Summary:

- NVDA dominates the AI chip market, consistently outpacing competitors like AMD with superior products.

- NVDA’s focus on AI-optimised GPUs and its robust CUDA framework creates a significant competitive moat.

- Expanding opportunities in AI, cloud computing, biotech, and IoT highlight NVDA’s vast growth potential.

- NVDA’s technological edge and established ecosystem protect against new competitors.

BING-JHEN HONG

Investment Thesis

Although Nvidia’s (NASDAQ:NVDA) future looks bright, the stock’s meteoric rise has left some investors feeling dizzy. Back in August (when the stock was up 220% YoY), we predicted that NVDA’s streak would continue, but we also suggested that cautious investors might consider hedging their bets by shorting AMD (AMD). Why? Because at the time we saw unwarranted hype around AMD’s MI300X, its answer to NVDA’s H100 launched a year prior. Our pair trade has played out nicely, with NVDA outperforming AMD by approximately 50% in the past nine months.

We still believe that for long-term growth (and growth-at-reasonable-price) investors, maintaining a position in NVDA remains a compelling strategy. The company’s leadership position, fueled by its innovative culture and secular tailwinds of accelerating AI adoption across virtually every industry, provides a solid foundation for sustained growth. While short-term volatility may be expected due to the stock’s remarkable ascent, we believe NVDA’s long-term prospects rest on solid foundations.

How Far is the Competition?

The past few months have highlighted NVDA’s technological moat like never before. With the commercial launch of AMD’s MI300X in late December 2023, boasting features comparable to NVDA’s H100 (released a year earlier), a battle of ‘equals’ (at least from a technical perspective) for AI chip supremacy ensued until NVDA launched its H200, putting it back in the lead.

During this intense first quarter of 2024, AMD failed to gain significant traction. Its recent Q1 2024 results show a decline in total revenue sequentially and flat growth YoY. A few Wall Street analysts celebrated an 80% increase in Data Center segment revenue, but this high rate boils down to a modest $1 billion YoY increase, a drop in the bucket compared to what NVDA earns, not to mention possible cannibalism with other segments that saw lower sales.

This lacklustre performance contradicts the explosive growth we’ve come to expect from semiconductor companies like NVDA. NVDA is set to announce Q1 2025 results (three months ended April 2024) next week, with management forecasting 212% YoY growth and 11% growth sequentially.

Any opportunity AMD had to challenge NVDA’s dominance was extinguished with the launch of the next-gen Hopper chip last month. The H200’s innovative dual-die architecture, interconnected by an NV-HBI link, enables it to function as a single, powerful GPU, outperforming AMD’s MI300X in numerous aspects. Later this year, NVDA is set to further widen the gap with the B200, a chip that leaves the MI300X in the dust in terms of raw compute performance, memory bandwidth, and power efficiency.

More importantly, NVDA’s long-standing focus on optimizing its GPUs for AI workloads is giving it an edge in the AI race. Its long-standing focus on optimizing its GPUs for General Purpose Computing has allowed a robust ecosystem to grow around its microchip offerings. For example, its CUDA framework was launched a decade prior to AMD’s ROCm, and is increasingly contributing to overall profitability with NVDA’s software and cloud sales reaching a $1 billion run rate in Q4 2023.

The Market Opportunity

A recent blog from NVDA notes that a single H200 can support 300 users on a rudimentary chatbot like Llama, which runs on 70 billion parameters. For perspective, ChatGPT-3.5 has 175 billion parameters.

With H200 prices at roughly $40,000, Meta (META) will need 9.7 million H200 GPUs valued at $387 billion to build enough capacity to support its 2.9 billion users simultaneously using its basic chatbot, Llama. If you divide the capacity needs equally throughout the day, Meta will need 3.2 million H200 chips, valued at $128 billion.

These estimates are for a single tech customer. In its latest earnings call, NVDA stated that large tech contributed to 50% of its sales, highlighting diversification that strengthens our conviction in the bullish rating going into 2024 and beyond.

And this is just the tip of the iceberg. When you consider more advanced chatbots like ChatGPT 4 (with a staggering 1.76 trillion parameters), and the potential for companies like META to advance their chatbot offerings, on top of other markets like IoT, video rendering, and biotech, the true market potential becomes almost unimaginable.

What To Expect in Q1 2025 Results?

