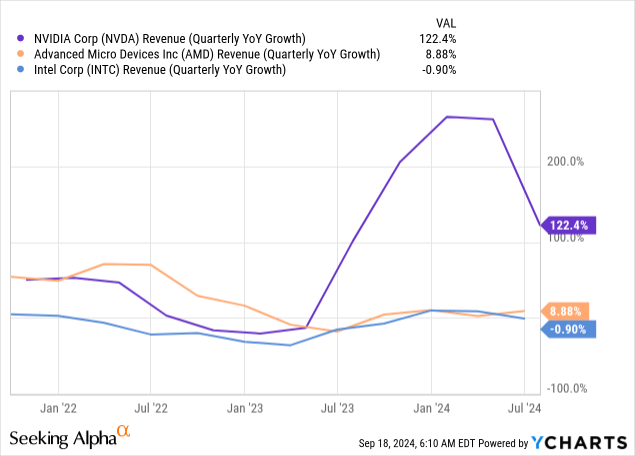

I like to bring competitors to the context because it clearly indicates how a company looks within the fierce competition. When we look at the below chart, we can conclude that the competition in the AI chips market is quite nominal as long as AMD’s revenue grows by single digits and Intel’s revenue stagnates.

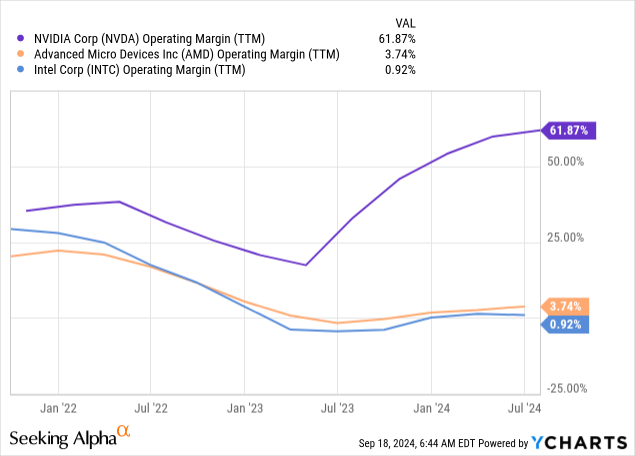

I believe it is also vital to emphasize that Nvidia’s profitability profile is rapidly improving, while its competitors are experiencing stagnation in low single digits. This significant gap in operating margin expansion suggests that Nvidia is able to exercise substantial pricing power, allowing it to capture the lion’s portion of the economic value created in the industry from AI tailwinds.

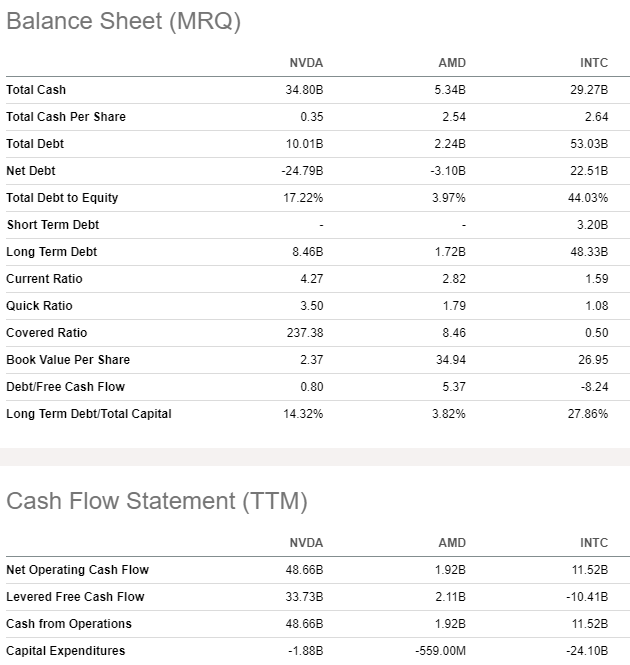

Comparing financial positions of these three semiconductor giants will also be useful to understand Nvidia’s unmatched positioning. AMD’s $3 billion net cash position is quite impressive, but it looks immaterial compared to Nvidia’s $25 billion net cash. Intel is not even in the conversation with its massive $22.5 billion net debt position.

