Summary:

- Occidental Petroleum completed a $12 billion acquisition of CrownRock, but shares have dropped 24.2% in recent months while the S&P 500 rose 14.5%.

- Management’s focus on debt reduction, including asset sales, adds complexity to an already complex situation.

- The firm should generate significant cash flow moving forward, but this doesn’t make it an appealing prospect at this point in time.

- Despite some growth potential, Occidental’s current valuation and leverage ratios suggest limited upside, making a ‘hold’ rating appropriate.

jetcityimage

One of the largest energy companies out there today is none other than Occidental Petroleum (NYSE:OXY). Earlier this year, the company got quite a bit larger when it completed its acquisition of CrownRock in a stock and cash transaction valued at $12 billion. I initially wrote about this transaction when it was announced in December of 2023. But it wasn’t until the beginning of August of this year that the deal was finally completed. By that point, I had already written a subsequent article, published in April, in which I decided to downgrade the business from a ‘buy’ to a ‘hold’. This was based largely on the company’s valuation. And it does seem as though I was perhaps too generous with that rating. Since then, shares have fallen by 24.2% while the S&P 500 has gone up by 14.5%.

Given this significant drop, I figured it would be a good time to re-evaluate the situation. But this decision to revisit the firm was driven by more than the price decline. It was also influenced by new guidance that the company came out with. This guidance does factor in growth attributable not only to the aforementioned acquisition, but also to an asset sale that the company is working to complete by the end of the third quarter of this year. This creates a lot of uncertainty, especially because management has not provided much in the way of detail. However, after plugging through the data myself, I was able to have a solid idea as to the value of the business and its investment prospects. I do believe that the market was wrong for pushing the stock lower in recent months. But I wouldn’t go so far as to upgrade it to a ‘buy’ just yet.

A new Occidental Petroleum

For all intents and purposes, Occidental Petroleum is a very different company today than it was a year ago. In my article from December of last year, I provided a deep discussion regarding the firm’s acquisition of CrownRock and the impact that would have on shareholders moving forward. However, a lot more has changed since then. Part of this is because management’s decision to focus on debt reduction, not just by using cash flows, but by also selling off various assets. Over the 12 months following the close of the transaction that saw the company pick up CrownRock, it plans to reduce debt by over $4.5 billion. This should be done using between $4.5 billion and $6 billion of asset divestitures completed within 18 months of the close of the deal.

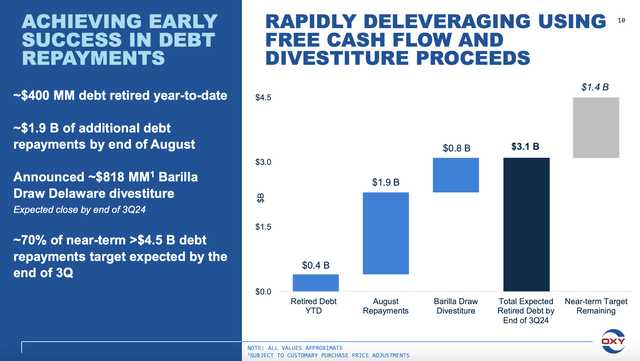

Occidental Petroleum

Management has already been working on that with ferocious speed. When they announced financial results for the second quarter of the 2024 fiscal year, they stated that they planned to pay down $1.9 billion worth of debt in the month of August. This was presumably done with cash on hand. However, the company also announced earlier this year its Barilla Draw Delaware divestiture. This will see overall output drop by roughly 15,000 boe (barrels of oil equivalent) per day. But in exchange, the company will get $818 million to use for debt reduction.

Occidental Petroleum

For the purpose of analyzing the company, I will assume that these near term plans will bear fruit. Because of that, I decided to reduce debt by these amounts. I also decided to factor in the 77.3 million shares that holders of some of its warrants can get at a strike price of $22 per share. This is because the stock is meaningfully higher than this. I did not assume any impact involving the more expensive warrants since those are not currently in the money. But including the cheaper warrants does reduce net debt by $1.70 billion on a pro forma basis. However, I did not make any other adjustments to the balance sheet when structuring this article since we don’t know at what cost, in terms of reduced production or a change in cost structure, additional asset sales will come at.

