Summary:

- NVIDIA Corporation reported strong quarterly results, beating estimates on both revenue and earnings.

- The company’s revenue growth was driven by investments in AI, with data center growth at an impressive 171% YoY.

- NVIDIA’s gross margins also saw significant expansion, reaching 71%, highlighting its strong position in the AI hardware space.

Edwin Tan

Article Thesis

NVIDIA Corporation (NASDAQ:NVDA) reported its most recent quarterly results on Wednesday afternoon. The company beat estimates easily and announced strong guidance numbers. The market reacted positively to these results, but due to a pretty high valuation, I believe being cautious is not a bad idea.

Summary Of Previous Coverage

I last covered NVIDIA two months ago, in June, giving it a “Hold” rating at the time. That article was focused on potential export curbs when it comes to some types of chips and the potential impact of said export curbs on NVIDIA. I argued that this is a potential threat for the company, but that NVIDIA also has major advantages, such as benefitting from increased AI spending. The chip export curbs theme has since waned and has not gotten a lot of attention, and it looks like this will not threaten NVIDIA meaningfully in the foreseeable future, while the AI exposure theme has gotten increasing attention.

In this article, we will focus on NVIDIA’s performance in the most recent quarter, the outlook, the valuation, and the massive improvements in NVIDIA’s fundamentals.

What Happened?

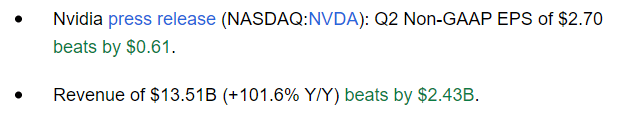

On Wednesday afternoon, following the market’s close, NVIDIA Corporation announced its most recent quarterly results. The company’s headline numbers can be seen in the following screencap:

Seeking Alpha

The company beat estimates on both lines and did so pretty substantially. Revenues soared by more than 100%, and NVIDIA’s earnings performance was even better. The market bid up NVIDIA’s shares in after-hours trading — at the time of writing, NVIDIA trades north of $500 per share, up more than 7% in extended-hours trading.

NVIDIA’s Performance During The Quarter

Due to the ongoing AI hype and NVIDIA’s strong guidance for the current quarter, expectations were pretty high. The company showcased massive sequential sales growth, which wasn’t a surprise, as the guidance that had been announced during the previous earnings release already implicated that sales would grow at a hefty pace. In fact, NVIDIA did deliver revenue growth of more than 100% on a year-over-year basis, although it should be noted that the previous year’s quarter was not especially strong. Even compared to NVIDIA’s best quarter so far, which was the first quarter in calendar 2022, the company generated revenue growth of 63%. Sequential revenue growth was extremely strong as well, at almost 90%.

Not surprisingly, the majority of this revenue growth was driven by AI investments. ChatGPT has resulted in a lot of attention for artificial intelligence technologies, and all kinds of companies are seeking to capitalize on the potential of AI. Many do so by investing in data centers and developing their own AI models and tools, across different areas such as large language models, autonomous driving tech, and many others. These programs, algorithms, and so on require a lot of computing power, and NVIDIA’s chips are some of the best to tackle these tasks. While NVIDIA is not the sole player in this space — AMD (AMD), for example, has been introducing AI-related chips as well — NVIDIA is the leading player in the AI hardware space, at least for now. That has had a profound impact on NVIDIA’s sales performance, which had been lagging prior to the most recent quarter, due to factors such as a slowdown in consumer spending which hurt NVIDIA’s gaming GPU business. But thanks to the massive growth in the AI space, these headwinds are more than offset, as data center growth came in at an incredible 171% on a year-over-year basis. That more than balanced out the weaker performance across markets such as Professional Visualization, where revenues dropped by more than 20% year-over-year. While not all is going well at NVIDIA, the ultra-strong performance of the company’s biggest business is enough to make company-wide results look very strong.

