Summary:

- Occidental Petroleum remains overvalued in a weaker oil market, with oil prices dropping from $90 to $70 per barrel, leading to a sell recommendation.

- The company’s cash flow is significantly weaker in a lower-priced environment, with FCF per barrel of oil production at roughly $11.

- The CrownRock acquisition, while synergistic, requires higher oil prices to be beneficial, posing a risk if prices remain low.

- Despite strong shareholder returns and debt reduction plans, mid-to-high single-digit returns are not competitive with the S&P 500.

jetcityimage

Occidental Petroleum Corporation (NYSE:OXY) is a stock we recently discussed: We were once long-term bulls, but we became a sell. Since then, the company has underperformed the market by ~15%. As we’ll see throughout this article, the company remains overvalued in a weaker market, and we remain at sell.

Market Outlook

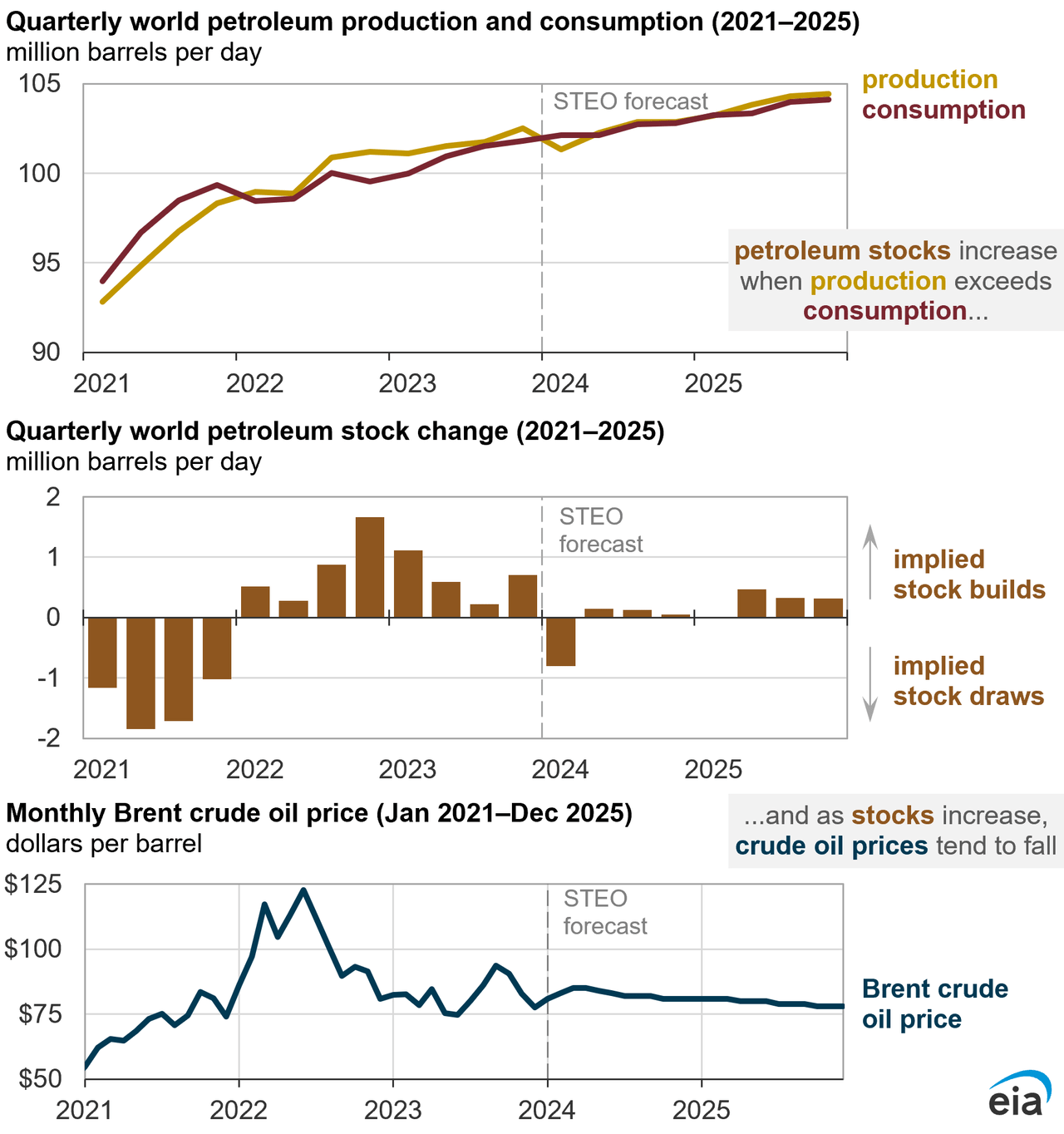

Oil prices peaked in April 2024 at more than $90/barrel and since then, they have dropped to roughly $70/barrel.

Oil production remains lofty as low-cost production continues to be discovered. At the current time, oil prices are primarily supported by production cuts from OPEC+. Current OPEC+ production cuts are roughly 3 million barrels/day and Saudi Arabia is responsible for almost 70% of those production cuts.

The Financial Times has released that Saudi Arabia is abandoning its $100/barrel price target. Saudi Arabia might have realized that cutting production simply had other producers make up the gap on the market as prices remained low, and the country might have decided that wasn’t the long-term goal financially.

