Summary:

- It has been my stance for years that AI will bring us a new set of FAANGs, one of which will be Nvidia Corporation.

- By improving the bandwidth issue, Nvidia’s goal is to create more demand for their DGX Pod and SuperPod Systems, which in turn, will create more demand for their software.

- It is our belief that Nvidia stock is setting up for a sizable pullback, which we believe will open the door for better long-term entries.

- Looking for more solid entries into tech stocks? Join my Investor Community, including an automated hedging signal and trade alerts.

Cylonphoto

My coverage on Nvidia Corporation (NASDAQ:NVDA) as an AI (artificial intelligence) leader began in 2018 (yes, really – five years ago). Since then, I’ve covered the AI microtrend for this specific stock 27 times on my research site, which is the equivalent of a novel.

I’ve also gone on record to say that Nvidia stock will surpass the valuation of Apple Inc. (AAPL). That particular analysis compared the impact that AI will have to mobile, with AI adding $15 trillion to GDP compared to mobile’s $4.4 trillion. Mobile brought us three FAANGs: Apple, Google (GOOG, GOOGL), and Facebook (META). It has been my stance for years that AI will bring us a new set of FAANGs, one of which will be Nvidia.

However, now is not the best time to buy the stock. Rather than flatly tell you that while offering no way forward, I want to continue providing value to my readers by discussing when my firm plans to buy the stock again.

But also, we should discuss why the market is rallying on this company specifically. Good investors must do both – understand what makes a company stand out while being patient on price.

AI is Not a Buzzword for Nvidia

Short sellers mistakenly believe that AI is a buzzword for Nvidia. This is true for many stocks, but not for the leader in parallel processing.

Here is what I wrote five years ago on the topic:

Nvidia is already the universal platform for development, but this won’t become obvious until innovation in artificial intelligence matures. Developers are programming the future of artificial intelligence applications on Nvidia because GPUs are easier and more flexible than customized TPU chips from Google or FPGA chips used by Microsoft [from Xilinx]. Meanwhile, Intel’s CPU chips will struggle to compete as artificial intelligence applications and machine learning inferencing move to the cloud. Intel is trying to catch-up but Nvidia continues to release more powerful GPUs – and cloud providers such as Amazon, Microsoft and Google cannot risk losing the competitive advantage that comes with Nvidia’s technology.

The Turing T4 GPU from Nvidia should start to show up in earnings soon, and the real-time ray-tracing RTX chips will keep gaming revenue strong when there is more adoption in 6-12 months. Nvidia is a company that has reported big earnings beats, with average upside potential of 33.35 percent to estimates in the last four quarters. Data center revenue stands at 24% and is rapidly growing. When artificial intelligence matures, you can expect data center revenue to be Nvidia’s top revenue segment. Despite the corrections we’ve seen in the technology sector, and with Nvidia stock specifically, investors who remain patient will have a sizeable return in the future.”

– Free Newsletter and Seeking Alpha, November 2018 with AI Thesis repeated again in April of 2019.

When I wrote that, Nvidia was considered a gaming stock with high-risk exposure to crypto. What is astonishing is that the company was still considered a gaming stock with high-risk exposure to crypto a mere seven months ago.

You may recall, the stock was down 60% last year after a $2.5 billion miss on gaming, and the market was pricing in a long recovery due to Ethereum’s merge to Proof of Stake (PoS). The bears believed the Merge would flood the market with mining GPUs and Nvidia would be unable to overcome this setback.

At the time, there was no mention of Nvidia’s AI lead despite the H100 GPU being released the very next month! Instead, the market had investors believing that Ethereum, with only 200 million users, which is a smaller user base than Snap or Pinterest, could tank the GPU-juggernaut on the eve of the company’s largest release to-date: the H100 GPU. Watch my Fox interview on Nvidia here.

The reason I’m emphasizing this is because my firm has worked hard to be a quality resource on tech stocks. Often times there is a major disconnect between the market’s pricing and a tech company’s positioning. There is no greater evidence of this than when Nvidia was down 60% seven months ago yet is the top performing stock in the S&P 500 today.

