Summary:

- Occidental Petroleum’s recent stock dip makes it a compelling “Buy”, especially given robust earnings and strong operational performance despite market turbulence.

- The CrownRock acquisition is expected to enhance Occidental’s portfolio, boosting FCF and market position in shale with significant cost savings anticipated.

- I think OXY is currently undervalued based on next-year PEG and EV/EBITDA ratios, presenting an attractive investment opportunity.

- Without necessarily following the strategies of great investors like Warren Buffett, retail investors like myself can conclude that Occidental is a “Buy” despite the risks.

TatyanaMishchenko

My Thesis

As you probably know, Occidental Petroleum Corporation (NYSE:OXY) is a major independent oil and gas producer in the US, the Middle East, and North Africa; it has a midstream services business, and also owns a chemicals business producing and marketing caustic soda and PVC, with operating results sensitive to the economy. Given that overall demand for oil seems to have barely declined in recent years and the US economy is outperforming globally right now, I think the decline in OXY stock in recent weeks has gone too far. I’ve heard people say that retail investors should target the stock now that OXY has fallen below Warren Buffett’s average buy price. I think with or without Buffett, OXY is definitely worth a look as the stock has gotten too cheap to ignore.

My Reasoning

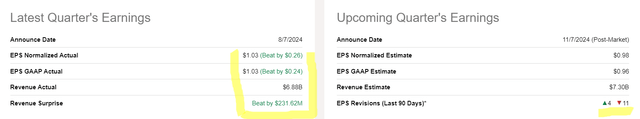

Occidental’s Q2 2024 results were actually quite robust as the firm reported sales of $6.88 billion (+1.7% YoY) and better-than-expected margins across the income statement, leading to the net income of ~$993 million ($1.03 per diluted share). The sales improvement we saw was primarily driven by “higher realized prices for crude oil and natural gas liquids”, which increased by 9% and 11% YoY respectively (although there was a 39% drop in natural gas prices for the same period). Anyway, the bottom line (as well as the top line) surpassed both the previous year’s $661 million ($0.68/share) and also exceeded analysts’ consensus expectations, according to Seeking Alpha:

Seeking Alpha, OXY, Oakoff’s notes added

I’ll come back to the highlighted earnings negative revisions a bit later. For now, let’s talk a little bit about the segments’ performance.

The pre-tax net profit of the Oil and Gas segment amounted to ~$1.639 billion, which is up 54% from $1.059 billion; this was due to 3% higher average daily production at 1,258 thousand barrels of oil equivalent per day, “driven partly by Permian Basin and the Gulf of Mexico.” The Chemicals segment struggled at the bottom line, with the pretax earnings down 32% to $296 million, due to “lower demand for key products and higher costs”; the Midstream and marketing segment, on the other hand, reversed an operating loss into an operating profit of ~$116 million, due to “higher gas marketing income and better gas transportation spreads.”

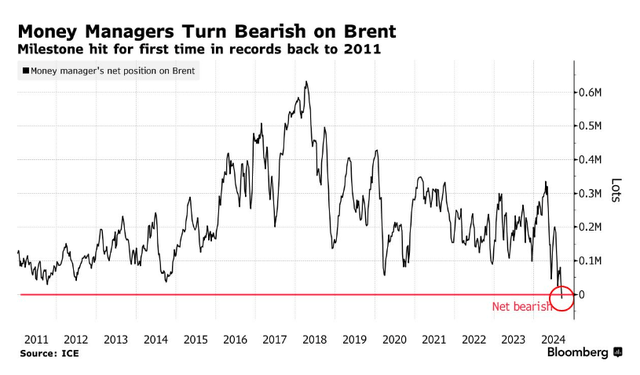

I believe Occidental’s recent acquisition of CrownRock L.P., a smaller operator in the Midland Basin, should augment the company’s project portfolio going forward. The roughly $12 billion valuation, including debt, is a purchase price for new production capacity and additional development opportunities. Financed by a mix of new debt, equity issuance, and assumed debt, management is counting on this deal to boost free cash flow by about $1 billion in the first year at oil prices of ~$70 a barrel. As I’m writing this article, the WTI crude oil futures are trading at ~$72 per barrel, and this price coincides with the most bearish hedge-fund positioning in oil for the past decades.