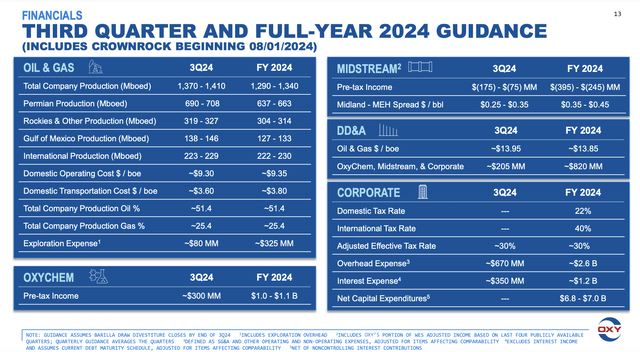

Occidental Petroleum

I wish that management provided more detail about what the future holds. But the best thing we really have is their guidance for the 2024 fiscal year as shown in the image above. Seeing as how we won’t see the latest asset sale be completed until the end of the third quarter, it’s really only the final quarter of this year that shows what Occidental Petroleum should look like with all of the transactions the company has been completing factored in. Stripping out historical results for the first half of this year and management’s guidance for the third quarter of 2024, we can see, on a daily basis, what production for oil, natural gas, and NGLs for the company should look like. All combined, the company should be responsible for about 1.413 million boe of output per day.

To keep things simple and since we are at the tail end of the 2024 fiscal year, I’m going to be forward-looking for 2025. There are some unknowns that we can’t get insight into it’s because of a lack of guidance, such as what operating costs domestically should look like on a per boe basis. So to keep up with the spirit that management is focusing on capturing further cost synergies, I mostly relied on estimates for the third quarter of 2024 with the understanding that those might overstate future expenses.

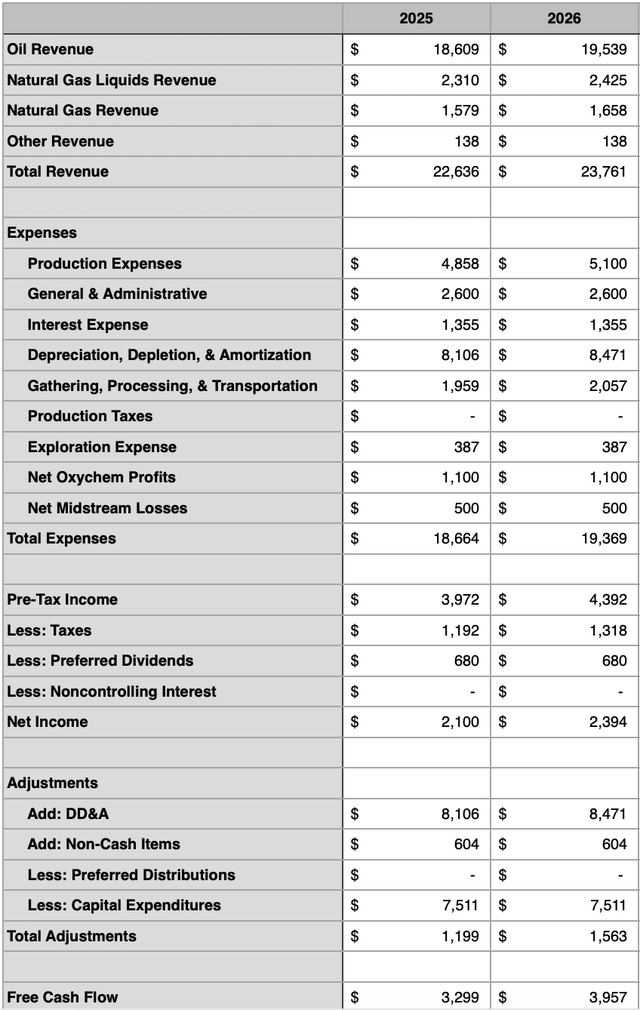

Author – SEC EDGAR Data

Using all of these adjustments and assumptions, you can see, in the table above, projected revenue through free cash flow for the company for its 2025 and 2026 fiscal years. I made the assumption that 2026 production will be 5% higher than 2025 will be. The first thing you might notice when comparing my calculations to the estimates that management provided when it came to free cash flow when incorporating the CrownRock acquisition is that my free cash flow for the business is quite a bit lower.

