Summary:

- Occidental Petroleum recently declined to multi-year lows when oil prices fell below $70.

- Current oil prices are the lowest seen since 2021.

- Most signs (output, demand and others) indicate that if a recession doesn’t happen soon, then oil prices will rise.

- Some concerns that people have about demand for oil aren’t supported by data. For example, China’s economy is growing and China is consuming rising amounts of oil (though the pace of growth is decelerating).

- In this article, I explain why I’d be willing to take a small position in OXY today.

Warren Buffett: a major Occidental Petroleum shareholder.

Jamie McCarthy

Occidental Petroleum (NYSE:OXY) recently declined to a multi-year low of $50.66 after oil prices dipped to $61. The decline was not the first big one in recent years???there was a similar selloff near the end of 2023???but this selloff took OXY to fresh new lows not seen since early March 2022, before the Russian invasion of Ukraine that kicked off that year???s oil bull market.

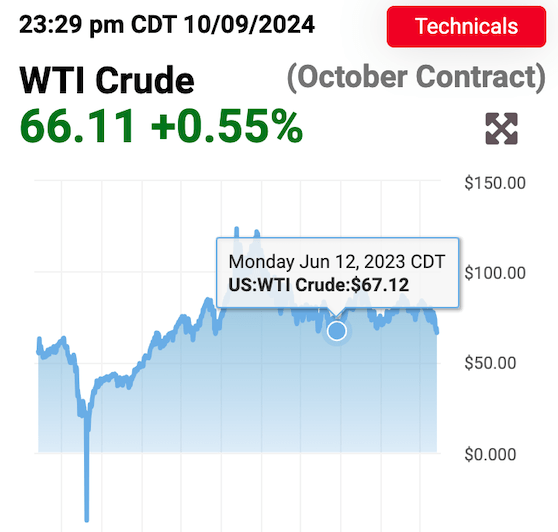

On Tuesday, when I saw that oil prices had fallen to unexpected lows, I went on Seeking Alpha to check the prices of stocks that I thought might have been affected by the oil price selloff. Sure enough, I saw that OXY had fallen to fresh new lows. Surprisingly, the stock continued selling off on Wednesday, even though oil prices recovered on that day. I found that interesting because the lows that the price of oil itself fell to recently were not unprecedented for the post-2021 period???WTI crude went to $67 in June of 2023 (see image below). OXY only fell to $56 at that time.

WTI Crude Prices (Oilprice.com)

It???s not entirely clear what caused OXY to experience such a massive price drop in response to the decline in oil prices. The liability side of the company???s balance sheet and the cost side of its income/cash flow statements both seem to be improving. For example:

-

Net debt is declining. It is down 49% from the 2020 peak and down marginally from the most recent fiscal year.

-

Interest expense is also declining. It???s down 45% from the 2020 peak (though up marginally from the most recent fiscal year).

-

The dividend payout ratio is trending downward.

These are all positives that Occidental Petroleum has in its favor.

Granted, the company has issues too. For example, current oil prices would provide it with less profit and free cash flow than was seen in past years; as a pure-play E&P its earnings are a direct function of the price of oil. The company breaks even at about $40 crude; it made $4.6 billion in 2023 with oil prices averaging $82; and its trailing 12-month interest, SG&A and ???other operating expenses??? were barely changed from the 2023 period. So we???d expect dramatically lower profits this year if current oil prices hold. There is no imminent risk of the company becoming unprofitable; but, a further decline in earnings, following the already steep decline in earnings in 2023, is a real possibility.

The question is whether oil prices are actually likely to remain at the current levels. The recent decline in prices was apparently due to hedge fund managers and other speculators making price bets; it was not attributable to ???on-the-ground??? market dynamics. From the early 2024 period to today, hedge fund long call volume declined from over 500,000 lots to just 139,000. According to CME Group, total crude oil option volume has varied between 694,900 lots and 1.34 million lots over the last two months (a ???lot??? is 100 barrels of oil). So, the decline in bullish bets from hedge funds was a sizable percentage of the change in options volume recently.

This means that at least one of the factors driving oil lower is unlikely to hold up long term. Hedge funds??? bets are not reflective of supply and demand from producers and consumers: such speculative influences on demand and supply tend to change more quickly than ones rooted in production. Therefore, it seems likely that oil prices will bounce back from their current slump???at least if we avoid a recession in the near term.

