Summary:

- NVDA’s Q2 2025 performance shows robust growth with revenues up 122% YoY and EPS up 168% YoY, driven by strong performance in the Data Center segment.

- Concerns about the sustainability of AI-related capex in recent years are irrelevant as GPU shortages and further computational requirements will continue to benefit NVDA’s topline.

- Geopolitical tensions between the United States and China are likely to persist, eventually resulting in NVDA losing revenue contribution from China.

- Despite factoring in a potential revenue decay from China and operating expense margin normalization, a potential upside still exists for NVDA; the company is neither overvalued nor in bubble territory.

BING-JHEN HONG

Introduction

Since the emergence of Generative Artificial Intelligence into the mainstream consumer market in November 2022, share prices of major semiconductors companies (with the exception of Intel) have surged exponentially. In less than two years, Nvidia Corp’s (NASDAQ:NVDA) market capitalization has gained more than 700%! Naturally, as with most stock rallies, it is inevitable that many will claim that the company is overvalued and has entered bubble territory, eventually the share price will come crashing down.

In the past two years, I have observed multiple concerns from market participants such as: (1) whether the demand for NVDA’s product and services is sustainable and (2) will geopolitical tensions affect NVDA’s growth prospects and financial standing. In this report, we will explore why demand is sustainable and how NVDA’s valuation is not overstretched despite factoring potential revenue decay from China and eventual operating margin normalization.

Latest Developments

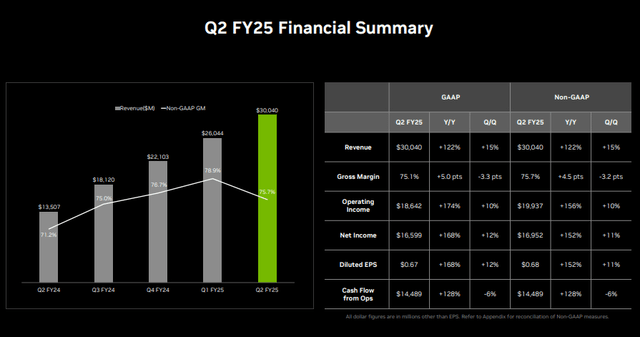

NVDA 2Q25 Financial Summary (Earnings Presentation)

Based on the company’s latest earnings release, NVDA continues its strong performance with no signs of slowing down. For 2Q25, NVDA generated revenues of $30 billion, representing a quarter-on-quarter and year-on-year growth of 15% and 122%, respectively. Diluted EPS for the quarter came in at $0.67, representing a quarter-on-quarter and year-on-year growth of 12% and 168%, respectively. The company’s strong performance is attributable to its data center segment; demand for NVDA’s Hopper remains high. In addition, demand for NVDA’s latest Blackwell platforms exceeds the company’s supply. NVDA have stated that production increase is likely to ramp up towards the end of FY2025 to FY2026.

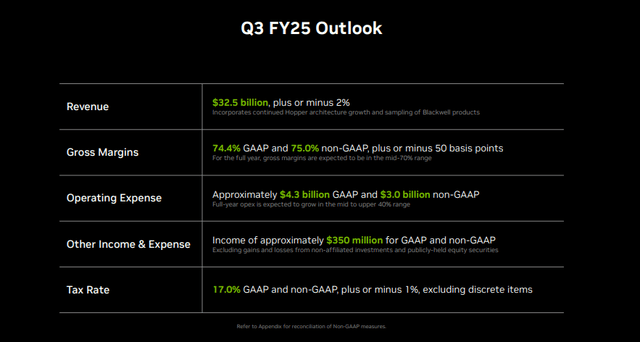

NVDA 3Q25 Guidance (Earnings Presentation)

Looking ahead, NVDA’s management team expects another strong quarter with sustained elevated revenues; NVDA expects the data center segment to continue to be its primary driver. For 3Q25, NVDA expects to generate revenues of $32.5 billion. Gross margins are expected to slightly deteriorate from 75.1% in 2Q25 to 74.4% in 3Q25; for the entire year, gross margins are expected to be around 75%. Operating expenses are likely to expand from $3.93 billion in 2Q25 to $4.3 billion in 3Q25; for the entire year, operating expenses are expected to surge by 40% year-on-year, indicating that the company is on a trek to normalize operating margins.

