Summary:

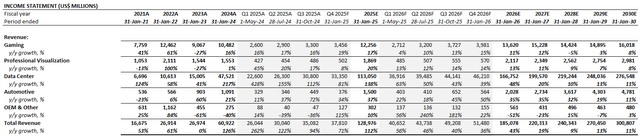

- NVIDIA Corporation reported strong fiscal Q3 2025 results, with a sizable revenue beat at $35.1B backed by record quarterly data center sales at $30.8B. Earnings also outperformed at $0.81 per share.

- Management guided fiscal Q4 2025 revenue of $37.5B, slightly exceeded consensus expectations, with FY25 margins expanding ~230bps.

- Yet, the lack of new, quantified Blackwell updates and non-Blackwell forward growth catalysts underpin fading momentum in the stock’s premium at current levels.

BING-JHEN HONG

The past quarter’s focus has largely been on Blackwell, with NVIDIA Corporation (NASDAQ:NVDA) (NEOE:NVDA:CA) left to fend for itself amidst repeated speculations on the new product line’s potential shipment delays. These allegations have spanned engineering snags in early production and, more recently, overheating servers in the 72-chip configuration systems.

But Nvidia has effectively put all of these concerns to rest in its latest earnings update. Management has confirmed that the next-generation Blackwell systems have begun volume production and remains on track to begin commercial deployments in the current period. Yet revenue contribution details for the current period remain vague, with the slight F4Q guidance beat suggesting that management’s previous expectations for “several billion dollars” of Blackwell sales in the period likely unchanged. Sentiment from management’s latest earnings commentary pertaining to Blackwell demand also remains positive, consistent with robust capex earmarked by hyperscalers towards AI infrastructure through calendar 2025.

However, Nvidia’s latest earnings update lacks new catalysts outside of prospects for Blackwell, which have largely been priced into the stock’s premium at current levels. This bodes unfavorably for Nvidia, given it faces an imminent reduction to its first mover advantage in accelerated computing amid intensifying competition. While AI opportunities continue to increase at a resilient clip, Nvidia’s share of the pie will inadvertently decrease with competitive products entering the marketplace. Despite still being the leading beneficiary of lucrative AI processor demand by wide margins, there is no room for deceleration given the high bar of expectations underpinning Nvidia’s valuation premium.

As Nvidia continues to ramp the new age of Blackwell system deployments, its previous bet on the transition to accelerated computing as the base case has materialized. And with no new catalysts lined up in sight, we expect the durability of Nvidia’s lofty valuation premium at current levels to gradually weaken.

All Eyes on Blackwell

The last several months leading up to Blackwell’s commercial deployment have been quite a challenge for Nvidia. It has had to fend off multiple allegations of Blackwell delays coming its way. In addition to earlier reports of “engineering snags,” which Nvidia has subsequently confirmed at the F2Q earnings update was a “change to the Blackwell GPU mask to improve production yields,” the new product line was recently faced with new allegations of overheating in servers.

Specifically, the speculated issue was isolated in the 72-chip configuration GB200 NVL72 systems. Recall that CEO Jensen Huang has clarified that the Blackwell system consists of seven different chips and represents one of Nvidia’s most powerful products to date. And the GB200 NVL72 is the most complex and innovative of them all. The system consists of 72 Grace Blackwell packages, connecting 36 Grace CPUs and 72 Blackwell GPUs. Since Blackwell builds on a 2-in-1 chiplet, 72 of them would be equivalent to 144 GPUs. This makes the GB200 NVL72 system the first of its kind to ever exhibit power consumption exceeding 100 kW, marking a mandatory transition to liquid-cooled servers.

Given the GB200 NVL72’s dabble in new technology territory, adjustments following initial sampling and commercial deployments are not unusual. And all speculated issues identified to date have remained well within Nvidia’s planned go-to-market timeline for Blackwell. Specifically, the reported concerns on Blackwell overheating in servers were swiftly debunked with Dell’s (DELL) shipment of the first GB200 NVL72 server racks fitted with its proprietary PowerEdge XE9712 liquid-cooled solution on November 18. This is corroborated by earlier trial deployments of Blackwell at Microsoft (MSFT) and Google (GOOG, GOOGL) in October.

On time commercial deployment of Blackwell GPUs was further evidenced by Microsoft’s announcement of its “first cloud private preview” of GB200 Grace Blackwell Superchip instances earlier this week. The strong and on time initial ramp of Blackwell chips in the current period was also confirmed by Nvidia during the F3Q25 earnings update, with management citing the new chips are in full production with “incredible” demand. However, they have stopped short on quantified details regarding anticipated revenue contributions from Blackwell in F4Q, with the period’s guidance implying that management’s previous expectations ballparked in the “several billion dollars” range likely unchanged.

Nonetheless, the ramp-up of Blackwell deployments through FY26 will be strong. This is consistent with more than $200 billion in combined capex earmarked by hyperscalers including Google, Microsoft, Amazon (AMZN) and Meta Platforms (META) – which account for 40% of Nvidia’s GPU sales – in calendar 2024, with the figure to increase further through calendar 2025.

Lacking Catalysts in Sight

Although demand for Nvidia’s AI processors continues to outpace supply, it lacks new growth catalysts beyond the transition to next-generation Blackwell and Rubin systems. This effectively caps the durability of Nvidia’s valuation premium at current levels, in our opinion.

Specifically, intensifying competition from both merchant GPU makers like Advanced Micro Devices (AMD), and in-house development of silicon across its hyperscaler customers is gradually diminishing Nvidia’s first mover advantage in the field. While the AI pie continues to grow with related capex spend expanding at a rapid clip, Nvidia’s share faces an imminent decline.

