Summary:

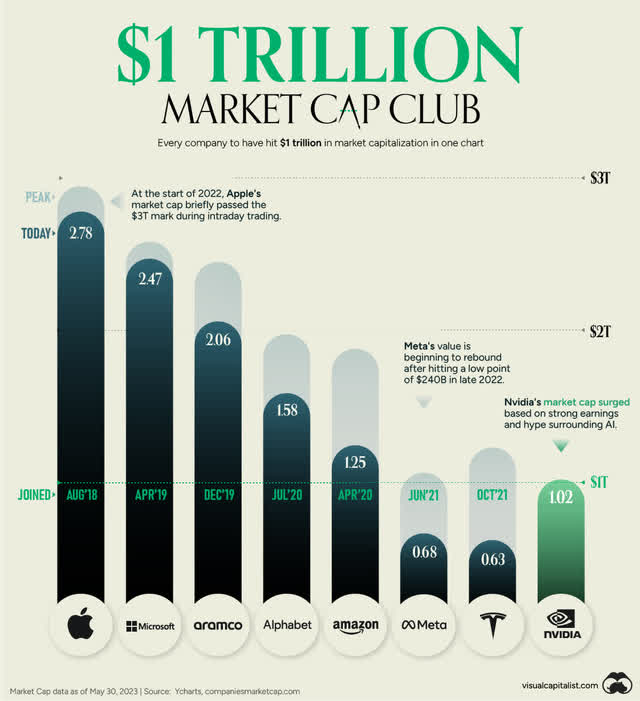

- Nvidia Corporation clearly outperformed in 2023 and joined the $1 trillion market cap club.

- And Nvidia issued an impressive guidance for Q2/24 and growth expectations for the years to come are really high.

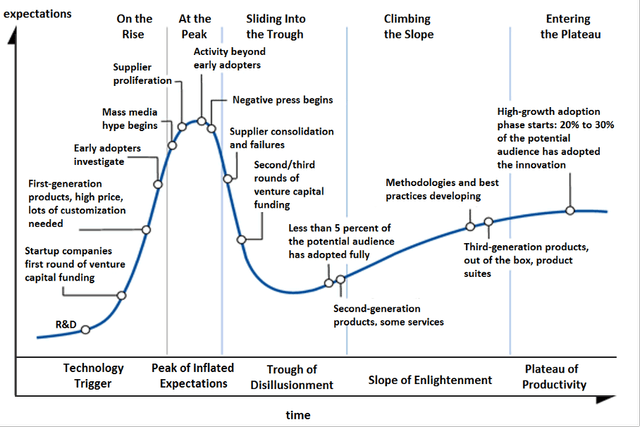

- But when being familiar with the hype cycle, we should be very cautious, as we might be at the peak of inflated expectations right now.

- Additionally, the extreme valuation multiples and Nvidia’s performance during past recessions should also be a warning sign.

Adrian Los

One of the most interesting stocks (and companies) right now is without much doubt Nvidia Corporation (NASDAQ:NVDA), as it seems to be a stock of superlatives right now. Nvidia is the stock with the best year-to-date performance in the Nasdaq-100 Index (NDX) as well as the S&P 500 (SP500). And since its temporary bottom in the fall of 2022, the stock has increased 290%. NVIDIA also jointed the $1 trillion market cap club, which consists of six companies right now.

And it certainly makes sense to take a closer look at Nvidia for several reasons. Not only does it seem like Nvidia stock is a great investment and everybody must buy shares of this great company, but when taking a second look, it also seems like the fear of missing out, for FOMO, is everywhere. We might be looking at the textbook bubble stock. Let’s start by looking at Nvidia’s last quarterly results.

Impressive Results?

