Summary:

- Occidental Petroleum’s aggressive debt reduction, including a $4 billion repayment last quarter, positions it well for future balance sheet stability and investor confidence.

- Operational improvements, particularly from CrownRock’s assets, and cost discipline are driving strong cash flow and production efficiency, ensuring steady revenue streams.

- Despite volatility risks from global crude oil prices and macroeconomic factors, Occidental’s diversification and cost management make it resilient for the coming years.

- With a P/E ratio of 13 and a DCF valuation suggesting significant upside, OXY’s current valuation appears justified, though investor sentiment remains cautious.

coffeekai/iStock via Getty Images

The energy sector has been plagued by a difficult few years, with volatile oil prices, extended geopolitical tensions, and a complex dynamic as customers and governments slowly pivot towards renewable forms of generation. Debt levels have always been high in the sector for the more traditional structure of companies, but I’ve got my eye on Occidental Petroleum (NYSE:OXY) for the next few years, as analysts now expect this debt to come down sooner than previously thought. Of course, a $27 billion debt is going nowhere quickly, but market enthusiasm can quickly move in a favourable direction if a company is able to steadily improve.

Debt Reduction Focus

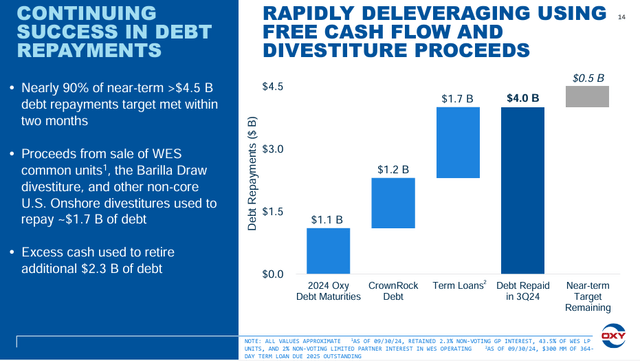

Over the last few quarters, management has really turned up the heat with debt reduction efforts. Following some fairly hefty acquisitions, most notably Anadarko for $55 billion, and CrownRock for $10.8 billion, bringing the balance sheet back onto a more stable footing has been critical. In the last quarter alone, Occidental paid back a huge $4 billion, achieving 90% of its near-term target already.

OXY Debt Reduction (OXY Earnings Report)

Various divestitures enabled this move, with about $1.7 billion coming from the sale of a stake in Western Midstream Partners (WES), and other non-core assets. The business operation also contributed significantly to this repayment, with a healthy cash flow of $3.1 billion before working capital being well-used.

These moves put the company well on track to put debt below its near-term targets over the current quarter, which may encourage investors of future investment in the balance sheet. This is clearly a priority for management, with a shareholder return priority section in the earnings presentation outlining an approach to growing dividends and share repurchases as opportunities emerge. This looks to get the overall debt levels back to about $15 billion, which feels more aligned to competitors, and historic levels.

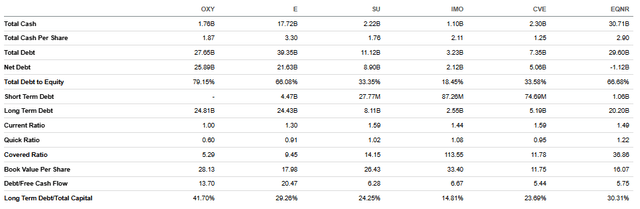

Debt Levels Comparison (Seeking Alpha)

Operational Strength Driving Cash Flow

Of course, none of these estimates or plans work if management cannot continue to grow and refine operations as the energy landscape continues to become more complicated. Expansion in key areas and cost discipline are going to be critical over the coming years.

The integration of CrownRock’s assets looks to be a major driver. With 109 Mboed, meaning 109 thousand barrels of oil equivalent per day, well are already exceeding initial expectations. Efficiencies are also being made across the company with optimized well sequencing, using existing facilities, and improvements across supply chains. Guidance of 156-165 Mboed will encourage investors that further improvements are on the way, with a steady and reliable source of production now in place for years to come.

Relying on a single project or income stream isn’t smart diversification for the company or investors though, so I’m encouraged to see cost discipline leading to domestic lease operating costs (LOE) down by 20% since last year, again by improvements in drilling cycles and efficiencies. Other basins, such as the Permian Basin, have also exceeded production targets, thanks to high levels of uptime and strong well performance.

Volatility Risks

As investors will have seen many times before, the company’s share price continues to be partly driven by the global crude oil price. While increased production helps to mitigate these pricing pressures, the macroeconomic picture still looks fairly cloudy going forward.

