Summary:

- Occidental Petroleum beat third-quarter estimates.

- TExpansionist monetary policy and low-interest rates may initially boost the stock market, but prolonged policies risk future economic challenges.

- Occidental received $500 million for its low carbon venture, enhancing its strong secondary recovery business and future profitability.

- Financials include non-operating items from acquisitions and sales. These sales cost some future income that the acquisition must recover.

- The CrownRock acquisition benefits and the anticipated natural gas pricing recovery enhance the future potential of these shares.

bjdlzx

Occidental Petroleum (NYSE:OXY) reportedly beat estimates with the third quarter results. But there were a lot of offsetting items that had nothing to do with operations in the quarter. With a large acquisition having been completed as well, there is a whole lot more optimizing activities not really related to the recurring results investors look for. The benefits will come next. So, the currently sagging stock price may be an opportunity to either initiate a position or add to the position you have. On the other hand, there may be too many one-time items to make the fourth quarter report very meaningful.

My Paul Samuelson textbook “Economics” tells me that the expansionist monetary policy that was followed by the incoming administration combined with low-interest rates should initially send the stock market soaring. Last time around, that left no good choices when the COVID challenges appeared and inflation resulted. But even without COVID, like the year 2008 for example, an expansionist policy that goes on too long brought on 2008.

So, while the good news comes first, we may pay for an easy money policy if we are not careful. If this last election was any indication, we do not like paying for it either. The future has yet to unfold, but it looks pretty good right now. Ideally, we should run budget surpluses as Bill Clinton did in the general budget in the good times, so there is a reserve for those other times.

This helps the stock market long-term at the expense of a short-term runup.

Last Article

The last article mentioned that the company received $500 million for its low carbon venture. This is something that is likely to turn quite a profit for Occidental when secondary recovery for all of these unconventional wells becomes necessary.

Some may know that Occidental has long run one of the largest EOR businesses in North America. They have a very long history of low-cost secondary recovery.

Reconciling Items

The financials are getting a lot of nonoperating items as part of the reporting. This time it looks like they cancelled each other out. But any time a large acquisition closes as was noted in the last article, then there are a lot of optimizations, and closing related costs that will complicate the reported results for a few quarters.

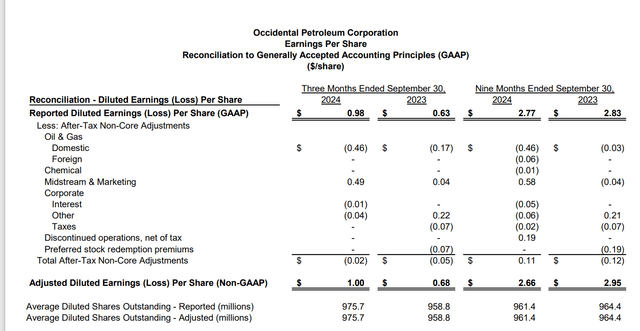

Occidental Petroleum Reconciling Results Third Quarter 2024 (Occidental Petroleum Supplemental Non-GAAP Reconciliations Third Quarter 2024)

The first big item was a loss on the sale to (primarily) Permian Resources (PR). That was offset by a gain on the sale of shares of Western Midstream (WES). While these items cancel, it is important to note that they happened as the sale resulting in a loss sold some production while the sale that was a gain will reduce distribution income from the midstream in the future. The acquisition has the additional burden of overcoming potentially lost income from the sales to show hoped-for earnings per share progress.

Occidental has largely met its debt goal with the help of these sales. It says something about the faith that management has in the acquisition to state that the acquisition will enable the company to show earnings progress even with sales like the ones shown above.

Lower Per BOE Costs

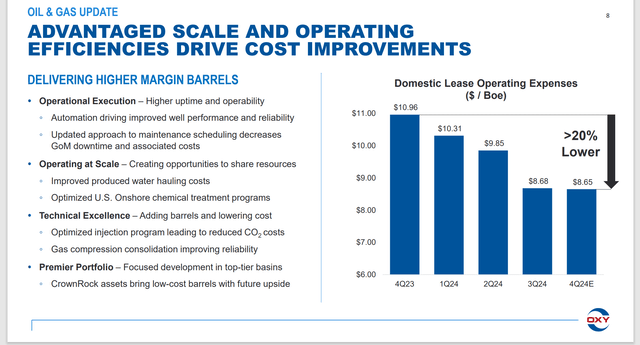

Probably the biggest part of lowering the BOE operating costs is the fact that the acquisition already has lower costs and therefore will lower the corporate average just by becoming part of the corporation.

Occidental Petroleum Operating Cost Efficiency Gains (Occidental Petroleum Corporate Presentation Third Quarter 2024)

That makes the lowest statement on the left-hand side of the slide very important. Now also important is that management intends to build upon that acquisition advantage by expanding that efficiency advantage in the future.

There are a lot of managements out there that find geology with a cost advantage and above-average profitability. They then drill it, knowing that they will get good results and pay a dividend to meet Mr. Market’s demand for return of capital. Shareholders never find out until the company gets acquired what the possibilities are. Clearly, Occidental does not buy that line of reasoning.

