Summary:

- Apple is once again hit by the narrative seeing its best days behind.

- Concerning news have caused a pullback.

- Yet, if we look at what the company can deliver over the next decade, the present value of the discounted free cash flows is staggering.

Justin Sullivan/Getty Images News

Introduction

For the first time since I have been a Seeking Alpha user, I am seeing quite a bit of controversy on Apple (NASDAQ:AAPL). Ratings range from sell to buy every day, while until a few months ago, the consensus I usually saw was to go long this stock. As an investor who has Apple as its second largest holding, I have gone over my investment to check if the reasons I started it are still there or not.

Recent concerns

There has been a lot going on:

- China banned the use of iPhones to government employees.

- France halted the sales of iPhone 12 because of concerns related to radiation levels.

- Disappointment as Apple debuted iPhone 15 and iPhone 15 Plus.

- Mixed takes over iPhone sales

- Expensive valuation

Regarding iPhone 15 sales, we have seen UBS saying initial demand for iPhone was mixed at best, while Wedbush sees very strong demand, just like CNN reported.

At the same time, Apple keeps on talking very little about AI during its earnings calls or events, ruling itself out of the AI-frenzy that has pushed the market up in the first half of the year. To be fair, Apple does talk about machine learning, but this seems less catchy than AI.

In addition, even the release of the Vision Pro didn’t excite the market. Furthermore, current estimates see Apple’s revenue declining this year and then grow at an 8% CAGR for the rest of the decade. According to many, Apple is becoming a stalwart, not growing anymore at a pace that justifies its valuation.

Yes, valuation is understandably a major concern. In fact, most people agree in considering Apple a great company, way better than the average one. However, investors start debating when it comes to valuation. Seeking Alpha Quant Rating gives Apple an F as a valuation grade. Yet, its 28.7 fwd PE is rated with a C, as well as its fwd price/FCF now at 23.7.

And Yet…

Following the news of the ban in China, the stock dropped several percentage points. And yet, as soon as the iPhone 15 was available people in China flocked to the Apple stores.

The issue in France will lead Apple to provide an iPhone 12 software update. But we should also know that, on average, only 30% of iPhone users hold on to their phone three years or longer. Since the iPhone 12 was released in September 2020, in the next year around 70% of those who purchased in its first year of release should be upgrading to a new version which will likely be the iPhone 15.

In the most recent earnings call, Apple’s CFO Luca Maestri openly said that the company’s installed base counts more than 2 billion active devices establishing “a solid foundation for the future expansion of the ecosystem”.

Customer engagement is growing as there are more transacting accounts and paid accounts. Another 150 million paid subscriptions were added in the last 12 months, a 2x in just 3 years.

Apple’s valuation seems expensive, but when we look at the FCF Yield, we see a very interesting 3.9%, which, all of a sudden, doesn’t make the stock seem that expensive, even when factoring in SBCs.

Why I am invested in Apple

The aforementioned concerns are all over the media. YouTube is no different. Even on Seeking Alpha, sell ratings have increased.

It seems like it takes some guts to be bullish on Apple right now.

Therefore, I want to go over my bull-case to see if it is still intact.

Here are the main reasons I picked Apple at first and continued accumulating more shares from time to time:

- Apple has the stickiest ecosystem I am aware of. In fact, at first I was weary of Apple’s products and didn’t want to buy one in order to be free from switching one. Then around 10 years ago, I got an iPhone as a present. From then on, I experienced firsthand a much better product and haven’t even thought of switching phone, if not to upgrade my iPhone (usually every 4 years).

- Apple’s installed base makes its newer and growing service business unique. In fact, being a hardware manufacturer leads to a one-of-a-kind control on the services monetizing the hardware. Meta (META) knows well what we are talking about.

- Though it seems from one version to the next of each product there is not much innovation, throughout these years Apple’s products have been improved a lot up to the point we start to understand how the Apple Watch could be a game-changer in healthcare. I like Apple’s approach to its products: they are released only when they can be perceived as the top. We will see if the Apple car will ever come to light, but we can bet that if it does, it will be a tough competitor for Tesla (TSLA) and other innovative carmakers.

- Apple has always been financially disciplined, unlike Google (GOOGL, GOOG) has been until recently. The way it manages stock-based-compensation is a clear example because the company is able to preserve its FCF.

