Summary:

- I reiterate my HOLD rating on Occidental Petroleum due to a mixed outlook.

- OXY’s Q3 earnings reflected some uneven segment performance.

- The balance sheet was another area of concern, with increased debt and new share issuances.

- Positive catalysts include reasonable P/E, a healthy long-term EPS outlook, and its ongoing divestment of non-core assets to raise cash.

Bluberries/iStock via Getty Images

OXY Stock: Wall Street’s HOLD rating is for good reasons

I last covered Occidental Petroleum Corporation (NYSE:OXY) stock on 10-30-2024. That article was titled “Exxon Mobil Is Both Cheaper And Better Than Occidental Petroleum” as you can see from the following screenshot. In it, I compared OXY to Exxon Mobil Corporation (XOM) and concluded that XOM presented a more attractive investment opportunity based on the following analysis. As such, I rated the stock as HOLD.

I am overall bullish on the energy sector and sector leader XOM is particularly attractive. Compared to close peer OXY and the overall sector, XOM offers better profitability metrics and balance sheet strength. Yet, Exxon Mobil trades at a lower valuation than Occidental. Both enjoy growth catalysts with their expanded exposure to the prized Permian Basin assets. However, XOM’s greater capital allocation flexibility and better ROCE enhances its ability to capitalize on growth initiatives.

Seeking Alpha

Since then, a few new catalysts have been developing around OXY. In the rest of this article, I will focus on the top 3 on my list: the prevailing sentiment change on the stock, its Q3 earnings report (ER), and also the changes to its balance sheet. After reexamining these changes, I do not see a clear bias in the stock’s risk/return profile and thus maintain my HOLD rating.

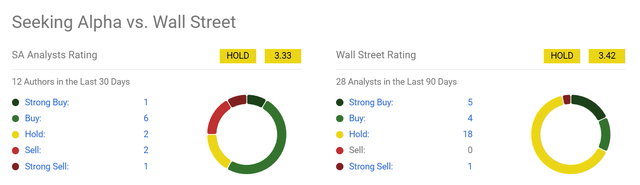

Let me start with the sentiment change. At the time of my previous publication, OXY’s price was $50.34 as seen in the chart above. Since then, the S&P 500 has increased by 4.83% over the same period, while OXY’s price has decreased by 8.21% in contrast. Currently, Wall Street analysts (and SA authors too) hold a generally neutral outlook on OXY as you can see from the next chart below. Over the last 90 days, 28 analysts have provided ratings, and the majority (18 for them) rated the stock as a HOLD, with an average rating of 3.42.

Next, I will explain why the above lukewarm sentiment is likely to persist in the near future (say the next 1~ 2 years).

Seeking Alpha

OXY stock: Q3 recap and headwinds

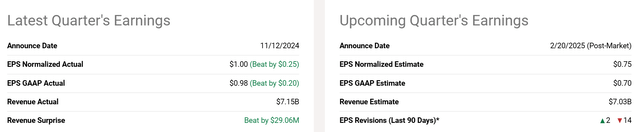

The second key development since my last writing involves the updates the company provided in its Q3 2024 earnings (released on 11-12-2024 as seen in the first chart below) My overall view is that OXY turned in a mixed performance in the third quarter. On the positive side, both EPS and sales exceeded Wall Street’s estimates (very narrowly in the case of sales). However, on a year-over-year basis, the company suffered a sizable decline in profits. The decline was due to several factors. The first factor is the losses taken on the sale of its assets (more on this later). Other factors include lower crude prices and also price pressure on other energy commodities (especially natural gas).

The headwinds were partially offset by Occidental’s crude output, resulting in a modest net increase of 1.8% YOY for its Oil and Gas segments as seen in the second chart below. The Permian Basin was a highlight for the output boost. However, other segments suffered considerable declines as seen (Chemical segment declined by 4.8% YOY and Midstream & Marketing by over 20% YOY).

