Summary:

- We’ve had unwavering conviction in Nvidia’s AI story since November 2018. In fact, it was our leading position going into 2023.

- Nvidia is a core holding of ours, so we will likely never close the position, as long as the story and tech trend remain intact.

- Until the $340 support breaks, Nvidia still has the potential for that last swing higher.

Sundry Photography

It is our stance that the stock market is not logical, rather it’s sentimental. There is no logical explanation for a stock to go up 100% or more – only to fall 40% or more in a matter of a couple of months. Fundamentals do not change this quickly, but sentiment does. In the simplest terms, sentiment is driven by how fear and greed interrelate with supply and demand. However, the way to track sentiment to protect capital is much more complex and needs to combine fundamental analysis with technical analysis

This roller coaster ride is most evident in tech stocks, which happens to be our specialty. Therefore, we openly and frequently discuss with our free newsletter readers the importance of layering into a leading position, setting up buy plans ahead of time, and also the importance of taking gains once the technical and fundamentals get stretched.

We’ve had unwavering conviction in Nvidia’s AI story since November 2018. In fact, it was our leading position going into 2023 and our AI allocation of 45% exceeded Stanley Druckenmiller at 29%, meanwhile, Druckenmiller was celebrated for having a leading AI portfolio. The Street is also taking credit for being early to Nvidia Corporation (NASDAQ:NVDA), which was a latecomer recommendation in March 2023. Ark Invest often discusses AI as a leading trend, yet almost missed this AI leader entirely. We point this out because we provided Nvidia as a stock tip for free, repeatedly, with top-tier analysis delivered on Seeking Alpha and through our free newsletter, with our own capital backing the research.

We are a strong proponent of offering quality information at the free level. We offer top-tier analysis every single week in our free newsletter, and we do not know any other top-performing portfolio that offers this at the free level in a consistent manner.

Unfortunately, free information tends to come from those who are unproven and may not be very good investors at all, while those with a proven track record keep trades close to their chest.

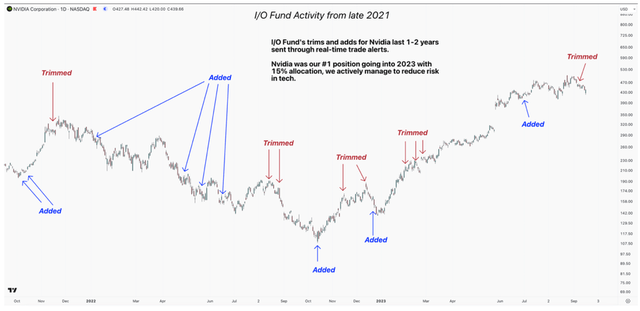

Not only do we actively manage every position we own and send real-time trade alerts, but we discuss openly and frequently our thoughts along the way. Our track record on Nvidia over the past 1-2 years looks like this:

The single biggest issue individual investors face is a lack of quality information that is early, consistent, and comes with ultimate transparency around position sizing, portfolio performance, and how to handle sell-offs.

It is this last point that we’d like to discuss with you today, “how to handle selloffs.” We were considered crazy for buying Nvidia in 2022 and we are considered crazy for trimming in 2023. Yet, in what is rare transparency for the financial world, we are sharing with you our plans with this leading portfolio position.

Price Analysis

On August 28th, we put out our price analysis on NVDA. We offered two general scenarios that we see playing out, which are still very much in play today. Here is what we said back then:

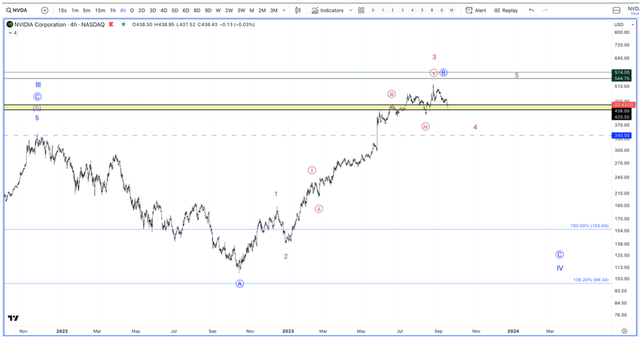

There are two general Elliott Wave counts I’m using that represent both of these gap possibilities.

- Blue – this count has the 2022 bear market as the first leg in a large-degree correction. That would make 2023 the corrective leg, with the final drop on the horizon, which would likely retest the October lows.

- Red – this count has us in a 4th wave correction within a larger 5 wave uptrend. This would make this current dip a buying opportunity as we push towards the $560-$590 region next.

