Summary:

- Nvidia Corporation’s market cap almost reaches $2 trillion, making it the 4th largest publicly traded company in the world.

- The company’s earnings show slowing growth and declining margins, raising concerns about its valuation.

- Nvidia heavily relies on its data center segment for revenue, but increasing competition and potential supply constraints may impact margins.

Justin Sullivan

Nvidia Corporation (NASDAQ:NVDA) almost closed above a $2 trillion market cap for the first time as the company has regularly touched above it. The company is currently the 4th largest publicly traded company in the world, spitting distance away from Saudi Aramco. We live in a world where Nvidia, once known mainly as a maker of gaming GPUs, and a company that didn’t exist 30 years ago, is soon to be larger than Saudi Arabia’s state oil company.

Despite its massive size, the company’s stock has grown more than 60% YTD. Part of that was earnings, but a substantial part is simply excitement. As we’ll see throughout this article, the company’s earnings show its momentum is done.

Nvidia 2024 Earnings Results

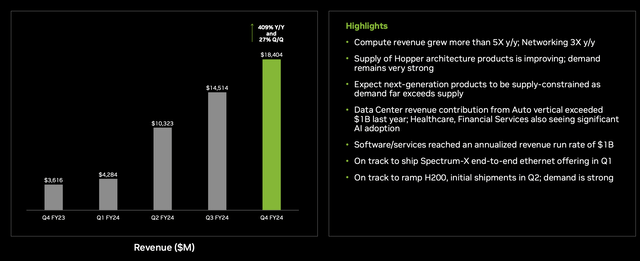

The company had reasonable earnings results, however, it’s clear that the growth is slowing down.

The company’s margin growth declined to 1.7%, and it seems to have roughly capped out at current levels based on the company’s guidance, which we’ll discuss below. As competition increases, and the companies that need GPUs as soon as possible at all costs get them, we expect margins to even decline in the next 1-2 year time period.

The company’s revenue growth has also slowed down at $4 billion QoQ versus almost $5 billion for the prior quarter, and more than $6 billion for the quarter before. These are the two pieces (margins and revenue) to see where the company peaks from a profit perspective. Current annualized profit of $50 billion from the last quarter is a P/E of 40.

The thesis here centers around the company’s revenue peaking and eventually declining along with margins.

Nvidia Segment Performance

The company’s segment performance shows that the entire company relies on one thing. Data center.

These chips make up more than 80% of the company’s revenue and made up ~100% of the company’s QoQ revenue growth. The company is working to improve supply and expects the next generation to be supply constrained which makes sense, as long as it works to ramp up production. However, as competition increases, we expect the company to solve silicon shortages.

That will put pressure on margins.

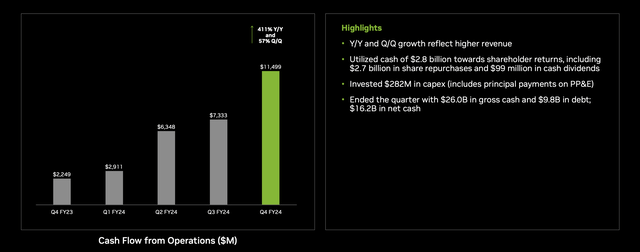

More importantly, the company’s revenue isn’t enough to justify its valuation. It needs to generate massive profits as a now $2 trillion company. The company’s CFFO was $11.5 billion in this quarter and shareholder returns were $2.8 billion. The company has $16.2 billion in net cash, less than 1% of its current market cap.

The company has ~2% in annual free cash flow (“FCF”), and even if it utilizes virtually all of that into shareholder returns, it can’t justify its current valuation. In fact, to justify long-term returns, its profits would need to grow to roughly 5x its current level, a massive amount.

Nvidia Guidance

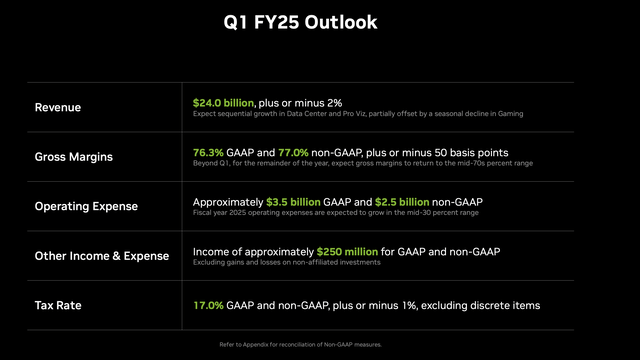

Nvidia’s guidance highlights some concerns.