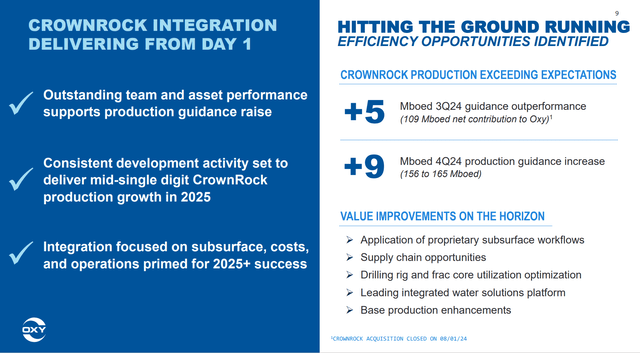

Occidental Petroleum Initial CrownRock Results (Occidental Petroleum Corporate Presentation Third Quarter 2024)

Already the company has more production than forecast production from the acquisition as shown above. This is yet another way to lower operating costs (higher production is cheaper to deal with on any well).

Note that this management is taking a good situation and making it better. That indicates a detailed orientation and also a “hard driving” attitude that is very hard to find.

Fourth Quarter Guidance

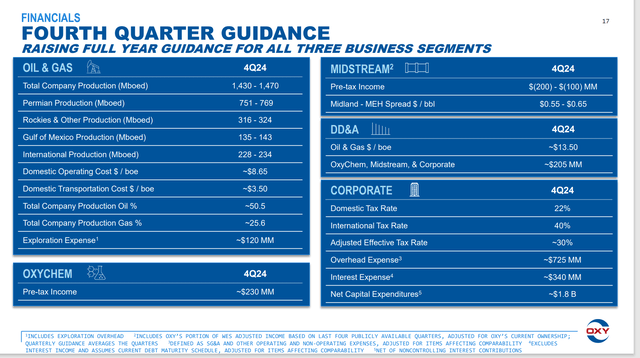

The guidance nearly always focuses upon the recurring business.

Occidental Petroleum Fourth Quarter 2024 Guidance (Occidental Petroleum Corporate Presentation Third Quarter 2024)

The reduction in operating cost per BOE is likely a straightforward average given that the acquisition had lower costs. What will be interesting to see is what management can do with those costs in addition to that straightforward calculation.

The other thing to consider is that this company will be a beneficiary of the expected natural gas pricing recovery because it produces a lot of natural gas in North America. That is something that could make the current price of the stock appear to be fairly cheap.

Summary

Occidental acquired CrownRock when that closing occurred in the third quarter. Since then, the optimization has begun. When that is combined with the dispositions that also caused non-recurring charges, it is clear that the third quarter had a lot of non-recurring items. The fourth quarter is likely to be loaded with one-time expenses as well.

Operating expenses should continue to have some extra items for up to a year because any acquisition needs optimization that usually involves spending money somewhere first to get the benefits next.

When this is combined with weak natural gas prices, that makes the next quarter a quarter to forget. But then again, companies tend to lump all the costs in a period with low prices to “clear the decks” for when the good times arrive. Clearly, this acquisition had some incredible timing to close when natural gas prices were weak, and the industry is still waiting for a natural gas pricing recovery.

The oil price outlook is also somewhat pessimistic. However, right now, the price obtained for oil is a price we were all “praying for” back in 2020. To me, it is something else that current prices and likely future prices are viewed now as “weak”. It just shows how much things have changed since 2020.

Occidental remains a strong buy as the CrownRock acquisition will show earnings benefits. Additionally, the company should benefit from the coming natural gas pricing recovery. Additional efficiency gains will be “icing on the cake”.

The immediate debt repayment goal has mostly been met. There is not much left to pay down to meet the goal.

Risks

Any upstream company is exposed to the low visibility and volatility of future commodity prices. A severe and sustained downturn of those prices could materially change the future of the company. This company does have investment grade rated debt. So, it should outperform much of the industry in such a hostile situation.

The loss of key personnel in a large company such as Occidental is not as significant an issue as it is for smaller companies. However, there could be an especially talented individual that could be hard to replace if they left.

The CrownRock could fail to meet one or more expected goals as the optimization process proceeds. Occidental has a long history of successful acquisitions. That should reduce this risk. But it will not eliminate it.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of OXY OXY.WT PR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor, and this article is not meant to be a recommendation for the purchase or sale of stock. Investors are advised to review all company documents and press releases to see if the company fits their own investment qualifications.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

I analyze oil and gas companies like Occidental Petroleum and related companies in my service, Oil & Gas Value Research, where I look for undervalued names in the oil and gas space. I break down everything you need to know about these companies — the balance sheet, competitive position and development prospects. This article is an example of what I do. But for Oil & Gas Value Research members, they get it first and they get analysis on some companies that is not published on the free site. Interested? Sign up here for a free two-week trial.