Summary:

- Occidental Petroleum’s Q3 delivered strong operational and financial results, leading management to raise full-year guidance across segments.

- Despite improved valuation and solid Q3 performance, OXY’s high-cost base and debt burden limit its competitive position, especially with a likely weaker 2025 oil market.

- Near-term cash flows are fully allocated to debt reduction, ruling out any material buybacks and putting OXY’s capital return potential far below peers.

- We raise our price target to $60/sh but maintain an Underweight rating as we do not believe the underlying story has changed.

Brandon Bell

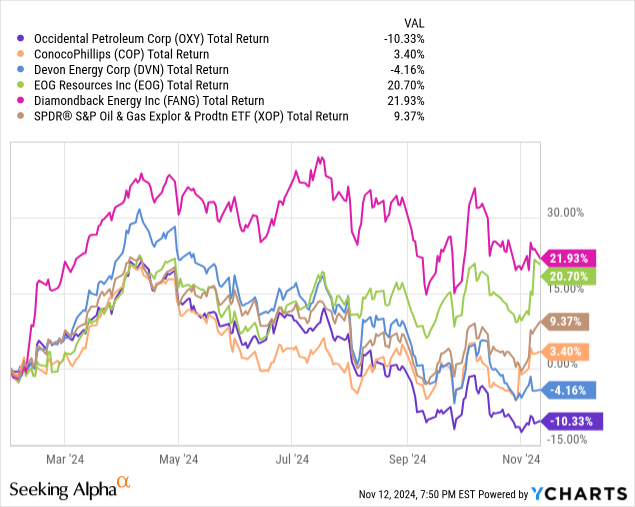

We initiated major US E&P Occidental Petroleum (NYSE:OXY) in February, beginning our coverage at an Underweight rating, as we believed its 1) higher-cost asset base and 2) lack of near term distribution potential put the company at a disadvantaged competitive position. We confirmed our stance in June in the wake of the company’s takeover of Permian driller CrownRock which we believed to further increase its relative debt burden vs. peers and delay any significant buyback activity into likely 2026. Since then, shares have performed at the absolute low end of large cap peers at an around 30pp total return gap vs. the top performers Diamondback and EOG, both key structural Overweights in our view (see here and here). Down 10%, OXY also underperformed the broader US E&P sector which is up by 9%, further confirming our Underweight.

However, OXY has not been devoid of any progress YTD. Q3 showed strong results on both an operational and financial scale, delivering record production levels and ~$1.5B in FCF. Driven by the strong quarter and the CrownRock integration delivering strong initial performance, management raised guidance across all segments, now expecting ~1% higher full-year production and a 4% higher EBIT in OxyChem while expected losses from Midstream were roughly cut in half.

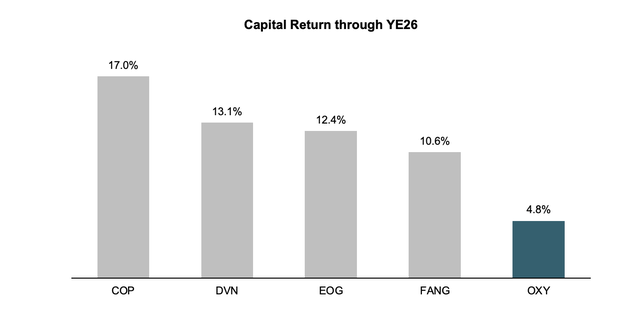

Still, we feel OXY significantly lags peers in what we believe to be the single most important metric for energy investors, that being capital returns. At a forward dividend yield of 1.8% and with no meaningful buyback capacity in the near term, OXY’s distribution potential remains miles behind peers, which are estimated to return on average ~13% of their market cap through YE26 (OXY: ~4%).

Further considering that OXY is a higher-cost, higher-debt and less-focused operator relative to peers, we believe shares remain at a disadvantage with oil prices likely surprising to the downside in 2025. Hence, we reiterate our Underweight rating on the shares, although we raise our price target by 12% to $60/sh as we acknowledge the strong Q3 and higher full-year guidance.

[Note: E&P peers refer to ConocoPhillips (COP), Diamondback Energy, Inc. (FANG), EOG Resources, Inc. (EOG) and Devon Energy Corporation (DVN). All financial information and company projections are from the Q3 earnings release and the Q3 investor presentation.]

