Summary:

- NVIDIA’s Bears have recently increased their voices, but their bear cases may be missing the big picture. AI’s revolution has just started and is far from being ‘just another bubble’.

- NVIDIA’s innovation, first-mover advantage, and customer stickiness ensure its leading position in the AI chip market despite concerns regarding competitive threats.

- NVIDIA’s financials are robust, with exceptional revenue growth, high profitability, and strong cash flow, justifying its premium valuation.

- I reiterate my ‘strong buy’ rating, leveraging the recent stock price pullback to increase my position, confident in NVIDIA’s long-term growth and market impact.

- I remain bullish on NVIDIA, emphasizing its dominance in generative AI and its unmatched hardware and software ecosystem, particularly the CUDA platform.

JasonDoiy

I built a strong position in NVIDIA (NASDAQ:NVDA) when the most prominent generative AI tool so far (ChatGPT) was first introduced to the mass public (at the end of 2022). Since then, I’ve been very bullish on NVIDIA and have regularly added to my position.

If you’re unfamiliar with NVDA, consider it an absolute leader in the AI-facilitated semiconductor space. One could compare NVDA to the best shovel producer during a dynamic ‘gold rush’ with perspectives to accelerate and last for years. Frankly, NVIDIA offers crucial hardware for all leading technological players that keep investing heavily in the generative AI space and need top-tier products to ensure the effectiveness of its large language model (LLMs) training that stands behind such solutions.

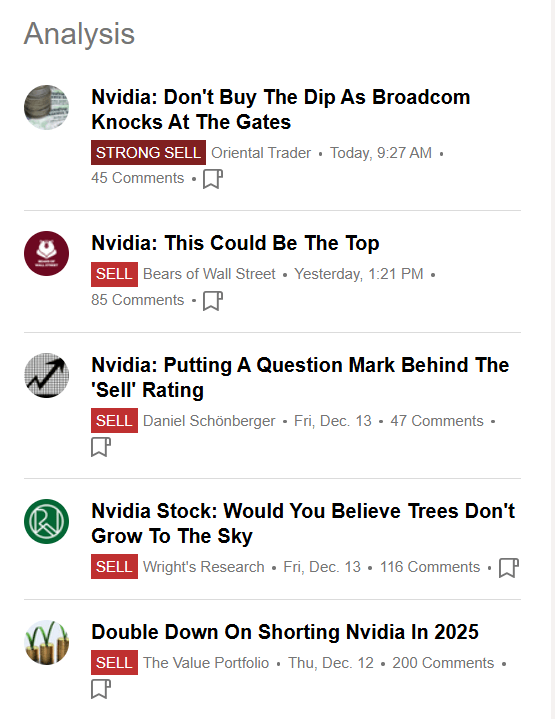

However, it comes as a surprise that the market sentiment towards NVDA has recently taken a turn, leading the stock price lower (from nearly $150 to below $130). It’s also observable among Seeking Alpha’s analysts, as the last five articles about NVDA recommend selling its shares.

Seeking Alpha

I decided to take another look at NVDA for several reasons:

- I want to tackle the most bearish arguments that keep occurring that I don’t believe to be accurate.

- There are a few updates I believe further facilitate my bullish stance on the company.

Before we get into the updates, let’s concentrate on the most bearish arguments 🙂

Dismantling The Bearish Case About NVDA

Concerns About Competition Threats Are Overblown

Many NVIDIA bears express the primary concern that the company will face intensive competitive threats in the upcoming years, as many other players (typically semiconductor businesses and hyperscalers) express a willingness to design their proprietary AI-oriented chips.

