Summary:

- Despite a 140% YTD gain, Nvidia Corporation remains attractive due to strong fundamentals, triple-digit growth, and consistent earnings beats, justifying its valuation.

- Nvidia’s Q2 results showed impressive growth with sales up 122.4% YoY and free cash flow doubling, reinforcing its long-term potential.

- I believe Nvidia’s 2025 EPS will exceed current estimates, making its current valuation of 30x forward earnings reasonable, with 7%-13.4% upside.

- Given limited high-conviction picks in the market, I’m considering adding to my Nvidia Corporation position, despite its recent rally, due to its strong growth prospects.

Sundry Photography

After the market’s recent rally, there aren’t too many high conviction picks left on my watch list that provide strong upside potential. As the S&P 500 (SP500) approaches all-time highs again, It’s difficult to find blue chip compounders that trade with appealing earnings/cash flow multiples (even on a forward basis). The good news is: cash still yields roughly 5%, so there’s no hurry for me to allocate new capital to the market.

These days, I’m happy to build my cash position and patiently wait for another macro pullback. With that being said, I do find myself tempted to add more Nvidia Corporation (NASDAQ:NVDA) shares to my already overweight position because after that stock’s recent pullback, I believe that NVDA offers an attractive margin of safety and significant growth prospects.

It seems crazy to say that about a stock that’s up more than 140% on a year-to-date basis. Yet, it’s true.

NVDA was a top pick of mine coming into the year and the stock has exceeded expectations.

On December 29, 2023, I wrote an article titled, “My Top 3 Stock Picks for 2024” which included NVDA. I highlighted an upside potential of 25%-75% at the time, depending on the earnings multiple that investors felt comfortable paying for NVDA shares. Well, since then, NVDA beaten Wall Street’s earnings estimates a couple of times…

6 months ago, the consensus EPS estimate for NVDA on Wall Street for 2024 was $2.39/share.

6 months ago, the consensus EPS estimate for NVDA for 2025 was $2.86.

Today, those two figures are 17.6% and 36.4% higher at $2.81 and $3.90, respectively.

Furthermore, NVDA continues to produce triple digit top and bottom-line growth.

So, while shares are up 140%, I don’t think they’re much pricier than they were when I wrote that Top Picks piece.

Back in December, NVDA shares were trading for 24.2x forward EPS estimates. Today, NVDA shares trade for roughly 30.5x 2025 consensus. But, I think those forward estimates might be too low.

This company has made a habit of crushing Wall Street estimates during the past couple of years, and I doubt that trend is going to stop. I wouldn’t be surprised if NVDA’s ultimate 2025 EPS total rises to the $4.50 level, which would represent that same ~26x forward multiple.

Paying 26x earnings for a company with 40%+ EPS growth isn’t a bad deal.

What’s more, when I began to plan out this article at the beginning of the week, NVDA was trading in that 24x area. Nvidia has rallied by roughly12% during the last 5 trading sessions and still, the stock sits near the top of my personal watch list. That’s because it’s one of the few blue chips that I track that is trading discounted to my fair value estimate.

NVDA is a perfect example of how a stock can move higher without getting pricier. To me, this company’s 2024 rally has been totally justified by its underlying fundamentals and with more fundamental growth on the horizon, I think that the stock’s post-earnings weakness has been irrational.

Q2 Results & Forward Outlook

During the second quarter, NVDA beat Wall Street’s expectations on both the top and bottom lines, while also posting Q3 guidance that came in ahead of expectations. And yet, the stock sold off.

Sales came in at $30.04b, up 122.4% on a y/y basis (and 15% on a sequential basis).

NVDA’s all important Data Center segment posted $26.3b in sales, up by 154% on a y/y basis (and 16% on a sequential basis).

Non-GAAP EPS came in at $0.68, up 152% on a y/y basis (and 11% on a sequential basis).

During Q2, NVDA’s gross margin was 75.1%. That was down 330 basis points from the 78.4% figure that it posted during the first quarter; however, 75%+ margins is still incredibly impressive.