Investing.com data, crude WTI oil futures

Bloomberg

So I don’t think that crude oil prices may go too much lower from here because the bearish bets that had surged are likely to get too crowded – the most obvious way out of that is a rapid oil prices recovery. But that’s the short-to-medium-term perspective.

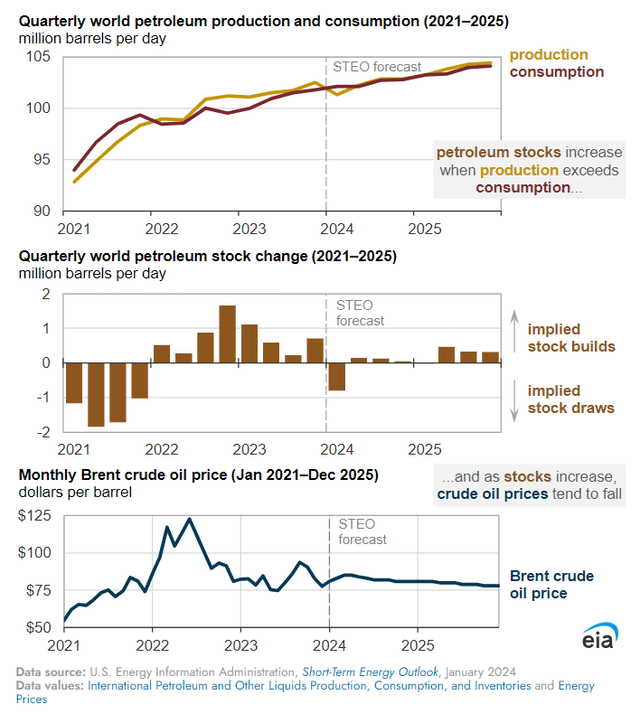

Based on EIA data and projections, global oil consumption is going to increase for the next few years at least with production following suit. The petroleum stocks are likely to go up as well, but there should be no sharp fall in oil prices in the longer term, no matter what you hear from some people here and there.

EIA data

That’s why I believe the assumed $70/barrel that is needed for CrownRock acquisition to add incremental value to Occidental’s portfolio is a reasonable thing. The OXY’s management expects the acquisition to strengthen their market position in shale, and, as a consequence, boost financial results linearly with production increases.

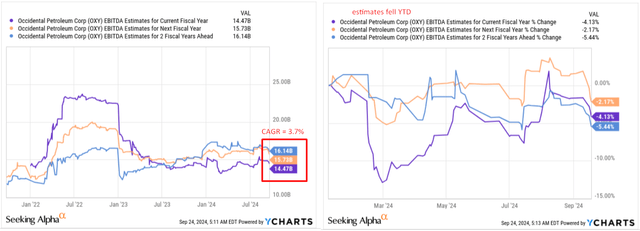

What OXY’s management also expects – and what many analysts don’t mention somehow – is that reduced rates for crude oil and transportation from the Permian Basin to the Gulf Coast are going to flow through to the firm’s financials by the end of Q3 2025. The company estimates these rate reductions will produce annualized savings of between $300 million to $400 million, with 40% of these savings to be realized in fiscal 2025 and the full savings to be captured in fiscal 2026. So given all that I find it intriguing that the market seems to be factoring in only the EBITDA growth driven by inorganic production increases, rather than the growth driven by the likely margin expansion in the span of the next 2-3 years:

YCharts, Oakoff’s notes

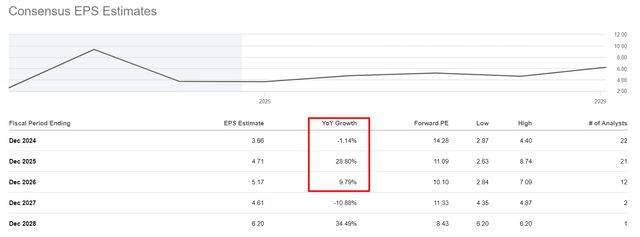

However, if we examine the company’s EPS consensus for the next few years, we’ll see analysts anticipating a 28.8% increase in FY2025, followed by a modest 9.8% growth in FY2026. In my view, given the management’s plans to enhance efficiency and achieve cost savings, these projections seem rather conservative, and it’s quite likely they will be revised upward.

Seeking Alpha, OXY, notes added

Speaking of the firm’s balance sheet condition, I think today, OXY’s debt position is like that of its closest peers, given that debt has been repaid in a significant fashion. However, as part of a concerted plan not to be overleveraged on the balance sheet again, OXY will sell off large numbers of non-core assets over the first 12 months post-closing of the deal with CrownRock. Therefore, in this regard, investors have little to worry about, in my view, even when considering the significant costs associated with the large acquisition.