Key Discussion Points

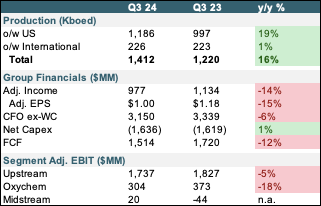

Strong Q3 results with good initial CrownRock well performance and guidance raises across segments. OXY delivered a strong Q3 in our view, with US production surging 19% y/y on higher base and additional volumes from CrownRock which exceeded initial estimates. Management noted CrownRock wells delivering 5Kboed higher production than expected for a net impact of 109Kboed during the quarter. With international production up 1% y/y, total group output grew 16% to ~1.4Mboed. Following the strong Q3 production figures, OXY also raised its Q4 and full-year output guidance, which we calculate to be around 2% and 1% higher than as of previous guidance respectively. Driven by the good progress at CrownRock, Permian guidance was raised by 6% and 2% for Q4 and 2024E.

Alongside lower domestic unit production costs which offset broadly decreased oil prices, this brought a just 5% y/y adj. EBIT contraction for the upstream segment. Now guiding for Q4 U.S. LOE per barrel at $8.65, this implies a ~1.3% decrease vs the prior guidance with full year LOE now expected ~0.4% lower at $9.31 as per our calculations. OxyChem also delivered a solid quarter, earnings $304MM on a pre-tax basis. While this is still down 18% y/y on lower chemical margins, new guidance implies a 21% higher expected Q4, or 4% on a full-year basis. Midstream was perhaps the key surprise, as pre-tax profits swung positive during Q3 for the first time this year on lower spreads. While still expecting negative profits for Q4, management cut expected losses by around half, which translates to a ~55% higher full-year guidance (-$145MM vs -$320MM previously).

Lastly, cash generation during Q3 looked very solid with OXY generating ~$1.7B in operating cash before working capital changes for ~$1.5B in FCF.

Q3 Variance Table (Company Filings) New vs Old Guidance (Company Filings, WSR Estimates)

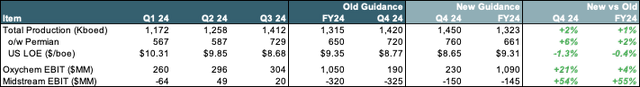

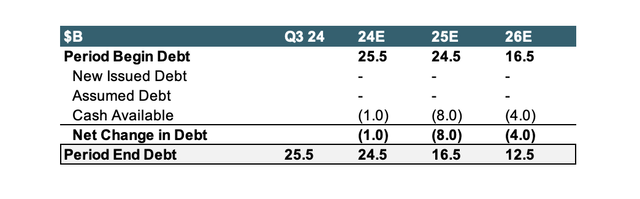

With near term cash flows allocated to the balance sheet, we do not see scope for any meaningful buybacks. While Q3 results were strong, we do not believe this to meaningfully change OXY’s midterm equity story. Following the addition of ~$10B in debt from the CrownRock deal, management remains firmly committed to its cash allocation framework, prioritizing the balance sheet.

Cash Allocation Framework (Occidental IR)

On consensus estimates of around $5B in 2025E FCF and $3B in projected cash proceeds from asset sales, we estimate OXY will not hit its $15B debt target before 2026E, likely ruling out any meaningful buyback activity in the near term.

Company Filings, WSR Estimates

And while we understand management’s focus on bringing down leverage, this does unarguably put OXY at a significant disadvantage to peers. Assuming zero buybacks during 2025E and around $0.5B during 2026E as well as mid single-digits dividend growth, we estimate OXY distributing around 4.8% of its current market cap through year end 2026. Compared to peers which are expected to return above 10% and Conoco which is estimated to pay out around 17%, we believe OXY continues to fall short on what we view as one of the most important value propositions in the post-Covid E&P space, that being shareholder returns.

