Summary:

- NVIDIA’s recent success was remarkable; now, the investor question is, can it be sustained?

- NVIDIA has developed a powerful platform strategy over the last five years, which provides enormous advantages in AI computing.

- Its broad and deep software platform is perhaps its most underrated advantage.

- Its software accelerates revenue growth by making customer implementations easier and enabling expansion into many vertical markets simultaneously.

- NVIDIA’s platform strategy also enables it to be one of the most profitable technology companies ever.

porcorex/E+ via Getty Images

I have been a fan of NVIDIA (NASDAQ:NVDA)(NEOE:NVDA:CA) since I first recommended the stock in 2021. NVIDIA’s recent success is undeniable. The critical investment questions are: Can it keep growing, justify a forward P/E of 46X, and fend off competition, so its stock price will continue increasing? So, with some encouragement, I began looking at its potential to grow and increase its stock price significantly. What I realized from my analysis actually surprised me.

As my previous readers and followers recall, I emphasize a company’s technology platform as a growth and competitive advantage, so this is my focus on NVIDIA. Apple and Amazon are tremendous examples of technology platform strategies, and so is NVIDIA, which has an extensive technology platform. NVIDIA’s technology platform is complex, powerful, and crucial to its success, making it one of the best platform strategies ever. Understanding this is key to NVIDIA’s investment potential.

Its platform strategy, particularly its vast software platform, drives its ability to:

- The growth in AI, particularly generative AI, seems unlimited in the foreseeable future, and NVIDIA’s platform is clearly the leader.

- Its software platform of systems, application libraries, and development tools enables it to penetrate multiple industries quickly.

- Its platform of advanced chips, complete systems, cluster computing, and software supports premium pricing for increasing revenue.

- The leverage from its platform strategy is so successful that it is most likely the most profitable technology company in the world, with an operating income of 62%.

In this article, I’ll briefly describe its Accelerated Computing Platform (it also has others, but this is the most important one) to provide a sense of its strength, complexity, and completeness. This will be a high-level summary, since this platform is highly technical and uses new technical terms and acronyms. Most investors only need to appreciate its importance, not understand all the technology. Following an analysis of the platform strategy, I’ll also discuss how its platform strategy leverages profitability. Within its platform strategy, I want to emphasize its software platform, which is often an underestimated contributor to its success.

While NVIDIA excels at advanced hardware, software may be the key to its long-term success. This was best stated in a recent interview with CEO Jensen Huang, who emphasized its software.

Huang told Haas that Nvidia would drive additional performance—without additional energy and cost requirements—by going beyond the GPU, designing the entire computing system, from networking and switches to software and other chips.

“We want to drive the cost down so that we could deliver this new type of reasoning inference with the same cost and responsiveness as the past,” Huang said.

He added that AI chatbots would be able to research ideas, reason, and reflect on their answers more thoroughly by going through thousands of thought computations before reaching a conclusion. “The quality of answers will be so much better.”

But more than before, Huang is also talking up the power of software. It’s another area of strength for Nvidia, but one where the company doesn’t get much credit.

On this week’s podcast, Huang emphasized the importance of software and its compatibility with future hardware.

NVIDIA’s Accelerated Computing Platform

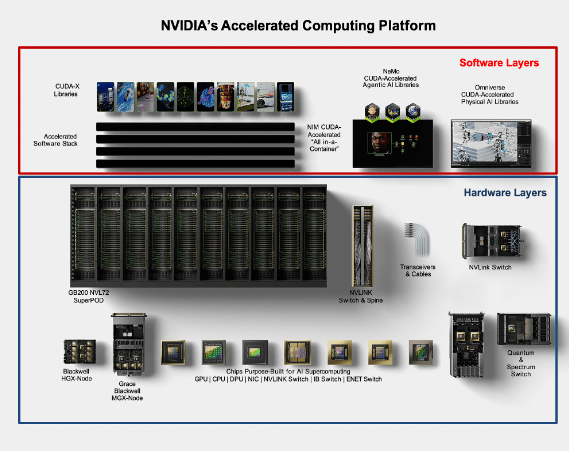

Let’s take a closer look at NVIDIA’s primary technology platform. NVIDIA’s Accelerated Computing Platform has multiple layers: chips, systems, software, algorithms, tools, extensive libraries, and implementation support. The diagram below shows the hardware and software layers.