The last time I wrote about Occidental Petroleum, I gave it largely bullish coverage because of what I believed to be the long term health of the oil market. That call ended up being fairly badly timed, underperforming the S&P 500 since I wrote it. However, considering OXY again today at these fresh new lows is a very different question. We are now looking at some of the lowest oil prices seen in the last 52 weeks, driven largely by speculation. It seems likely, therefore, that the oil market will get back in gear and take OXY along for the ride.

Oil and Gas Supply Dynamics

As I explained previously, a primary reason for the recent decline in oil prices was hedge funds and money managers changing their directional bets on the commodity. Price moves were not strongly driven by on the ground supply and demand dynamics. OPEC did hint at a production hike at a future meeting, but is backpedalling now because of the recent price rout. Specifically, it is delaying output hikes that were meant to kick in the next month, to December.

So, the lower prices have delayed a primary catalyst expected to take prices lower still. This lends credence to the idea that oil prices are heading higher in the near term.

Second, there are long-term dynamics implying that the oil market will be relatively healthy going forward. Economic growth in the U.S. remains strong, with GDP having grown 5.8% in the second quarter. It???s the same growth story in China, with GDP up 5.2% in 2023 (at least in Yuan terms, USD denominated growth was weaker). China???s demand for oil, although decelerating, is still growing, at a rate of 200,000 barrels per day. Meanwhile, the U.S. Energy Information Agency estimates that global oil consumption will continue to rise???albeit slowly???this year.

So the demand side for oil appears healthy. The supply side, of course, is where the problems are. Western countries have been pumping out oil to offset OPEC???s cuts, which led to some of them sitting on too much supply. However, ???supply glut??? doesn???t characterize the global situation. Globally, supply is still held back by last year???s OPEC cuts.

So, oil prices are likely to be relatively healthy in the near term. With that information, we can estimate what Occidental Petroleum will earn if oil prices revert to the long-term mean.

What OXY Will Earn if Oil Bounces Back

In 2024 so far, oil prices have averaged about $79. If prices mean revert to that level, then Occidental Petroleum???s earnings from the fourth quarter onward should be similar to those seen in the first and second quarters. As mentioned previously, OXY???s interest, S&G and ???other operating expenses??? haven???t changed much in the last year; therefore, oil prices should be the dominant factor in how much the company earns in the near term.

So, what did OXY earn in Q1 and Q2?

According to Seeking Alpha Quant, the relevant earnings and operating cash flow (???OCF???) figures were those shown in the table below:

|

Second quarter |

First quarter |

|

|

NET INCOME |

$1.162 billion |

$888 million |

|

EPS |

$1.03 |

$0.75 |

|

$2.394B |

$2B |

|

|

OCF per share |

$2.67 |

$2.23 |

Using the first and second quarter figures as our guideline for what OXY should earn if oil prices mean revert, we???d expect:

-

$3.56 in annual EPS.

-

$9.8 in annual OCF per share.