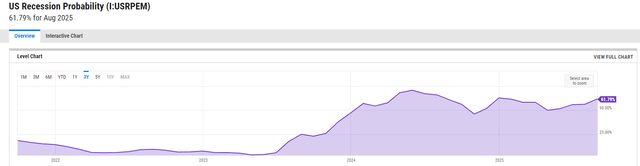

Stock builds are expected to continue into 2025. U.S. oil production is hitting record highs that have never been seen before, at 13 million barrels/day, and the U.S. is officially the largest oil producer in the world. We expect prices to remain weaker for longer in this environment, where plenty of low-cost production is being found.

At the same time, primarily due to rising interest rates, recession odds are high. While rates have started to be walked down, that’s a continued risk. The chance of a recession could be another factor that has a major impact on oil demand, especially as we’re in one of the longest bull markets that has been seen for a while.

That could be another risk for Occidental Petroleum’s future returns.

Occidental Petroleum Cash Flow

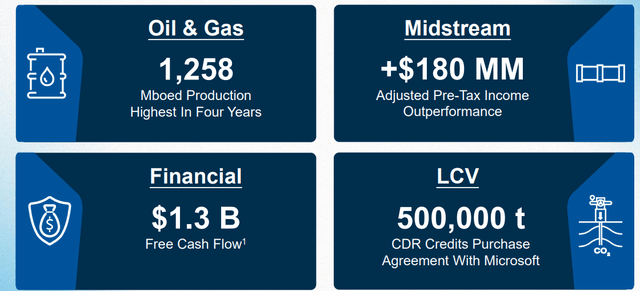

Occidental Petroleum earned more than $5 billion in annualized FCF in the most recent quarter (annualized), a ~10% FCF yield, with Brent >$80/barrel.

Occidental Petroleum Investor Presentation

We discussed the company’s earnings in detail in our last article. However, the key takeaway here is that the company’s quarterly production is more than 100 million barrels/quarter. The company’s FCF per barrel of oil production is roughly $11/barrel ($5 billion annual FCF/450 million barrels annual production). While the company has costs that don’t scale linearly with prices, and its inventory breakeven is <$40/barrel, there’s still risk.

In a lower-priced environment, the company’s cash flow potential is much weaker.

