Summary:

- Nvidia Corporation has reached our forecasted 2024 price target of $700.

- We believe the 40% rally YTD has backed in many of the positives to the near-term operating and financial momentum.

- We believe caution is warranted ahead of Nvidia Corporation’s upcoming Q4 earnings report.

SOPA Images/LightRocket via Getty Images

Nvidia Corporation (NASDAQ:NVDA) is up more than 40% to start the year, extending the breathtaking 2023 rally, with the company adding more than $1 Trillion in market cap over the last twelve months. Without being dramatic, the emergence of artificial intelligence (AI) as a secular theme in technology has been historic, and NVDA is simply the jackpot winner at the center of that growth universe.

While we won’t claim to have been early, we did cover NVDA twice last year. We highlighted first how shares appeared undervalued, and later suggested any late summer dip was a buying opportunity. We bring this up because that last article set a price target for the year ahead at $700, which was about 50% higher at the time.

Fast forward and here we are with NVDA sitting at just around that level, which is only surprising to us in terms of the pace of the move, arriving much sooner in 2024 than we expected. The update today considers that while we believe the company is fundamentally sound, a buy rating at the current level is no longer justified.

Looking ahead to the upcoming Q4 earnings report (expected February 21st), we sense that expectations are extremely high, which introduces an unnecessary layer of risk. Our base case is that we see an extended period of consolidation from recent gains, with room for a resurgence of volatility. For traders that have pushed their luck, now may be a good opportunity to trim exposure and take profits.

NVDA Q4 Earnings Report Preview

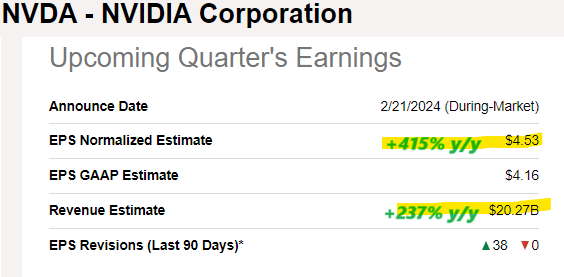

Nvidia is expected to report its fiscal 2024 Q4 earnings on February 22nd, after the market closes. According to consensus, the EPS estimate of $4.53, if confirmed, will represent an increase of 415% from the period last year. The revenue forecast of $20.3 billion is 237% higher from Q4 fiscal 2023.

The context considers the timing of the H100 AI GPU rollout at the start of last year, which gained force into the subsequent Q1. This leaves a low base effect this quarter for comparison purposes. The implied sequential growth is still impressive considering $18.1 billion in sales during the most recent Q3, where NVDA reached $4.02 in EPS.

Seeking Alpha

What the market wants to see is continued strong growth and preferably a big beat to the top line as an indicator of the ongoing demand for the AI opportunity.

Keep in mind that beyond the actual AI hardware consolidated within the data center segment, a big part of the story has been the CUDA software platform developers use to build commercial AI applications. This incremental growth driver has also added to margins.

For the other smaller segments including gaming, visualization, and automotive applications, the expectation is for steady growth benefiting from the regular product lineup update and replacement schedule.

So, when we think about that sales forecast, keep in mind that management guided for a $20 billion target back in Q3. It’s fair to assume Nvidia will come in around that figure, with the only constraint being physical manufacturing capacity and the logistics involved in delivering that supply.

Some questions remain regarding sales to China and the time of implemented trade embargoes last year based on national security. We can assume that demand is strong enough to simply divert orders to other international customers.

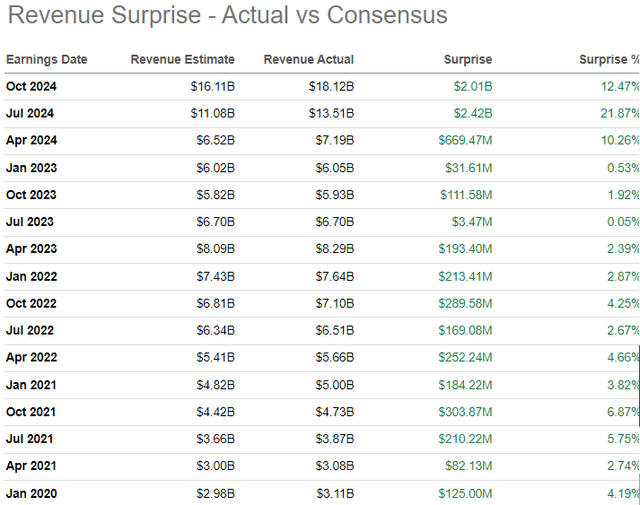

Nevertheless, it’s hard to bet that sales will somehow miss significantly. The table below highlights how Nvidia is currently on a 4-year streak of delivering a revenue surprise to the consensus, even going back to the pandemic era volatility.

The pattern for Nvidia beating EPS estimates over the last several years is similar, outside of two small misses in 2022 during a period when shares traded as low as $108.

For this upcoming report, the focus on the financial side will be on the gross margin which reached 75% in Q3, up from 71.2% in Q2 and even 56.1% last year. Again, this shift captures not only the pricing power of Nvidia, where each AI GPU sells for over $30,000, but also the broader ecosystem of tools within the developer stack.