The combination of rapidly rising sales and increasing margins has turned NVDA into a free cash flow machine. During Q2, NVDA’s FCF was $13.5b, up from just $6.05b the year before.

And what I love about this company is that it’s not being stingy with this cash flow. During Q2 NVDA returned $15.4 billion to its shareholders in the form of dividends and buybacks.

Yes, after its amazing share price rally, NVDA’s dividend yield is miniscule. However, I’m not going to blame management for its tremendous success in that regard. NVDA recently raised its dividend by 150%. Obviously, that pace is not sustainable over the long term, but I do think that this is a stock that can compound its dividend at a strong double-digit clip for years to come.

That expectation, alongside ongoing buybacks (during Q2, NVDA announced a $50b buyback authorization), makes this one of the more interesting companies in the market for me, in terms of shareholder returns over the next 5–10 years.

Because of my bullish long-term outlook, I can’t believe that so many investors get caught up in near-term guidance and fear regarding produce rollout cycles.

Sure, the Blackwell chips were delayed. But in the grand scheme of things, who cares if they go on sale during Q4 or Q1? Not me.

For what it’s worth, recently headlines have come out reconciling those fears…

A recent article from TrendForce said,

“The report [regarding an article in Commercial Times citing sources familiar with NVDA’s production outlook] noted that NVIDIA’s updated version of B200 is expected to be completed by late October, allowing the GB200 to enter mass production in December, with large-scale deliveries to ODMs expected in the first quarter of next year.”

If this headline is the catalyst for NVDA’s 12% run this week (which it very well could be), then that’s all the evidence that you need that the market is driven by fear/greed and not efficient in the short term.

My point is…we all know that NVDA was going to sell billions and billions of dollars worth of Blackwell chips whenever they came out. Sure, this could mean an extra quarter of low-teens growth next year once NVDA starts facing its rough 2024 comps; however, it doesn’t change the longer-term growth outlook.

As you can see below, the primary hyperscalers have been accelerating their spending and none of them pointed towards capex slowdowns during their recent quarterly reports.

Hyperscaler Capex (Billions)

|

Ticker |

GOOGL |

META |

MSFT |

|

Q1 2023 |

$6.30 |

$7.09 |

$7.80 |

|

Q2 2023 |

$6.89 |

$6.35 |

$10.70 |

|

Q3 2023 |

$8.06 |

$6.76 |

$11.20 |

|

Q4 2023 |

$11.02 |

$7.90 |

$11.50 |

|

Q1 2024 |

$12.01 |

$6.72 |

$14 |

|

Q2 2024 |

$13.19 |

$8.47 |

$19 |

Amazon doesn’t break out its capex as clearly as the others; however, during the full year in 2023 their management noted capex spending of $48.4b. That figure rose to $30.5b during the first half of 2024. And during its recent Q2 report, AMZN’s CFO, Brian Olsavsky said,

“Looking ahead to the rest of 2024, we expect capital investments to be higher in the second half of the year. The majority of the spend will be to support the growing need for AWS infrastructure as we continue to see strong demand in both generative AI and our non-generative AI workloads.”

And that’s just the tangible spending.

There’s been no indication that the accelerating capex spending by the hyperscalers is going to stop anytime soon (most big-tech companies have publicly stated their plans to continue to spend, despite criticism from some regarding ROI on AI-related chips/data center buildouts).

What’s more, there have been other mega-projects rumored, such as Sam Altman’s (the founder/CEO of OpenAI) theoretical Stargate project, which would combine millions of XPU’s (multiple data centers) to create a super computer that would be powerful enough to create true AGI (artificial general intelligence).

After the Stargate rumors began to emerge (do you remember rumors of Altman headed to the Middle East to ask the oil barons for trillions of dollars to build his dream?) Timothy Prickett Smith, at NextPlatform, performed analysis which pointed towards Microsoft’s ability to build out Stargate on its own.