Occidental Petroleum CrownRock

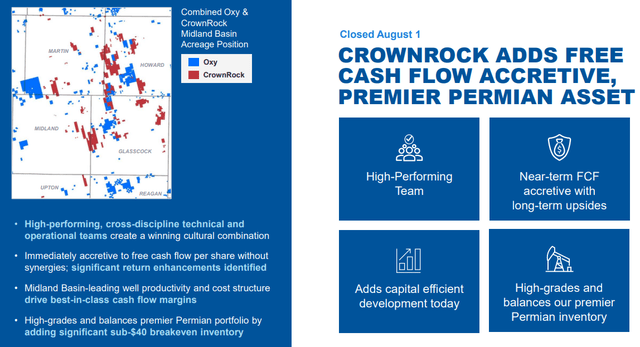

The company is acquiring CrownRock in a $12 billion acquisition, an acquisition in the company will issue <$2 billion in debt.

Occidental Petroleum Investor Presentation

It’s an intelligent acquisition that synergizes well with Occidental Petroleum’s portfolio of assets. The investment is expected to generate $1 billion of FCF starting in 2025 at $70 WTI (several $/barrel above current prices). However, while the acquisition is impressive, and the $10 billion in debt is manageable, it’s still one that needs higher prices.

The FCF from the transaction is based on 62 million barrels in annual production, which is $15/barrel. That breakeven of $55/barrel WTI could put Occidental Petroleum in a similar position to where it was during the 2020 oil price recession where debt was balanced with a substantial drop in prices. That’s a concern with prices remaining weak.

Occidental Petroleum Shareholder Returns

Occidental Petroleum remains committed to shareholder returns, and we expect that to continue, but the company’s FCF has room to fall.

Occidental Petroleum Investor Presentation

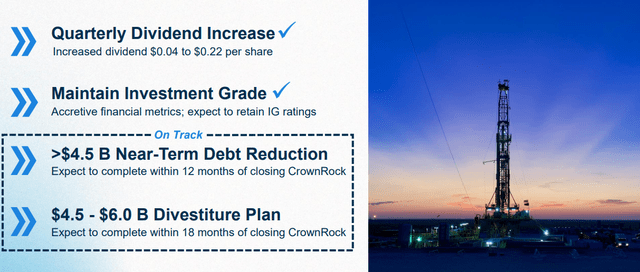

The company has a dividend yield of more than 1.7% and an investment-grade credit rating that it can comfortably afford. The company is putting its FCF along with divestments toward debt reduction and expects an almost $6 billion divestiture plan to be able to support >$4.5 billion in near-term debt reduction for the company.

The company’s shareholder returns are at a level it can comfortably afford, but mid-to-high single-digit returns aren’t worth investing in over the S&P 500. Additionally, with prices dropping, there’s the risk of a much stronger decline for the company.

Warren Buffett Factor

As long-term bulls for Occidental Petroleum, prior to our recent shift, we were well aware of the company’s history. The company’s 2019 Anadarko Petroleum acquisition came with support from Warren Buffett through both preferred equity yielding 8% (some of which were paid in shares) and additional options that Warren Buffett received.

Since then, Warren Buffett bought equity when the company was attractively valued, building up a 29% stake. That doesn’t count his warrants, which could increase his stake by 10%, or his continued preferred equity stake of roughly $10 billion. However, after regularly buying up equity during dips he hasn’t bought any since June despite lower prices.

While there are lots of reasons why that could be the case, Berkshire Hathaway does have the largest cash pile in its history. Clearly, he seems to think the thesis has changed if he’s no longer willing to buy at a price he once was, and that’s something we agree with. That’s another indication that the company is still overvalued given it’s a price the company invested at before.

Thesis Risk

The largest risk to our thesis is that Occidental Petroleum has an impressive portfolio of assets with a market cap of almost $50 billion. The company produces more than 400 million barrels of oil per year, and in a high-priced environment, its ability to drive profits is much higher, which can support future shareholder returns.

Conclusion

Occidental Petroleum is a company that we have discussed recently, and since then, several articles have come out arguing that with recent weakness the company is worth investing in now. The company has underperformed the market by ~15% since our last article 1.5 months ago recommending against investing.

Going forward, with the continued risk of oil prices remaining weaker for longer, and the amount of debt the company has taken on recently, we recommend against investing at this time.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated, and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.