Summary:

- Nvidia Corporation’s stock triggered a significant selloff after better-than-expected 2Q results and forward guidance, indicating that beating estimates alone is not enough to drive the stock higher.

- The company has triggered a “growth inflection” point, with both revenue and margins starting to normalize and deviating from its previous unsustainable trajectory.

- Both revenue and EPS growth are expected to drop below triple digits for the first time in the past five quarters, with the outlook indicating that growth will slow further.

- The CEO indicated that Blackwell chips have started ramping up production and are expected to ship in 4Q FY2025.

- Given the 23.7x EV/Sales fwd following the selloff, further downward adjustments to valuation multiples are expected due to growth normalization.

BING-JHEN HONG

What Happened

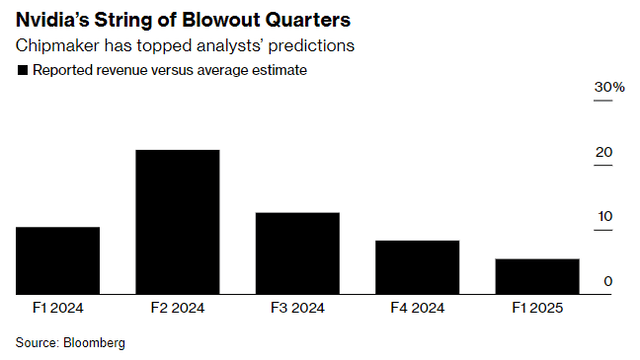

Nvidia Corporation (NASDAQ:NVDA), the biggest beneficiary of the current AI boom, has consistently beat market lofty expectations in both growth and margin, justifying its premium valuation. However, I believe that the stock’s movement is still largely driven by market momentum, supported by unsustainable expectations on its growth potential. Despite a strong 2Q FY2025 results and forward guidance, the stock still triggered an over 8% selloff, indicating that its valuation has already priced in a “better-than-expected” results. As shown in the chart below, the level of exceeded expectations has been decreasing.

In early August, we saw a broad-based market selloff that led to a steep 15% decline for NVDA, but it quickly reversed its course, recouping all the losses as the market rebounded, approaching to its all-time high. In my previous analysis, I maintained a strong sell rating on the stock, expressing concerns about the significant downside risk associated with chasing the “biggest market mover.” Following the 2Q FY2025 earnings release, it’s clear that NVDA’s growth is starting to normalize, which will impact its valuation. Since the stock is still trading at nearly 24x of EV/sales fwd after the post-earnings selloff, I reiterate my strong sell rating on NVDA.

A “Growth Inflection” Quarter

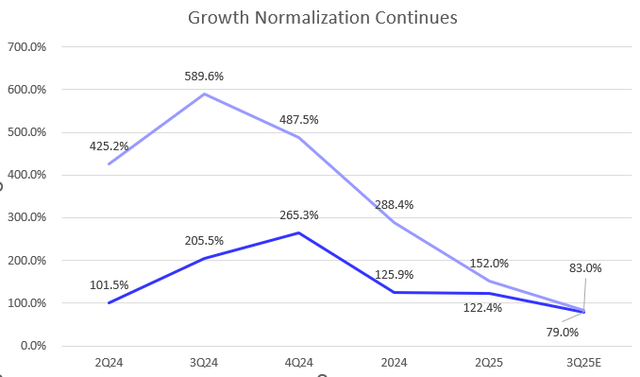

As expected by the market, NVDA topped both revenue and non-GAAP EPS estimates, delivering another quarter of triple digit revenue growth. Particularly, its Data Center segment continued to grow sequentially by double digits, up 154% YoY in 2Q FY2025. The company also forecasted a 79% YoY revenue growth for 3Q, beating market consensus as well. However, this guidance suggests that NVDA’s growth may fall below triple digits for the first time in five quarters, indicating a potential “growth inflection” that could disappoint some growth-oriented investors.

NVDA has maintained massive growth acceleration in its Data Center segment, reaching its peak with 427% YoY growth in 1Q FY2025. Its non-GAAP EPS growth had also been robust, consistently exceeding 400% YoY growth in recent quarters. However, signs of normalization have emerged, with a significant QoQ slowdown in revenue growth seen over the past two quarters. I believe NVDA’s growth momentum is likely to decline sharply in the coming quarters, especially given the extremely high YoY comparisons heading into 2H FY2025.