Why the Market is Bulled-Up on Nvidia

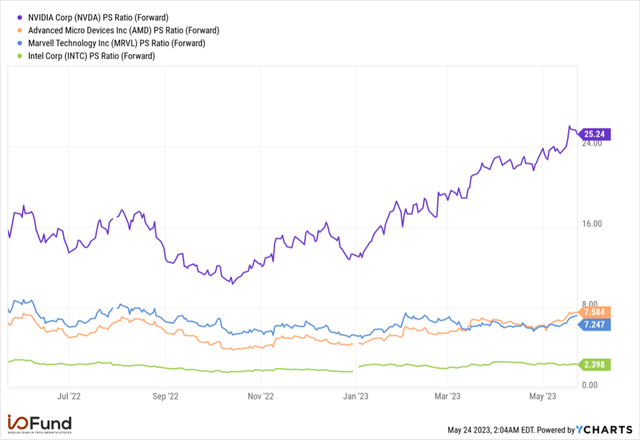

I want to take the opportunity to explain why Nvidia has the ability to arrive at a valuation that is 3X higher than its peers and in some cases 12X higher.

I’m not defending this valuation, rather I want to explain how it’s possible that smart money continues to buy up here.

The H100 is a Turning Point from Hardware to Software

The Hopper architecture is ramping and it’s yet again going to disrupt the GPU and AI accelerator market. I’ve written quite a bit about Nvidia […] however, I will keep it simple by saying the A100 GPU is what led the company’s gains since Q2 2020 and the Hopper H100 GPU is what will lead the company’s gains for the next two years.”

– Premium Site August 2022, following Nvidia’s $2.5 billion revenue miss.

Note: the information below is a bit technical, so I’ve bolded the key points for a quick read.

For context, the A100 GPU was a monumental release for Nvidia as the Ampere architecture unified training and inference onto a single chip, whereas in the past Nvidia’s GPUs were mainly used for training.

The result is a 20x performance boost from a multi-instance GPU that allows many GPUs to look like one GPU. The A100 offered the largest leap in performance to date over the past 8 generations. One year later, the Ampere architecture had become the best-selling GPU architecture in the company’s history.

The A100 was special but it’s the H100 that is Nvidia’s iPhone moment. The reason is quite simple – it’s the release that will help Nvidia breakout from hardware and put the company firmly on the map for AI software.

Hardware has allowed Nvidia to become a $700B market cap company, but it is the recurring revenue from AI software that will propel Nvidia into a market cap worth trillions.

You know this story well: the relationship between a hardware company leveraging their position to capture the lion’s share of software — because that’s exactly what Apple did. My contention is that the iPhone was successful because of the moat iOS developers created, and the additional flywheel from the App Store. I discussed this more in a webinar “The New Kings of Tech.”

The H100 delivers 9X more throughput in AI training, and 16X to 30X more inference performance. The company also states in HPC application-specific workloads, the H100 is 7X faster. The goal of the H100 was not only to add more transistors and make the H100 faster, but to also offer function-specific optimizations. This is achieved through the transformer engine.

The transformer engine is one of the key aspects of the H100. Transformers are becoming one of the most popular neural-network models by applying self-attention to detect how data elements in a series influence and depend on one another.

Prior to transformer models, labeled datasets had to be used to train neural networks. Transformer models eliminate this need by finding patterns between elements mathematically, which substantially opens up what datasets can be used and how quickly. Transformers are partial to the parallel processing that GPUs offer.

The Hopper architecture aims to answer one of the bigger challenges facing superfast compute, which is that moving data into traditional servers overloads the CPU and system memory and becomes bottlenecked by PCI-Express.

By improving the bandwidth issue, Nvidia’s goal is to create more demand for their DGX Pod and SuperPod Systems, which in turn, will create more demand for their software.

The DGX SuperPods scale into a super-GPU capable of 768 terabytes per second. To compare, the entire internet requires 100 terabytes per second. This results in 1 exaflop of FP8 AI performance that runs trillions of parameters. FP8 is most commonly used for inference yet may be used for training in the future due to boosting throughput.

Whereas traditional workloads required many connections exchanging small amounts of data, the workloads of the future will require data to be shared quickly between GPUs and storage. This is accomplished by bypassing the CPU and sending data directly to the GPU while using the network hardware to move the data.

This is ideal for enterprise use cases where people are more likely to use Ethernet while AI and HPC workloads continue to use the Quantum-2 based off Mellanox’s InfiniBand.