NVIDIA’s Accelerated Computing Platform (NVIDIA)

Hardware Layers

The hardware layers start with proprietary NVIDIA chips specially designed for AI supercomputing. The platform diagram above references these AI-designed chips:

- Graphics Processing Units (GPUs) are specialized processors NVIDIA pioneered initially for gaming. These chips are now used in AI applications to process vast data.

- Central Processing Units (GPUs) are more traditional primary computer processors, but NVIDIA optimizes the integration of CPUs and GPUs in its architecture.

- Data Processing Units (DPUs) are programmable processors specifically designed to manage data-centric tasks such as networking and security.

- Other Chips in the diagram include a network interface card (NIC), an NVLINK switch, an InfiniBand switch, and an Ethernet switch (ENET).

The chips are combined into systems, such as the GB200 NVL72 SuperPOD that uses NVIDIA’s Grace and Blackwell processors for large-scale, high-performance computing clusters designed for AI applications. This system performs high-speed AI processing with minimal latency. It includes the Grace Blackwell MGX-Node and the Blackwell HGX-Node to combine the processing capabilities of these two subsystems. Nodes are building blocks containing multiple components, such as CPUs, GPUs, memory, etc., used for cluster and high-performance computing.

The platform diagram also references other system components.

Software Layers

The platform diagram shows that the software layers are extensive and complex. This software platform provides NVIDIA with a significant advantage. It makes its hardware much more productive and easier to use than anything competitors can offer, and NVIDIA keeps adding more system software, application libraries, and development tools.

Let’s look at some of the software mentioned in its Accelerated Computing Platform diagram.

What it refers to as its Accelerated Software Stack includes some critical software:

- CUDA (Compute Unified Device Architecture) is NVIDIA’s most important software platform. It is a parallel computing platform of programming models and tools. It enables software developers to use NVIDIA’s GPUs for general computing tasks, making NVIDIA hardware more attractive because it increases productivity. NVIDIA generally provides this software for free to accelerate system sales.

- DOCA is a set of software libraries and APIs for creating high-performing data centers.

- NCCL is NVIDIA’s Collective Communications Library for multi-GPU and multi-node communications. It enables multiple GPUs using NVLIink, InfiniBand, and Ethernet.

- Cluster-scale software is a set of tools and frameworks for managing AI computing across a cluster of servers.

- System Software is a set of software modules that controls Nvidia’s hardware.

- Chip Software includes the firmware and basic APIs for NVIDIA chips, such as GPUs, CPUs, and switches.

The diagram’s NIM CUDA-Accelerated “All-In-One” Container refers to how NVIDIA bundles all the tools, components, libraries, and APIs described. This simplifies the implementation of NVIDIA systems for AI inference workloads.

CUDA-X Libraries are built on the CUDA platform. They are a collection of software that enables developers to accelerate the use of GPUs for AI high-performance computing. They are helpful in a broad spectrum of applications.

NeMo CUDA-Accelerated Agentic AI LIbraries is a weird term. NeMo is an open-source framework for training and deploying large-language models. Agentic AI means autonomous systems that perform computing tasks based only on goals or objectives.

Omniverse CUDA-Accelerated Physical Libraries is also a complicated term. Omniverse refers to NVIDIA’s omniverse. The term “physical” describes libraries that mimic the physical world, such as engineering and manufacturing.