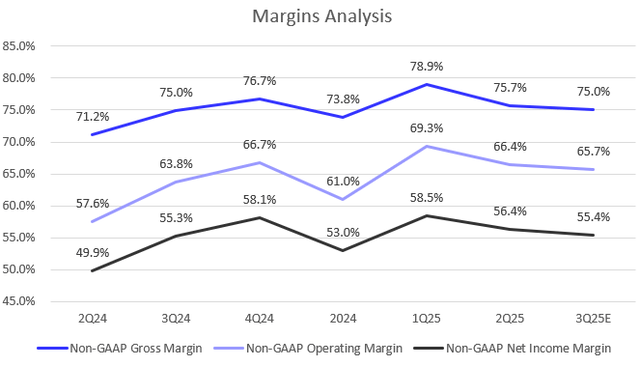

With margins also normalizing, I expect the company’s non-GAAP net income margin to decline similarly to its non-GAAP operating income margin, anticipating a 55.4% in 3Q FY2025. This would imply an 83% YoY growth in non-GAAP EPS for 3Q, based on its revenue outlook, as indicated in the chart above.

Ramping Production on New Chips Impacts Margins

As NVDA ramps up production on its new AI chips, this is expected to impact its gross margin, which is projected to decline to the mid to low 70% range in the coming quarters as the management previously mentioned. This indicates a reversal of the previous margin expansion trend. As shown in the chart, non-GAAP gross margin, operating margin, and net income margin triggered an “inflection” in 2Q FY2025. The company has also guided for a 75% non-GAAP gross margin in 3Q FY2025, suggesting a further decline. Additionally, NVDA anticipates $3 billion in non-GAAP operating expenses for the current quarter, which allows us to calculate a non-GAAP operating margin of 65.7%, indicating a 70 bps sequential decline. Lastly, with a non-GAAP net income margin of 56.4% in 2Q FY2025, I estimate a further 100 bps sequential decline in 3Q, bringing it down to 55.4%, reflecting the continued downward trend.

Unsurprisingly, the company not only significantly increased its R&D expenses but also nearly tripled its capex in 2Q FY2025 as it continues to invest heavily in AI chips. As a result, its FCF margin dropped to 44.9%, down from 57.5% in 1Q FY2025, remaining flat on a YoY basis. While I believe NVDA can sustain strong growth fueled by elevated AI investments, the growth rate will likely be significantly lower than in previous quarters, especially as the semiconductor industry becomes increasingly competitive in coming years.

Blackwell Chips Expected to Begin Shipping in 4Q This Year

Earlier this month, NVDA informed major cloud providers, including Microsoft (MSFT), that its next major AI chips, Blackwell, might face a shipment delay until early 2025 due to a potential design flaw. However, CEO Jensen Huang mentioned in a Bloomberg interview that demand for the Blackwell chips has far exceeded supply. He also mentioned that production of the new AI chips has already begun, with shipments expected in 4Q FY2025. While I believe this delay will not materially impact the company’s near-term growth outlook—especially with the shipment gap likely to be filled by strong demand for Hopper chips—the delay could still negatively affect the stock’s near-term sentiment.

Valuation Needs to Be Adjusted Accordingly

Despite significant revenue growth, NVDA’s stock is currently trading at a historical peak EV/Sales TTM, reflecting continued optimism that the company will not largely deviate from its previous growth momentum. However, even after the post-earnings selloff, NVDA’s EV/Sales fwd remains around 23.7x, nearly three times that of Taiwan Semiconductor Manufacturing (TSM) and double that of Advanced Micro Devices (AMD). In addition, this multiple is also more than 30% above NVDA’s 5-year average.

Moreover, its forward non-GAAP P/E is trading at 42x, nearly double the sector average. I strongly believe that consistently exceeding market expectations may not be sufficient to justify the current valuation. According to Bloomberg, NVDA’s 2Q FY2025 revenue came in below the highest estimates on the street, which could negatively impact the stock’s sentiment.

Furthermore, I think the stock’s valuation should be reassessed as the company’s growth and margin begin to normalize. We’ve seen valuations of many “pandemic beneficiaries” compress significantly due to a growth normalization process, where revenue growth slowed considerably. Therefore, I believe similar adjustments may be necessary for NVDA as its growth trajectory stabilizes. Therefore, I remain bearish on the stock currently due to its unattractive risk and reward profile.

Conclusion

In summary, I admit that NVDA has previously demonstrated impressive growth and margin increases driven by the AI boom and consistently exceeded expectations. The post-earnings selloff despite strong 2Q results suggests that simply beating expectations may not be sufficient. The significant stock decline in early August and the normalization of growth in revenue imply continued volatility.

With a “growth inflection” indicating a slowdown and lofty valuation multiples significantly above historical averages and peers, Nvidia Corporation stock faces increased downside risk. Although potential delays in new chip shipments to 4Q FY2025 may not significantly impact incremental growth, I remain bearish on NVDA, anticipating that ongoing growth normalization will compress its valuation multiples.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.