Not only will Nvidia begin to monetize through software on the DGX systems but accessibility will improve through CSPs, or cloud service providers. This is an attempt to democratize AI development while driving software sales. On a trailing 4-quarter basis, cloud service providers drove 40% of data center revenue. This is important as cloud service providers will help move DGX Cloud along and AI-as-a-service.

Nvidia’s TAM of $600 Billion is Easily and Quickly Achievable

The conclusion to my analysis is the same as the introduction, which is that I believe Nvidia is capable of out-performing all five FAAMG stocks and will surpass even Apple’s valuation in the next five years.”

– Forbes and Free Newsletter, August 2021.

Last year, Nvidia CEO Jensen Huang provided a total addressable market of $300 billion in hardware and $300 billion in software. Meanwhile, Elon Musk is deploying 10,000 GPUs in the cloud and there will likely be tens of thousands more to inference a widely deployed model for a social media generative AI project.

Per the analyst on the Q1 conference call:

So it seems like the incremental TAM is easily in the several hundred thousands of GPUs and easily in the tens of billions of dollars. But I’m kind of wondering what this does to the TAM numbers you gave last year. I think you said $300 billion hardware TAM and $300 billion software TAM. So how do you kind of think about what the new TAM would be?”

Huang aptly answered (emphasis added):

I think those numbers are really a good anchor still. The difference is because of the, if you will, incredible capabilities and versatility of generative AI and all of the converging breakthroughs that happened towards the middle and the end of last year, we’re probably going to arrive at that TAM sooner than later.”

Today, Nvidia trades at 1.5X this total addressable market, or TAM, at $773 billion compared to an achievable TAM of $600 billion. This would suggest the stock price does not yet fully reflect the future market opportunity. Also, compare this TAM of $600 billion to Apple’s revenue of $394 billion, which helps illustrate why I said in the past that Nvidia Will Surpass Apple’s Valuation.

What to Expect in the Upcoming Earnings:

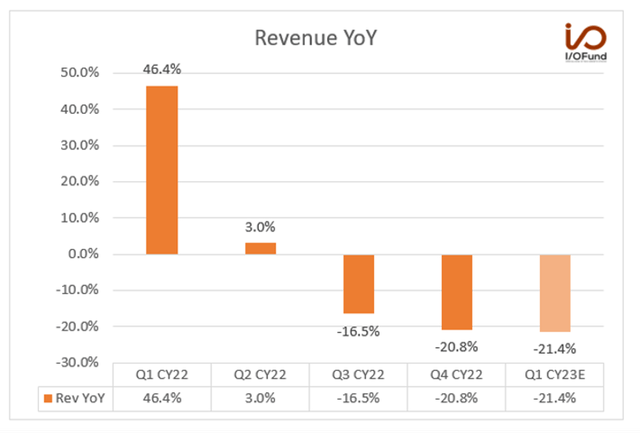

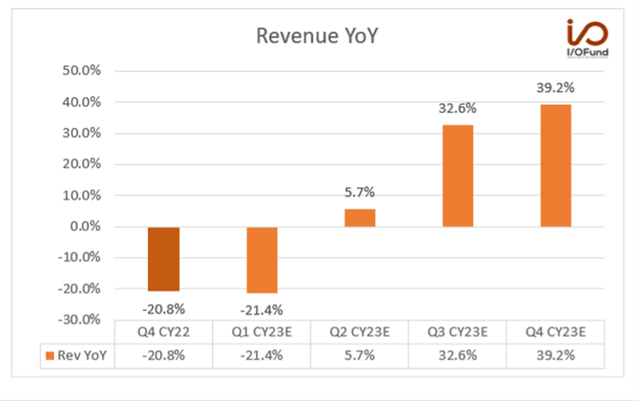

If we set aside the AI thesis for a moment, you can see below why Nvidia has rallied as the revenue is expected to rebound from (-21.4%) for the upcoming quarter to as much as +32% growth by fiscal Q3 ending in September. The popularity of the H100 could lead to a beat somewhere across these next few quarters. In addition, the RTX40 Series lower-end model will be released today for $299 and up, and this may further help the gaming revenue for Q2 and beyond.

