Summary:

- Nvidia’s stock rally has intensified, driven by investor enthusiasm about the AI boom.

- Competition from AMD and Intel is increasing, posing a potential threat to Nvidia’s dominance in the chipmaking industry.

- While Nvidia’s growth is impressive, its stock valuations are currently extremely high, raising concerns about sustainability.

BING-JHEN HONG

A lot has happened since my last coverage of Nvidia’s (NASDAQ:NVDA) stock. The high-tech company’s rally has only intensified. By all means, I did not exclude this possibility in my previous analysis. However, I still believe that “this too shall pass”. In other words, there is growing competition from AMD (AMD) and Intel (INTL), even though Nvidia remains the most popular chipmaker. But this may change sooner rather than later. Investors’ enthusiasm about Nvidia’s success has grown stronger thanks to the AI boom and the recent innovations, and a great set of quarterly results.

Nvidia stock: my previous coverage

In my previous analysis, I wrote that Nvidia Corporation’s quarterly and annual earnings were excellent, with revenue and earnings per share seeing substantial growth. Namely, the company’s quarterly sales totaled $22.1 billion, a 22% rise from the previous quarter and a surge of 265% from a year ago. GAAP diluted EPS were $4.93, a 33% increase compared to the previous quarter and a surge of 765% from a year ago. Nvidia’s growth was due to its data center segment and the rising demand for artificial intelligence processing. I wrote that the stock was a “hold” because of the sky-high valuations, excessive investors’ enthusiasm, and key risks, including US-China relations, a likely recession ahead, and also the growing competition. Despite my rather cautious forecast, the stock rallied incredibly, Nvidia reported even better results, and the key risks I mentioned remain the same.

The earnings reported in May were indeed brilliant. The company’s quarterly sales totaled $26 billion, and the EPS was $6.12. Just like the previous time, the success was also due to the data center segment and the AI boom.

Since my last coverage, there have been no events affecting U.S.-China relations, Nvidia still dominates the market for GPUs, and no recession has actually come. But it does not mean that Nvidia’s stock will remain unaffected by these risks in the future.

My “hold” rating, therefore, remains unchanged. In spite of the remaining risks, NVDA’s valuations have gotten even higher. In this article, I will focus on the company’s results, fundamentals, valuations, and competitors. I will also explain why NVDA is not an obvious “buy” in spite of investors’ enthusiasm.

Nvidia: recent news

Nvidia has recently overtaken Apple (AAPL) to become the second most valuable US company after Microsoft (MSFT). What has caused Nvidia to become such an expensive corporation?

The rally did not only come thanks to a broader gain in tech stocks, with weaker US macroeconomic data and a fall in Treasury yields, raising market optimism on hopes the Fed may reduce interest rates as early as July. NVDA did not surge just because of that.

The rally was also due to an announcement on Sunday from the company’s CEO, Jensen Huang, who said that the company will release a high-powered version of its Blackwell chip — called the Blackwell Ultra — in 2025 after a new AI chip platform, Rubin, in 2026. The company will present an Ultra version of Rubin in 2027. Nvidia’s stock also underwent a 10-for-1 split on June 7 and a dividend increase. The company would now pay $0.10 per share.

The demand for Nvidia’s high-end chips that power virtually all AI applications, including OpenAI’s ChatGPT, exceeds supply. So, both revenues and earnings keep rising.

Nvidia’s earnings

I will not go into too many details of the recent earnings because a lot has already been written here about that on Seeking Alpha. I will just focus on the key points.

For the April 2024 quarter, Nvidia earned an adjusted $6.12 per share on $26 billion in revenue, thus beating the already high estimates of $5.58 per share on revenues of $24.59 billion for the quarter.

At short, the company keeps growing its sales and earnings. In my last article, I covered the first quarter of 2024. Well, the results have substantially improved even compared to the extremely successful 1Q 2024.