The lowest I would allow this correction to go and still keep the red count valid would be the $340 region. If we break below $340, then the odds shift that the gap from Nvidia’s last earnings call was in fact an exhaustion gap. Our next move would be to set up downward targets to accumulate Nvidia for the long haul.

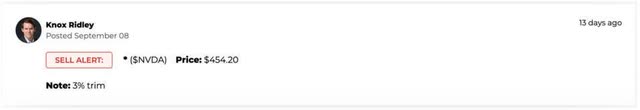

Also, in the last report, we were looking for a breakout above $480 to signal that a low was in, and we were heading toward our first overhead target around of $545. We did see a breakout, but it failed to hold, which was a warning of more volatility to come. This, coupled with some heavy distribution volume above the $440 price level, had us decide to take more gains in Nvidia.

Real-time trade alert offered by Tech Insider Network (Tech Insider Network)

My prior analysis still holds – as long as we hold $340, Nvidia has the potential for one more swing higher into year-end/early next year. However, we do not believe current prices are ideal for a long-term, buy and hold mindset. Patience will likely pay off in the long run. So, it will be up to each investor to decide if they want to take on the risk of potentially getting one more high.

For us, the reward is not worth the risk, which is why we have decided to trim. Our last buy at $410 in July is our last buy, and we do not have any more buys planned until we see a resolution. There are two other AI-related stocks that we like better in the near term, and when we enter these, we will notify our premium members with real-time trade alerts.

This remains my primary perspective as long as we hold the $340 support. Below there, and the top is likely in.

When We Plan to Trim Next

Nvidia is a core holding of ours, so we will likely never close the position, as long as the story and tech trend remain intact. However, we do strongly believe in taking gains, reducing risk, and targeting lower levels for a better cost basis. That being said, we believe we are approaching one of these moments. Even though we broke a key trendline today, we expect a bounce to occur soon. If this bounce is a corrective bounce that fails to reclaim key overhead levels, we will trim our position even more.

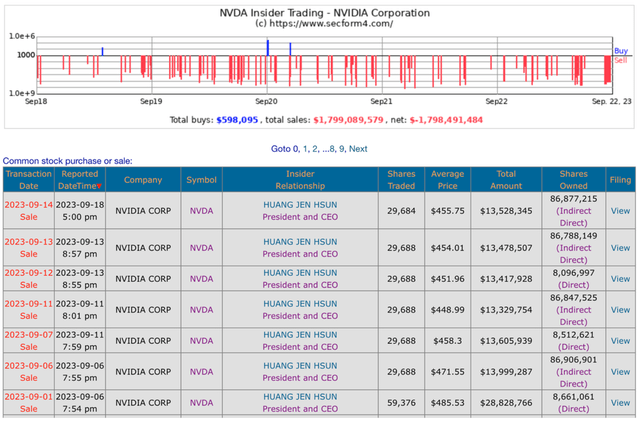

Insider Selling Has Elevated Over the Past Month

There has been an excessive level of insider selling by the CEO, Jensen Huang. So far, he has sold over $110,000,000 worth of shares over the last 3 weeks. Regarding insider activity, there are many reasons insiders sell, which may have nothing to do with the business. However, when you see the executives within a company, like the CEO, it’s worth paying attention to. Since June, we’ve seen about $175,000,000 worth of NVDA sold.

Conclusion

In conclusion, our broad market work suggests that a complex topping process is forming. Many sectors and stocks have likely topped, while some big tech names look like they have the potential for one more high into the end of the year.

Insider activity and institutional selling point toward another high being less likely. If we do get that second high, our plan is to trim more. Until the $340 support breaks, NVDA still has the potential for that last swing higher. Regardless, we believe being patient will pay off for those looking to buy a great company at a great a price. We are also being patient for when we add back to our position and feel it’s better to be defensive at the moment.

If you own Nvidia stock, or are looking to own NVDA, we encourage you to attend our weekly premium webinars, held every Thursday at 4:30 pm EST. Next week, we will discuss NVDA, as well as two other AI plays that we will likely buy next – what our targets are, where we plan to buy, as well as where we plan to take gains.

Tech Insider Network Portfolio Manager, Knox Ridley, contributed to this analysis.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Check out Tech Insider Network

Check out Tech Insider Network

We offer tech sector coverage that combines fundamentals and technicals. After recommending a stock, we provide entries and exits.

Our audited 3-year results of 47% prove we are a top-performing tech portfolio. This compares to popular tech ETFs at negative 46% and the Nasdaq at 19%.

We are the only retail team featured regularly in Tier 1 media, such as Fox, CNBC, TD Ameritrade and more.

Our services includes an automated hedge, portfolio of 10+ positions, broad market analysis, real-time trade alerts PLUS a weekly webinar every Thursday at 4:30 pm Eastern.