Nvidia is unique in that the healthy growth is expected to continue into the foreseeable future – long after the company laps the quarters of the crazy gaming miss. What we don’t want is to invest in companies propped up temporarily by low comps. This is not the case with Nvidia.

Here is Nvidia’s revenue growth over the past five quarters, which shows the effects of the gaming segment:

As stated in our previous earnings coverage on Nvidia, all segments are expected to grow sequentially. I believe this is a major contributor for the rally we are seeing. The market saw what we saw, which was a sharp rebound in the fundamentals and that is critical to understanding why Nvidia is the top stock in the market right now.

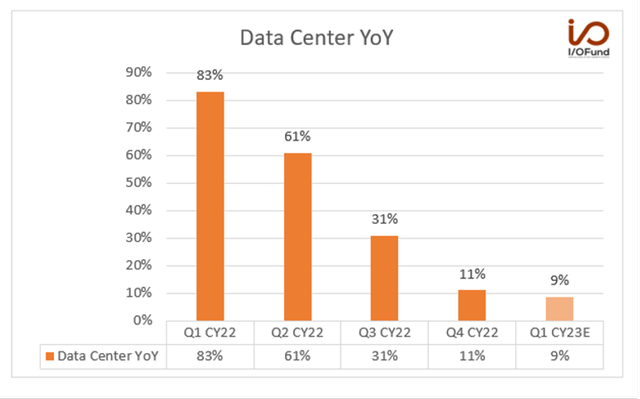

Compare that picture to this one:

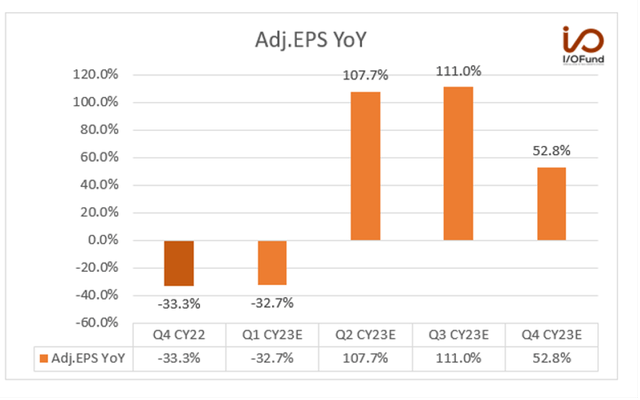

It’s not only the top line that is rebounding but also the bottom line too (which makes sense but is important to point out):

Moving along, data center revenue was $3.75B in Q1 FY23. The projected mid-point above is $4.075B, representing 8.7% YoY growth and 12.7% growth sequentially. Here is what was said on the call:

Thanks for the question. First, talking about our data center guidance that we provided for Q1. We do expect a sequential growth in terms of our data center, strong sequential growth. And we are also expecting a growth year-over-year for our data center. We actually expect a great year with our year-over-year growth in data center probably accelerating past Q1.”

So, what we don’t see in the graph above is what the “accelerating past Q1” will be and this is the one data point that can get the stock to move AH.

Where Nvidia’s Price Will Go Next:

With the cash we raised throughout 2022, NVDA was the primary target of deploying some of this cash once our analysis signaled a bottom was in place. The below is a real-time trade notification we sent to our members on the October 13th.

Since February of 2022, we have been systematically taking gains at key levels. Even with logging sizable wins in this position in 2023, it remains our top position while still having enough cash to buy at lower levels.

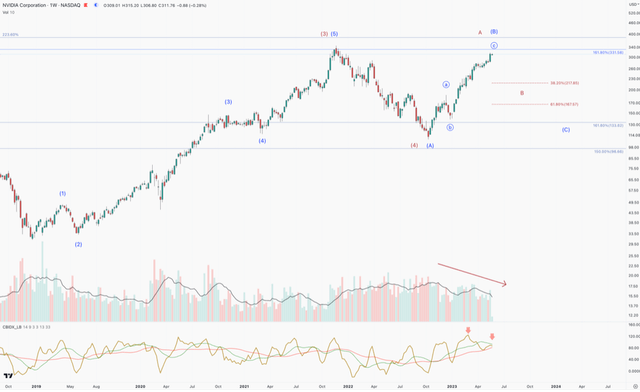

It is our belief that NVDA is setting up for a sizable pullback, which we believe will open the door for better long-term entries. The reasons for this are below:

The structure/pattern of NVDA’s bounce signals caution. If we look at the pattern off the October low, it may feel like a straight line up; however, you can clearly see 3 swings (marked a, b, c). The first swing up off the low (a), a bearish retrace that makes a higher low (b), and the current swing that we are still in (c).