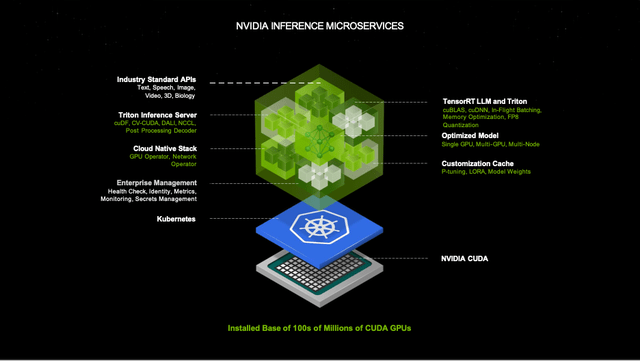

NVIDIA has many more systems, software, application libraries, and development tools for specific uses. One example is NIM, or NVIDIA Inference Microservices, illustrated in the following chart.

NVIDIA Inference Microservices (NVIDIA)

NIM is a platform that includes AI inference models, enterprise management, a Triton Inference server, and the supporting infrastructure. Notice that it is built upon NVIDIA CUDA, emphasizing its reusability. NIM simplifies the deployment of distributed AI services for on-premises, cloud, or hybrid AI inference computing. AI Inference computing is the process of AI production after an AI model is trained. This is where AI systems need to be the fastest and most efficient. NIM gives NVIDIA enormous competitive advantages in AI inference computing.