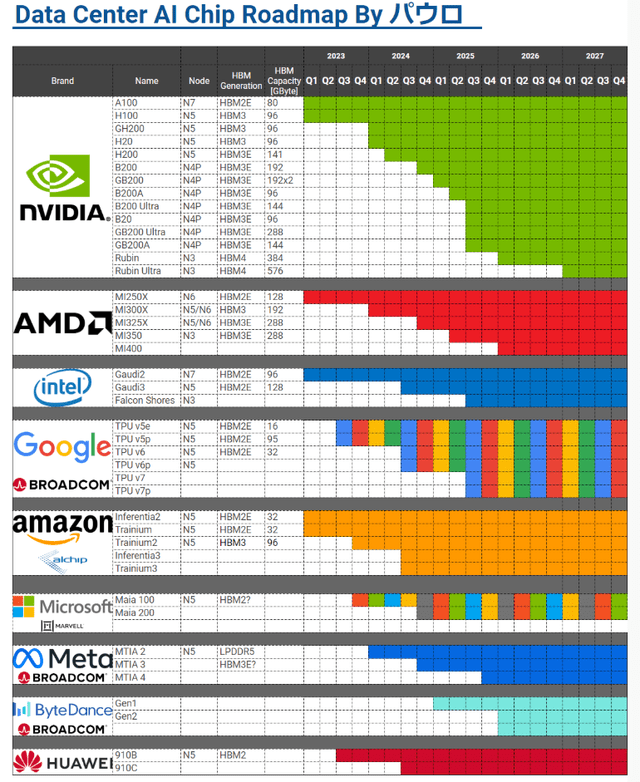

Please review the graph below to examine the pipeline of leading market players.

However, I’m willing to present another viewpoint on this matter and state that NVDA will continue dominating the space.

Firstly, the willingness to develop its own chips doesn’t change the fact that these products will still substantially lag behind NVIDIA. Let’s take even Advanced Micro Devices (AMD) as an example. AMD has provided numerous favourable comparisons of its upcoming MI325x to NVIDIA’s widely used H200 (the leading solution from the Hopper architecture). Yes, MI325x compares very well, BUT it’s still far behind Blackwell, which AMD wasn’t eager to compare to. I believe that will also be the case for other companies.

Secondly, as the graph above shows, many projects will take several quarters or years to develop. Currently, nothing compares to NVIDIA’s Blackwell solutions, and likely, even competitive solutions that are about to launch in 2025 or 2026 won’t be able to compete. Moreover, as its competitors approach the level NVIDIA has already reached, who’s to say that NVDA won’t develop another architecture set to revolutionize the industry?

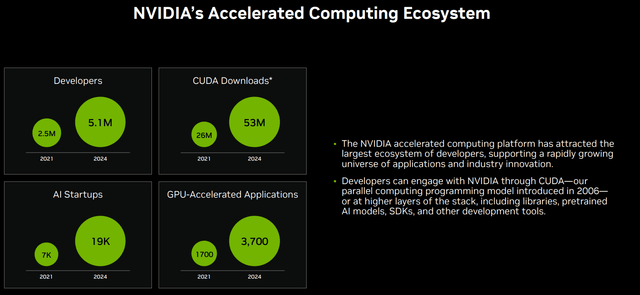

Thirdly, NVIDIA’s products are more than just hardware. We must remember that they also developed a proprietary programming platform (CUDA – Compute Unified Device Architecture), which has already won the hearts of millions of developers. It further solidifies customer retention for NVIDIA, as rewriting CUDA-based applications to other solutions wouldn’t be optimal (costly and time-consuming). Moreover, leading libraries and tools embedded within the CUDA environment incentivize developers to keep using NVIDIA’s products, as they integrate better with CUDA.

Therefore, one could say that NVIDIA’s competitors battle its state-of-the-art hardware and top-tier software solutions integrated with it that are already used globally.

I believe NVIDIA will remain the first choice due to its indisputable top-tier quality. Its leading customers have to keep up with the race to ensure the highest possible effectiveness of LLM training and, thus, the development of their AI-based solutions. The outstanding demand for Hopper and Blackwell serves as an example; consulting firms expect NVIDIA to dominate the market further (as mentioned later in the article), and the most prominent player in the AI-based software space (Microsoft (MSFT)) bought twice as many NVIDIA’s chips as its biggest competitors. To review these overwhelming numbers, please refer to this link.