Global GPU Shortage Persists and NVIDIA is Well Positioned to Benefit from Sustained Demand

During the latest earnings call, I noted that there were many concerns on whether NVDA can continue to maintain its revenue growth. There are doubts on whether the recent surge in investments for AI/ML infrastructure is sustainable and will provide positive returns on investments. Additionally, multiple market participants such as Goldman Sachs have argued that the investments in Artificial Intelligence is unlikely to payoff; the poor return on investments will discourage companies from further investing in AI/ML related infrastructures.

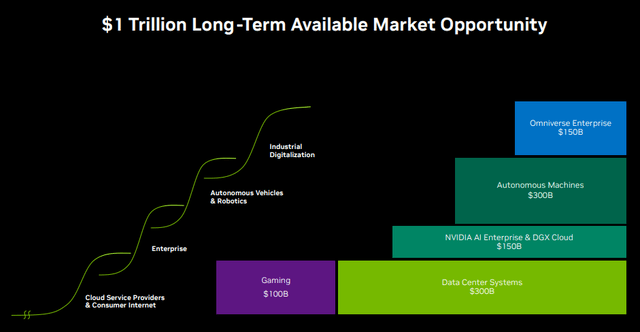

NVDA’s Trillion Dollar Opportunity (Company Overview Presentation)

However, I argue that these analysts are approaching this question wrongly. Whether investments in AI/ML related capex will pay off or not, the fact is there is a huge shortage of GPUs globally, and we are merely in the early stage of artificial intelligence where further R&D spending will be required. AI/ML practitioners will know that, due to global GPU shortages, it is very hard to gain access to GPUs from cloud providers (e.g. Microsoft Azure and Google Cloud) to train or deploy their models.

At this emerging stage of artificial intelligence, where most of our models are still Narrow Artificial Intelligence, more computing power is required to research and train better models to achieve Artificial General Intelligence; we are just at the nascent stage of the industry. In fact, the small step-up from Meta’s Llama 3 to Llama 4 already require more than 10x more computational power! Imagine how many more resources will be required for us to achieve Artificial General Intelligence. In addition, major technology companies that have invested in AI/ML infrastructure will continue to invest in surplus capacity, given the uncertainty of how much computational power they require. In fact, in Meta’s latest earnings call, Market Zuckerberg have stated, “…at this point I’d rather risk building capacity before it is needed, rather than too late, given the long lead times for spinning up new infra projects.”

The demand for hardware to train AI/ML models will continue to sustain in the near future. According to a recent study conducted by Bloomberg, the market size for AI/ML related infrastructure is expected to reach $140 billion and $473 by 2027 and 2032 respectively. Thus far, we have only discussed training of AI/ML models. We have not factored in the AI/ML inference market, which is expected to be one of the largest emerging markets as more AI/ML models are pushed into production for consumer usage. According to Bloomberg’s study, the hardware for the inference market is expected to reach $82 billion and $168 billion in 2027 and 2032, bringing the overall hardware market to $223 billion and $641 billion in 2027 and 2032. Hence, it is more than evident that the growth of the industry will continue to provide strong tailwinds for NVDA’s topline.

Investors Are Overlooking Geopolitical Tensions as a Significant Risk

Although overall demand is likely to serve as a tailwind for NVDA, geopolitical tensions will continue to weigh on the company. The effects of the technological war between the United States and China are often overlooked.

Since October 2022, the United States has started banning the exports of high-end AI chips such as NVDA’s A100 and H100 to China. Over the years, the United States has continuously revised export restrictions to ensure that NVDA’s newer chips will not fall into the hands of China. In 17th October 2023, the United States released a new tranche of rules, preventing China from accessing high-end chips through the cloud or data servers in other countries and banned NVDA’s A800 and H800 which were created specifically for the Chinese markets.

In a statement last year during December 2023, United States Commerce Secretary Gina Raimondo indirectly warned NVDA, stating that, “If you redesign a chip around a particular cut line that enables China to do AI, I’m going to control it the very next day”.