- In addition to this fourth point, Apple has a clear cash-management strategy it is pursuing. Companies such as Apple sit on a lot of idle cash. This is why Apple is targeting cash neutrality, meaning it wants to have as much cash as debt.

- To do this, Apple is returning a lot of cash through dividends and, most importantly, huge buybacks of about $90 billion per year, as of late. Many investors believe that, once Apple will reach cash neutrality it will significantly reduce buybacks. I have written an article where I show why I think this won’t happen (Apple: Why Buybacks Won’t Stop Once It Reaches Cash Neutrality) trying to imagine how much FCF Apple will generate by then.

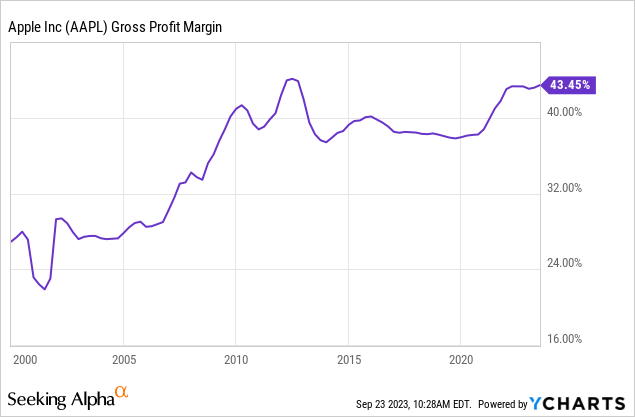

- Though the largest company in the market and though it is a mature company, Apple’s growth rate keeps on being forecasted around 8-10%. This is top-line growth. In the meantime, Apple’s margins have generally been growing. As Apple enters the fintech space and grows its services there, too, it is reasonable to expect higher margins down the road, in line with the overall trend shown below.

The Category Apple Belongs To

Clearly, Apple belongs to big tech. Its industry is technology, no doubt. And yet, the more I look at Apple, the more I come to consider it as a different type of company.

It is a breed of its own because it can be seen as a consumer defensive stock and a luxury stock at the same time.

Let me explain why.

To me, the best consumer defensive company I know of is Costco (COST). Consumer defensive companies produce and/or distribute consumer staples. These are goods consumers will have to buy out of necessity, regardless of economic conditions. Because of this, investors usually bid up consumer staples multiples given their stability in earnings. In particular, these multiples go up during time of uncertainties or when recessions are looming on the horizon. Now, I dare say Apple is a consumer defensive company too. In fact, as Warren Buffett said, people would rather give up a second car than their iPhone. The iPhone, in particular, has become a good consumers want to have. Actually, as far as I see it, it is not that inappropriate to see that consumers even crave the iPhone.

But the paradox lies here: the iPhone is a top tier product among smartphones. In its category, it is a luxury item and it is priced accordingly. The same is true for iPads, Macs, AirPods and the rest of Apple product lineup. Apple doesn’t throw out a product unless it can be at the vertex of its category. Therefore, Apple enjoys premiums margins, just like luxury goods producers do. I have come to understanding Apple as a luxury manufacturer through my research on Ferrari (RACE). Part of the strategy between the two companies is similar and it is what makes both of them belong to luxury: they sell only top tier products.

Just like Costco, Apple is relying more and more on subscriptions. Costco attracts customers by selling goods almost at cost. Apple attracts customers in another way and in this it is more similar to Ferrari. It sells premium goods that make their owners feel good because they have purchased the best and most expensive available product.

Apple leverages its installed based as it is monetizing it more and more. In other words, Apple considers its sold devices not only as product sales revenue, but also as the key to earn more money from its users during the device lifetime. This is why Apple has started breaking down its revenue between products and services. And, guess what, while product revenue from time to time stagnates, services revenue goes up, just like we saw in the 3Q report. Products net sales decreased from $63.3 billion in 3Q 2022 to $60.6 billion this year (-4.3%). At the same time, services grew from $19.6 billion to $21.2 billion (+8.2%).

Seeking recurrent revenue

Back in March 2022, Bloomberg reported that Apple is working on a hardware subscription service for the iPhone which would not be equal to the full price split over 24 months, but that would really offer a new way of becoming an iPhone user. However, while this news is promising, we don’t have enough data to make a forecast of the positive impact if will have on Apple.

