Summary:

- Throughout October, there was a plethora of positive news and reports, which indicated that Nvidia Corporation stock still has plenty of upside.

- Currently, Nvidia has all the chances to once again exceed expectations and improve guidance when its Q3 earnings report comes out in November.

- NVDA stock remains a BUY for me, and its upside could be even greater than previously expected.

BING-JHEN HONG

Nvidia Corporation (NASDAQ:NVDA) is on a path to exceed its earnings expectations next month when its Q3 report comes out. While an earnings beat is not fully guaranteed, the latest earnings results of the company’s peers, suppliers, clients, and businesses that have a connection to the generative AI industry point to Nvidia having a stellar performance in Q3. The demand for its AI GPUs remains high, the company has been receiving upward revisions recently, and its stock is trading around its all-time high levels with a potential to appreciate even further in the upcoming months.

While challenges are gradually mounting, it’s still safe to assume that all the growth opportunities currently exceed the existing risks. That’s why I believe that Nvidia remains a BUY and the upside could be even greater than previously expected.

The Upside Is Still There

Right after Nvidia reported its Q2 earnings results in August and its shares slightly depreciated, I wrote a bullish article on the company in which I noted that the market is underestimating the business’s growth opportunities. After positive news started to come in days and weeks after the Q2 numbers were revealed, Nvidia’s shares rebounded and are currently up 15% since my latest article on the company was published.

While the company is expected to release its Q3 results in late November, we could already assume that the numbers that will be revealed are unlikely to disappoint investors. There’s also a possibility that the company once again raises its guidance. If that happens, we’ll likely see a further appreciation of Nvidia’s shares in the following months to records.

I’m optimistic about the upcoming earnings report for several reasons. First, throughout October, there was a plethora of positive news and reports, which indicated that Nvidia still has plenty of upside. At the beginning of the month, Nvidia’s CEO Jensen Huang stated that demand for Blackwell is insane. Shortly after, Microsoft (MSFT) and Google (GOOG, GOOGL) both announced that they started to use Nvidia’s latest server GPUs from the Blackwell series in their data centers. With Nvidia dominating the AI GPU market, it’s safe to assume that a significant portion of $160 billion, which is expected to be spent on AI infrastructure by hyperscalers in 2024, will go directly to the company. This should improve its performance this year.

Moreover, Nvidia has also received several price target upgrades, which signal that the company’s growth story is far from over. Major investment banks like Citi (C), Morgan Stanley (MS), Wells Fargo (WFC), and Bank of America (BAC) increased Nvidia’s price target to $150, $150, $165, and $190 per share, respectively.

Finally, a number of Nvidia’s suppliers, competitors, and clients have already released their Q3 results. Those results point to the fact that the generative AI revolution is far from over, and the spending on AI chips is unlikely to decrease anytime soon.

Earlier this month, TSMC (TSM), which produces Nvidia’s chips, announced that its revenues in Q3 increased by an impressive 36% Y/Y to $25.5 billion, above expectations. At the same time, TSMC’s CEO C.C. Wei also stated the following (emphasis added):

The demand is real. And I believe it’s just the beginning of this demand. All right. So one of my key customers said, the demand right now is insane. That’s it’s just the beginning, it’s a form of scientific to be engineering. Okay. And it will continue for many years.

Nvidia’s other supplier SK hynix (OTCPK:HXSCF) also reported a record profit for Q3 thanks to the increased demand for its high bandwidth memory chips that are used in AI servers.

In addition to that, Nvidia’s competitor Advanced Micro Devices (AMD) also reported impressive earnings results earlier this week. In Q3, the company’s data center revenues increased by 122% Y/Y to $3.5 billion, primarily thanks to the rising demand for its AI chips during the quarter.

When it comes to Nvidia’s clients, it appears that they’ll continue to buy the company’s GPUs in the foreseeable future. Earlier this year, it was reported that Tesla (TSLA) alone will likely spend $3 billion to $4 billion on Nvidia’s chips this year. Then, during the latest earnings call from a week ago, Tesla’s management said that its cost savings efforts were partially offset by the higher spend on AI. The company plans to deploy 50,000 GPUs in Texas by the end of October. This might indicate that a decent portion of Tesla’s expenditures were spent on Nvidia’s chips in Q3. The same could be true with Google, which noted in the latest conference call that its $13 billion CapEx in Q3 was used primarily on investing in servers and data center equipment and that it has a wonderful partnership with Nvidia.

All of those developments indicate that Nvidia will likely be able to once again exceed expectations and potentially increase the guidance at the same time. Considering this, I’ve also decided to update my valuation model to better reflect the latest developments described above.

In August, my valuation model showed that Nvidia’s fair value is $123.93 per share. Back then, I said that the assumptions in that model were fairly conservative, and the upside could be even more significant.