Part of this is likely because of the aforementioned asset divestiture that will negatively impact revenue. But the bigger thing relates to an adjustment that I make to free cash flow in these types of cases. I understand that preferred stock distributions are not an operating cash flow item. However, they are almost always required payments, and I believe that removing these from the picture gives a more accurate view of the company as things stand. Adding the $680 million of preferred distributions back to my $3.30 billion of free cash flow would give a reading of $3.98 billion. That’s only $220 million lower than the $4.20 billion that management forecasted with the same $70 per barrel oil price. This disparity amounts to only about 5% of overall cash flow and can likely be found in differences in cost estimates. But in the grand scheme of things, it’s not a terribly significant difference.

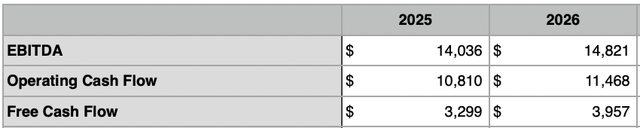

Author – SEC EDGAR Data

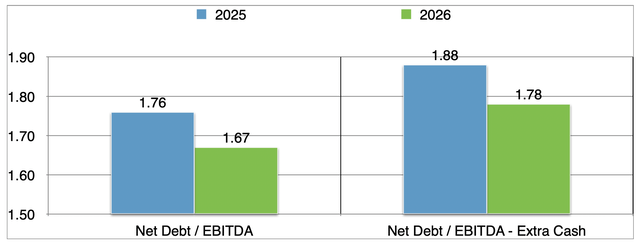

At the end of the day, I would argue that free cash flow is the most important metric to take into consideration. But there are others that matter as well. In the table above, you can see operating cash flow and EBITDA calculated for Occidental Petroleum for the 2025 and 2026 fiscal years. These are naturally considerably higher than the free cash flow readings would be. Before we get into valuing the company, I would like to use the EBITDA that I calculated for the company to look at its net leverage ratio. After all, the debt picture has changed significantly because of these latest moves. In the chart below, you can look at two different scenarios. The one with the lower net leverage ratio for 2025 and 2026 adds in the cash from the exercise of the warrants that are currently in the money. But there is no guarantee when these will be exercised. So the second scenario shows the net leverage ratio without this cash factored in. This would be more appropriate at this time.

Author – SEC EDGAR Data

Generally speaking, the market prefers a net leverage ratio for companies like this to be 2 or lower. And in all honesty, Occidental Petroleum is tilting toward the high end of this range. This is not to say that there is some issue with the leverage exceeding this. If the company is growing nicely and is generating robust cash flows, readings higher than this can be tolerated. But it does paint a picture of a business that, if energy prices drop considerably, might have to make some difficult choices regarding production and/or assets. These are the levels that I would say investors should be cautious about, but not necessarily view as a dealbreaker from an investment perspective.