Looking ahead, I expect many of these challenges to persist. In particular, I see energy commodity prices to remain pressured judging by the latest OPEC projection (quoted below).

Seeking Alpha news: OPEC on Wednesday lowered its forecast of oil demand growth for this year and next for a fifth straight month. The cut was the cartel’s biggest reduction to the 2024 outlook yet after its members agreed to prolong curbs on production. The Organization of Petroleum Exporting Countries lowered projections for consumption growth in 2024 by 210,000 barrels a day to 1.6 million barrels a day. It has cut estimates by 27% since July.

Seeking Alpha

Seeking Alpha

OXY stock: balance sheet is in transition

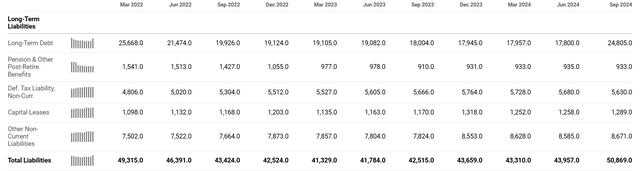

Another area of concern is its balance sheet. Lately, Occidental has been issued new debts, in part to finance its bolt-on acquisitions (with the CrownRock acquisition as a recent example). These issuances have increased its debt burden and stretched its balance sheet considerably as you can tell from its following balance sheet. As seen, its long-term was about $18 billion only a year ago (as of the Sept 2023 quarter). The figure has significantly increased to the current $24.8 billion as of Q3 2024 (an increase of about $6.8 billion). OXY’s total liabilities have increased even more during this period. Its total liabilities were about $42.5 billion a year ago and have increased to the current level of over $50.8 billion (an increase of more than $12 billion).

Seeking Alpha

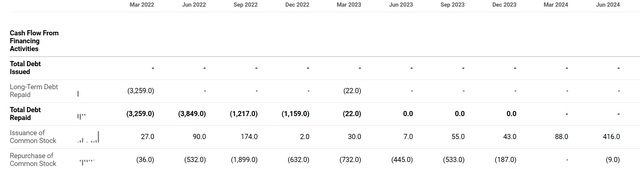

To add to my concern, during the recent quarter, Occidental has also started issuing new shares as you can see from its cash flow statements below. To wit, the company issued $88 million worth of new shares in the March quarter and over $400 million worth of new shares in the June quarter, reversing its repurchases in the past 1~2 years.

Seeking Alpha

Other risks and final thoughts

In terms of positives, analysts project an EPS recovery starting in FY 2025 and I tend to agree given the secular demand for more energy. To wit, for FY 2024, the estimated EPS is $3.43, or a YOY decline of 7.34% due to the headwinds mentioned above. However, starting in FY 2025, a growth trajectory is anticipated for the next few years, with an EPS YoY increase of 6.13% and 13.18% for the next two years. Overall, the average growth rate is projected to be 8% for the next 5 years. Another positive is its reasonable valuation after the price correction since my last writing. As seen, the forward P/E is about 13.59x, a reasonable multiple in my view in both absolute and relative terms amid an otherwise very expensive market. The implied P/E would further decline to be in the range of 11x to 12x on FY2 and FY3 terms with the projected EPS recovery. Finally, OXY has also been divesting nonstrategic assets recently. Leadership has been selling non-core assets and has raised about $1.7 billion in cash in the last quarter. Thus far, assets in the Power River Basin and Delaware Basin have been sold. I expect OXY to continue divesting its less profitable assets and also expect it to use the proceeds (or at least a good part of them) to repay its debt, which would lessen my above concern over its balance sheet.

Overall, I see a mixed picture facing OXY. To recap, the top negatives in my assessment are the prevailing lukewarm sentiment, the headwinds reflected in its Q3 updates, and also the balance sheet. These negatively are largely offset by its healthy long-term prospects and reasonable valuation. As such, I reiterated my hold rating on the stock under current conditions.

Seeking Alpha

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.