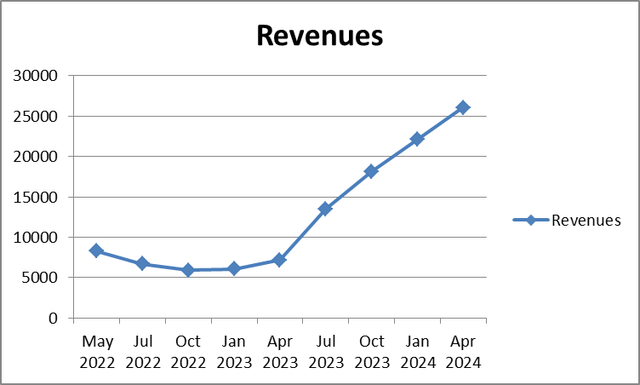

Nvidia’s quarterly earnings (In Millions of United States Dollars, except per share items)

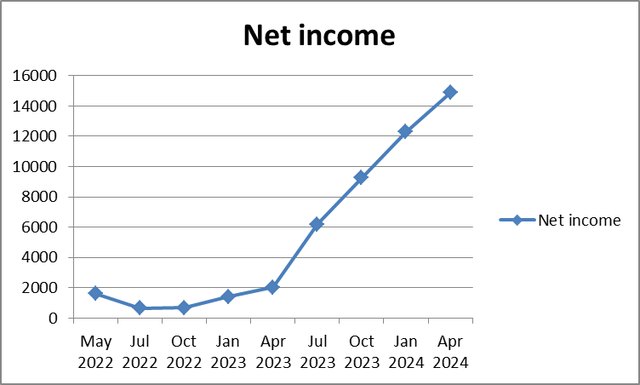

| May 2022 | Jul 2022 | Oct 2022 | Jan 2023 | Apr 2023 | Jul 2023 | Oct 2023 | Jan 2024 | Apr 2024 | |

| Revenues | 8288 | 6704 | 5931 | 6051 | 7192 | 13507 | 18120 | 22103 | 26044 |

| Net income | 1618 | 656 | 680 | 1414 | 2043 | 6188 | 9243 | 12285 | 14881 |

Source: Prepared by the author based on Seeking Alpha’s data

As you can see from the table above, the quarterly net income has increased by 21%, rising from $12285 million to $14881 million. As for revenues, these increased from $22103 million to $26044 million. The increase thus totaled 17.8%.

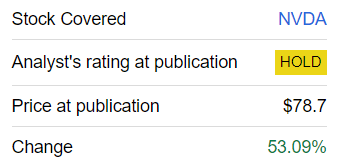

However, the price of NVDA stock when my previous article commenting on the company’s quarterly results was published totaled $78.7 in today’s money after the stock split. Therefore, the stock price rise has totaled about 53% as I am writing this.

Seeking Alpha

Given that the net income only increased by 21% over the same period, the 53% rise in the stock price does not seem to be a fair and proportional price rise. At the very least, this disconnect alone may suggest NVDA’s stock’s overvaluation.

Prepared by the author based on Seeking Alpha’s data

Prepared by the author based on Seeking Alpha’s data

However, the sales and earnings upward trend started in the April 2023 quarter and is still continuing now. But given the fact every single quarter was extremely successful, it does not seem like the company’s performance is sustainable, simply because dramatic earnings growth does not usually last for ages. Market conditions, including competition and economic statistics, eventually change, and this growth slows down as a result.