The picture becomes even worse for AMD and Intel compared to Nvidia when we look at key cash flow statement metrics. Intel’s business model with its own fabs is extremely capital intensive, which is a big burden that makes its FCF deeply negative. AMD’s FCF is much lower compared to Nvidia’s. With the TTM FCF dynamics of these three companies, we can expect that the gap between the three players in terms of financial power will continue to widen rapidly. Therefore, Nvidia is expected to remain miles away from its rivals in terms of financial power, which is a significant competitive advantage for an innovative industry.

Seeking Alpha

Nvidia dominates not only in terms of the financial strength, but also technologically. It is an apparent number one choice for customers, as the company commands a staggering 88% market share in AI GPUs. I think that such an intact strategic positioning creates a wide moat for NVDA against its closest rivals.

Moreover, Nvidia is a sought-after partner for the largest players in their markets. For example, the company collaborates with BlackRock (BLK) and Microsoft (MSFT) to build data centers worth billions of dollars. Recent news underscoring high demand for Nvidia’s offerings also includes recent announcement from Salesforce (CRM) that it will use Nvidia’s accelerated computing and AI software solutions to optimize predictive and generative AI workflows.

I am also optimistic because of expected interest rate cuts from the Fed. It is highly likely that Jerome Powell will announce several cuts in 2024, which will continue through 2025. The information is very positive not in terms of apparent tailwinds for the broader economy, but less hawkish Fed is usually very positively absorbed by the stock market. According to Wedbush, the Fed’s expected interest rate cuts will highly likely be a bullish catalyst for AI stock. As the major AI darling, NVDA is also poised to thrive.

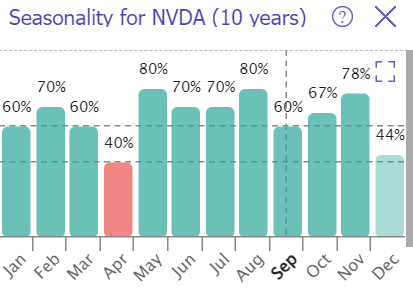

TrendSpider

Last but not least, while the stock market is usually weak in September, Nvidia’s historical seasonality trends suggest that this month is not that scary for NVDA. This historical strength in September might also be attractive for investors, especially while the broader market is expected to demonstrate a pullback in the last month of Q3.

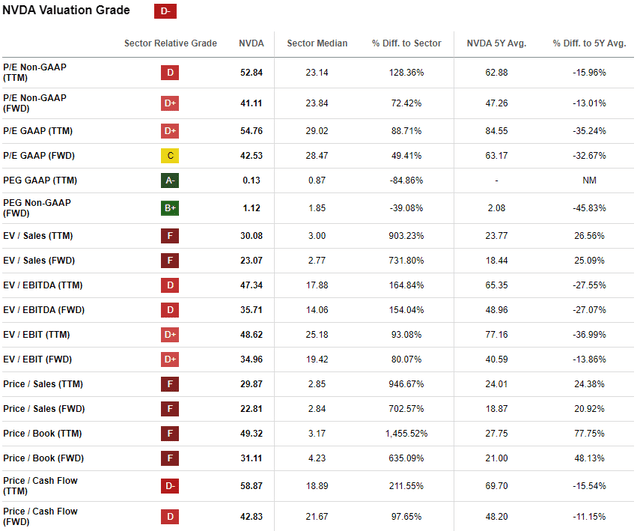

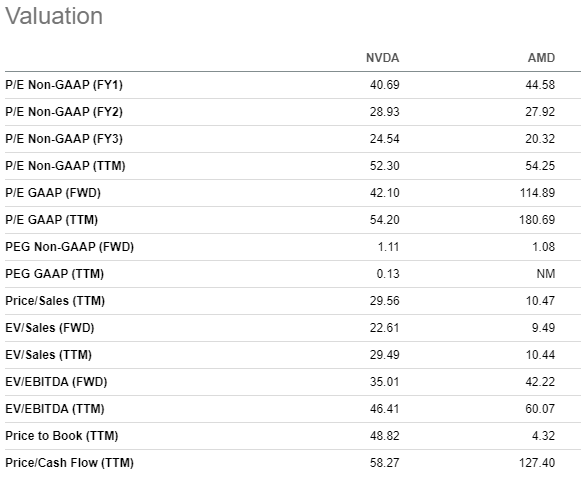

Valuation update

As usual, let me start with looking at valuation ratios. NVDA received a very low “D-” valuation grade for Seeking Alpha Quant because its multiples are far above the sector median. On the other hand, NVDA is a dominating force in one of the strongest megatrends of the past few decades [AI revolution]. Therefore, comparing to the sector median is likely not representative. It is better to look at NVDA’s current valuation ratios versus historical. From this perspective, the stock looks attractively valued.

