Summary:

- In my last bullish update, I stated that OXY was still undervalued despite some clear risks tied to the recent CrownRock acquisition and turbulence on the O&G market.

- From what I can see today, I think longer-term investors – and even speculators – should continue to add to their long positions, (if they hold any).

- The strategic buyout of CrownRock by Occidental for $12.0 billion marks one of the biggest additions to its shale-heavy portfolio.

- OXY should take advantage of lower crude oil and transport costs between the Permian and the Gulf Coast, which management expects to translate into $300 million-$400 million in annualized savings.

- Occidental has become even cheaper than it was 3-6 months ago. I calculate a fair value per share 32-35% higher than today’s price. Buy the dip in OXY.

Pornpimone Audkamkong/iStock via Getty Images

Intro & Thesis

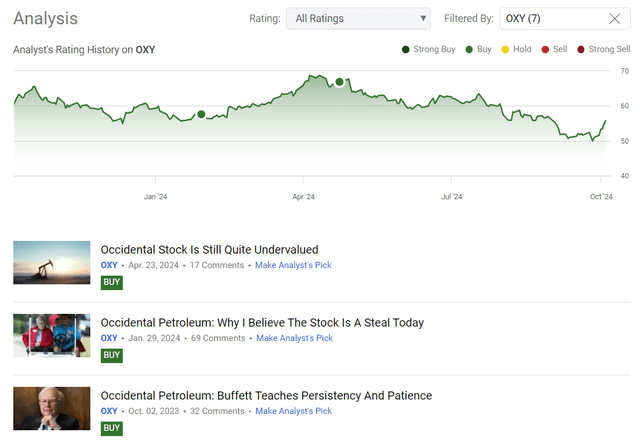

I initiated coverage of Occidental Petroleum Corporation (NYSE:OXY) stock 2 years ago with a “Hold” rating, which I upgraded to “Buy” in a few months after that initiation. Unfortunately for my bullish thesis, the stock has done poorly since that upgrade, lagging far behind the broader market represented by the S&P 500 Index (SPX) (SP500).

Seeking Alpha, my coverage of OXY stock

In my last bullish update, I stated that OXY was still undervalued despite some clear risks tied to the recent CrownRock acquisition and turbulence on the O&G market. Today I decided to update my thesis given that the company reported for Q2 FY2024 and its stock managed to fall by ~16.6% (on a total return basis).

From what I can see from OXY’s financial and operating results, I think longer-term investors – and even speculators – should continue to add to their long positions, (if they have any). In my view, OXY has become even cheaper than it was 3-6 months ago and has great potential to reward investors not only through generous dividends but also through nominal stock price appreciation.

Why Do I Think So?

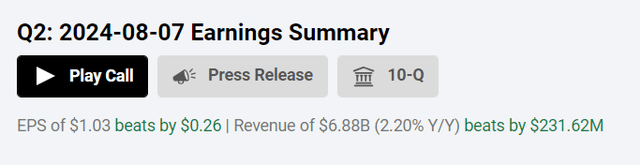

Occidental’s revenue rose 2.2% in Q2 FY2024 (to ~$6.8 billion), as realized prices for crude oil and natural gas liquids continued to rise slightly, with natural gas prices having been a significant decline though. Pretax net profit for Oil and Gas rose to $1.639 billion due to 3% production growth from the Permian and Gulf of Mexico regions, but with demand being weak and prices rising, the Chemicals segment posted a 32% drop in pretax profit. The Midstream and Marketing segment had its major turnaround, earning $116 million EBIT on “better gas transportation spreads and reduced losses in low-carbon initiatives.” As a result, the bottom line EPS beat consensus expectations massively on a relative basis:

I think OXY’s Midstream and Marketing segment should take advantage of lower crude oil and transport costs between the Permian and the Gulf Coast, which management expects to translate into $300 million-$400 million in annualized savings. Those savings will start showing up in financials by the Q3 FY2025, and full implementation by FY2026.

