Summary:

- Nvidia is expected to report strong Q3 2025 earnings growth of 84.7% and revenue growth of 83.3%, continuing its trend of outperforming guidance.

- Despite strong earnings, Nvidia’s stock may not rise post-results due to high implied volatility and potential market maker adjustments in options trading.

- Analysts’ current revenue estimates for Q3 seem low, suggesting Nvidia might report higher-than-expected results and provide robust Q4 guidance.

- The options market anticipates an 8% price swing post-earnings, but high call delta indicates potential stock selling pressure once implied volatility drops.

BING-JHEN HONG

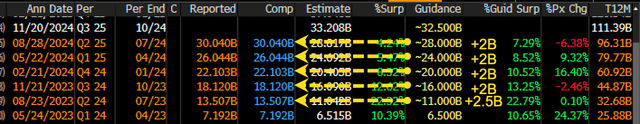

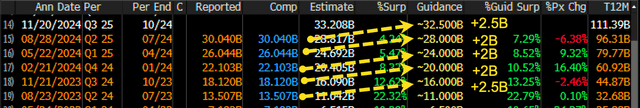

It is the question everyone is asking themselves: will Nvidia (NASDAQ:NVDA) beat its own guidance for the sixth quarter in a row by $2 billion and then guide the next quarter higher by $2 to $2.5 billion, again, for the sixth time?

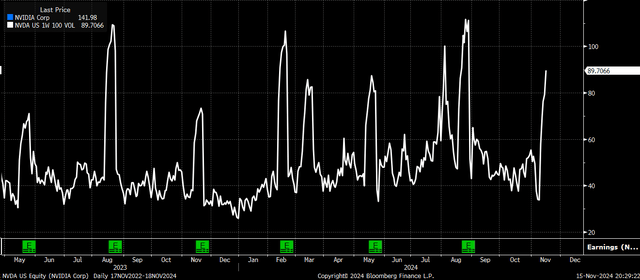

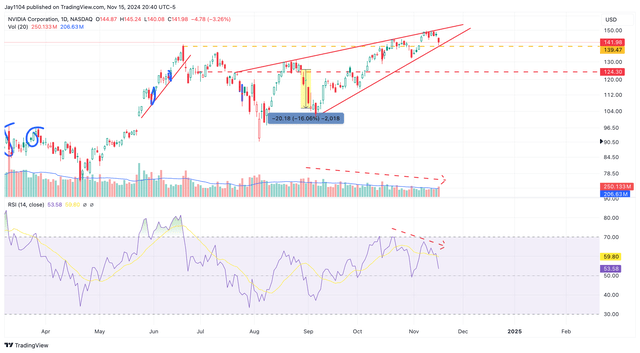

Nvidia will report results on November 20 and is expected to deliver another strong quarter of sales and earnings growth. Unfortunately, that doesn’t mean that the stock will rise following those results because, at least as of the time of this writing, it appears that the stock is in a similar position as it was last quarter when it dropped more than 15% over the subsequent four trading sessions.

Can It Surprise Anyone At This Point?

The company is expected to report fiscal third-quarter 2025 earnings grew 84.7% to $0.74 per share, while revenue increased by 83.3% to $33.2 billion, with adjusted gross margins of 75%. For the fourth quarter, analysts expect the company to provide revenue guidance of $37.0 billion and adjusted gross margins of 73.5%, with earnings of $0.82 per share.

However, everyone probably already expects these results and better. The company has a history of beating its own guidance by almost $2 billion every quarter over the past five quarters.

The company also seems to be able to guide the next quarter higher by $2 billion to $2.5 billion. It has done this 5 quarters in a row, too. Therefore, it may be safe to assume that the company will report revenue for the current quarter in the $34.5 to $35 billion range, followed by revenue guidance of $36.5 to $37 billion. This would indicate that current analysts’ revenue for the third quarter is too low, but fourth-quarter revenue estimates are just right. It is not exactly clear why analysts’ estimates for the current quarter are so low when the pattern is so obvious.

This probably means that, to no surprise, the company’s revenue guidance for the fourth quarter would need to come in above $38.5 to break the current trend of beating by $2 billion and raising by $2 to $2.5 billion, which has taken place for five quarters in a row.