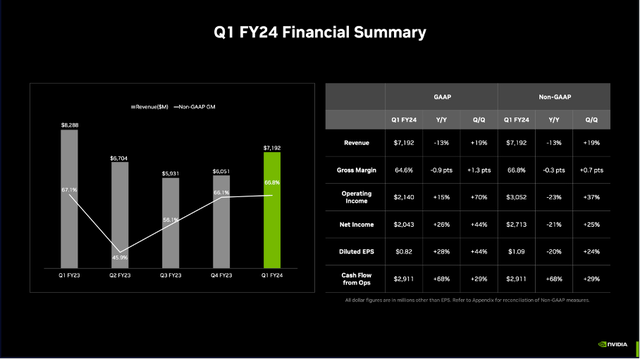

When looking at the results, we can look at the quarterly results from many different angles. First, Nvidia beat earnings per share estimates by $0.17 and it also beat revenue estimates by $670 million. Of course, one can argue that estimates were lowered in the months leading up to the earnings release, and when estimates were lowered beforehand it naturally is easier for a company to beat expectations.

Instead, when looking at the actual Q1 FY2024 results, revenue declined 13.2% year-over-year from $8,288 million in Q1/23 to $7,192 million in Q1/24. Income from operations increased from $1,868 million in the same quarter last year to $2,140 million this quarter – resulting in 14.6% year-over-year growth. The main reason for this increase was $1,353 million in acquisition termination costs in Q1/23, which had a huge negative effect on the results in the same quarter last year. And finally, diluted net income per share increased from $0.64 in Q1/23 to $0.82 in Q1/24 – resulting 28.1% YoY growth.

When trying to put results into perspective, we can also look at the company’s peers. If we compare Nvidia to Intel Corporation (INTC), for example, there is no other alternative than to call Nvidia’s results great.

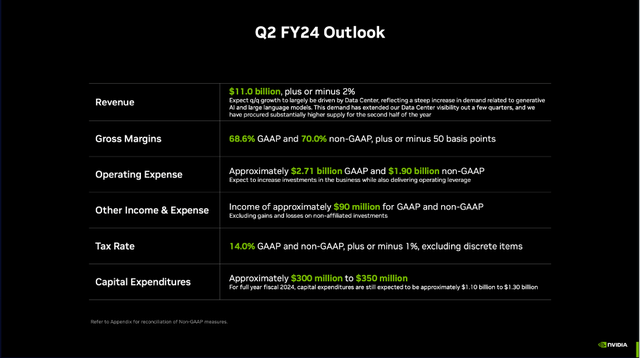

The main reason for the stock rally that followed the quarterly results was probably the company’s guidance for the second quarter. Nvidia is expecting revenue in the second quarter to be around $11.00 billion, which is much higher than in any previous quarter. The company is also expecting its gross margin around 68.6% (on GAAP basis) – much higher than in any previous quarter. During the earnings call, management commented:

We expect this sequential growth to largely be driven by data center, reflecting a steep increase in demand related to generative AI and large language models. This demand has extended our data center visibility out a few quarters and we have procured substantially higher supply for the second half of the year.

Artificial Intelligence

When talking about artificial intelligence (“AI”) – and especially about the growth potential – we must be very cautious right now. On the one hand, we must acknowledge that AI has a huge potential that could lead to growth for entire economies (and especially for some companies offering products and services in the field). On the other hand – and this is key – we should be extremely cautious not to get carried away by irrational growth expectations.

When being familiar with bubbles or the hype cycle, you probably know the “peak of inflated expectations” – a stage during the hype cycle when many market participants have unrealistic growth expectations about a technology or certain company.

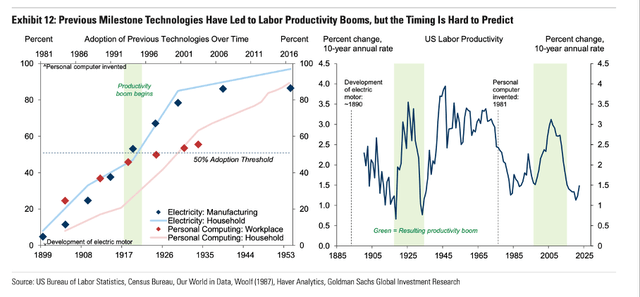

It is not like these technologies can’t have massive growth potential – but the expectations (especially for the near-term future) are often unrealistic at that point, and it often takes 5 or 10 years (or even longer) before an invention or technology is taking off and we see a productivity boom and really measurable growth for an entire sector (or even the economy of a country).