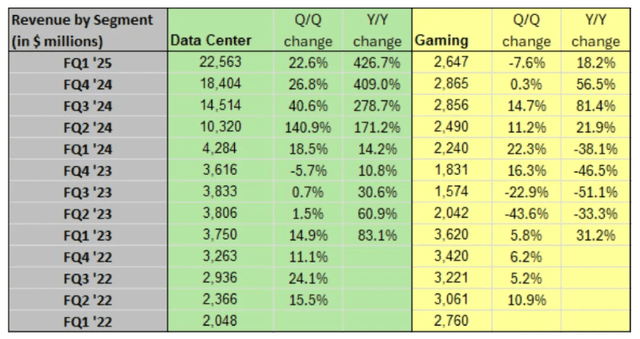

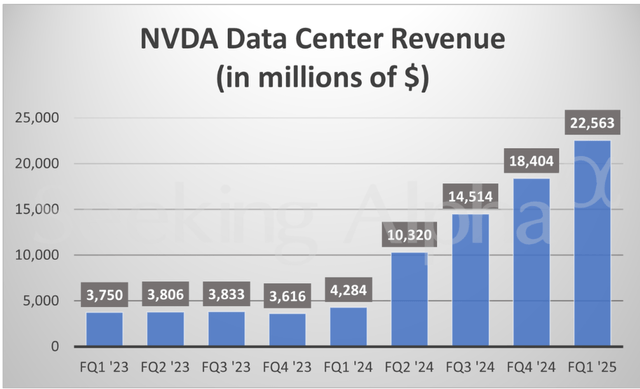

Without making too many attempts to guess the next earnings and sales revenues that Nvidia will report in the next several quarters based on the current market conditions, we can just have a look at the segment trends. The data center’s earnings growth seems to be excellent on the surface. But the growth rate seems to have slowed down. The greatest Y/Y and Q/Q change happened in FQ2’24 or 3Q 2023. The Y/Y change totaled 171.2% vs. 14.2% the previous period, a 12-fold rise. Then, the Y/Y change was 278.7%, a 63% rise compared to the 171.2% in the previous period. Then, the growth rate has slowed down further. 426.7% Y/Y change was not much higher than 409.0% reported for the previous period. If this trend continues, earnings growth will be even slower in the next quarter.

It is also noteworthy to see that most, if not all, of the revenue gains have been due to the data center division alone. Note that 2Q 2024 is recorded as FQ1 2025 by Nvidia on the diagram below.

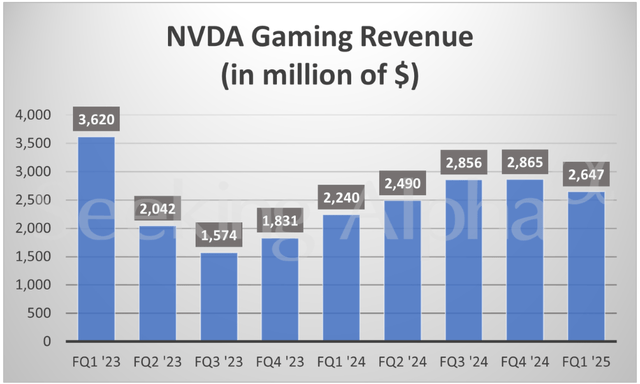

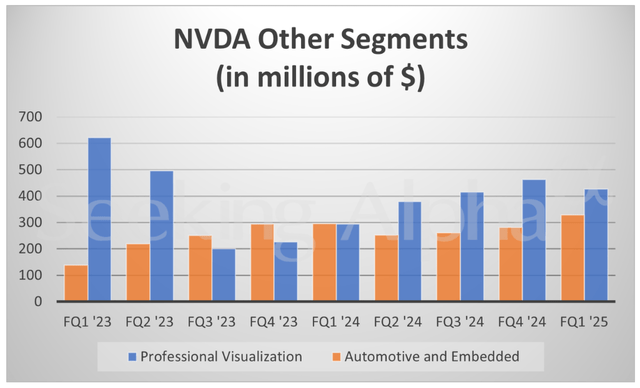

The gaming revenues and other segments have stayed almost flat for several quarters in a row.

The data center division did a good job thanks to artificial intelligence, the company’s primary source of growth. It might seem like a piece of good news that Nvidia is so innovative, but there is too much risk in relying on one source of profit maximization.