When we see a 3 wave pattern off of a major low, more times than not, it is a corrective bounce in a larger downtrend. While it may feel impossible at such heights, please keep in mind how sentiment can and does work against us as investors. It felt like tech could never go down in late 2020, and then it felt like it would never go up in Q4 of 2022.

Nvidia is no different, and what we have is a pattern that suggests a larger pullback than most expect is likely, at minimum. So, until this 3 wave pattern can morph into a 5 wave pattern, the odds favor a sizable pullback soon.

Further evidence of this can be seen in how NVDA is now at a significant supply region that marked the top in late 2023. We are now in the region that would constitute a double top playing, and note how price keeps trending higher with less momentum.

We are approaching a double top in conjunction with one of my favorite “sell signals” – when you have price making 3 higher highs, while the momentum indicator being used is making 3 lower highs. This is clearly happening on multiple time frames, which we believe warrants caution.

Similar patterns can be seen on the weekly chart of NVDA below. As price pushes higher, it is doing so on less momentum and less volume. When we see the same pattern on multiple time frames, it further builds the case for caution.

Regarding the targets we are tracking for entries, there are two general paths I see playing out from the price data in the above charts.

The Blue Count suggests that we completed the large degree uptrend that started in 2018. This would put it in a very large corrective rally with the final leg lower coming later this year/early next year. This would have us retest the October lows, and possibly slightly lower. The big tell for this count playing out will be if the coming pullback is a 5 wave pattern pointing down. If we see a large 5 wave drop from the highs, it is signaling that NVDA will likely go lower than most are anticipating.

The Red Count suggests that the October low was THE low. This will still set us up for a sizable pullback into the $220 – $167 region before setting up to make a run to new highs. This count implies that the large uptrend that started in 2018 is not complete and will be targeting fresh highs in the coming year. The tell for this scenario will be if the coming pullback is a 3 wave pattern. If we see a 3 wave pullback, we will look to be heavy buyers in the general target box just outlined.

Conclusion:

My firm tracks Nvidia very closely due to its leading allocation in our portfolio. We saw evidence of a gaming bottom in November, which we published about here. We also felt Nvidia had masterfully timed its RTX40 Series with the Ada Lovelace architecture plus the H100 release to drop exactly when the crypto mining selloff would be most felt. We discussed this here in September. These points were entirely overlooked by Nvidia critics.

Yes, a $2.5 billion revenue miss is crazy – but what was lying beneath the surface for chances of a quick recovery? The devil is in the details and not a lot of investors or analysts care to look into Nvidia’s complex hardware products.

For my readers, it has worked out in their favor that talking heads prefer to discuss stocks after they are up triple digits in price, and that the masses are collected around hindsight narratives. My firm is carefully and patiently building an AI portfolio that we believe will outperform institutions and hedge funds. Taking our sweet time to enter Nvidia at the lows – as we have done for the past five years and will continue to do so for the next five years – is part of that strategy.

Looking for more solid entries into tech stocks? Join my Investor Community incl an automated hedging signal and trade alerts here.

Recommended Reading:

- Nvidia Stock Is Ready To Rumble With RTX 40 Series And H100 GPUs

- Nvidia Stock: Evidence Gaming Bottomed And Why It’s Important

- Here’s Why Nvidia Will Surpass Apple’s Valuation In 5 Years.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Check out Tech Insider Network

Check out Tech Insider Network

We offer tech sector coverage that combines fundamentals and technicals. After recommending a stock, we provide entries and exits.

Our audited 3-year results of 47% prove we are a top-performing tech portfolio. This compares to popular tech ETFs at negative 46% and the Nasdaq at 19%.

We are the only retail team featured regularly in Tier 1 media, such as Fox, CNBC, TD Ameritrade and more.

Our services includes an automated hedge, portfolio of 10+ positions, broad market analysis, real-time trade alerts PLUS a weekly webinar every Thursday at 4:30 pm Eastern.