Occidental has also been consistently returning value to its shareholders through dividends and share repurchases. In early February 2024, the company increased its quarterly dividend by 22% to $0.22 per share ($0.88 annualized) with a current yield of about 1.51%. For 2024 and 2025, dividend estimates are currently $0.91 and $0.98 respectively, according to Seeking Alpha Premium data. In regards to share repurchases, Occidental completed a $3 billion buyback program in 2022 and initiated another $3 billion program in 2023. By the end of 2023, they had repurchased a total of $1.8 billion of shares leaving about $1.2 billion available under the current authorization as of the end of Q2 2024. So given the pace of repurchases and combined with the dividend yield, the recent dip in the stock price points at the total shareholders’ yield of over 6%, which looks quite good to me.

One can’t overlook the question of valuation. If you look at Seeking Alpha’s data, you’ll see that compared to the entire Energy sector, the company may be trading a bit expensively at 14.3 times earnings multiple for next year, which is 24.4% higher than the sector median. However, according to the Seeking Alpha Quant Rating system, OXY’s Valuation grade has improved from “D-” to “C-” in just 3 months – all thanks to that swift drop in the stock during the designated period:

Seeking Alpha, OXY’s Valuation, Oakoff’s notes

Furthermore, if you look at other key multiples such as PEG (FWD), which is basically the P/E ratio weighted by the projected growth rate, you’ll see that Occidental Petroleum’s stock is actually undervalued at the moment by ~46% compared to the sector median. This undervaluation, albeit in a weaker sense, is also confirmed based on the EV/EBITDA ratio. The latter multiple, considering the quality of the firm’s balance sheet at the moment, should lead investors to conclude that Occidental is a quite attractively valued company at the current stock price.

Even using straightforward logic, without necessarily following the strategies of great investors like Warren Buffett, retail investors like myself can draw a conclusion from all the above information provided: Occidental Petroleum deserves a “Buy” rating today.

Risks To My Thesis

Of course, my conclusion above carries certain risks that every interested investor should consider.

As an analyst from Argus Research recently noted (proprietary source), there are doubts regarding the management’s plan to keep deleveraging its balance sheet following the acquisition of CrownRock:

We have doubts about this strategy [plans to divest numerous ‘non-core’ assets] – concerning both the timing and price these asset sales will generate. Therefore, we will wait until we see signs that the OXY strategy (asset sales) will be completed, and also that energy markets are supportive enough for these sales to be completed, before we consider an upgrade.

Source: Argus (proprietary data, August 2024), notes added by Oakoff

Perhaps it might be wiser indeed to wait for a significant catalyst in the crude oil market that could drive the underlying asset prices higher, subsequently boosting Occidental’s stock as well.

Also, as another Seeking Alpha analyst, Stone Fox Capital, noted in their recent research, Mr. Buffett actually paused its purchasing of Occidental shares after consistently buying at the $60 mark, so that may indicate a note of caution. Why he didn’t buy more while he’s managed to accumulate substantial cash reserves this year?

Your Takeaway

Despite the aforementioned risks – which can also include the instability of oil prices overall in the long term and the lack of a single reliable source of information for forecasting future oil prices that may actually be lower than I assume – I still believe that Occidental Petroleum deserves a “Buy” rating after its recent drop. I base this primarily on the operational strength that the company has been able to demonstrate even during periods of turbulence in its addressable markets.

I like OXY’s prospects of increasing margin and cost savings in the future, and I believe that Wall Street is too pessimistic about the company’s EPS growth prospects for at least the next few years. This pessimism, in theory, should provide room for OXY to deliver results that are more outstanding than projected, beat forecasts once again, and thus provide a catalyst for more investors who are currently too skeptical.

I also like that for once Occidental Petroleum has become cheap, which we haven’t seen for quite a while, judging by the rating history from Seeking Alpha.

Taking all of the above into account, I believe that the company deserves a positive assessment today.

Good luck with your investments!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in OXY over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Struggle to access the latest reports from banks and hedge funds?

With just one subscription to Beyond the Wall Investing, you can save thousands of dollars a year on equity research reports from banks. You’ll keep your finger on the pulse and have access to the latest and highest-quality analysis of this type of information.