Summary:

- Nvidia’s “Data Center” subsegment is the clear driver of the company’s revenue and an indicator for the ongoing evolution of the company.

- Institutional holdings are unlikely to increase, given ongoing sector rotation and asset class diversification. Economic headwinds further cloud the forward outlook.

- Market players’ positioning indicate little support for skyward valuations. Ultimately, the company is a prime candidate to become a “bellwether” of the global economy in my view.

Cylonphoto

Nvidia Inc (NASDAQ:NVDA) has received a lot of attention in the Year To Date (YTD). As an article published in June indicated, the company’s stock was labeled a key member of America’s “Magnificent Seven”, i.e., one of seven stocks subjected to intense investor crowding relative to, say, the other 493 constituents of the S&P 500. This crowding did have some hand in the stock’s meteoric 217% price increase in the YTD.

However, as other articles have indicated, high valuations generally divorce the stock’s valuation from the company’s business performance. While Nvidia isn’t exempt from this truism, it must be said that the latest Q2 earnings release at last somewhat justifies why the company is so well-regarded.

Line Item Trends

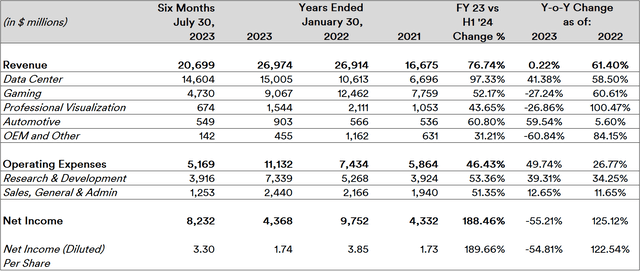

The company’s latest earnings release relative to that of past full years clearly highlights the company’s excellent performance:

Source: Created by Sandeep G. Rao using data from Nvidia’s Financial Statements

The company’s Compute & Networking segment – which encompasses its “Data Center” accelerated computing platform, networking, automotive vehicle services, robotics and other embedded platforms, enterprise solutions and cryptocurrency mining processors (CMP) – has witnessed a sea change by accounting for nearly 74% of the company’s revenues in the first half of the year (H1 ’24), which is a significant rise from 47% in FY ’21. “Data Center” alone accounts for 70% of the company’s revenue as opposed to 40% in FY ’21 and has delivered nearly as much revenue in these past six months than it did in the entirety of FY 23. At this stage, Nvidia isn’t just a company for gamers.

On a very related note, the Graphics segment – which encompasses Graphical Processing Units (GPUs) for gaming and related services, enterprise visualization services, metaverse and 3D internet applications – has halved its revenue share from nearly 53% in FY ’21 to 26% in H1 ’24. Gaming remains the major driver of this segment.

While the revenue share contribution from “Graphics” is largely trending to be around par relative to the previous year, “Compute & Networking” is trending strongly above par. Virtually every subsegment is above 50% in H1 ’24 versus the previous year, with “Data Center” ahead by several full lengths.

Some media coverage from earlier today indicates that the company’s “automotive” subsegments – once touted by CEO Jenson Huang as the company’s “next billion-dollar business” – haven’t done quite as well as it did in the previous quarter. Forward outlook is cloudy due to downward revisions of sales forecasts for high-end vehicles in the coming two quarters. Among those affected are NIO (NIO) and XPeng (XPEV) – major clients of Nvidia’s in China’s crowded automobile market. This is to be expected: as the last article published indicated, China is undergoing a quiet economic crisis.

Note: NIO and XPeng’s prospects and inherent potential were also discussed in a recent article. Click here to read more.

Be that as it may, the “Automotive” segment has performed above par in H1 ’24. Even with a slowdown, it can be expected to close somewhere around par by the end of the year. Furthermore, it bears noting that “Data Center” seems poised to go from strength to strength: with the GH200 Grace Hopper Superchip for complex AI and HPC workloads shipping in Q2, the universal data center GPU L40S made available in a broad range of platforms, and the release of the server reference design MGX for the quick buildout of server variations for AI, HPC and Omniverse applications, the company is developing consistent client-oriented support capabilities that will likely secure dedicated clients who could turn into legacy customers in the future.

Despite these factors and the hype around earnings, market players are rather cool to affording the company’s stock any further tailwinds. The reason: no stock exists in a vacuum and virtually no large-ticket investor is a single-ticker player.