The company’s guidance is for $24 billion in revenue, single-digit QoQ growth, and the biggest weakness since large language models, or LLMs, came out. The company’s gross margin guidance is roughly constant QoQ with the range for ~0.3% growth. The company expects $3.5 billion in operating expenses, with growth in operating expenses in the mid-30% range.

As a result, the company expects gross margins to actually go down for the remainder of the year into the mid-70s% range. The fact that margins have peaked so soon and will decline indicates that this aspect of the company’s profit growth has peaked. All profit growth will come from revenue now. For a company trading at >20x sales, that’s a tough spot.

The company still needs substantial long-term profit growth to justify its valuation. We expect that, as revenue growth peaks, investors will change their valuation on the company.

Nvidia Competition

In our view, Nvidia’s largest issue is that it needs continued growth and cash flow. And the company’s customers are effectively massive.

Nvidia’s H200, high-end A.I. Chip Increases its Dominance

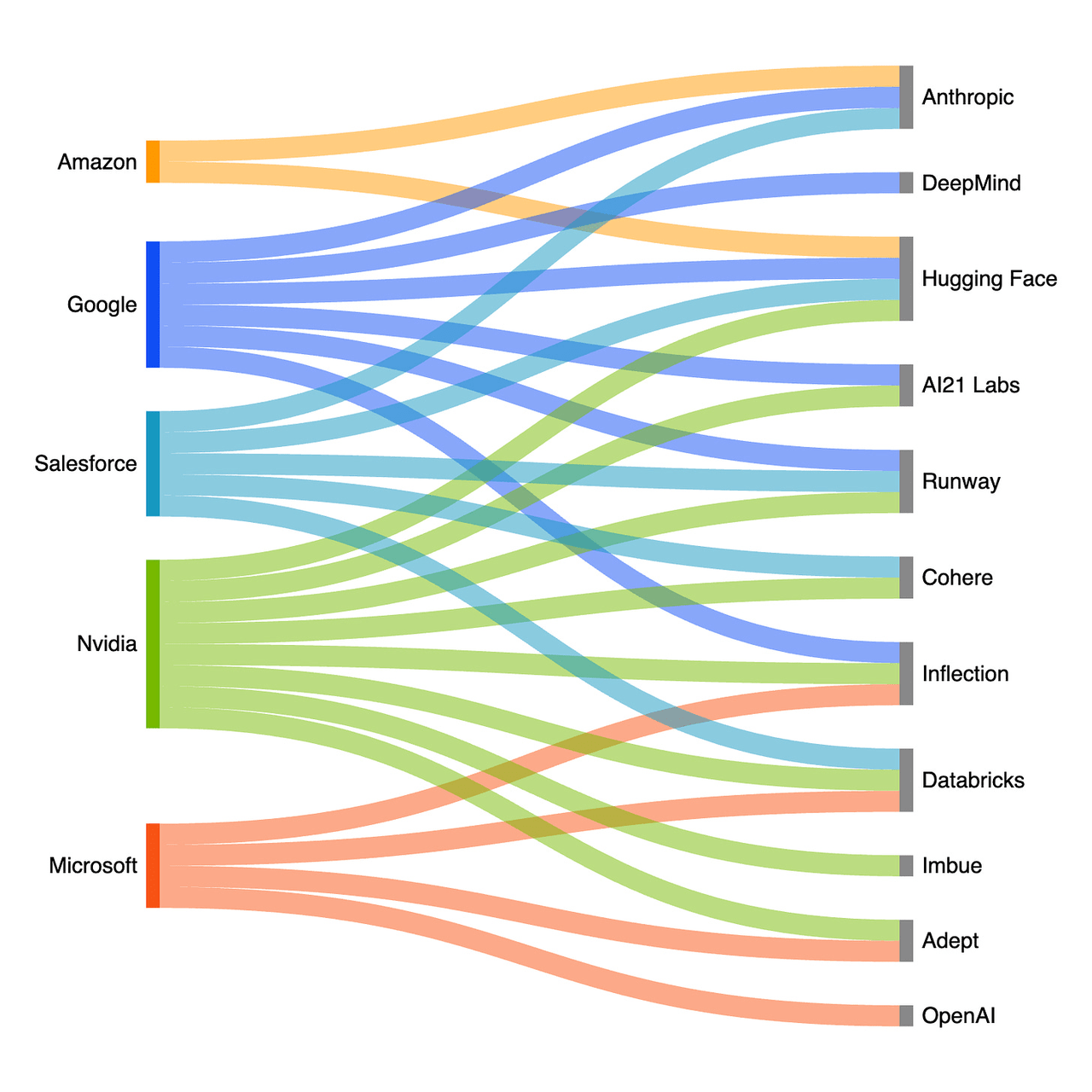

The above shows a variety of major AI start-ups and their investors. Outside of Nvidia, the company’s investors are virtually completely a few large tech companies. These companies are working on the same things: LLMs. Many of these companies are using infrastructure (such as Azure or AWS) from their investors.

Estimates are that it took 3 months with 25k Nvidia GPUs to train the latest OpenAI model. Meta Platforms (META) has announced it is planning to purchase 350k H100 GPUs. That’s a cost of ~$14 billion before any discounts. Except Meta hasn’t announced any purchases after that. How many large companies will build how many large LLMs?

It’s tough to tell, however. When the capital expenses for an established tech company are that high, the list of potential customers is small. With lead times continuing to decrease, we don’t think demand is over, but we view 2024 as the peak year for the company. The company’s competitors, both AMD, and the GPU providers themselves, are building competitive GPUs.

AMD’s latest GPUs are roughly as fast as the MI300x. They’re released at an opportune time. As availability increases, margins will decrease. A drop in margins will substantially hurt Nvidia’s ability to generate future returns when it needs growth.