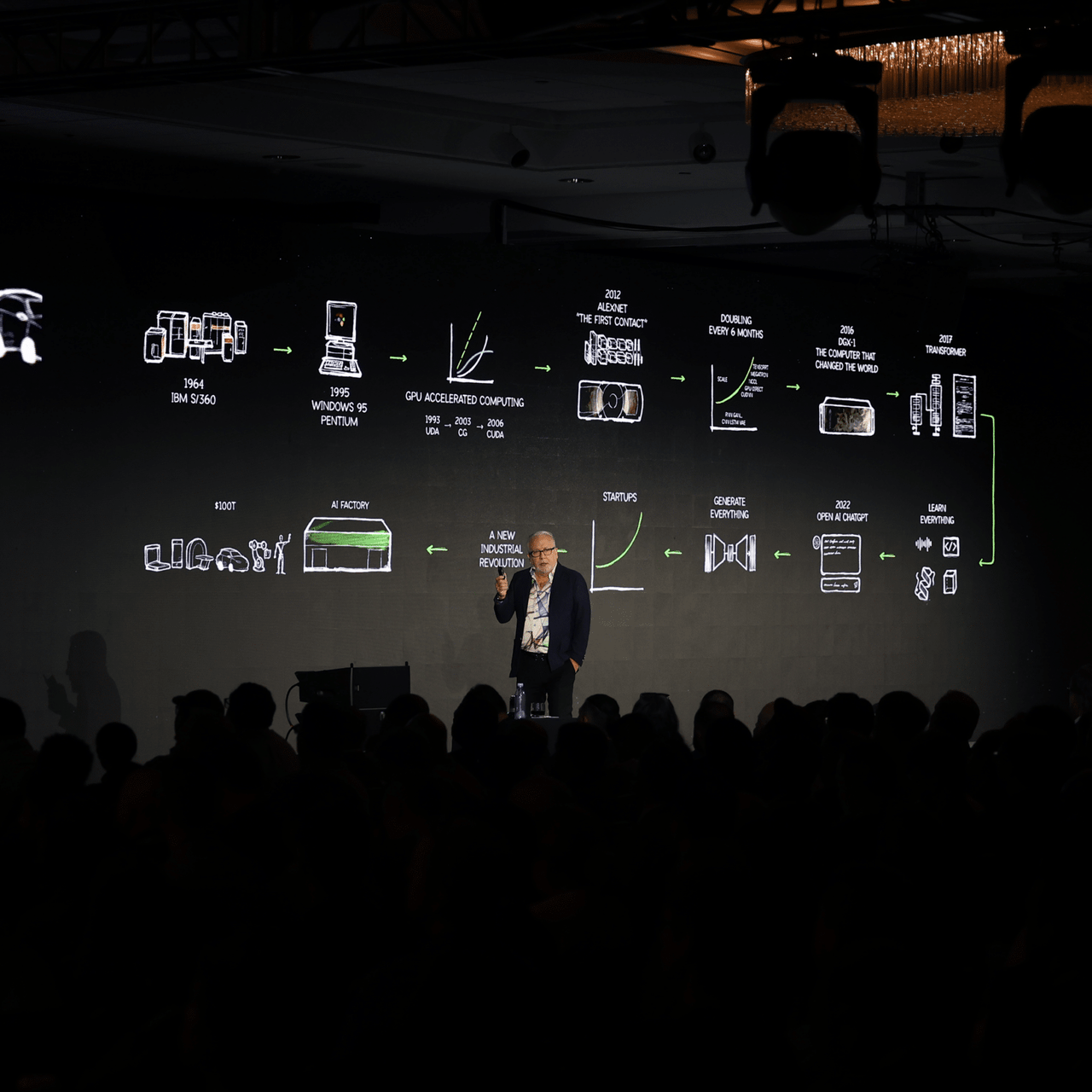

NVIDIA AI Summit

This past week, NVIDIA showcased more new software at its AI Summit in DC, but the primary focus was on presentations from customers across a broad base of industries.

In his keynote, Bob Pette, NVIDIA’s vice president and general manager of enterprise platforms, discussed how NVIDIA’s accelerated computing is transforming many industries, with a particular emphasis on software.

Bob Pette at NVIDIA’s AI Summit (NVIDIA)

Here is an extract of some of his more important insights

These AI factories produce products. Those products are tokens, tokens are intelligence, and Intelligence is money. That’s what “will revolutionize every industry on this planet.”

NVIDIA’s CUDA libraries, which have been fundamental in enabling breakthroughs across industries, now power over 4,000 accelerated applications. CUDA enables acceleration…. It also turns out to be one of the most impressive ways to reduce energy consumption.

These libraries are central to the company’s energy-efficient AI innovations driving significant performance gains while minimizing power consumption.

Pette also detailed how NVIDIA’s AI software helps organizations deploy AI solutions quickly and efficiently, enabling businesses to innovate faster and solve complex problems across sectors.

Then, he discussed the concept of agentic AI, which goes beyond traditional AI by enabling intelligent agents to perceive, reason, and act autonomously. Agentic AI is capable of reasoning, learning, and taking action. It’s transforming industries like manufacturing, customer service, and healthcare.

These AI agents are transforming industries by automating complex tasks and accelerating innovation in the manufacturing, customer service, and healthcare sectors. He also described how AI agents empower businesses to drive innovation in healthcare, manufacturing, scientific research, and climate modeling. With agentic AI, you can do what used to take days in minutes.

Pette emphasized that NVIDIA is unlocking a $10 trillion opportunity in healthcare. Through AI, NVIDIA is accelerating diagnostics, drug discovery, and medical imaging innovations, helping transform patient care worldwide. Solutions like the NVIDIA Clara medical imaging platform are revolutionizing diagnostics, Parabricks is enabling breakthroughs in genomics research and the MONAI AI framework is advancing medical imaging capabilities.

Pette also announced that a new NVIDIA NIM Agent Blueprint supports cybersecurity advancements, enabling industries to safeguard critical infrastructure with AI-driven solutions. In cybersecurity, Pette highlighted the NVIDIA NIM Agent Blueprint, a powerful tool enabling organizations to safeguard critical infrastructure through real-time threat detection and analysis.

The event’s primary focus was customer applications, providing insight into the many different vertical markets NVIDIA supports through its systems, software extensions, and application libraries.