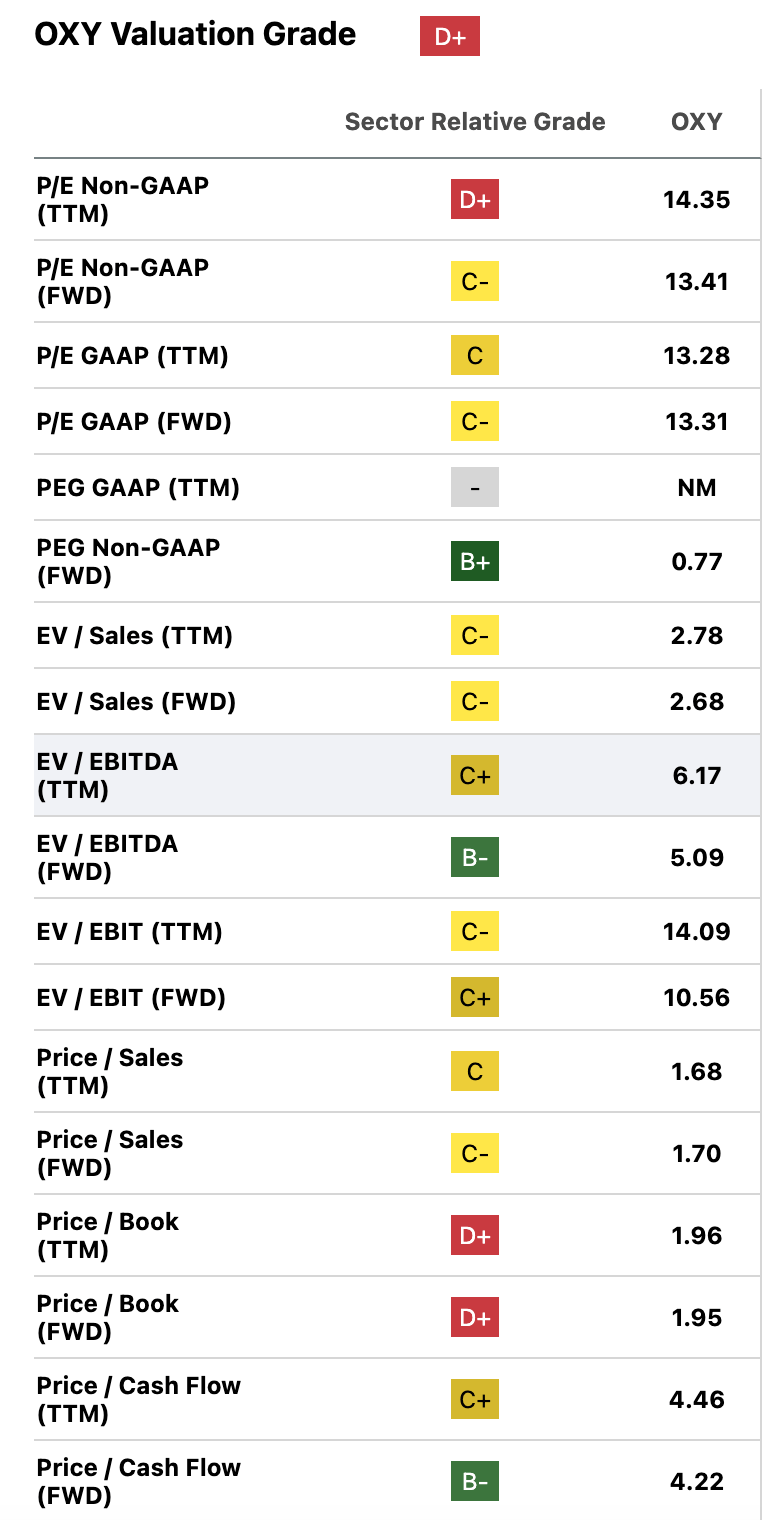

If I???m right about oil prices mean reverting, then, OXY???s forward P/E is 14.2 and forward price/cash flow is five. These are pretty healthy multiples, and are in the same ballpark as the numbers that Seeking Alpha Quant has on file. You can see those in the image below:

OXY multiples (Seeking Alpha Quant)

Now, what are OXY???s cash flows worth?

It depends on which cash flows you???re talking about. You???ll notice that I used OCF instead of FCF above, that was due to a capital expenditure increase related to the Crownrock acquisition. I felt the FCF for the last two quarters was too low because of that non-recurring item. However, I wouldn???t value OXY???s cash flows using OCF as the metric because OCF leaves out too many items: $9.8 billion is definitely way more than OXY is free to distribute to shareholders.

So, instead of the trailing 12 month FCF ($3.6 billion) I???ll use 2023???s $5.89 billion as a guide to future years. That sum works out to $4.52 on a per share basis. That amount, discounted at the 10-year treasury yield (3.68%) plus a 3% risk premium, is worth $65.88. That???s 30% upside to Thursday???s closing price.

Risks

Before concluding, it would be prudent to mention some risks to my bullish thesis on Occidental Petroleum. These include:

-

Competition from renewables. Renewable investments are ramping up around the world, and with EVs fairly common now, renewables and nuclear can power the world???s #1 transportation method. This could reduce demand for oil over time.

-

OPEC hiking output. Earlier, I mentioned that OPEC delayed its plans to hike oil output due to the recent price crash. They did, but the delay as of right now only runs until December 1. Extra supply will enter the market on that date if OPEC doesn???t change its plans.

-

A recession. Recessions are the bane of oil companies everywhere. The 2008 recession coincided with a major decline in oil prices; the 2020 COVID recession saw oil futures go negative! It???s unlikely that the 2020 scenario will play out again, as that recession was driven partially by mass travel bans unique to the time period. Most recessions don’t feature negative oil prices. However, a 2008-like scenario, with low oil prices, could play out.

The risks above are worth keeping in mind. However, when we look at the supply and demand dynamics in the oil and gas sector, as well as OXY???s recent debt reduction and valuable assets in the Permian Basin, we can see that there???s a lot to like here. I wouldn???t bet the barn on Occidental Petroleum, but a small position in a diversified portfolio could do well.

Analyst???s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.