WTI Crude Oil Price (Trading Economics)

As always, the WTI Crude Oil price is impacted by increased U.S. shale production, potential movements in policy from OPEC, interest rate changes, and geopolitical developments, particularly relating to Russian export limits and general trade tariffs.

Wall Street forecasts a decline in crude prices in 2025, which could clearly impact the bottom line of the company, especially if global economic growth slows as expected in Europe and China. From my perspective, though, the company’s cost discipline and diversification put it in decent shape to survive whatever the next few years have in store.

Long-Term Outlook

Occidental is clearly more than just a petrochemical company after all. With OxyChem, it produces a range of vital chemicals, driving $304 million cash flow in the last quarter. Increasing demand for many of these key products, such as caustic soda and polyvinyl chloride (PVC) are reliable revenue streams, regardless of what happens with oil prices.

I’m also interested to seeing more from the company’s Stratos project. Looking to begin in 2025, it will continue the company’s leadership in Direct Air Capture (DAC) technology, capturing as much as 500,000 tonnes of CO2 per year. This is clearly a huge win for management, looking to demonstrate a genuine effort in environmental impact, and also potentially a huge revenue stream as global demand for carbon capture grows. With BlackRock (BLK) partnering with Occidental, providing $550 million of funding, this could become a core element of the business moving forward.

Valuation

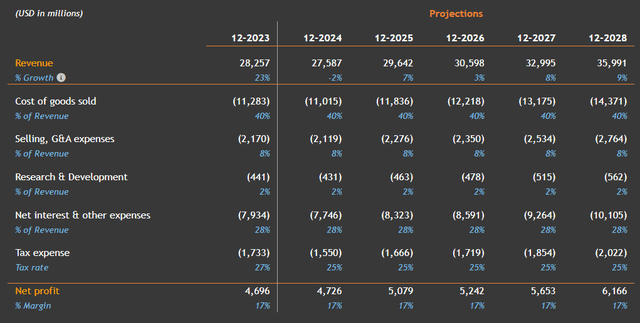

To me, the valuation could easily be higher. While many will say the enthusiasm from Warren Buffett’s investment in the company has driven it beyond fair value, a P/E ratio of 13 is hardly a premium. While slightly higher than competitor Chevron at 10 times, I’d say the company’s balance sheet reduction and operational improvements justify it.

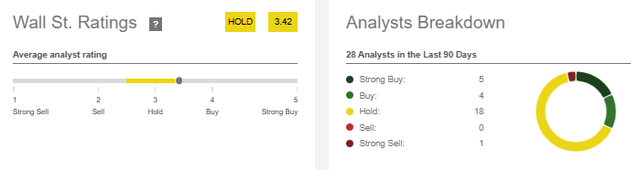

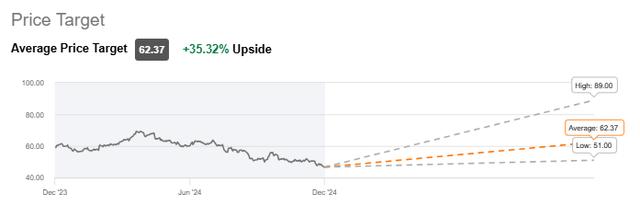

From Wall Street’s perspective, there is about 35% upside ahead. I’m curious to see as many hold ratings for the company, with such Bullishness in the average price target, but I think it reflects the ongoing uncertainty in the energy sector.

Wall St. Ratings (Seeking Alpha) Wall Street Price Targets (Seeking Alpha)

Such ratings haven’t changed much in the last few years, with the majority of analysts covering the company advising a “wait and see” strategy. I can see the reason, with management outlining plenty of reasons to like what they’re doing, but with the share price still down over 21% in the last year alone.

From my perspective, a basic discounted cash flow (DCF) calculation at a discount rate of 7.7% puts the fair price at $73.41. This is an impressive 57.5% above the current price.

OXY DCF Calculation (ValueInvesting.io)

Of course, with so many external factors impacting the company, most notably oil prices for now, I’d be more comfortable with a price target of $55, just below Buffett’s average purchase price. This would reflect a reversion to the downward trend seen in the last year and would be above some key levels of support for those looking at more technical elements of the share price.

On the Right Track

With debts being paid down aggressively, and encouraging operational signs, I think the company is on the right track for now. As much as the share price is not following the performance of the business exactly, I think there will be opportunities ahead. I’m staying on the sidelines for now, as investor sentiment and uncertainty continue to be a problem, but I think once the sector begins to turn around, Occidental has all the hallmarks of a giant of the sector both in the market and beyond.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.