Here is a partial list of the experts from different companies presenting how they are using NVIDIA systems and software for AI applications:

- U.S. Department of Energy

- MITRE

- Boston Dynamics

- Cybersecurity and Infrastructure Security Agency

- Federal Energy Regulatory Commission

- T-Mobile

- The Weather Company

- ARPA – Health

NVIDIA’s Software Advantages

As shown in the previous software platform overview, NVIDIA uses software to its advantage. For the most part, NVIDIA provides this software free to its customers to make it easier for them to develop advanced AI systems. Here is how this accelerates revenue growth for NVIDIA:

- It enables NVIDIA to sell more expensive, complex, and faster AI computing hardware. Without these software systems, libraries, and tools, AI development and deployment would take customers longer, and they would need to delay subsequent purchases from NVIDIA. So, these software libraries and tools help accelerate revenue.

- NVIDIA has built a broad set of advanced application libraries and frameworks for a wide range of industries. This accelerates growth by providing solutions to many industries very quickly. Most companies would traditionally expand into one or two vertical markets every year.

- Complete systems, with all the software and advanced hardware, enable NVIDIA to charge a premium price. Customers prefer the NVIDIA platform, no matter how expensive. Premium prices increase revenue and profitability.

- From a competitive standpoint, NVIDIA’s extensive software platforms provide an enormous barrier to competitors. It will be impossible for any competitor to develop such extensive software capabilities.

And NVIDIA keeps investing in software at an accelerated pace. Search for “NVIDIA Software Engineer” on LinkedIn; the results seem endless.

Platform Leverage for Financial Results

The second significant platform advantage for NVIDIA is the incredible leverage it provides. Platform leverage enables faster growth and immense improvements in productivity. For NVIDIA, this platform’s leverage is incredible. Let’s compare its performance in the July 2024 quarter to the previous July quarter.

- NVIDIA’s revenue increased 122% in July 2024 from $13.5 billion to $30 billion. AI computing is already a fast-growing market, but as was just discussed, NVIDIA’s platform strategy accelerates its growth. Its software technology and tools enable customers to implement NVIDIA systems faster, accelerating revenue. Its growth is accelerated by leveraging its technology platform into multiple vertical industries with unique applications. Its vast software libraries and development tools enable NVIDIA to penetrate multiple markets simultaneously.

- It improved its gross margin from 70% last July to 75% this year. Again, this is the platform strategy and strong software footprint at work. A platform of standard modules applied in different markets enables economies of sales in the cost of goods. Also, a significant component of software value is bundled into the premium selling price of its systems.

- It increased R&D expense by $1 billion in the July 2024 quarter, while reducing R&D as a percentage of revenue from 14.8% to 10%. R&D was approximately $2 billion in the July 2023 quarter and increased to $3 billion in the current quarter. Here again, it’s the platform strategy on steroids. Technology is leveraged across a much bigger sales base. Frankly, I’ve never seen anything like this!

- Finally, NVIDIA increased its operating income to 62%! In the July quarter last year, operating income was 50%, which was already incredible. Last quarter, it increased to 62%. This comes from the combined platform leverage of improved gross margins, more efficient R&D, and more efficient sales and marketing. This level of profitability is unprecedented in a technology company, and it ensures immense profits for shareholders in the future.

Conclusion

Although it may seem pricey, NVIDIA’s stock price has considerable potential for continuing increases. The advanced computing market for AI is snowballing, with almost no end in sight for the next few years. NVIDIA’s platform strategy, particularly its exceptional software platform, will continue to provide accelerated growth opportunities within this hot market. Finally, NVIDIA is one of the most profitable technology companies in history, providing enormous cash flow to shareholders.

There are always some downside risks. The AI market could fizzle out early. Competitors could capture enough of NVIDIA’s magic to take away some market share. China is always a significant risk. I worry that NVIDIA will grow so large that it could become bureaucratic and lose some of its magic.

Nevertheless, three tremendous forces are at play: (1) NVIDIA is a dominant company with enormous competitive barriers in a rapidly growing hot market. (2) Its platform strategies enable it to accelerate its growth within this hot market. And (3) it is more profitable than possibly any technology company in history. An investment opportunity with those three advantages does not come along very often.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.