There are too many investors’ expectations due to Nvidia’s strong AI position, and these seem to be already factored in the stock price. Just a few excerpts from the company’s press release illustrate how optimistic the management is:

“The next industrial revolution has begun — companies and countries are partnering with NVIDIA to shift the trillion-dollar traditional data centers to accelerated computing and build a new type of data center — AI factories — to produce a new commodity: artificial intelligence,” said Jensen Huang, founder and CEO of NVIDIA. “AI will bring significant productivity gains to nearly every industry and help companies be more cost- and energy-efficient, while expanding revenue opportunities.”

“We are poised for our next wave of growth. The Blackwell platform is in full production and forms the foundation for trillion-parameter-scale generative AI.”

I have put the strongest and the most optimistic words in bold. Many of the CEO’s remarks are constructive. For example, he said that AI would likely raise productivity in many industries and that the Blackwell platform presents good opportunities for Nvidia. However, the expectations of the “next industrial revolution” or building a “multi-trillion dollar” empire might still be far-fetched. Do not take me wrong. The upward trend can go on for a while, and AI might start influencing even more aspects of our daily lives. But so high and growing expectations are hard to exceed and even meet. Eventually, all market rallies and frenzies end. Just think of investors’ enthusiasm for radio companies and automobile makers in the 1920s. But the Great Depression ended this frenzy when many high-tech companies went bankrupt at the time. The 1990s Dot.com bubble also ended sadly for many investors. And AI stocks would eventually lose their popularity. Abundant optimism about NVDA can be easily seen from the stock’s valuations.

Valuations and fundamentals

But let me cover Nvidia’s fundamentals and valuations in some more detail.

To start with, the company’s profitability and debt indicators are very sound.

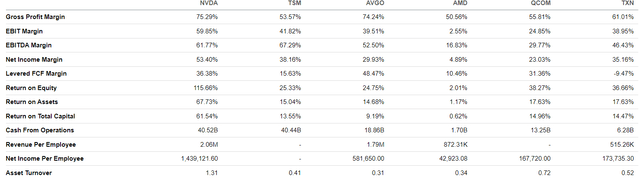

For example, if we look at the company’s profitability indicators and compare them to these of the company’s peers, we will see that even large and successful companies like Qualcomm (QCOM) and AMD (AMD), have much lower net income and EBIT margins as well as lower returns on equity compared to Nvidia. For example, AMD’s return on equity is just 2,01%, while NVDA’s is a whopping 115,66%.

Nvidia’s debt fundamentals (The data are given in USD millions apart from ratios.)

|

Indicator |

Value |

|

Debt-to-Equity ratio |

27930/49142=0,57 |

|

Current ratio |

53729/15223=3,53 |

|

Interest coverage ratio (EBIT/interest expense) |

47741/255=187 |

Source: Prepared by the author based on the Seeking Alpha’s data

Nvidia’s debt and liquidity fundamentals are also very sound. If we look at the debt-to-equity ratio, it is just 0,57. The lower it is, the better it is. The average debt-to-equity ratio for S&P 500 companies is approximately 1,50. Nvidia’s is almost 3 times lower than that, which is very good. Nvidia’s current ratio of 3,53, is over and above the S&P 500 average of 0,92. Also interesting is the interest coverage ratio. Nvidia’s ratio of 187 is over and above the S&P 500’s average interest coverage ratio of about 25. Nvidia’s current and interest coverage ratios suggest the company has ample amounts of liquidity, which makes it seem like a safe choice. But is it really? Well, to be considered safe, a stock should also offer a margin of safety, that is, trade below its intrinsic value. But Nvidia’s valuations suggest the opposite is true.

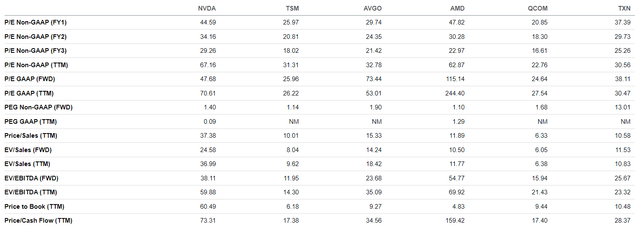

Let us compare Nvidia’s valuation ratios to its peers’.

