Summary:

- Nvidia Corporation provides a comprehensive package of AI hardware, software, solutions, and services.

- Moreover, Nvidia is the global leader in GPU technology, used to power the enormous computing capacity required by AI.

- Nvidia crushed its last earnings estimates and should continue surpassing consensus figures as we advance.

- Nvidia’s industry-leading position in AI could enable it to increase revenues and EPS faster than anticipated.

- Nvidia’s stock is up by more than 300% from its October lows and should continue appreciating long term.

Justin Sullivan

In May, Nvidia Corporation (NASDAQ:NVDA) provided one of the most outstanding earnings announcements ever. Nvidia delivered approximately $7.2 billion in revenues vs. the expected $6.52 billion. Moreover, Nvidia’s EPS increased to $1.09 vs. the consensus estimate of 92 cents. Nvidia smashed the Q1 earnings out of the park. However, genuinely stunning was Nvidia’s forward guidance. Nvidia guided to a staggering $11B (plus/minus 2%) in revenues for Q2, much higher (53%) than the consensus estimate of only $7.18 billion.

This remarkable guidance illustrates several crucial elements:

- First, the analyst community was and may continue to be significantly behind the curve on Nvidia and the AI revolution.

- Second, to post such results and future expectations, Nvidia is positioned incredibly well to capitalize on AI-driven markets in the future.

- Also, by posting such stellar numbers, Nvidia suggests it will likely beat its estimates. Otherwise, what would be the point in providing such excellent guidance if there is a likelihood of missing the mark?

While Nvidia’s valuation remains relatively high, the company could continue beating consensus estimates, and its stock should continue appreciating in the long term. The AI industry has tremendous untapped potential, and Nvidia’s unique industry-leading position should enable it to excel in future years. We are still in the initial innings of the AI revolution, and Nvidia’s comprehensive AI solutions should play a leading role in this game. Therefore, we should continue seeing Nvidia’s stock trade at a premium multiple, and its stock price should continue appreciating in the coming years.

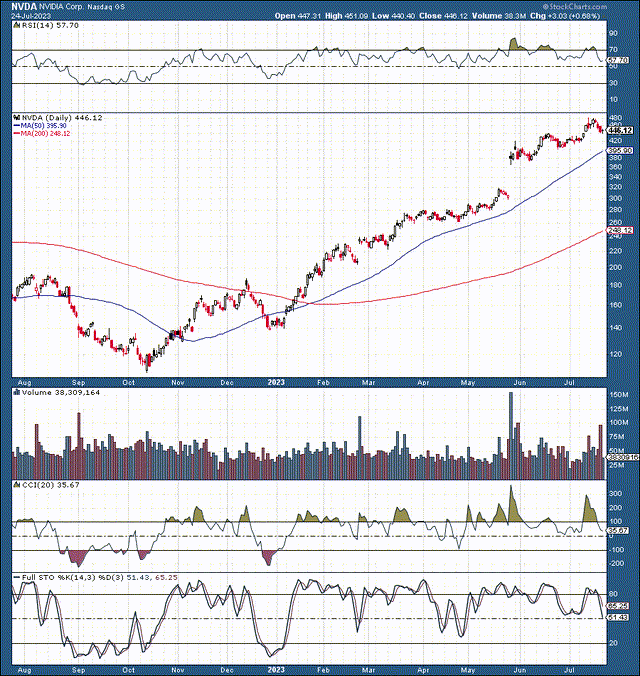

Technically – Nvidia Has Been on Fire

Nvidia’s stock has more than quadrupled since I called it a strong buy in the $100-120 buy-in zone. However, while Nvidia’s stock is relatively overbought in the near term, the share price could continue appreciating long term.

Ideally, we’d get in on a 20-30% pullback. However, due to Nvidia’s massive AI potential, a significant correction may not be in Nvidia’s cards. Nevertheless, the open gap around the $360-300 range is vulnerable. Therefore, if we see enough volatility, Nvidia could fill this gap. This dynamic would create an excellent buying opportunity in Nvidia’s stock.