Goldman Sachs Economic Research

And Goldman Sachs identified some patterns: It took about 20 years after the invention before the productivity boom began (in the case of electric motors and personal computers), but timing remains difficult.

Goldman Sachs Economic Research

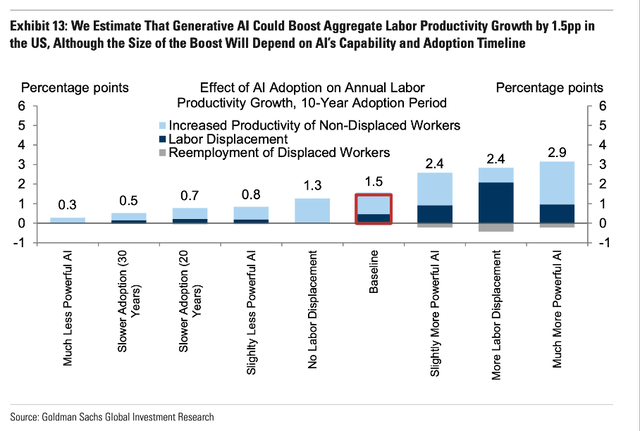

Nevertheless, in a baseline scenario, Goldman Sachs is estimating about 1.5% growth during the next ten years (in total, not annually!) by AI. And while this might not sound like a lot, the current GDP is $26,486 billion and 1.5% would be $397 billion in revenue by AI for companies only in the United States. By comparison, Nvidia generated $25.9 billion in revenue in the last twelve months (worldwide).

And when looking at rather bullish headlines (and not very surprisingly, everything about Nvidia is bullish), AI is seen as the greatest technology force of our time. And starting with the “first wave of AI,” which includes the ability to recognize images, understand speech, or recommend a video or an item to buy, we are moving to the “next wave of AI,” which is robotics and AI planning actions.

And while we should be cautious not to get carried away by any hype, it also happens quite often that we underestimate how massive new technologies can become. Also, we often can’t imagine the growth potential new technologies can have. And generative AI is unlocking new opportunities including text generation, translation, coding, or image generation or medical imaging.

This is the range we are caught in – not to get carried away by any hype at the peak of inflated expectations, but also being able to imagine what potential new technologies could have and not underestimate the potential.

Bubble Peak

Now let’s return to our headline, “What were you thinking?” and my current take on the situation. Some of you might still be familiar with the quote, although it was about 20 years ago that Scott McNealy – the CEO of Sun Microsystems back then – made the statement in an interview (quote taken from here):

At 10 times revenues, to give you a 10-year payback, I have to pay you 100% of revenues for 10 straight years in dividends. That assumes I can get that by my shareholders. That assumes I have zero cost of goods sold, which is very hard for a computer company. That assumes zero expenses, which is really hard with 39,000 employees. That assumes I pay no taxes, which is very hard. And that assumes you pay no taxes on your dividends, which is kind of illegal. And that assumes with zero R&D for the next 10 years, I can maintain the current revenue run rate. Now, having done that, would any of you like to buy my stock at $64? Do you realize how ridiculous those basic assumptions are? You don’t need any transparency. You don’t need any footnotes. What were you thinking?

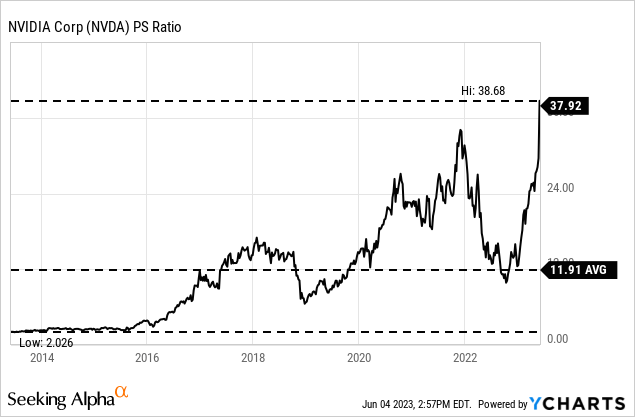

In my opinion, the probability is high for Nvidia CEO Jen-Hsun Huang making a similar statement in a few years from now. Microsystems was trading for 10 times revenue; Nvidia is trading for 38 times revenue right now.