Smith wrote,

“So Microsoft doesn’t have the dough to do the Stargate effort right now all at once, but its software and cloud businesses together generated $82.5 billion in net income against about $227.6 billion in sales for the trailing twelve months. Over the next six years, if the software and cloud businesses just stayed where it was, Microsoft will bring in $1.37 trillion in revenues and have around $500 billion in net income. It can afford the Stargate effort.”

He also broke down the theoretical costs, which included more than $57b in GPU/XPU hardware cost over the next 5 years (and being that NVDA dominates the market share in this space, it’s reasonable to assume that they’d be the biggest financial beneficiaries).

And ask yourself this…

Is Alphabet, Meta, Apple, or Tesla going to simply let Microsoft/OpenAI going to run away with the AGI-creation of its own?

That’s highly doubtful.

Elon Musk’s AI startup, xAI, recently unveiled its AI supercomputer called “Colossus” which runs on 100,000 NVDA chips.

This will be the biggest technological race that we’ve ever seen. Trillions will be spent. And as of right now, NVDA is the clear beneficiary (and really the only company that has been able to successfully monetize the AI craze at scale).

With all of that in mind, it seems clear that NVDA is going to have a big second half (regardless of which chipset is for sale) and an even bigger 2025 once Blackwell finally rolls out…and strong earning years for the foreseeable future.

The AI naysayers might end up being right. Maybe the hyperscalers are lighting money on fire right now because they’ll never be able to generate strong returns on the capital they’re investing in this space. But, the risk of sitting on the sidelines is too large. AI is likely to be the biggest technological disruptor of our lifetimes and even the biggest of the big-tech companies can’t afford to risk missing this trend.

Yes, during Q2 we saw slowing growth show up in the sequential numbers. That’s OK. Currently, consensus EPS forecasts point towards ~40% growth next year. That seems like a reasonable expectation to me (given the Blackwell launch) and therefore, I don’t think shares are trading with an extraordinarily high valuation premium attached to them.

Valuation

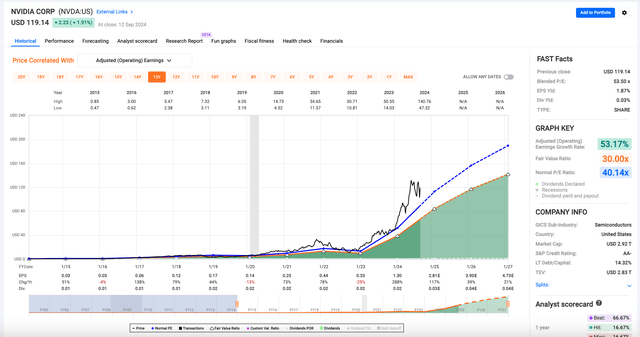

I’ll admit, when looking at NVDA through a trailing twelve months (“ttm”) or even a blended P/E lens, shares can look pricey.

The stock’s blended P/E ratio right now is 53.5x. That’s a lot. But, once you factor in the likelihood of ~120% EPS growth this year and another 40% next year, things don’t look so bad on a forward basis.

This is the entire premise of my bullish outlook here. If you doubt that NVDA is going to post strong results during the next 6 quarters or so, then it probably makes sense to be bearish on shares. As for me, I have a lot of conviction that NVDA will continue to post strong growth.

Back in December, I said that 30-35x forward earnings was a fair price to pay for this company.

Because of slowing growth prospects, I’ve lowered my target multiple a bit, to 30x (which, as you can see above, is well below the stock’s 10-year average of 40.1x; for further reference, NVDA’s 3 and 5-year average P/E’s are 53.7x and 48.9x).

With that 30x target in mind, shares look cheap here.

30x the current 2025 EPS consensus of $3.90 is $117 (so just a couple of bucks north of today’s $119 share price).

But, like I said, I think it’s highly likely that NVDA’s actual 2025 EPS result comes in well ahead of current consensus.