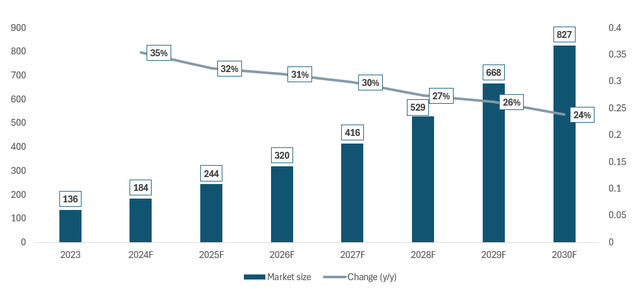

Some still believe AI is just another bubble, but the true revolution has yet to start. Don’t fail to see the big picture!

The AI revolution has just started, and leading market research agencies, such as Statista, still forecast robust growth until 2030. This signals the potential of the global AI market to reach an outstanding CAGR of 29.4% and a market value of nearly $827B.

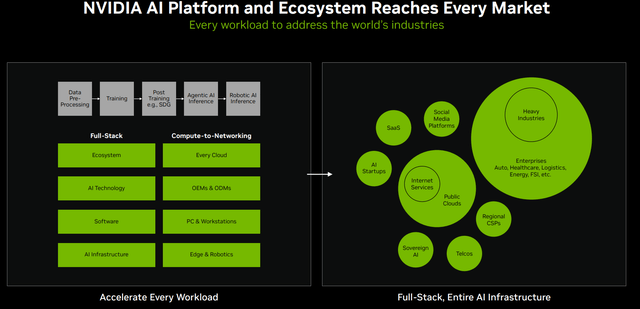

Such positive numbers may raise doubts among investors, but it’s important to realise that even now, at an early stage of global AI adoption, some leading tools (Chat GPT, Copilot, tools embodied in the AWS) have already become used daily. NVIDIA itself emphasizes that solutions created thanks to its hardware will impact each market.

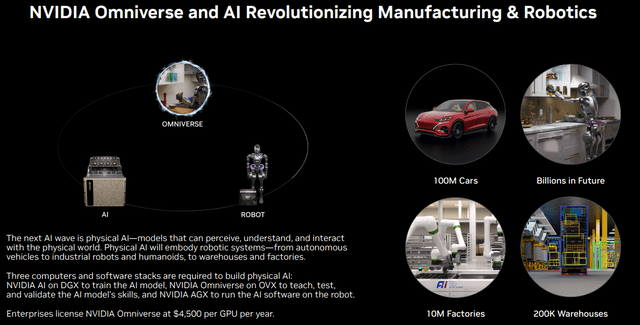

With the wave of physical AI, NVIDIA may take us to the Omniverse

Naturally, none of the above things are set to happen ‘tomorrow’. I included this page of NVIDIA’s presentation to paint a long-term-oriented picture of the paths NVIDIA still has to explore. Cars, ‘daily robots’, factories, warehouses – the scope of infrastructure that AI-driven robotic systems can impact is immeasurable.

Even with the ‘simple’ solutions that took the world by surprise since 2022, the potential to further scale AI-driven solutions, and thus, the demand for NVIDIA’s solutions is outstanding, but it’s worth recognising that there’s much more to come.

Therefore, I believe that sceptics who often present AI as a ‘bubble’ to justify their bearish cases fail to see the long-term picture. Naturally, some can have another investment strategy, but as a long-term investor, I find it difficult to find technological players better suited to the transformation we are witnessing.