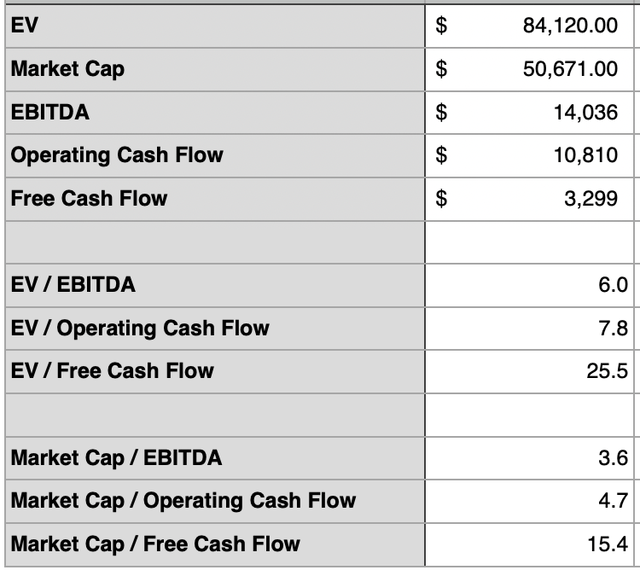

Author – SEC EDGAR Data

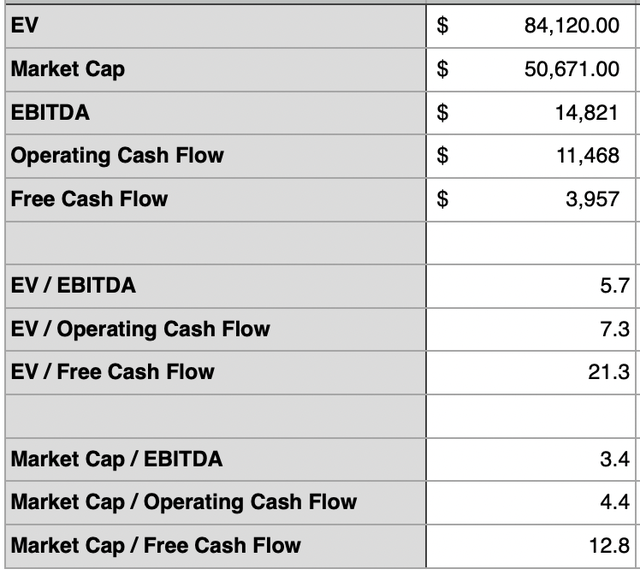

Author – SEC EDGAR Data

Keeping this in mind, I would like to then point you to the first table above. In it, you can see how shares are currently priced in a couple of different ways. One of the most important for investors in this market is the EV to EBITDA multiple. In this case, we get a reading of 6. From what I have seen in the energy space, readings of 4 to 6 are quite typical at this point in time. So Occidental Petroleum does appear to be near the higher end of that range. Using the estimates for 2026, as shown in the second table above, you can see that the enterprise is a bit cheaper. But compared to other firms that I have seen in this market, it’s definitely not a value play.

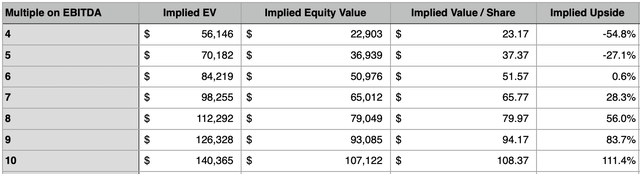

Author – SEC EDGAR Data

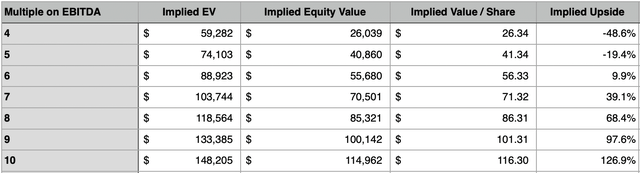

Now that we know how shares are currently valued, we should ask ourselves what kind of upside potential, if any, the company should offer to investors. In the table above, you can see what the company would be worth at various EV to EBITDA multiples beginning at 4 and ending at 10. You can see the implied upside for shareholders at each of these points. Unless we expect the company to trade at an EV to EBITDA multiple of at least 7, upside seems to be severely limited. In the table below, you can see the same thing for the 2026 fiscal year. In this scenario, the upside potential is greater. But it’s really not enough to interest me.

Author – SEC EDGAR Data

Takeaway

At this point in time, Occidental Petroleum is an exceptionally difficult company to assess given all the changes that are going on. I feel confident in my model because I came within striking distance of management’s pro forma estimate for free cash flow at the same price for crude oil as when they came out with their presentation regarding the acquisition last year. When deciding whether or not an opportunity is worth buying into, I really will only pull the trigger when fundamentals are so good and shares are so cheap that even if things go wrong, the upside potential should be attractive. And in all honesty, I really don’t see that here. I see a solid business that has had its upside. Of course, there could be other catalysts, such as its emphasis on clean energy. But at this point in time, it’s too early to know what that will turn into. Ultimately, I feel like this makes the ‘hold’ rating I assigned the stock previously appropriate.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!