NVDA is poised to release its Q1 2025 results on Tuesday, May 21, 2024, presenting its performance for the three months ended April 2024. Management’s latest statements emphasized continued strong demand outpacing supply, with supply chain issues being its main hurdle.

Last week’s impressive 60% growth from Taiwan Semiconductor (TSM), a major supplier to NVDA, hints at potentially strong results for NVDA.

While some softening in the gaming segment (which contributed to roughly 11% of sales last year) is expected, the momentum in AI and HPC should allow NVDA to power through this drag.

NVDA’s enviable position, where demand exceeds supply, gives it significant pricing power and the ability to leverage its software offerings to drive revenue growth, for example, by incentivizing customers to adopt its software solutions to gain priority access to its GPUs. So, the company has some levers to maintain a healthy revenue trajectory, giving us confidence in next week’s results.

Valuation

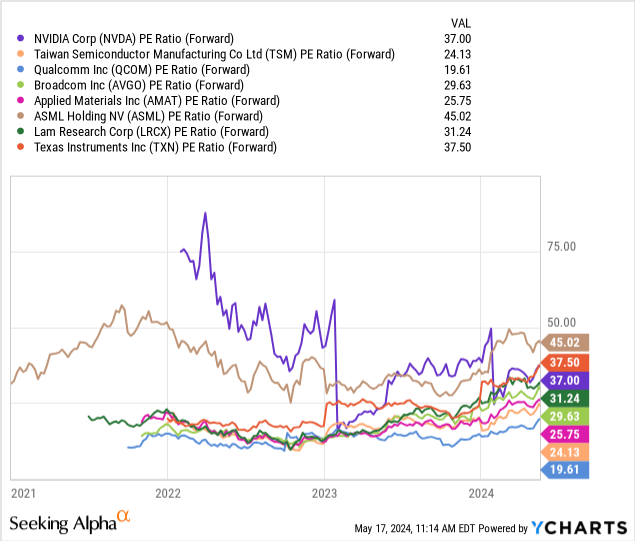

Despite its meteoric rally, NVDA’s valuation is getting better by the day, as it adjusts its revenue and earnings projections upwards. Forward PE now stands at about 37x per share, much less than AMD’s 46x. It has zero net debt ($26 billion in cash vs. $9 billion in debt) and for the past 24 years, has only been FCF-negative twice, reflecting its capital-light, fabless, semiconductor design operations, where manufacturing is outsourced to the likes of TSM (TSM) and increasingly Samsung (OTCPK:SSNLF).

NVDA is perhaps at the upper end of the industry range in terms of valuation, but still, this premium is well justified given its leadership position, accelerating growth, and massive market opportunity. Cloud providers are increasingly shifting from CPUs to GPUs for applications beyond AI, offering another growth engine for NVDA.

How I Might Be Wrong

The tech giants are making strategic moves in the lucrative microchip market. With a 70% gross margin, it is an attractive space for established players like Apple (AAPL), Microsoft (MSFT), Alphabet (GOOG), and Meta (META), who all possess significant tech expertise and have unveiled plans to enter the AI microchip arena.

While these companies are developing their own chips, they still heavily rely on NVDA’s tech. MSFT, for instance, recently introduced Azure Maia for AI tasks but simultaneously announced plans to buy NVDA’s H200 chips. Similarly Meta, despite making advancements in the semiconductor market, intends to train its Llama chatbot on H100 and transition to H200, which launched last month.

Google recently revealed its Sixth-generation Tensor Processing Units, called Trillium. Yet, a press release dated March 18, 2024, by NVDA, confirms GOOG’s adoption of NVDA’s B200 platform.

The bottom line is that investing in NVDA comes with the risk of new market entrants attracted by the sector’s lucrative margins. Yet, the company’s technological moat, supported by its decade-long software ecosystem, offers some protection at least in the medium run.

Summary

While NVDA’s valuation may seem a bit steep, it is arguably justified by the company’s dominant market position, robust growth trajectory, and the vast, untapped potential of the AI market. The competitive landscape, while evolving, still heavily favors NVDA, whose tech moat and well-established ecosystem offer significant protection against new entrants. Despite potential risks, such as increased competition, the overwhelming demand for NVDA’s products, coupled with its pricing power and innovative culture paint a compelling picture for future growth. For investors with a long-term horizon and a healthy risk tolerance, NVDA remains a compelling investment opportunity despite its meteoric rally.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.