NVIDIA Is Not Slowing Down: Four Updates Facilitating My Bullish Stance

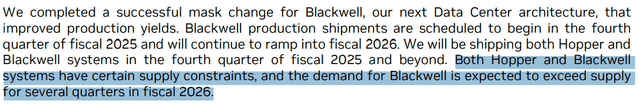

Firstly, let’s take a look at Blackwell GB200, which consulting firm TrendForce has recently analyzed. Many positive news results from the report, as TrendForce stated, show that the overall production of GPUs from the Blackwell architecture proceeds according to expectations. It’s important as the risk of potential delays is an important aspect of NVIDIA’s operations, especially given the sophisticated design of GB200 that further increases concerns about such delays.

What’s worth emphasizing, especially in the light of numerous concerns expressed by analysts regarding increasing competitive threats, is that TrendForce expects GB200 NVL72 to dominate the market:

The GB200 NVL72 is expected to become the most widely adopted model in 2025, potentially accounting for up to 80% of total deployments as NVIDIA ramps up its market push

NVIDIA realizes strategic partnerships, which further solidify its dominant market position. It was recently announced that NVIDIA collaborated with Apple to improve LLM inferencing for NVDA’s GPUs further:

This collaboration between NVIDIA and Apple, has made TensorRT-LLM more powerful and more flexible, enabling the LLM community to innovate more sophisticated models and easily deploy them with TensorRT-LLM to achieve unparalleled performance on NVIDIA GPUs

Also, NVIDIA has recently partnered with Verizon (VZ) to develop a 5G platform powered by AI capabilities. The purpose of the platform is to:

…run massive AI workloads over a secure, reliable private network on a customer’s premise.

Built to be plug & play, the new solution is capable of handling intensive applications including large language and vision AI models, as well as computer vision, video streaming and IoT.

Demonstrations of the solution are set for the first quarter of 2025. I believe such partnerships emphasize NVIDIA’s leadership in the space and the need for other major players to cooperate with NVDA to ensure top-quality of their strategic initiatives. They also gradually take us closer and closer to the earlier-mentioned omniverse that NVIDIA envisages.

Moreover, NVIDIA continues its Southeast Asia expansion and intends to open an AI R&D centre in Vietnam:

Nvidia will use the R&D center to focus on software development, capitalizing on the country’s talent pool, and to engage people and organizations to accelerate adoption of AI.

As many Asian countries compete for such investments, Vietnam is set to benefit from increased NVIDIA’s presence and use the know-how to, once again, move closer to the omniverse as the AI-based applications developed in the R&D centre will serve crucial industries in the country.

Valuation Outlook: Several Factors Justify A Solid Premium

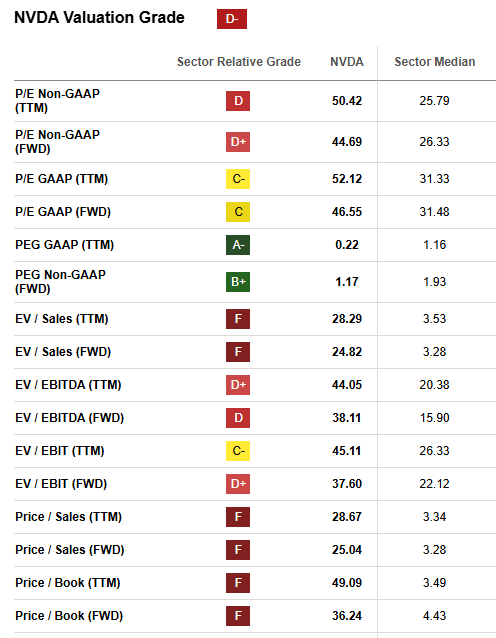

It’s hard to deny that NVIDIA is highly valued by looking solely at the numbers. Its forward-looking EV/EBITDA (the metric used for most M&A processes) is over twice the industry’s median.

Seeking Alpha

However, several facts must be considered when evaluating business valuation. Simply concentrating on dry metrics would be like failing to see the forest for the trees.