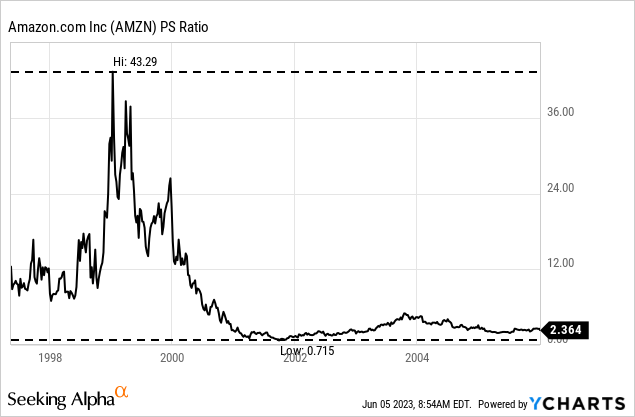

By the way, Amazon’s (AMZN) stock during the Dotcom bubble peaked at 43. And in the following years, the P/S ratio declined to 0.7.

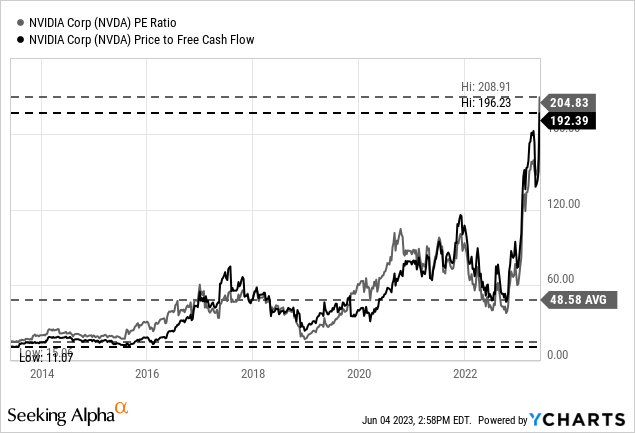

And before anyone else is pointing it out, I know the comparison between the unprofitable Amazon in 2000 and the highly profitable Nvidia in 2023 is misleading. Higher price-sales ratios might be justified for companies reporting high operating margins – and Nvidia is certainly a company being able to generate high margins. But when looking at the P/E ratio or P/FCF ratios, NVIDIA is reporting multiples above 200, and that’s absurd.

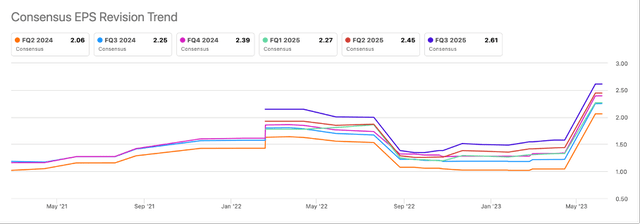

The question would be if such a valuation is justified – and in my opinion the answer is a clear “No!” Of course, I have the impressive guidance for the second quarter in mind, and while Nvidia management could have been a bit too optimistic (I don’t know), I tend to believe the guidance. But we should also not ignore that it is just the guidance for one quarter. Nevertheless, analysts get extremely bullish for the following consecutive quarters as well. The earnings revision data is showing the extreme jump and how bullish analysts became.

NVIDIA Quarterly Earnings Revision Trend (Seeking Alpha)

And countless studies and research is expecting phenomenal growth rates for artificial intelligence – from a CAGR of “only” 20% in the next few years to several studies expecting growth rates between 36% and 38% for the current decade (see here, here and here). We might see AI driving growth in many different fields and for many different companies in the years to come. That does not mean every business profiting from AI is also a good investment. And especially extreme valuation multiples are a strong warning sign.