The point here is to say that given the recent trends and tailwind of momentum, there’s little reason to expect this quarter will be different, and another headline beat here is very possible.

What’s Next For NVDA?

Recognizing the very strong backdrop and operating tailwinds, the reality here is that none of this is a secret. Shares of NVDA have marched higher over the last several months based exactly on this growing consensus that the AI momentum is real and will likely continue for the foreseeable future.

At the same time, it’s a mistake for investors to head into this Q4 report with the assumption Nvidia is going to blow out the numbers and shares explode higher with an “Nvidia Moment 2.0.” We’ll take the under on that scenario.

As we see it, the market has already baked in this runway of near-term growth, which makes it that much more difficult to significantly exceed expectations. As it stands, what we believe will play out in this Q4 report is a sell-the-news type of dynamic where the market takes the opportunity to reset, starting to think about the future of the AI opportunity for Nvidia into 2025 and 2026.

We know that as we enter the next several quarters, the comparison period from early last year will mean that those exceptional triple-digit growth rates begin to normalize. That’s fine. What is less clear is how the pipeline of AI GPU sales evolves, getting past this post-launch wave from high-profile customers.

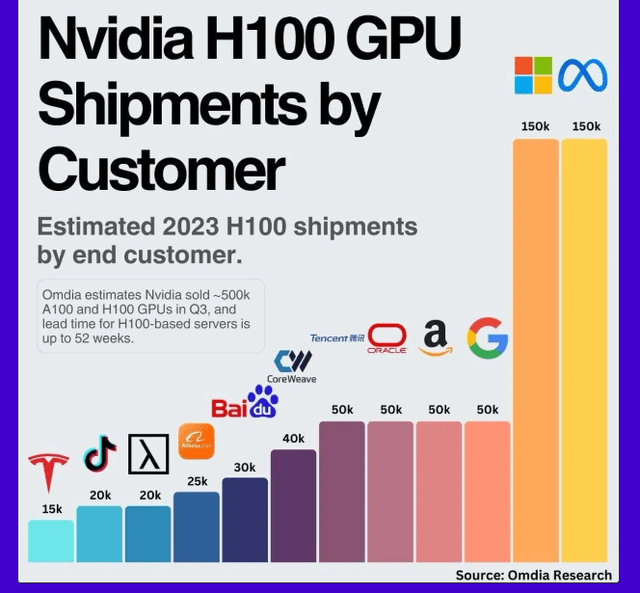

Industry data from “Omdia Research“, suggests major companies like Microsoft Corporation (MSFT), Alphabet Inc (GOOG) (GOOGL), and even Tesla Inc (TSLA) were big buyers in 2023. Reports suggest Meta Platforms Inc (META) alone is planning to spend upwards of $9 billion on Nvidia chips this year.

The question becomes whether Nvidia has already captured the low-hanging fruit and what the demand will look like over the next several years as opportunity matures.

A couple of themes that have caught our attention include an effort on the AI software side attempting to do more with less. Companies recognizing that the chips are expensive are turning to new methods to optimize language learning models toward more computational efficiency. This means that what may have taken 10k H100 GPUs in 2023 will be accomplished by a significantly smaller infrastructure in the future.

We can also bring up reports that companies are choosing to move forward with their technology, such as Microsoft with its “MAIA” chipset or Alphabet with its “Gemini” platform as an in-house alternative to Nvidia. Not to mention a pipeline of competition in this segment from names like Advanced Micro Devices (AMD) eyeing similar market opportunities in high-performance applications computing.

What we can say here is that the risks are higher for Nvidia today at a $700 share price level compared to $500 just two or three months ago. As strong as the upcoming Q4 numbers will likely be, there’s a good amount of uncertainty thinking about the earnings trajectory for Nvidia beyond the next couple of quarters, with the potential for disappointment.

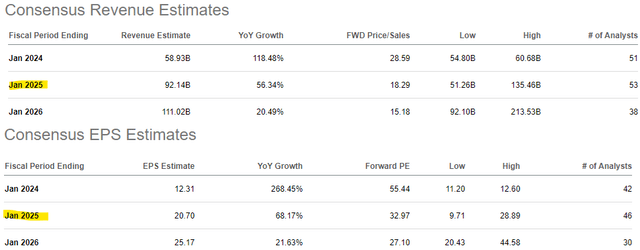

In terms of valuation, a forward P/E multiple of around 30x between the fiscal 2025 and fiscal 2026 EPS estimates is a fair value for Nvidia in its present state.

Final Thoughts

We rate Nvidia Corporation as a hold, leaning bearish in the short term, with an expectation that the next big move in the stock is lower. The stock appears technically overbought, with a correction down to $550 as a key area of support not off the table. We believe that would offer an improved entry point for new long positions on a risk-adjusted basis. Otherwise, our expectation is for the upside to be limited from here through the rest of the year.

Nvidia has cemented its leadership in the hottest theme in tech, but nothing goes in a straight line higher indefinitely. We believe caution is warranted. Forward guidance from management, including trends in operating expenses and margins, will be key monitoring points in the Q4 report.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Add some conviction to your trading! Take a look at our exclusive stock picks. Join a winning team that gets it right. Click for a two-week free trial.