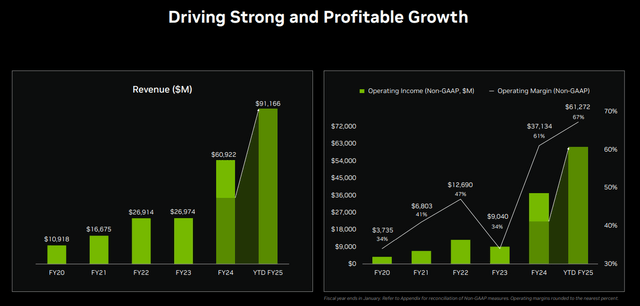

Firstly, is the business growing? NVIDIA’s FY 2024 revenue over doubled the amount generated in FY 2023. YTD’s performance for FY 2025 has already beaten the whole of FY 2024 by 50%, while the Blackwell sales (already booked for 12 months ahead) still haven’t been recorded.

Secondly, does the growth hurt profitability? Please, if you know businesses growing so dynamically at already large scale with such substantial profitability, reaching 67% operating margin during FY 2025 YTD, let me know in the comment section – I’d be happy to take a look 🙂

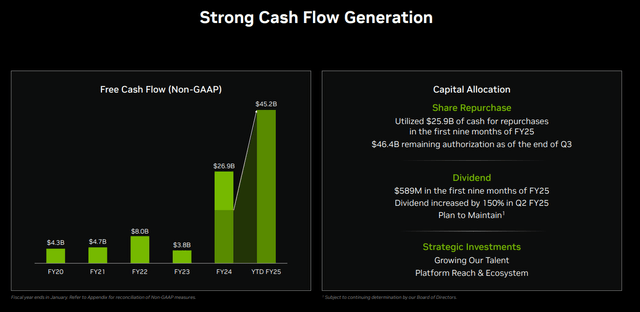

Thirdly, how’s the cash flow situation? NVIDIA is a true cash flow beast, generating $45.2B of free cash flow during YTD FY 2025 and providing its shareholders with the following:

- $25.9B of share repurchases (with 46.4B remaining to be authorized)

- $589M in dividends

during the period.

As these value drivers remain intact, I believe NVDA will continue growing into its seemingly high valuation multiples, further increasing its market cap. NVIDIA is an undisputable leader in AI and high-performance computing, facilitating operations for all hyperscalers, major cloud providers, and dozens of thousands of other businesses.

My Investment Thesis: Your Takeaway

I am bullish on NVIDIA. I’m a long-term holder who has never sold a share and kept adding regularly. NVDA holds one of the most prominent positions in my portfolio and is my largest tech holding (I intend to maintain it as the most notable tech position).

I believe that bearish cases fail to see the long-term impact NVIDIA will still have on the global business. It’s impossible to identify any other business with that scale, growing at such a dynamic pace while improving profitability, competitive position, innovative approach, and growth drivers, setting the stage for the years to come.

I’ve previously expressed a bullish thesis on NVIDIA but decided to take another look now that, despite the promising data and market outlooks it continues to provide, the bearish cases have started piling up.

I am happy to reiterate my ‘strong buy’ rating, as I’m not buying into these concerns about competition or AI being a ‘bubble’. NVIDIA’s business model is top-notch, which is reflected in its financials—well, not fully, as Blackwell-related profits have yet to be accounted for. Moreover, the company continues engaging in promising partnerships and strategic initiatives, further highlighting its market position.

I used the stock price pullback to increase my position in NVDA. Nevertheless, there are risk factors accompanying each stock market investment, which, in the case of NVDA, include:

- Geopolitical tensions and uncertainty.

- The state of the economy and FED policy.

- Risk of potential delays or inability to deliver on its promise regarding the ambitious pipeline.

- Risk of rising competitive threats, which I consider to be overblown.

- Further stock price volatility, which is common for technological players and is something that investors have to be ready for.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMD, AAPL, AVGO, NVDA, MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information, opinions, and thoughts included in this article do not constitute an investment recommendation or any form of investment advice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.