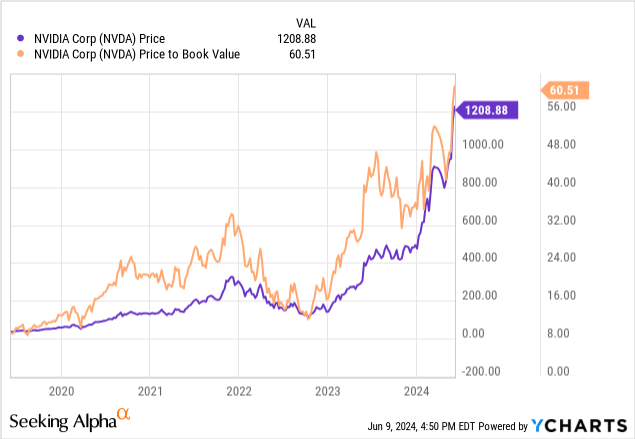

Almost all the indicators, including the company’s price-to-earnings (P/E) and price-to-sales (P/S) ratios are higher than its peers’. Only AMD’s profitability ratios are higher than Nvidia’s because AMD records very low profit figures. The most stunning overvaluation example is Nvidia’s P/B ratio, currently lingering at a level above 60, in some cases 10 times higher than its peers’.

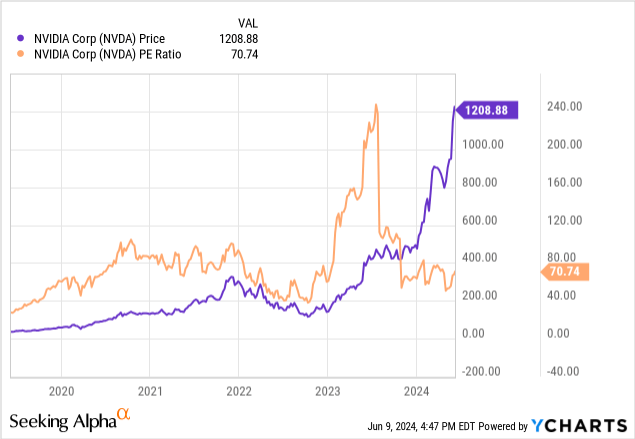

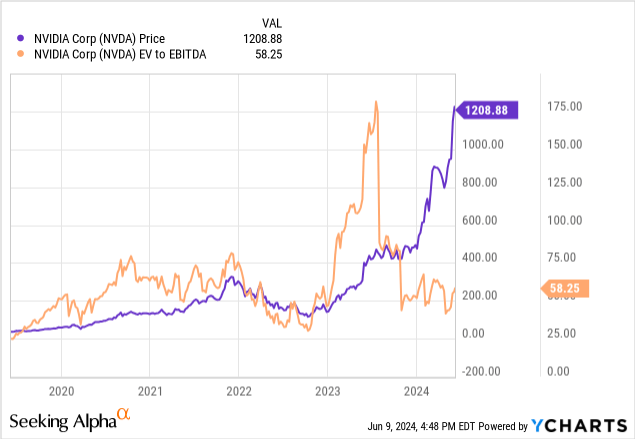

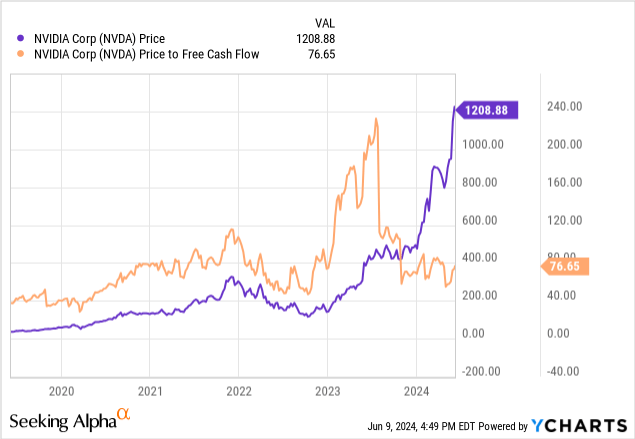

However, as demonstrated by the diagrams below, Nvidia’s valuation ratios, including P/E, EV/EBITDA, price-to-free cash flow and price-to-book ratios, used to be much higher because the company was not as profitable as it is now. But all of its valuation indicators suggest that it is not good value for money compared to its peers.