Headwind A: Cool Hands Prevail

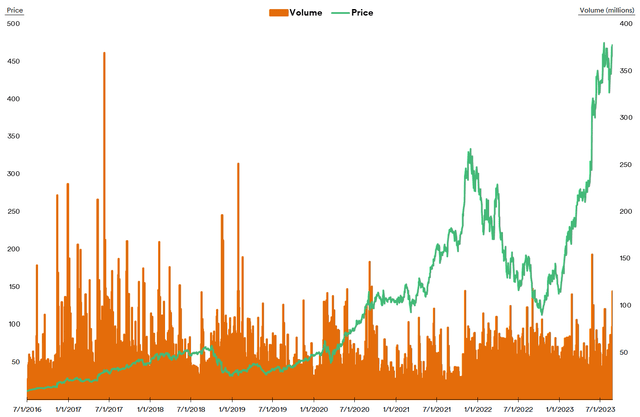

An examination of traded volumes of the company’s stock versus its price over the past seven years reveal some very interesting facets on market player trends:

Source: Created by Sandeep G. Rao using data from Yahoo! Finance

- H2 2016 through Q1 2017 saw very high volumes of the stock traded with relatively little effect on the stock’s performance. This is highly suggestive of a “strong disaggregated convergence”, i.e., while there was a high variety of players – institutional, tactical and retail – the overall consensus price remained quite tight.

- Q3 2017 through Q4 2020 saw relatively low to moderate traded volumes with a “weak disaggregated divergence”, i.e., players differed on consensus price but with an upward trajectory largely commensurate with decent earnings (no surprises here: the company has traditionally been a decent earner).

- Q1 2021 through Q4 2021 saw relatively low volumes of the stock traded with a “strong disaggregated convergence” primarily due to retail and tactical investors driving up the hype around the stock on the back of strong earnings.

- Q1 2022 through Q3 2022 saw relatively low traded volumes with a “strong aggregated convergence” as large volumes of retail investors exited, tactical players turned bearish and institutional investors held steady.

- Q4 2022 through Q2 2023 was the stock’s “Magnificent Seven” phase through “strong aggregated convergence”: AI hype brought in a (relatively) small contingent of retail investors at a time when most continued to stay out of markets, tactical investor strategies and (initial) institutional investor buy-ins.

In Q3, i.e., weeks before the Q2 update rolled in, institutional investors (typically long-term holders) indicated a move towards sector rotation (which was discussed in a recent article) while tactical players and retail investors both continued to remain in play. Nonetheless, given that institutional investors are periodic bulk drivers of volume and framers of outlook, the stock’s trajectory begins to find growing resistance.

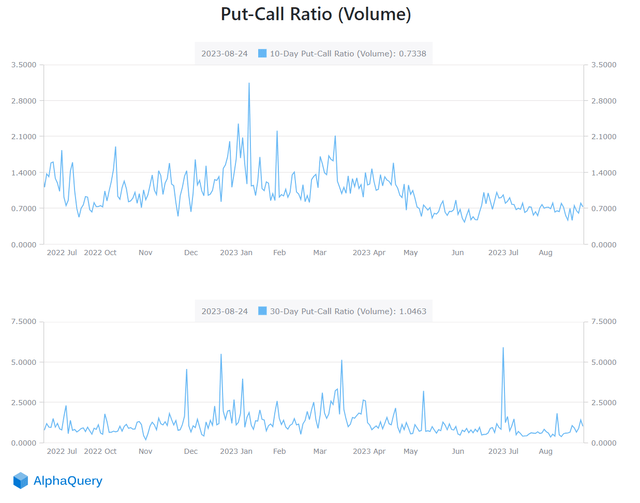

Overall outlook among tactical investors is fairly balanced. In the 10-day outlook on the day of the earnings release, the Put-Call Ratio trends bullish while the 30-day outlook is nearly perfectly balanced at 1.

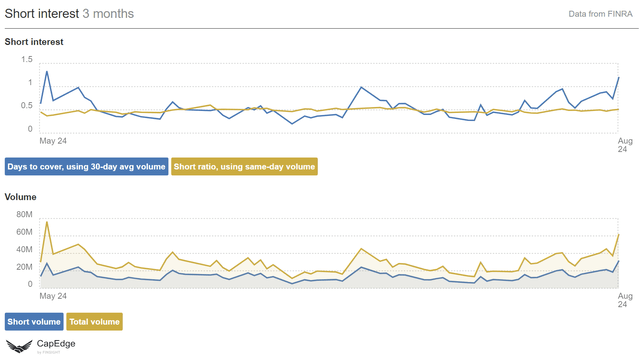

The idea that Nvidia would rise (given its now-customary strong earnings) and then rationalize on account of sector rotation seems to be the prevalent outlook among short sellers: overall short interest perked up in the month of August and the weeks leading up to the earnings release.