Now, in 2016, the average Apple user was estimated to pay $1 per day for hardware and services. According to Katy Huberty, an Apple analyst, in 2022 the average user spent $280 per year on Apple hardware and an additional $69 on services.

According to the analyst Woodring, Apple users will spend in a few years $2 per day on Apple products or services. At the end of Q3 2023, Apple reported 1 billion paid subscriptions. This means that Apple will see a daily revenue of at least $2 billion, which leads to an annual revenue of $730 billion only from subscriptions, compared to the $394 billion in total sales the company reported for FY 2022.

Are investors pricing a 2x in sales in a few years? Apple trades at a price/sales ratio of 7. It means Apple’s sales for the next seven years should equal today’s market cap. Assuming sales will stay flat at $400 billion, we have exactly $2.8 trillion in 7 years, which is the current market cap. Therefore, on a price/sales ratio, Apple will only need to increase by a couple of percentage points its top-line and today’s price will seem cheap.

Valuation

Apple has had a nice run this year, with the stock moving all the way from the $120s to almost $200 before it retraced in the $170s.

What I want to do here is to show why I am not at all concerned with today’s valuation, which I actually think to be fair, if not still a bit cheap. I plan on holding Apple for many decades and possibly hand over my holding to my children.

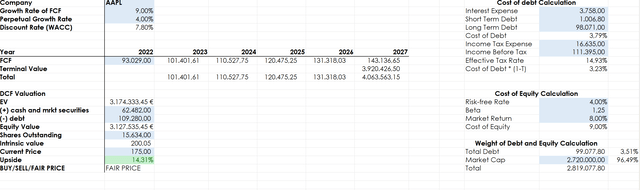

I ran two different DCF models. The first one focuses on the next five years.

Author, with estimates and TTM data from SA

Forecasting a FCF growth around 9% and discounting it at 7.80% (Apple’s WACC is calculated to be 8.80% but I took off one percentage point to award the company a premium), I actually happen to find Apple’s fair price at $200, which gives us already a nice $25 upside (14%). I usually consider a range of +/- 15 percentage points to be the fair price range.

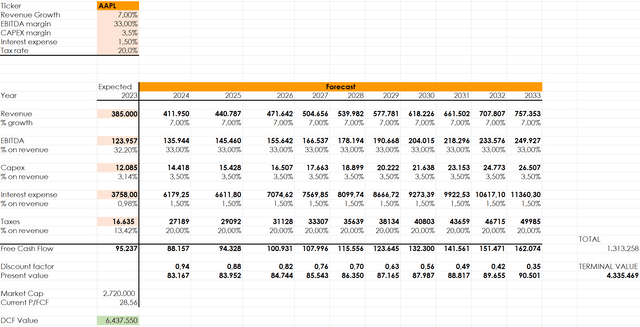

But let’s zoom out and try to look at what could happen over the next ten years. Here I start from the top-line and then calculate the EBITDA. From here I subtract capex, interest expenses and taxes to get a rough estimate of the generated free cash flow.

I stayed a bit more conservative and assumed a 7% revenue growth. Estimates are usually above this. I also chose to keep EBITDA margins flat at 33%, even though Apple should see its margins widen as its service business picks up speed. Even on the tax rate I have exceeded because Apple is usually able to pay well below 20%.

Author

In any case, let’s look at some numbers and see if they are really concerning. Apple currently has a $2.7 trillion market cap. In the next decade it should generated at least $1.3 trillion in free cash flow. If we add in the terminal value (forecasted FCF of 2034 / discount rate – perpetual growth rate) we have a DCF value of almost $6.5 trillion. I am not kidding when I do believe Apple can reach this market cap within the decade. I actually believe we will see even better numbers than the ones in this model as Apple over the long-term usually overdelivers.

Conclusion

Can Apple 2x once again? Yes. Will it happen soon? Maybe not. Will Apple over the long-term generate an enormous amount of FCF? Yes. Is this really at risk? Not particularly. Is there a specific reason to worry about Apple’s business and its trajectory? I don’t see any substantial weakness in the company. Is there a real threat to Apple’s brand appeal and its dominance? No.

There are times when much buzz is made around a stock. People will sell it out of fear and it will probably be Apple itself that will buy those shares from them.

Patience is key in investing. Being invested in Apple requires some patience to let it compound year after year. As for me, I think Apple will do just fine and I am actually considering this new dip as another opportunity to buy a few more shares.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.