Company Filings, WSR Estimates

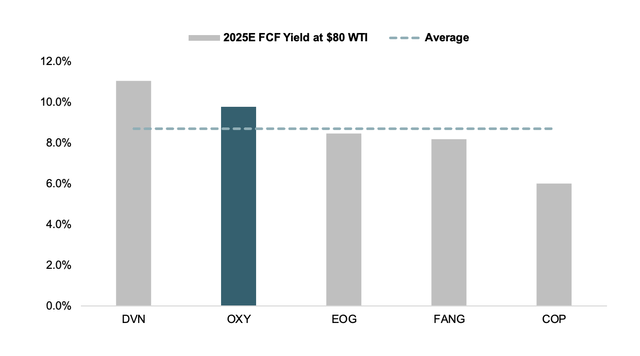

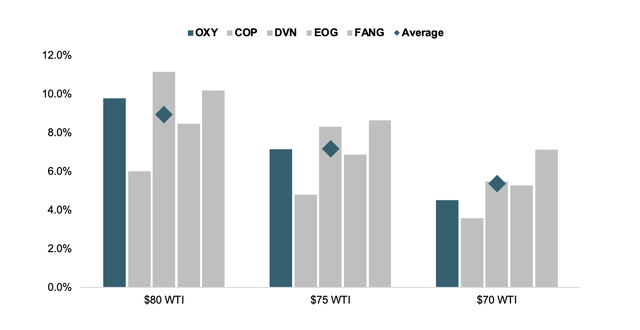

Valuation has become more attractive, yet we see more relative downside in a likely lower 2025 price environment. With OXY having severely underperformed YTD, shares now trade at a ~10% fwd FCF yield assuming $80 WTI, roughly around YTD average. This contrasts earlier quarters when OXY was consistently trading at lower yields than peers and actually moves shares above peer average (~9%).

Company Filings, WSR Estimates

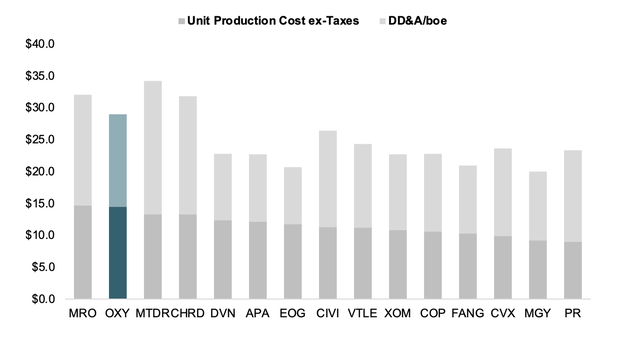

However, while yields at $80 WTI look attractive, we note that OXY remains one of the highest-cost operators across the entire US shale patch. As of 2023, OXY had a worldwide unit opex of $14.5/boe and DD&A worth a further $14.5/boe for total unit costs of almost $30. This puts them among the top three highest-cost operators, only behind Matador and Chord (excluding Marathon due to its pending acquisition by Conoco) with both Matador and Chord around $1/boe below on actual cash opex/boe.

Company Filings, WSR Estimates

Overall, we find OXY’s total unit costs to be around 15% above the sector average with ~25% higher direct operating cost per flowing barrel, while DD&A/boe is ~7% higher. Compared to our top picks in the sector, EOG and FANG, OXY’s direct unit costs screen almost 40% higher. And while we acknowledge management’s solid YTD performance, especially during Q3, we remain at our assessment that OXY is at a structural disadvantage to peers due to its relatively uncompetitive cost base.

OXY’s cost base should be an especially crucial point given that oil prices will likely surprise to the downside in 2025 with all major agencies cutting forecasts for both total demand and prices. While gas is set to rebound next year, it is ultimately oil prices that really move P&Ls for the major E&Ps. OXY estimates a $250MM sensitivity in operating cash flows for every $1 change in oil prices on an annualized basis, or around ~2% of annualized YTD CFO.

Running a (highly) simplified analysis with oil prices as single variable, we calculate OXY’s 25E FCF could drop as low as ~$2.2B in a $70 WTI scenario. This would imply an FCF yield of ~4.5% on current market cap, or more 500bps below the $80 WTI implied yield of ~9.8%. This screens at the lower end of peers with on average a 360bps drop when going from a $80 WTI to a $70 WTI scenario and would move OXY below the peer average FCF yield of 5.4%.

Company Filings, WSR Estimates

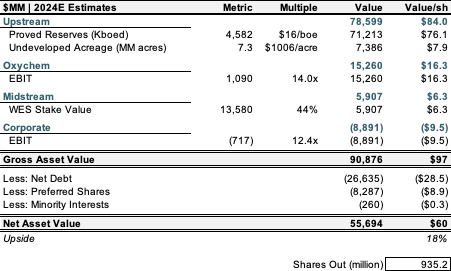

Valuation Update

Flowing through the updated full-year guidance and assuming slightly higher production growth, we raise our price target by 12% to $60/sh for ~18% upside to current levels.

OXY NAV (Company Filings, WSR Estimates)

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.