Summary:

- Occidental Petroleum stock has fallen below several critical support levels, reversing gains from the past two years.

- Occidental’s cautious 2025 production outlook has likely lowered the market’s confidence in justifying OXY’s valuation premium over peers.

- Analysts still see a potential nadir in its adjusted earnings estimates through 2026, although the return of Trump’s “Drill, Baby, Drill” has lifted uncertainties markedly.

- Occidental’s execution risks have risen markedly, corroborated by its relative underperformance against its energy sector peers.

- I argue why investors should avoid catching this falling knife, as the bullish narrative has fallen apart.

jetcityimage

Occidental Petroleum Corporation (NYSE:OXY) investors have been battered as the stock of the leading Permian oil and gas producers buckled, as OXY fell below critical support levels. The uncertainties hovering over President-elect Donald Trump’s “drill, baby, drill” mandate have worried investors about whether it could spur significant production increases in the near- and medium-term, affecting the leading US E&P players. Given Occidental’s material sensitivity to WTI crude oil futures (CL1:COM), it seems like the market has turned increasingly fearful, even though CL1 futures have remained above their September 2024 lows. However, OXY has declined well below its pivotal $54 support level, falling to levels last seen in early 2022. Hence, investors have reversed more than two years of gains, likely anticipating heightened uncertainties about Trump’s promises to bolster oil and gas production significantly.

In my previous Occidental article, I maintained my bullish thesis, even though I indicated that OXY’s buying momentum had weakened considerably. Although OXY delivered a solid Q3 earnings scorecard while posting robust production levels, management highlighted the need to be more cautious in its 2025 outlook. Occidental’s integration of its CrownRock acquisition has progressed as planned, seeking to lower its debt profile while allocating capital spending prudently to meet its 2025 targets.

However, the market is likely concerned whether the company’s mid-single digit production growth in Permian in 2025 is sufficient to mitigate the weakness observed in the underlying energy market currently. I find it baffling as the market seems to have de-rated OXY relative to its energy sector peers (XLE). While selling momentum has gained traction over the past three weeks, OXY’s underperformance against its peers over the past six months underscores the market’s pessimism on its thesis.

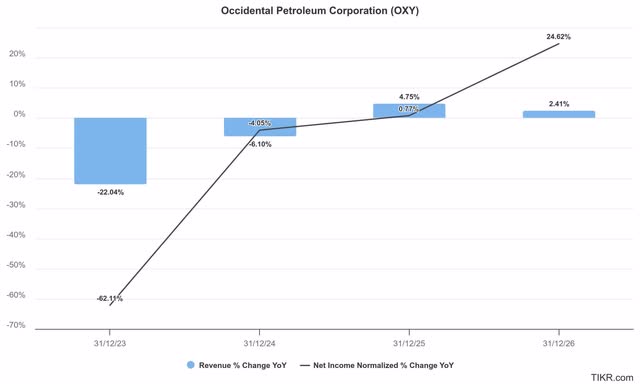

The E&P industry’s net earnings revisions have continued to suffer downgrades over the past month, corroborating the weakness observed in the sector. I assess that the market rotation away from OXY and its peers isn’t isolated to just the stock. While Occidental’s estimates have been lowered, analysts are still cautiously optimistic about improved earnings growth projections through 2026.

Therefore, Occidental’s earnings are still expected to climb out of its nadir through 2026, bolstered by the company’s commitment to manage its capital spending prudently in boosting production capacity. Moreover, the $15B medium-term debt target remains in progress, suggesting management remains focused on returning total shareholder value.

OXY Quant Grades (Seeking Alpha)

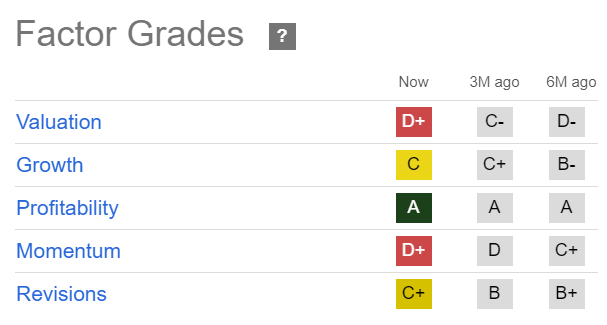

OXY’s “D+” valuation grade indicates that it’s still valued at a premium against its sector peers. However, its “C” growth grade has likely affected the market’s assessment of whether the stock deserves its premium valuation. Occidental’s cautious 2025 production outlook has elevated its execution risks while it continues to integrate its CrownRock assets. Although Occidental has maintained its sector-leading profitability, it might not be enough to overcome the valuation de-rating as energy investors rotated out of the sector.

OXY’s forward adjusted EPS multiple of 13.6x is well above its E&P peers of 11.4x. Therefore, unless management can promulgate a more robust outlook for 2025, I assess a lack of significant near-term catalysts in driving a valuation re-rating. Furthermore, the uncertainties have also affected OPEC+’s outlook, even though the IEA lifted its 2025 projections. However, the uncertainties in China’s economy will likely keep energy investors on their toes as they react to Trump’s energy policies when he takes over the presidency in January 2025.

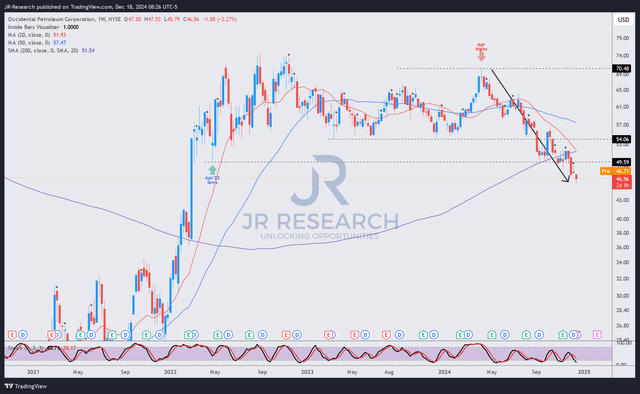

OXY price chart (weekly, medium-term adjusted for dividends) (TradingView)

OXY’s price action doesn’t convey sufficient confidence for me to maintain my bullish conviction. Moreover, income investors aren’t likely to find OXY’s forward dividend yield of 1.9% attractive, as it is more than 50% under its sector median.

Its decline (see the downward pointing arrow in the chart) has also broken decisively through several critical support zones, justifying its selling intensity. OXY’s “D+” momentum grade validates my observation, as the lacking of dip-buying sentiments has surprised me, even though WTI crude oil futures have remained above their September 2024 bottom.

Therefore, it’s increasingly clear that sellers have regained the upper hand, as the market seems less confident about Occidental’s execution prowess through 2026. Given its relative premium over its peers, OXY faces an uphill battle as it needs to justify to investors about its ability to boost production in a disciplined manner. Coupled with the uncertainties attributed to the incoming Trump administration, I believe it’s timely for me to step back into the sidelines, as my bullish proposition on OXY has failed to work out.

Rating: Downgrade to Hold.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!