Moreover, from the P/E and P/Cash flow ratios perspective, NVDA looks notably cheaper than AMD. I am not including INTC in my comparison because this competitor demonstrates stagnation in revenue and profitability, while its balance sheet is substantially weaker compared to both NVDA and AMD.

Seeking Alpha

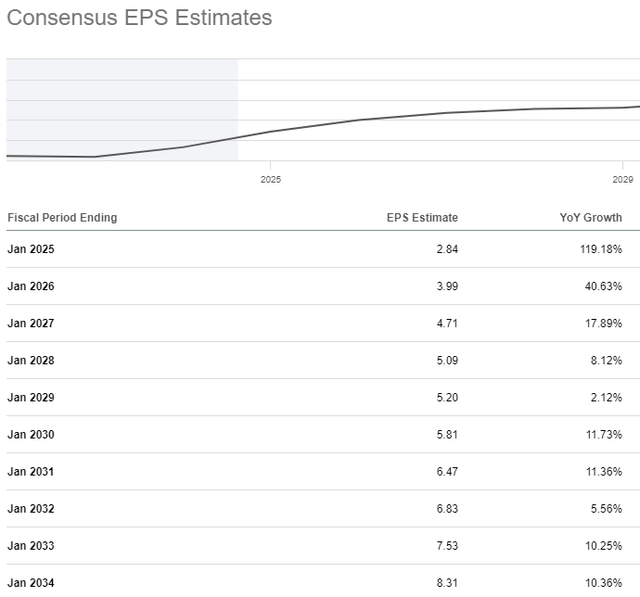

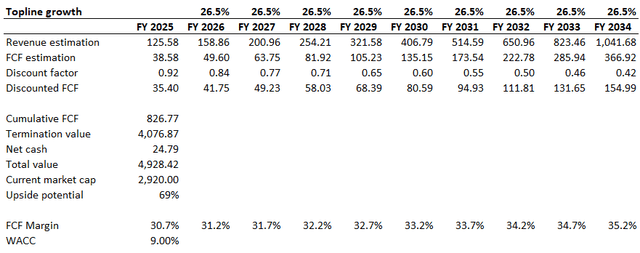

Simulating the discounted cash flow model [DCF] for an aggressive growth company like NVDA is the best option to determine the stock’s upside potential. I am not relying on consensus forecasts projecting a 13.4% revenue CAGR for the next decade. I think that this CAGR is unfairly low because the GPU market is projected to compound with a 31.5% CAGR by 2032.

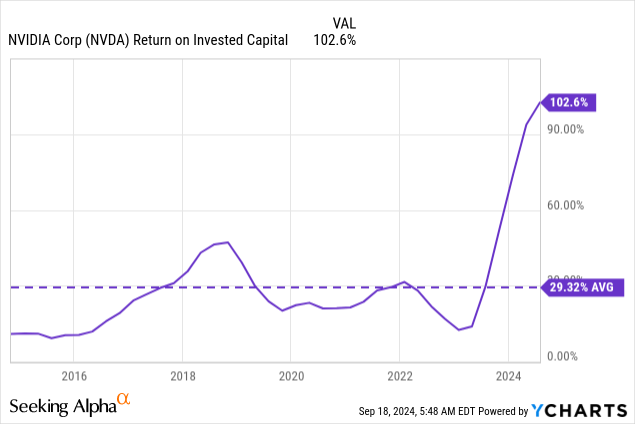

Despite several apparent signs of NVDA dominating in the industry, AMD and INTC are still large corporations which can potentially capture some portion of NVDA’s market share. Moreover, the rule of big numbers will apparently start working against NVDA sooner or later. Therefore, I think that incorporating NVDA’s revenue CAGR of 31.5% for the next decade will be too optimistic, and I need a 5% haircut. That said, NVDA’s revenue CAGR for the next decade is 26.5%. Moreover, let us not forget that NVDA will highly likely reinvest its substantial profits into new ventures and growth drivers will likely expand far beyond AI applications. NVDA’s historically high ROIC gives high confidence in the company’s ability to unlock new profitable revenue growth drivers over time.

