Summary:

- Oil could hit $300 in the next three-to-five years.

- High coal demand: According to the IEA, China, India, and Southeast Asian countries will consume three out of every four tonnes of coal guaranteeing dependency on non-renewable energy.

- Despite environmental concerns, oil remains essential as the growth economies rely on coal.

- Given rising inflation and developing nations’ growth, oil’s price will return to its inflation adjusted range which in years to come is $200-$300.

bymuratdeniz

It has been a trope that oil is going to become an ‘orphan asset’ and that its use would end, and it would become an obsolete energy source. This is because of the gigantic efforts to halt ‘climate change’ caused by human CO2 emissions. The thrust of so much change to get to ‘Net Zero’ is to end the use of hydrocarbons.

The end of oil is not going to happen, and the implications are huge.

Let’s start with why

According to the IEA, the International Energy Agency:

“China, India and Southeast Asian countries together are expected to account for three out of every four tonnes of coal consumed worldwide in 2023.”

From the article: “Global coal demand set to remain at record levels in 2023.”

The IEA is not some pay-play NGO, it is a global institution.

This implication is obvious; developing countries are not going to crucify themselves on a cross of sustainability. After all these years of accords, dramatic predictions, plans and – in the developed world – giant shifts in policy, developing countries have embraced cheap energy with both hands as a guarantee of their ascendancy.

It’s hard not to slip from being dispassionate about this situation but the magnitude of the facts speak for themselves.

As oil is a ‘less worse’ source of CO2 than dirty and sometimes very dirty coal, oil has no chance of becoming an ‘orphan’ source of energy. As developing countries grow (as they will at a dramatic pace) so will their thirst for energy. With these countries’ GDP per head only a fraction of their potential, their energy needs are also only a fraction of what they will be, and these needs will grow in parallel with their economies. Fortunately for them – and unfortunately for plans for ‘Net Zero’ – there is no shortage of coal and likely never will be, with enough already found for half a millennium.

This means, at the very least, business as usual for oil and that likely means $300 a barrel.

This idea has proved rather emotive because the thought of oil at these levels brings a realisation of how much gasoline is going to cost at the pump, and it sounds like a wild prediction we so often seen on the web.

It is not a wild prediction

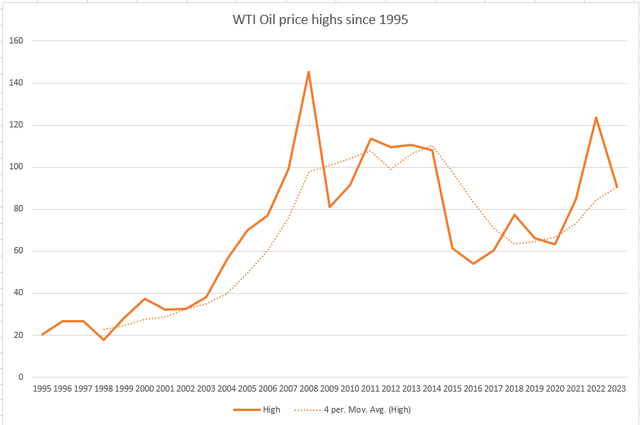

Take a look at this chart of historic oil over the last decade or so:

WTI oil price highs since 1995 (Chart compiled by Clem Chambers)

The simplest way to look at this chart is to see that for a period of six years (2008-2014) on a four-year average, oil was at or above $100 a barrel.

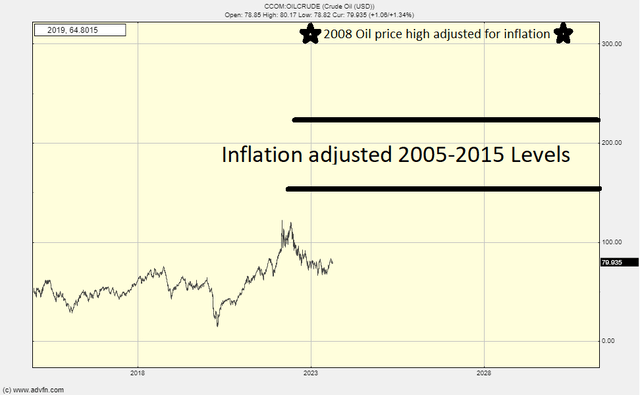

When you inflation adjust this for recent years you get this:

The $300 a barrel number comes from taking the 2008 high and adding on the average US energy inflation of the last 60 years. You could also add the rolling inflation of the next two or three years on top for good measure but let’s not worry about the exact number. The time frame is three-to-five years.

Once you have decided fossil fuel consumption is not going down then all you need do is write in the inflation already baked into the world economy to have oil trade much higher than today.

Investors therefore have a simple call to make: write oil off or factor into the price the impact of inflation (as must be done for any commodity in the long term) and then position accordingly. For me it is the latter; the fact this is not generally understood underlines the potential for investors. Futures traders will have no problems trading this with all the fun and games available with highly leveraged contracts but for the more conservative of us, sitting on Exxon (XOM) or Chevron (NYSE:CVX) or the less highly-priced overseas listed Shell (SHEL), BP (BP) and Total (TTE) – all of which I own – is not a difficult theme to buy in on without playing with the risks connected to companies bellow giant status.

Once upon a time the market was trusted to solve problems and when the price of hydrocarbon energy rises above the falling cost of sustainable power, then coal and oil will become niche commodities.

I am happy to point out the former and work on the latter, and invest accordingly.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SHEL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I own Shell, BP and Total.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.