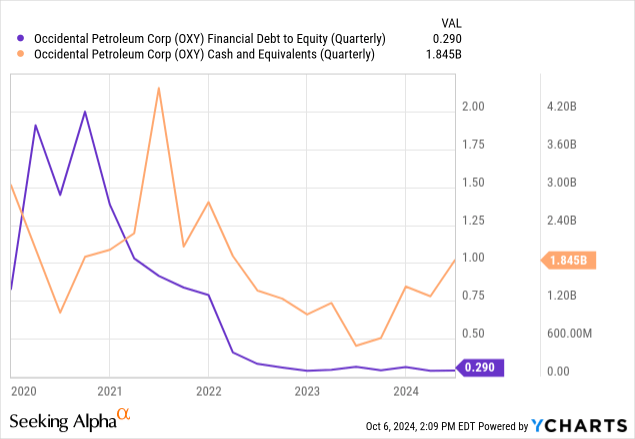

The strategic buyout of CrownRock by Occidental for $12.0 billion marks one of the biggest additions to its shale-heavy portfolio. It’s a transaction that will add ~170 thousand barrels per day of high-margin oil production in the Midland Basin and generate $1 billion in FCF within the 1st year (assuming a $70/bl WTI price). The transaction was funded by a combination of new debt, capital offerings, and takeovers of existing debt reflecting Occidental’s growth aspirations with flexibility in finances. In today’s environment, I think it’s more crucial than ever to examine a company’s balance sheet: All indicators suggest increasing stability, with a debt-to-equity ratio well below 1 and growing cash reserves.

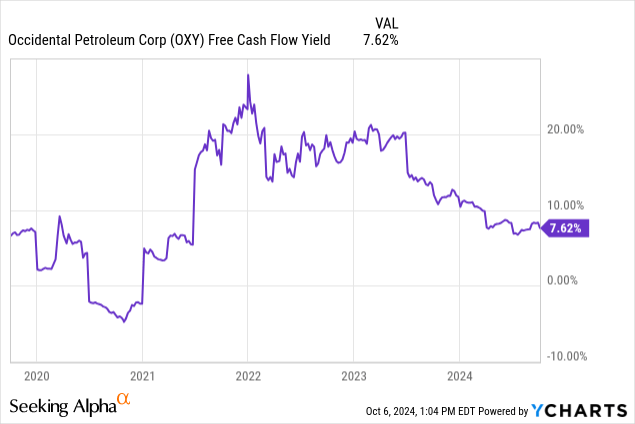

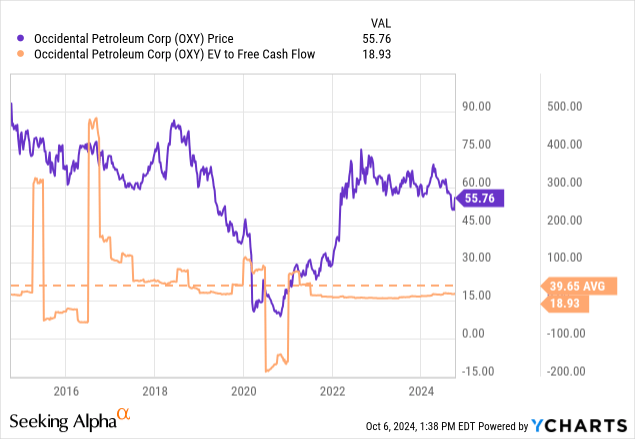

Even without the extra free cash flow that Occidental is set to generate from CrownRock’s assets and operations, the company is already producing a robust free cash flow yield. Although this metric has decreased compared to a few months ago, it remains above 7.6%, which still looks quite impressive:

Management’s reiteration of full-year production expectations and higher capital investment estimates, now expected to be $6.4-$6.6 billion, underscores their long-term outlook – their high-carbon investments and shifts from shale and exploration to more long-term activities aim to prime Occidental for strong growth in production in the decade ahead, in my opinion.