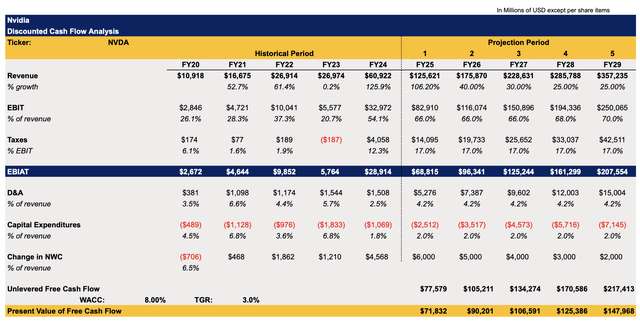

The updated model below assumes a greater revenue growth rate, which closely aligns with the overall consensus for the next two years. The EBIT assumptions have also increased due to Nvidia’s ability to potentially increase margins thanks to its leadership position in the AI GPU market and a lack of major competitors that can pose a threat to its dominance. The EBIT assumptions for the next two years also closely correlate with the consensus. As for the other years, it’s more than possible for Nvidia to continue to generate impressive revenues and earnings at the same time. Everything points to the fact that the demand for its chips is unlikely to significantly slow down anytime soon. The assumptions for all the other metrics in the model remained the same as before.

Nvidia’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

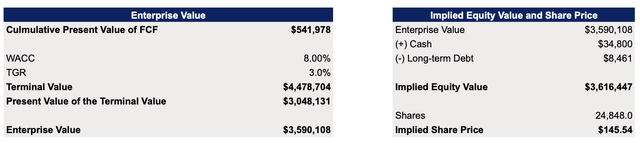

The updated model shows that Nvidia’s fair value is $145.54 per share, which represents an upside of ~4% from the current market price.

Nvidia’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

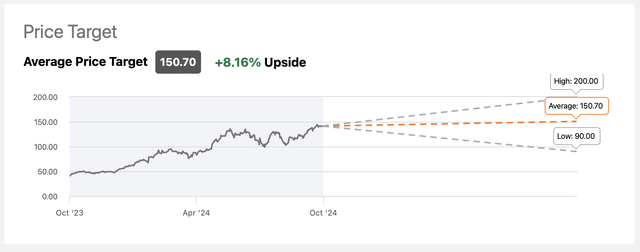

For a while, the constant change in valuation has been caused by the upward revision of assumptions due to the explosive growth of Nvidia’s business. Recently, the company has been receiving dozens of revisions, which point to the fact that the upside is still there. The consensus price target at this stage is $150.70 per share, which is slightly higher than my fair value calculation.

However, the upside still could be even more significant than what my model shows or what the street assumes if Nvidia continues to surprise everyone. Given the latest developments, it’s likely that the fair value is going to increase once more if the company exceeds expectations and increases its outlook again. That’s why I remain bullish about Nvidia’s future, as its growth story seems to be far from over.

Nvidia’s Consensus Price Target (Seeking Alpha)

Major Challenges Remain

Despite all the positive signals that Nvidia received in the last month, the further growth of the company’s stock is certainly not guaranteed. Even after Nvidia’s competitor AMD reported stellar results, its shares depreciated, primarily because the midpoint of its guidance for Q4 was below the street expectations.

Nvidia, so far, was able to avoid such a faith as it was able to impress the market in recent quarters. In the last five quarters, the company beat revenue expectations by over $1 billion and also increased its guidance above the estimates. This has resulted in the long-term rally of its stock that continues to this day. However, at this stage, Nvidia is priced for perfection. If its upcoming guidance disappoints the street, then its shares could depreciate in the same way AMD’s shares depreciated this week. I don’t think this is going to happen during the release of the upcoming earnings report given the impressive demand for Nvidia’s products, but it could certainly happen in the future.

We should not forget that Nvidia’s performance in China has been negatively affected by the U.S. export restrictions. In the recent earnings call, Nvidia’s management stated that while its data center revenues in China were up Q/Q, they were nevertheless below the levels that were seen before the implementation of export restrictions. At the same time, the U.S. government might be planning to implement country-specific export restrictions, which could have an even greater negative effect on Nvidia’s ability to generate revenues in the future.

Earlier this month, ASML Holding’s (ASML) CEO Christophe Fouquet already said that the U.S. government will continue the policy of restricting high-tech exports to China. In addition to that, TSMC’s founder Morris Chang recently stated that the company will see the most severe challenges to its growth due to the American export restrictions. This could also have a greater negative effect on Nvidia’s ability to generate impressive returns in the future.

The Bottom Line

While Nvidia is priced for perfection, the developments from this month indicate that the company is likely to release another impressive earnings report that could include a further guidance upgrade. At this point, it’s safe to state that the generative AI revolution is far from over, and Nvidia is likely to continue to benefit from the increased demand for its chips that could last for years to come. That’s why the company’s growth story seems to be far from over, and its stock remains a solid BUY for me.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Bohdan Kucheriavyi is not a financial/investment advisor, broker, or dealer. He's solely sharing personal experience and opinion; therefore, all strategies, tips, suggestions, and recommendations shared are solely for informational purposes. There are risks associated with investing in securities. Investing in stocks, bonds, options, exchange-traded funds, mutual funds, and money market funds involves the risk of loss. Loss of principal is possible. Some high-risk investments may use leverage, which will accentuate gains & losses. Foreign investing involves special risks, including greater volatility and political, economic, and currency risks and differences in accounting methods. A security’s or a firm’s past investment performance is not a guarantee or predictor of future investment performance.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.