You might argue that Nvidia’s profitability metrics should allow Nvidia to trade at a premium to peers. But certainly, NVDA does not seem to be good value for money, given its valuation ratios.

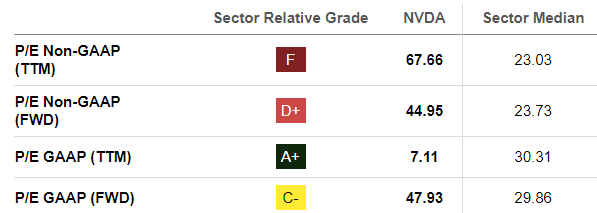

What is a fair stock price for Nvidia, then? Well, I would just take the sector’s average valuation ratios. Many analysts estimate the company’s fair stock price based on its GAAP forward earnings because they say the company has a brilliant future.

Seeking Alpha

Nvidia’s forward GAAP P/E is 47.93, versus the sector’s median of 29.86. So, dividing Nvidia’s current $120.40 stock by its P/E GAAP (FWD) of 47.93 and multiplying the result by 29.86, the sector’s median, gives us a price of $75 per share. I assume the company should trade closer to peers because AMD and Intel are also growing well, and Nvidia is not the only AI play. My thesis on the company’s overvaluation has not changed. Only Nvidia’s stock appreciated even further, thus getting even more expensive.

Upside factors

Nvidia’s AI-inspired graphics processing units account for about 90% of AI-GPU market share. The company’s next-generation Blackwell chip, costing between $30,000 and $40,000, is predicted to be sold out well into 2025. With demand exceeding supply, Nvidia has not had any difficulties increasing the price of its AI-GPUs and recording high profit margins as a result.

Artificial intelligence is an innovative area with a lot of growth potential. But it is unclear how long this boom would last and how long Nvidia would hold its leadership position and keep growing its sales and profits.

Right now, the company is recording excellent sales and profit growth. The management suggests that more is yet to come, thanks to the “AI industrial revolution”. Moreover, Nvidia records better results compared to its peers and its investors are willing to pay the high price for NVDA stock.

Downside risks

But the biggest problem here is that Nvidia is not the only AI game in town.

AMD and Intel are strong competitors to Nvidia with their own AI chips. For example, AMD recently announced its MI325X and MI350 will enter the market in 2024 and 2025, respectively, and said its next-generation MI400 AI accelerator platform will be available in 2026.

Intel, in turn, said its Gaudi 2 and Gaudi 3 AI accelerators will be cheaper than the competing chips on price. Since chip companies’ clients are spending billions on AI chips, any discounts will be appreciated.

Nvidia also has to deal with growing competition from its own clients because of Amazon (AMZN), Google (GOOGL), and Microsoft trying to get independent of Nvidia’s chips and decrease its capital expenditures while innovating in the AI area.

As I have mentioned above, if there is a recession, the AI boom might slow down somewhat and Nvidia will be one of the first companies to suffer. Investors’ enthusiasm will wane too, which will bring NVDA’s valuations down substantially.

Conclusion

In my view, in spite of Nvidia’s astounding success, high sales and brilliant profitability margins, investors’ expectations are far too great. In order to fuel this stock rally, NVDA’s earnings should keep increasing as fast as before. But this might be complicated due to rising competition. One industry cannot usually be dominated by one company forever. At the same time, NVDA stock is far too overvalued compared to its peers’. I still remain Neutral on the stock. So, in spite of the recent brilliant results, my thesis still remains unchanged from the previous analysis.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.