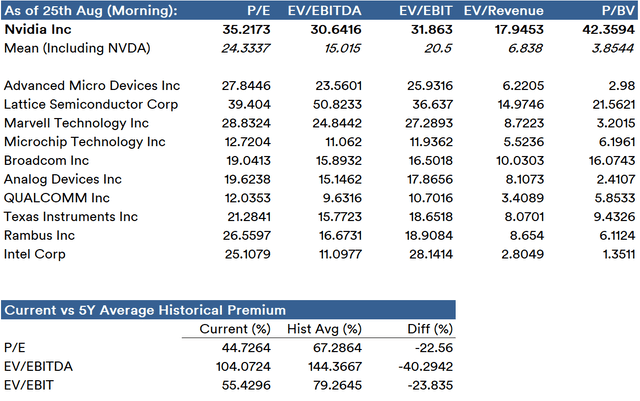

One reason for institutional caution is the relative overvaluation of the company’s stock relative to its peers:

Source: Created by Sandeep G. Rao using data from Bloomberg

While it’s certainly true that Nvidia’s strong performance affords it a certain premium relative to its peers, what’s also true is that its peers have burnished their own niche within the electronics ecosystem. Nvidia trends substantially the average in terms of price ratios. Institutional investment into a sector is sensitive to overvaluation as it displaces weightings away from other constituents and creates concentration risk.

All in all, without substantial retail investor hype, cooler heads have begun to prevail in the market with a distinct disinclination to push the hype further skywards.

Headwind B: The Economy

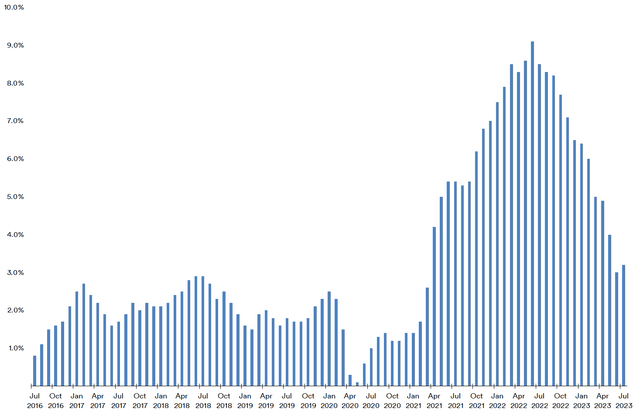

In addition to the aforementioned headwinds from China, Federal Reserve Chair Jerome Powell indicated earlier today that inflation is well above the Fed’s comfort and gave little indication that they will be easing rates any time soon.

We are prepared to raise rates further if appropriate, and intend to hold policy at a restrictive level until we are confident that inflation is moving sustainably down toward our objective.

The data-driven approach to battling inflation plaguing the American consumer as opposed to guaranteeing market stability is a return to form for the Federal Reserve. While the U.S. Consumer Price Index (CPI) is no longer displaying the historical Year-on-Year (YoY) highs exhibited a little over a year ago, there are early indications of YoY increases resuming an upward climb again.

Source: Created by Sandeep G. Rao using data from Investing.com

The ongoing rate hike schedule has been creating new opportunities (with decreased downside risk) for institutional investors in the fixed income market. Earlier this month, Franklin Templeton highlighted the growing attractiveness of the fixed income market via instruments such as:

- Corporate bonds that show solid fundamentals on account of current leverage, interest coverage, free cash flow and amortization schedules being at stronger levels than in the recent past.

- High-yield bonds that offer a bridge for investors between the typical risk/return profiles of fixed income and equity, with yields near 8.5% and some capital appreciation potential.

- Private credit in the form of highly diversified pool of mostly senior secured loans that offer yields ranging from 11.5% to 12.5%, strong risk-adjusted returns, lower leverage and tighter terms in exchange for some illiquidity.

The volatility inherent in overvaluation imputes a higher risk relative to the risk/reward balance in the higher tiers of the fixed income market. With higher rates also come higher interest payment from new U.S. Treasury issuances; this has helped increase the attractiveness of at least a section of the government bond market for some institutional investors (such as Nvidia itself).

In Conclusion

Investment in AI-relevant infrastructure is increasingly necessary to rationalize operational costs and structurally improve operational efficiency. It can be expected that the “Compute & Networking” segment will continue to be the primary breadwinner for the company. Its peers will undoubtedly be taking notes on integration best practices and advances.

With some institutional capital potentially shifting to other asset classes and equity-oriented capital intent on sector rotation, there’s a tangible possibility that the company’s price ratios will continue to rationalize until the company’s stock evolves from being a member of the “Magnificent Seven” to being a bellwether of the global economic machinery in my opinion.

The ongoing rationalization of the stock is no reflection on the performance of the company. In fact, rationalization might even make the company’s stock an even more attractive choice for long-term investment. The fact that the stock already pays a dividend when so many other tech companies don’t is a mark of the company’s eligibility for such considerations.

Investors looking for continued outperformance over the broad market by virtue of simply holding this one stock might benefit from diligent research towards building a bigger and more dynamic basket of holdings to achieve such goals. All in all, it’s a great company to own but the stock does carry a high degree of overvaluation risk.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I lead research at an ETP issuer that offers daily-rebalanced products in leveraged/unleveraged/inverse/inverse leveraged factors with various stocks, including some mentioned in this article, underlying them. As an issuer, we don't care how the market moves; our AUM is mostly driven by investor interest in our products.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.