What if Nvidia doesn’t correct by 20-30%?

I was long Nvidia in the initial stages of the rally, and regrettably, I took profits in this stock too soon. However, I got blindsided by Nvidia’s rollercoaster ride of crashing profitability, the rapid revenue increase, and the blowout Q2 revenue guidance of 53%. Despite Nvidia’s overheated technical image, its stock price should continue appreciating long-term.

The Market Was Very Wrong on Nvidia

It seems ludicrous that Nvidia crashed to the $100-120 range about nine months ago. Its stock is around $450 now, and it’s challenging to comprehend that a stock of this ultra-high quality got so drastically oversold during the bear market stage.

Yet, let’s put things in perspective. Nvidia’s stock was the poster child of the highly overbought equity during the 2021 tech bubble days. Nvidia’s stock appreciated too high too quickly in late 2021, and then the bear market came. Nvidia’s stock got obliterated due to a temporary slowdown in gaming and fears of lost cryptocurrency-related sales.

However, Nvidia’s leading AI position got ignored, and despite the substantial slowdown, Nvidia continued making gains in its data center segment. Also, due to its tremendous GPU-powered computing power, Nvidia should continue expanding revenues in the server space. Furthermore, Nvidia’s gaming segment should recover. Yet, most importantly, Nvidia has enormous revenue growth and profitability potential in AI.

Nvidia AI Platform And Industry-Leading Technology

Nvidia’s AI platform, or the world’s most advanced AI platform, is ready for enterprises and consists of critical components like generative AI, AI training, data analytics, inference, speech AI, and cybersecurity. Nvidia has done an excellent job in prioritizing AI, enabling it to stay ahead of its competition in one of the most promising markets globally. Through its inception program and other initiatives, Nvidia helps essential start-ups evolve much quicker through access to Nvidia’s industry-leading hardware and top experts.

Therefore, Nvidia offers the complete package when it comes to AI. This dynamic makes Nvidia highly unique and in a prime position to capitalize on the AI revolution moving forward. On the hardware side, Nvidia provides enterprises with supercomputers powered by Nvidia’s industry-leading GPU technology. Moreover, Nvidia provides unique AI platform software to complement the hardware business. Nvidia provides AI models and services to complete the comprehensive AI package through its AI foundations solutions. AI foundations include cloud services, visual media, and biology-based generative AI models.

Therefore, Nvidia is in an excellent market position, offering a comprehensive AI hardware, software, and services package. Moreover, Nvidia is the global leader in GPU technology, essential in the heavy lifting relative to powering AI. The AI industry is still in the very early stages of its development cycle, and it’s clear that Nvidia’s chips are in high demand and should continue powering the AI revolution moving forward. Thus, despite Nvidia’s unusually high valuation, its stock price should appreciate considerably in the coming years.

Nvidia – Not As Expensive As It Seems

Despite Nvidia’s lofty 58 times forward EPS estimates (consensus), its revenues should expand considerably in the next few years. Moreover, Nvidia’s growth runway remains vast, and it could sustain substantial 25-30% or higher revenue growth through fiscal 2028 (potentially longer).

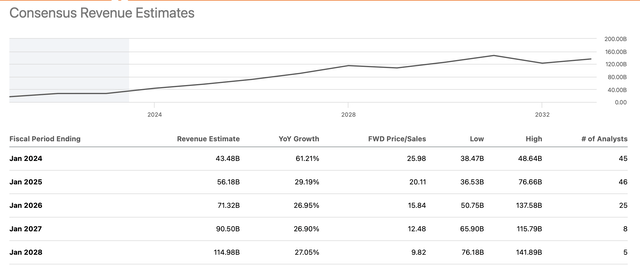

Remarkable Revenue Growth Ahead

Revenue estimates (SeekingAlpha.com)

Consensus estimates suggest Nvidia will achieve approximately $115 billion in revenues in fiscal 2028 (2027). Moreover, higher-end estimates imply Nvidia could reach around $140 billion or higher by then. Also, consensus estimates could still be relatively low, and Nvidia likely has a high probability of achieving higher-end forecasts in the coming years. As Nvidia’s revenues increase more than expected, its profitability could skyrocket in the years ahead.