According to my calculations, NVDA’s TTM FCF ex-SBC margin is 30.7%. Due to NVDA’s strong pricing power for GPUs and rapidly expanding operating margin, I think that a 50 basis points yearly FCF expansion is fair enough for my DCF model. My confidence in NVDA’s ability to further expand its free cash flow margin is also backed by the EPS forecast from Wall Street analysts indicated above. The EPS is expected to observe a 12.7% CAGR over the next decade, which also adds optimism about the ability to drive FCF expansion. I implement the same 9% WACC, which aligns with the range offered by valueinvesting.io.

With a 26.5% revenue CAGR, the company’s fair capitalization is very close to $5 trillion. This outcome is 69% higher than the current market cap, meaning that the upside potential is significant.

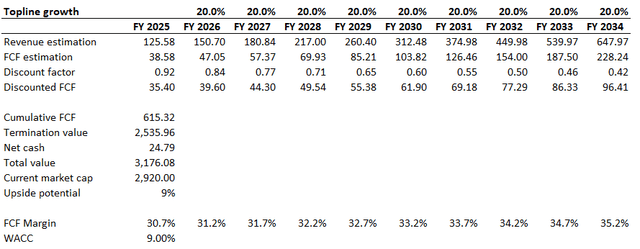

I believe that some readers will not agree with a 26.5% revenue CAGR for the next decade. Therefore, I want to simulate a much more conservative scenario with a 20% revenue CAGR. All other assumptions remain unchanged.

Even with a much more conservative revenue growth assumption compared to the projected GPU industry’s growth, NVDA is still around 9% undervalued. Therefore, the margin of safety is solid at the current share price.

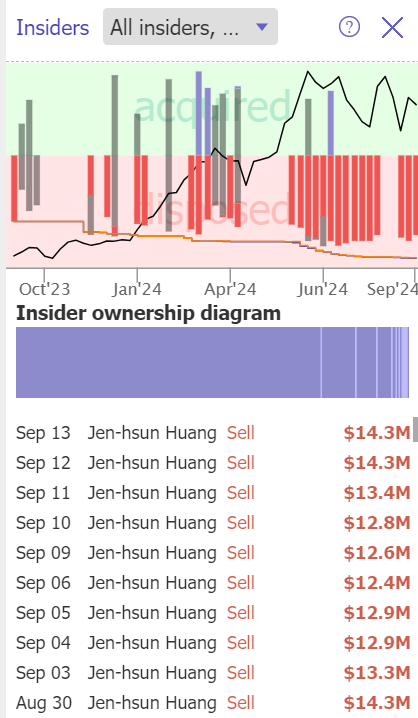

Risks update

Recent activities of insiders suggest that I might be overestimating the near-term upside potential for NVDA. For example, insiders were selling quite aggressively over the last twelve months. Jensen Huang, the CEO, has been very actively selling his stake in September. On the other hand, these sales were insignificant compared to Jensen Huang’s overall $127 billion net worth.

TrendSpider

I think that the company’s market cap did not go far above $3 trillion for longer is because it is a big psychological resistance level for the stock market. A $5 trillion or even $4 trillion market cap is something that the U.S. stock market has never seen before, and it might take a while before NVDA moves closer to these levels. The stock’s recent relatively weak performance after the latest earnings release suggests that it might take a few more quarters of strong performance against consensus estimates before the stock will start moving closer to new psychological levels.

The macroeconomic environment is quite uncertain. The fact that the Fed is ready to start cutting interest rates is good, but it will take several quarters before the U.S. economy absorbs the effect of a less restrictive monetary policy. As of now, we see that the economy only started absorbing the effect of monetary tightening as the unemployment rate moved above 4% relatively recently. Recession odds are increasing, which is another warning sign for NVDA investors.

Bottom line

To conclude, NVDA is still a “Strong Buy”. The stock is still extremely attractively valued, and the margin of safety is solid. I think that the market might not be ready enough to see a $4 trillion market cap company, but the strong mix of positive catalysts for NVDA makes the probability of breaking far through the $3 trillion market cap very high.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.