Overall, I believe that with OXY’s management’s focus on building out production capabilities and asset portfolio, anticipated cost savings, and EBITDA enhancements, the firm is well-positioned to take advantage of market conditions and the new growth prospects within the energy sector.

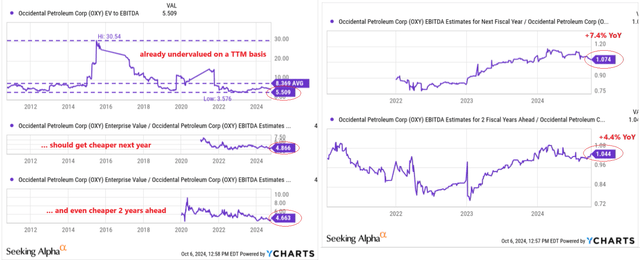

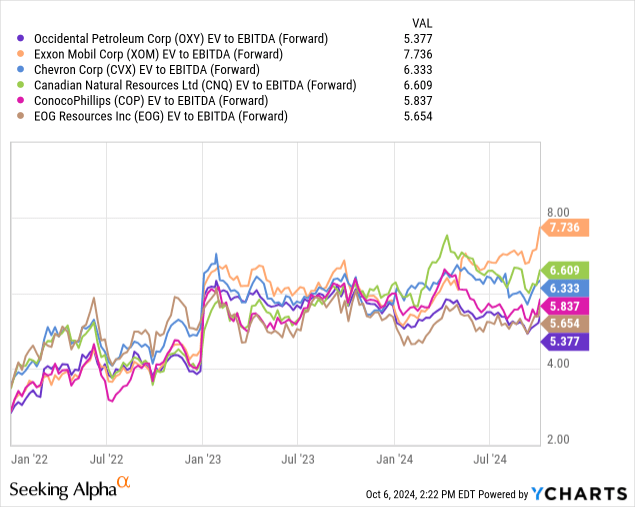

However, the market seems to disagree with my assessment, maintaining a high level of skepticism towards the company. This conclusion is drawn from the discount at which Occidental Petroleum stock is trading relative to its historical metrics. For instance, if we consider my favorite valuation multiple – EV/EBITDA – and its projected figures for the next year and two years ahead, there’s a disconnect: Despite consensus forecasts predicting continued EBITDA growth during these periods, the market is also pricing in much lower multiples for the next two years. In my view, this doesn’t entirely make sense, making OXY undervalued.

YCharts, the author’s notes added

The identified underestimation is also confirmed by comparison with other industry peers:

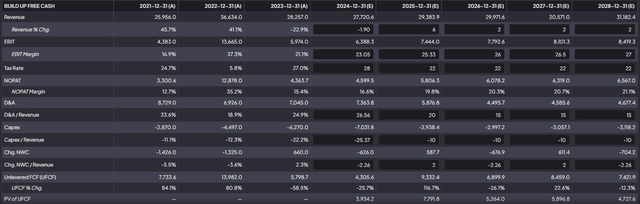

Let’s make some napkin calculations and make a DCF model for Occidental. I’ll use the consensus forecasts of the firm’s sales for the next few years ahead, but add a little premium to them (at 1-2%) as I think the expanded production amid relatively stable crude oil prices should make it possible indeed. I also assume slightly rising EBITDA margins for the next few years (nothing extreme on this front though). Taking D&A-to-sales to normal levels and assuming CAPEX-to-sales at 10% for FY2025-2028, I’m getting the following operational model:

FinChat, the author’s notes added

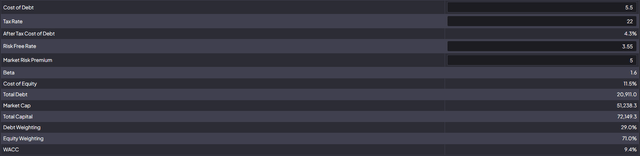

I’m assuming a cost of debt at 5.5% taking into account the industry’s risk and possible spreads to the high risk-free of ~3.55%. With an MRP of 5%, the WACC arrives at 9.4%, which I consider fair enough:

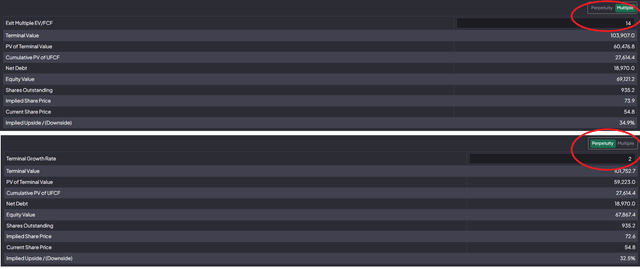

Now let’s get to one of the most controversial topics of any DCF model – terminal value calculation. The model template I use (FinChat) suggests using EV/FCF or Gordon’s growth model, so I’m going to use both to have different perspectives.

OXY’s EV/FCF multiple is almost 19x today, but for my EV/FCF-driven TV model, I’ll take 14x, which would account for the company’s maturation.

As for Gordon’s growth model, I assume a 2% growth rate in perpetuity, which is lower than the 3% accepted as a rule of thumb, but I do it on purpose to allow for risks I might have overlooked.

As a result, my DCF model says the stock is undervalued by 32-35% depending on the TV model we pick:

Based on all this, I think Occidental stock has become too cheap to ignore – the market’s “hate”, so to speak, seems unfounded to me. OXY is still a “Buy” even if the market doesn’t currently support this take.

Where Can I Be Wrong?

The risk factors that investors should carefully consider before buying Occidental Petroleum shares aren’t significantly different from those I listed in my previous article.

First of all, it’s the company’s vulnerability to fluctuations in oil prices. That’s logical – since OXY is closely tied to the oil and gas industry, changes in commodity prices can lead to big swings in share prices that affect earnings and cash flow. In addition, Occidental is dependent on the global economic situation and interest rates. An economic downturn or persistently high interest rates could affect demand for oil and gas and impact the company’s earnings.

Occidental’s recent focus on high-return core areas such as the Permian Basin and parts of the Middle East following asset sales also demonstrates a strategic shift – while this may increase earnings, it also exposes the company to regional geopolitical uncertainties, regulatory changes, and potential disruption. In addition, the debt profile will be elevated for some time, which brings further risks.

The valuation calculations I’ve made above may also prove to be too optimistic and OXY’s EV/EBITDA could fall even further. No one can know in advance how large and long-lasting the valuation discount will be.

The Bottom Line

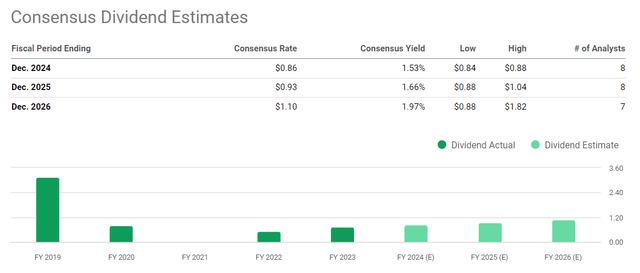

Despite the obvious risks to my thesis, I believe Occidental Petroleum is building the infrastructure for a strong future with its business strategy and improvements. The current valuation at this point and its inherent uncertainty put prospective investors on guard, and there is a lot to be worried about indeed. However, the sell-off we have seen in OXY shares in recent months appears to be overdone. According to my calculations, OXY could be 32-35% undervalued today, not taking into account dividends, which are likely to continue to rise for at least the next few years:

Based on all that, I reiterate my “Buy” rating today.

Thank you for reading!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of OXY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Hold On! Can’t find the equity research you’ve been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!