Notable up-and-coming contenders include AMD, which has recently bested Nvidia on the TOP500 supercomputer list. The El Capitan system at the Lawrence Livermore National Laboratory was ranked the no. 1 most powerful supercomputer on the TOP500 list. It boasts more than 11 million combined CPU and GPU cores powered by AMD’s fourth-generation “Genoa” EPYC server processors and Instinct MI300A accelerators.

Meanwhile, Nvidia’s key hyperscaler customers have also been venturing into in-house developed accelerators. Although they do not represent a direct substitute to Nvidia’s GPUs, in-house developed silicon will effectively dilute Nvidia’s hyperscaler wallet share, nonetheless.

And while adjacent end-to-end full stack solutions, including the sale of complementary software and server system solutions, help to diversify Nvidia’s revenue streams, their prospects just aren’t as lucrative as data center hardware sales. They have been buoying the company’s cash flows and, inadvertently, valuation. Despite Nvidia’s recent initiative in quantum computing, as evidenced in its partnership with Google Quantum AI, related prospects and their implications on the chipmaker’s growth trajectory also remain to be seen.

Fundamental Outlook

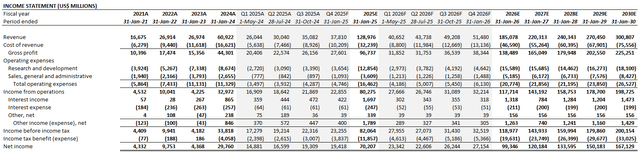

Adjusting our previous forecast for Nvidia’s actual F3Q performance and outlook for the current period with consideration of the foregoing analysis, we expect FY 2025 revenue to grow 112% y/y to $129.0 billion. Data center sales will remain the key growth driver, with ramping Blackwell deployment expected to drive additive growth and margin accretion to Nvidia. However, Nvidia’s broader growth trajectory is expected to shift towards impending deceleration due to the ongoing imbalance in supply demand dynamics and intensifying competition.

Meanwhile, Nvidia’s profit outlook is expected to expand further given the ongoing ramp of higher-margin data center sales. This is consistent with management’s guidance for F4Q gross profit to exceed the 70% range on a GAAP basis, suggesting full-year margin expansion of almost 230 bps.

Valuation Considerations

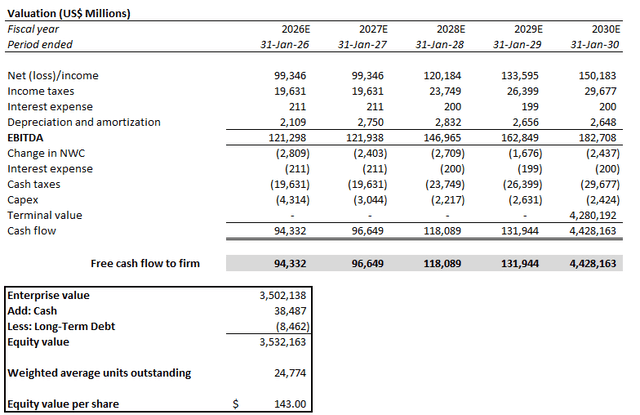

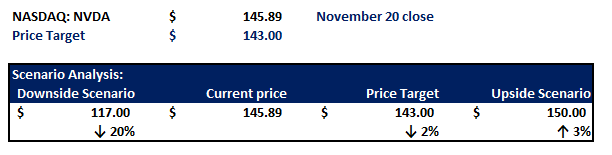

We are setting a base case price target on the stock at $143, which approximates its current market price.

Author

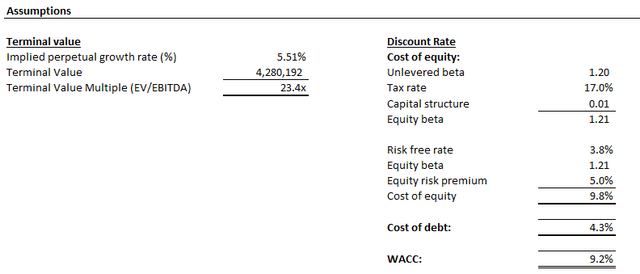

The price is set using the discounted cash flow (“DCF”) approach, which considers projections taken based on the foregoing fundamental analysis on Nvidia. The DCF analysis applies a WACC of 9.2%, which is in line with Nvidia’s capital structure and risk profile. An implied perpetual growth rate of 5.51% is also applied on Nvidia’s FY2030E EBITDA to determine its terminal value. The premium growth assumption is in line with Nvidia’s mission-critical role in enabling next-generation technologies that underpin economic growth.

The terminal value considered is also equivalent to the application of a 3.5% implied perpetual growth rate on FY2035E EBITDA. This is when Nvidia’s growth is expected to normalize towards levels in line with the longer-term pace of anticipated economic expansion across its core operating regions.

Conclusion

While Nvidia’s F3Q results outperformed alongside a robust F4Q outlook (backed by expectations for incredible Blackwell contributions) continue to support the stock’s valuation premium at current levels, momentum is evidently trailing off. This is consistent with the lack of new growth catalysts to justify a further re-rate in its valuation. Nvidia now instead embarks in the execution phase with its transition to a new era of accelerated computing underpinned by the more powerful Blackwell systems. Despite it being the backbone to mission-critical next-generation AI developments, Nvidia faces limited additive growth drivers in sight needed to jet-set the stock to further upsides from current levels.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.