Investment Recommendation

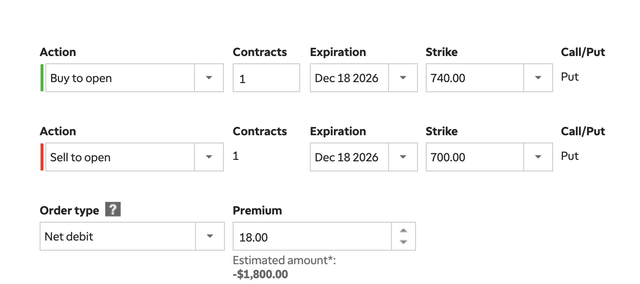

For those looking to bet against the stock, we recommend using a vertical PUT spread. Of course, please fully understand the risks of trading options before placing any trades.

This is much lower risk than a short for a rapidly growing stock, but the downside is losing 100% of your capital. We recommend purchasing a single PUT option at $740 / share and selling one at $700 / share. The midpoint of the premium is roughly $18 / share. The best-case scenario is the share price on Dec 2026 is <$700 / share, implying a 13% share price drop.

Your profit in that case is $22 / share, or a 130% return on your money. The worst-case scenario is the share price is >$740 / share, where you lose the entire investment. We recommend only doing this with a very small part of your portfolio given the capital loss % but think it’s highly likely the company’s share price finishes Dec. 2026 below $700 / share

Thesis Risk

The largest risk to our thesis is momentum. Nvidia is currently a momentum stock, as seen with its YTD performance. There’s a famous saying that the market can remain irrational longer that you can remain solvent, and that’s a risk here. Our option investment has a fixed expiration, and if the thesis does not pan out, then you lose your entire capital. That’s worth paying close attention to.

Conclusion

Nvidia has had an incredible year. The company continues to see its share price increase as the market struggles to look for exciting alternative investments. The company now has a market cap of ~$2 trillion, making it the 4th largest publicly traded company in the world, on par with Saudi Aramco. And the market can remain irrational longer than you can remain liquid.

At the end of the day, the chicken comes home to roost. Nvidia Corporation is seeing competition increase rapidly, which is threatening margins. Lead times are decreasing as customers are able to get the GPUs they need. We recommend shorting the stock through a vertical PUT spread, which caps losses at 100%, and can more than double your money if the stock drops 12%.

We expect this to be profitable. Let us know your thoughts in the comments below!

Analyst’s Disclosure: I/we have a beneficial short position in the shares of NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.