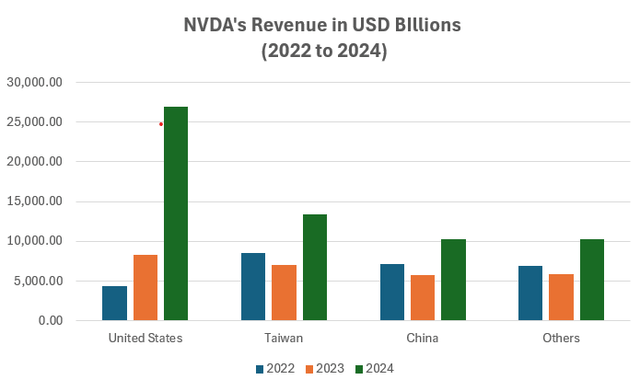

NVDA’s Revenue By Geography (10K)

Although NVDA has managed to sell its H20 chips in China, it is evident that the United States will continue to make it harder for China to achieve its computational requirements. This unstable dependence on the United States semiconductors has pushed Chinese technology firms to reduce its reliance on NVDA’s chips. We should not be surprised that NVDA will eventually lose its revenue contribution from China entirely. As investors remain enthusiastic about NVDA’s reign in this new investment supercycle, we must also factor in the potential revenue deterioration that the company will inevitably see from this region.

Upside Exists Despite Factoring Revenue Decay from China and Normalization of Operating Expenses

NVDA’s valuation is perhaps one of the most fiercely debated topics today. It is easy to find market participants arguing that NVDA is a bubble stock and that the recent popularity of Generative AI is hyping up chipmakers such as AMD or NVDA. For example, both Elliott Management and the Dean of Valuation, Aswath Damodaran, have suggested that NVDA is simply overhyped and overvalued.

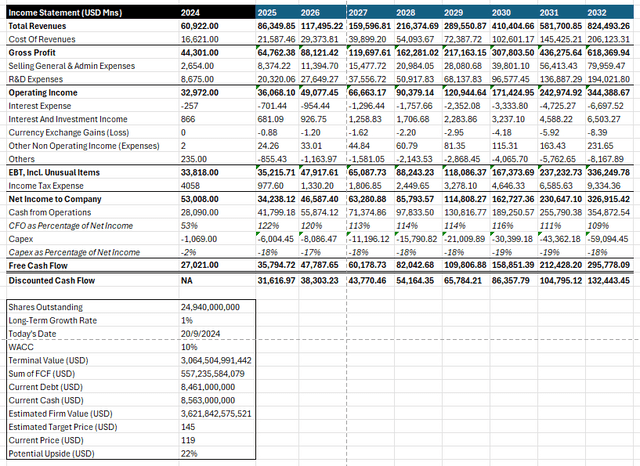

Hence, to further investigate the potential valuation of NVDA, I have conducted a valuation analysis based on discounted cashflow with the following core assumptions: (1) NVDA’s top line will grow in-line with AI market at a CAGR of 41.74%, (2) NVDA’s will eventually lose all of its revenue contribution from China by 2029, (3) NVDA’s operating expenses will normalize from about 18.6% to 33.23%.

DCF Valuation (Author’s Projection)

Based on these assumptions with a long-term growth rate of 1% and a WACC of 10%, we should expect the total market capitalization of NVDA to be around $3.6 trillion, indicating an estimated share price of $145 and representing an upside of 22%. Therefore, it is clear, that even if we account for normalization of margins (which no one is really talking about in the markets right now) and the potential revenue decay from China, potential upside still exists for NVDA.

Closing Remarks

In summary, it is easy to label a company experiencing a meteoric rise as overvalued and entering bubble territory. My analysis suggests that despite factoring a potential revenue decay from China and a normalization of operating expenses, potential upside still exists for NVDA; I strongly disagree that the company has entered bubble territory and is poised for a correction.

However, much of the potential from the Artificial Intelligence market has been priced in. For investors who have recently bought into NVDA, it is important to manage your own expectations; at this stage, it is unlikely that we will see NVDA achieving another meteoric rise of more than 50%.

Finally, it is important to highlight that NVDA’s current valuation is based on the assumption that the Artificial Intelligence market will continue to grow exponentially and NVDA will be able to at least maintain its market share (excluding China). The current price of NVDA leaves the company with little margin for error; if there are signs that growth is abating or lose market shares to competitors (e.g. AMD), it is likely that the share price of NVDA will deteriorate significantly.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in NVDA over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.