Not only did NVIDIA grow its revenue substantially, but it also was able to boost its margin. While operating margin growth was a sure thing due to the expected revenue growth, which results in operating leverage, NVIDIA also was able to grow its gross margins at a hefty pace. It looks like customers are so eager to buy AI hardware that they are willing to pay hefty prices, which made NVIDIA’s adjusted gross margin jump from 46% to 71% over the last year — a 2,500 base point margin increase. That is almost unheard of and underlines NVIDIA’s very strong position in the AI hardware space right now. If the company had more competitors, or if market demand wasn’t as strong, then NVIDIA would not generate these margins. But at least for now, NVIDIA is able to grow very profitably. Thanks to the combination of hefty revenue growth, substantial gross margin expansion, and operating leverage, net profits soared by more than 400%, which, again, is a very strong result. While profits during the previous year’s quarter were rather weak, NVIDIA generated the highest profits in its history during the most recent quarter, with earnings per share coming in around almost twice as high compared to the previous record ($2.70 versus $1.36 during Q1 in CY2022).

The Current Quarter Will Be Even Better

While NVIDIA’s strong performance in the most recent quarter was no surprise, the company also indicated that the current quarter would be better compared to what analysts had been predicting. The company guides for revenues of $16 billion at the midpoint, which implies sequential growth of 19% versus the most recent quarter. When we consider that NVIDIA did beat its own guidance handsomely during the most recent quarter, it is very much possible that actual results will be even stronger — although that is, of course, not guaranteed.

Factoring in NVIDIA’s guidance for operating expenses, gross margins, etc., the company’s earnings per share could come in at around $3.20, which would be a new all-time record and which would represent a very nice sequential growth rate of around 20%. While the guidance implies that sequential growth will slow down quite a lot, from around 90% to around 20%, the guidance also indicates that the growth story continues — we have not seen the peak yet, and demand for NVIDIA’s AI chips is strong enough to drive further sales and profit growth. Some analysts and market watchers had believed that the most recent quarter might have been the top in terms of sales for a while and that AI chip sales would start to fade, but that seems to not be the case yet. We will have to see whether the current quarter will be the “top” quarter or whether NVIDIA will continue to grow on a sequential basis beyond that point, but at least for now, the party continues — both when it comes to underlying business growth and when it comes to NVIDIA’s share price, as the current after-hours price represents a new all-time high for the company.

The Valuation Has To Be Considered

The underlying results for the most recent quarter were extremely strong, and the guidance for the current quarter is excellent as well. That being said, investors should also consider NVIDIA’s valuation. While strong growth can justify a premium valuation for sure, investors nevertheless shouldn’t chase growth stocks.

When we annualize NVIDIA’s most recent quarterly results, we get to annual profits of a little less than $11. That makes for an earnings multiple in the 45 range. That is pretty pricy, considering how the broad market is valued. While that valuation could definitely be justified if NVIDIA continues to grow its profits at a substantial pace for many years, that is not guaranteed. It is at least possible that growth will slow down next year and beyond, and growth might even stall. A potential recession could cause this, while the baseline effect — tough comparisons — should also be a headwind for NVIDIA’s business growth next year.

Everyone who bought NVIDIA at the lows last year, when the stock was trading for just above $100 for some time, made an excellent pick. But that does not mean that buying the stock at north of $500 will be an equally good decision. Those that bought Tesla (TSLA) at the highs of during the pandemic are down quite a lot, despite meaningful business growth since then. The same can be said about those who bought Cisco (CSCO) at a too-high valuation during the dot.com bubble. The same will not necessarily happen to those who buy NVIDIA at north of $500, but at the current level, massive earnings growth for several years is baked into the stock price already, making this a somewhat risky investment.

Final Thoughts

NVIDIA had an excellent quarter and the operational near-term outlook is very positive as well. NVIDIA bulls that bought the stock when it was temporarily unloved did everything right. But that does not necessarily make NVIDIA a great investment at more than $500 per share — the valuation is far from low right here. This could be justified in the long run, but when a company is valued at way above $1 trillion, then everything has to go right — and that is not guaranteed.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

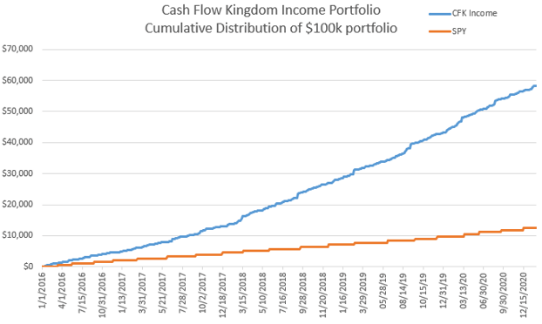

Is This an Income Stream Which Induces Fear?

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!