Aside from the extremely high valuation multiples – that are already a risk in itself – we also must keep in mind that the probability for a recession in several advanced economies around the world is rather high. And a recession will most likely have a huge impact on NVIDIA’s business. It doesn’t matter if we are looking at gaming (which is responsible for a huge part of NVIDIA’s revenue), the creator economy or cryptocurrencies as well as crypto mining. These are all sectors with the potential for high growth in bullish times, but also bear the risk of an abrupt reversal of these trends. Gaming was improving again in the previous quarter, but I don’t know how sustainable that growth is right now.

Aside from these growth drivers, it is especially AI and the massive investments companies will make in the coming years, that are driving growth expectations for Nvidia. During the Q1 earnings call, Nvidia underlined that growth and demand is strong:

Third, enterprise demand for AI and accelerated computing is strong. We are seeing momentum in verticals such as automotive, financial services, healthcare, and telecom, where AI and accelerated computing are quickly becoming integral to customers’ innovation roadmaps and competitive positioning. For example, Bloomberg announced it has a 50 billion parameter model, BloombergGPT, to help with financial natural language processing tasks such as sentiment analysis, named entity recognition, news classification, and question-answering.

In case of a recession, however, I would argue (and expect) that many businesses will reduce these investments drastically. The smart decision would be to keep investing into the future even during economic downturns, but that is not how it usually works. When revenue is declining, margins are contracting and some companies not being able to generate a profit anymore, management will reduce spending and investments wherever possible. And projects that might not generate profits for the next few years (and AI investments could be a good example) are usually among the first to be scrapped.

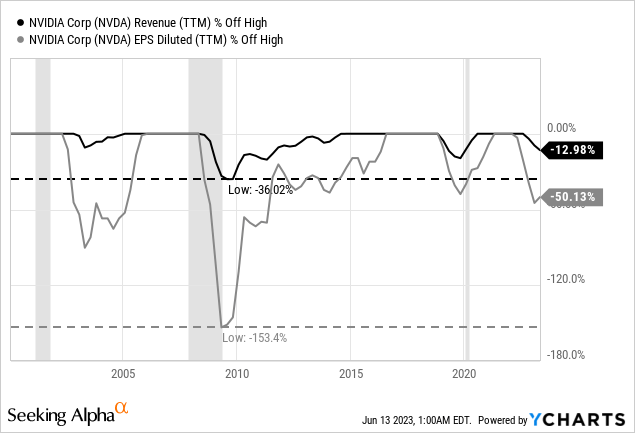

In my opinion, companies will reduce their investments in AI drastically during a recession and overall, I would argue that Nvidia is very vulnerable to a recession. Revenue as well as earnings per share have already declined from the previous peak, and while analysts are now extremely bullish for the top and bottom line reaching previous levels quickly (and surpassing them), I would be more cautious.

Looking at previous recessions should also make us cautious. Past data is clearly showing that Nvidia is not resilient to recessions and the data is even indicating that the decline for revenue as well as earnings per share could be much steeper. And we should also look at the years following the decline – in most cases it took several years before Nvidia could reach its pre-crisis EPS again. Especially following the Great Financial Crisis, it took about eight years before Nvidia could report similar earnings per share as before. Nvidia is a more mature business now, but I still would argue it is not recession-resilient and we should be prepared for a similar scenario.

Conclusion

It seems like “artificial intelligence” might be a similar hype as the Internet almost 25 years ago. The patterns are very similar. And I am expecting Nvidia (the stock) to follow a similar path as several companies during the Dotcom bubbles – the names to google would be Intel, Cisco Systems, Inc. (CSCO), or in the case of Germany, Deutsche Telekom AG (OTCQX:DTEGY). Artificial intelligence will most likely have a sustained and huge impact on our lives and impact almost everyone and every company. And it has the potential to boost the economy – but similar to the Dotcom bubble and the Internet, it might take several years (or maybe a decade) before this effect will become visible.

Not only is it difficult to time the impact of innovations, the inflated expectations that are typical for this stage of the hype cycle we are obviously in right now pose a huge risk for investing in these stocks, as the triple-digit valuation multiples are not justified – and there have been only very few times in history when investing in stocks with a multiple of 200 or higher worked out. We will see if Nvidia Corporation might be the exception.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of INTC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.