Remember, NVDA has beaten Wall Street’s estimates during each of the last 8 quarters and throughout this period of time, the consensus estimate has continued to rise.

Heck, I started writing this article a week ago and since then, I’ve already had to edit it because the 2025 EPS consensus rose by $0.02.

I think $4.25-$4.50 is where EPS will ultimately land and with that in mind, a 30x forward multiple would represent a fair value range of $127.50-$135.00.

That points towards 7%-13.4% upside potential. .

And that’s just over the next 16 months or so. In 5–10 years, I believe that NVDA’s EPS could be multiple times higher than its current level, pointing towards solid long-term potential as well.

Conclusion

It’s a bummer that NVDA has rallied this week. On Monday, when I added this article to my weekly calendar, I thought shares had 20%+ upside potential over the next year or so. Because of the rally, that’s no longer the case.

However, I’m still pleased to hold my overweight position. That’s because I believe this stock still has market-beating potential over the longer term. Like I said, I’m thinking about adding to my position because there aren’t many other, attractively priced compounders left in the market today.

NVDA is my second-largest holding, accounting for roughly 6.8% of my overall portfolio.

Today, NVDA represents 6.2% of the S&P 500, so I’m overweight the broad market benchmark.

It’s difficult for me to think about making a significant addition to my take because:

- I like to stay diversified and limit single stock risk by limiting positions to the high single digit percentage threshold.

- Nvidia doesn’t pay a significant dividend yield, so adding shares at these levels doesn’t do much to enhance my passive income stream

- As silly as this may be, because of my extremely low-cost basis, it’s hard for me to think about buying shares at today’s prices… I irrationally wish that I could hop into a time machine and buy a bunch more shares back in 2017 when I originally started building my position, instead.

Yet, due to the lack of great bargains in the market, I find myself drawn to stocks with strong organic growth potential and Nvidia fits that bill.

Because of my conviction in the stock moving forward, I’d be willing to push my NVDA stake up towards the 7-8% range, meaning that I could purchase several more share lots before I’m in a total hold mode.

As I’ve said before, I’d rather rely on organic compounding for upside potential than to place deep value bets that rely on shifting sentiment in the markets and multiple expansion.

I’d even rather risk potentially overpaying for shares than falling into a value trap. Over time, money thrown into value traps tends to disappear, whereas, fundamental growth will eventually overcome elevated premiums in the near-term, eventually resulting in rising share prices.

In the very short-term (the coming days/weeks) I don’t feel compelled to rush into another NVDA purchase. But, I do want to stay disciplined and continue to allocate new cash to the market every month. Therefore, NVDA is a real contender for one of my September purchases at today’s prices.

Simply put, I’m not seeing very many other options with similar valuation and quality scores.

And, if the bullish sentiment surrounding shares sours, and we see a sell-off back down below the $110 range, I’ll happily get more aggressive here. Now that the Q2 results are officially out, I feel comfortable continuing to build this position.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAPL, ACN, ADP, AMGN, AMZN, APD, ARCC, ARE, ASML, AVB, AVGO, AWK, BAH, BIL, BLK, BKNG, BR, CME, CNI, CP, CPT, CRM, CSL, DE,, ECL, ELV, EMR, ENB, SPAXX, GOOGL, HON, ICE, JNJ, KO, LIN, LMT, MA, MAIN, MCD, MCO, META, MSCI, MSFT, NNN, NOC, NVDA, O, OBDC, PEP, PH, PLD, PLTR, QCOM, REXR, RSG, RTX, SBUX, SHW, SPGI, TD, TXN, USFR, UNH, V, WM, ZTS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Dividend Kings helps you determine the best safe dividend stocks to buy via our Master List. Membership also includes

Dividend Kings helps you determine the best safe dividend stocks to buy via our Master List. Membership also includes

- Access to our model portfolios

- real-time chatroom support

- Our “Learn How To Invest Better” Library

- Exclusive trade alerts from Nicholas Ward

Click here for a two-week free trial so we can help you achieve better long-term total returns and your financial dreams.