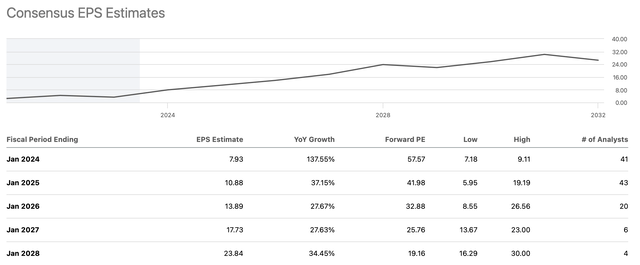

EPS Estimates – Still Too Low

EPS estimates (SeekingAlpha.com )

While Nvidia’s EPS should surge by around 138% or more this year, consensus forward EPS estimates could be too low for future years. Next year’s EPS estimate range is vast, ranging from a low estimate of around $6 up to $19. The mid-range or the consensus estimate is around $11, but Nvidia EPS could increase more than that. As Nvidia’s revenues surge in future years, its profitability/EPS growth could increase more than the consensus estimates suggest.

For instance, if Nvidia earns around $15 next year (fiscal 2025), its forward P/E ratio is only about 30 now. Even using depressed consensus figures puts Nvidia’s forward P/E ratio at about 40 here. Due to its unique market-leading position in GPU technology, the data center sector, AI, and other lucrative segments, Nvidia deserves its premium multiple of 30-40 times forward EPS. Therefore, as Nvidia’s revenues and profitability continue increasing, its stock price should appreciate considerably in future years.

Where Nvidia’s Stock Price Could Be in Future Years

| Year (fiscal) | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 |

| Revenue Bs | $46 | $65 | $88 | $110 | $135 | $162 |

| Revenue growth | 70% | 41% | 35% | 25% | 23% | 20% |

| EPS | $8.50 | $15 | $20 | $26 | $33 | $40 |

| EPS growth | 155% | 53% | 33% | 30% | 28% | 22% |

| Forward P/E | 30 | 33 | 35 | 34 | 33 | 32 |

| Stock price | $450 | $660 | $910 | $1122 | $1320 | $1500 |

Source: The Financial Prophet.

Risks to Nvidia

The most significant risk to Nvidia’s stock may be a “disappointing AI revolution.” If the AI segment is much smaller than expected, or if Nvidia’s role gets minimized in the futuristic segment, we could see substantial problems in Nvidia’s stock. A worsening AI outlook would likely lead to lower revenue and EPS adjustments, resulting in multiple compression and a lower stock price for Nvidia.

Additionally, there are continuous risks of competition in AI. Many high-quality tech companies invest heavily in AI-related hardware, software, and services worldwide. Also, gaming and other segments constantly face the threat of completion, geopolitics, and macroeconomic elements. Investors should consider these and other risks before investing in Nvidia’s stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in NVDA over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Are You Getting The Returns You Want?

- Invest alongside the Financial Prophet’s All-Weather Portfolio (2022 17% return), and achieve optimal results in any market.

- Our Daily Prophet Report provides crucial information before the opening bell rings each morning.

- Implement our Covered Call Dividend Plan and earn an extra 40-60% on some of your investments.

All-Weather Portfolio vs. The S&P 500

Don’t Wait! Unlock Your Own Financial Prophet!

Take advantage of the 2-week free trial and receive this limited-time 20% discount with your subscription. Sign up now, and start beating the market for less than $1 a day!