Bullish As Always

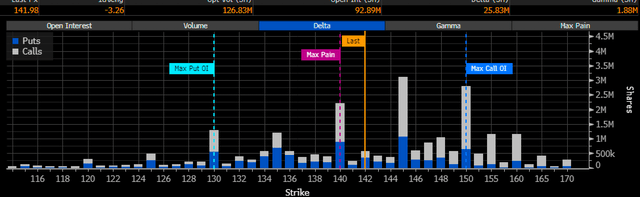

Anyway, the options market, in typical fashion, is bullish on the stock following results and sees the stock’s price rising or falling by 8%, which is equivalent to the market cap swinging by $279 billion, up or down. That is because the IV for the stock is relatively high for the options expiring on November 22 at around 90%. That implied volatility will likely continue to rise as we head into the company’s results. However, once the company reports results and event risks pass, the IV will fall sharply like it does following results for all events and earnings.

But again, like last quarter, the call delta easily outweighs the put delta values, and so when the stock IV drops and premiums for both the puts and calls decline sharply, it will likely mean that market makers will need to reduce their hedges and have stock to sell.

A market maker is short the call option, assuming a customer buys a call. To delta hedge their position, the market maker needs to go long Nvidia, whether by owning the stock or some kind of equivalent. So when the IV drops as it normally does, the value of the call and put premiums will decline sharply, and that means the market maker will need to adjust their position. So, in this case, since there are more open call positions, the market will need to reduce the amount of Nvidia it owns and bring stock for sale.

The option positioning suggests that the stock may have a difficult time breaking above the $145 to $150 range.

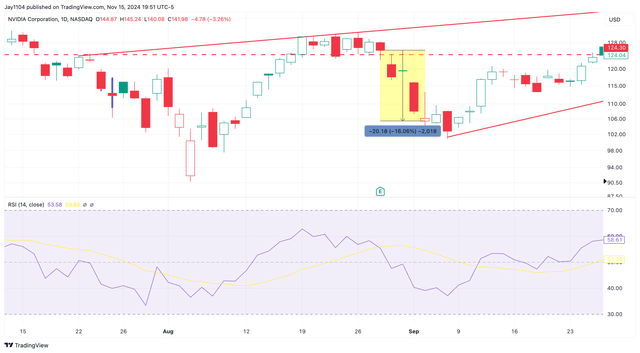

Technicals Are Weak

Technically, the stock doesn’t look great and appears to have formed a rising wedge pattern. Volume levels have been steadily declining, too, which is the hallmark of a rising wedge. Additionally, the relative strength index has declined, suggesting bearish momentum. A break of support at $139 probably sets the stage for the shares to return to $125 and potentially back to the origin at some point around $100.

So yeah, maybe Nvidia will beat results and raise guidance, but will it be a surprise if they beat by $2 billion and raise by $2 to $2.5 billion for the sixth quarter in a row? Probably not.

At 20 times sales 1-year forward sales, were you really expecting more?

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Charts used with the permission of Bloomberg Finance L.P. This report contains independent commentary to be used for informational and educational purposes only. Michael Kramer is a member and investment adviser representative with Mott Capital Management. Mr. Kramer is not affiliated with this company and does not serve on the board of any related company that issued this stock. All opinions and analyses presented by Michael Kramer in this analysis or market report are solely Michael Kramer’s views. Readers should not treat any opinion, viewpoint, or prediction expressed by Michael Kramer as a specific solicitation or recommendation to buy or sell a particular security or follow a particular strategy. Michael Kramer’s analyses are based upon information and independent research that he considers reliable, but neither Michael Kramer nor Mott Capital Management guarantees its completeness or accuracy, and it should not be relied upon as such. Michael Kramer is not under any obligation to update or correct any information presented in his analyses. Mr. Kramer’s statements, guidance, and opinions are subject to change without notice. Past performance is not indicative of future results. Neither Michael Kramer nor Mott Capital Management guarantees any specific outcome or profit. You should be aware of the real risk of loss in following any strategy or investment commentary presented in this analysis. Strategies or investments discussed may fluctuate in price or value. Investments or strategies mentioned in this analysis may not be suitable for you. This material does not consider your particular investment objectives, financial situation, or needs and is not intended as a recommendation appropriate for you. You must make an independent decision regarding investments or strategies in this analysis. Upon request, the advisor will provide a list of all recommendations made during the past twelve months. Before acting on information in this analysis, you should consider whether it is suitable for your circumstances and strongly consider seeking advice from your own financial or investment adviser to determine the suitability of any investment.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Join Reading The Markets For Just $9.99 The First Month

Reading the Markets helps readers cut through all the noise, delivering daily video and written market commentaries to prepare you for upcoming events.

We use a repeated and detailed process of watching the fundamental trends, technical charts, and options trading data. The process helps isolate and determine where a stock, sector, or market may be heading over various time frames.