Summary:

- In this article, I start by discussing the implications of the just-announced OPEC production cuts.

- Exxon Mobil’s long-term bull case just got stronger. Supply will remain subdued, yet its own ability to boost output is strong, providing fertile ground for higher shareholder distributions.

- As bullish as I am, I suggest investors wait for share price weakness before buying/adding Exxon shares. The short-term negative implications of the cut cannot be underestimated.

grynold/iStock via Getty Images

Introduction

I wasn’t planning on writing this article. However, thanks to OPEC’s surprise oil production cut announcement, it’s time to update my bull case of Exxon Mobil (NYSE:XOM), my single-largest oil investment, which I bought dirt-cheap in 2020.

Not only is OPEC playing political games, but it is also cutting production with oil prices trading at elevated levels. The cartel is paving the road for a sustainable oil price rally in triple-digit price territory the moment global demand expectations bottom. After all, we’re still in an economic downturn.

Hence, in this article, I will walk you through this decision, explain why this amplifies an already large supply shock, and why it’s so great for my/our Exxon dividends and buybacks.

So, let’s get to it!

They Did It. They Cut Production

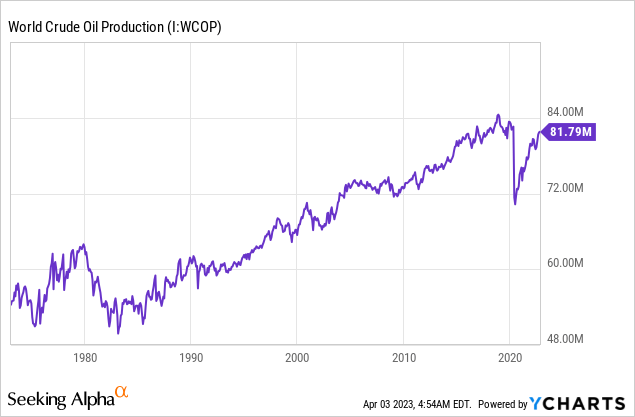

On Sunday, April 3, OPEC decided to cut production. While economic turmoil, in general, warrants lower oil price production, we’re now in a different situation. As I wrote in a just-released article on oil giant Diamondback Energy (FANG), global oil supply growth has flatlined.

While the world is NOT running out of oil, production growth has weakened. Especially in the United States, unconventional oil basins are running out of high-quality reserves, making it more expensive to increase production.

For example, major producers are running out of good wells to drill.

Oil production from the best 10% of wells drilled in the Delaware portion of the Permian was 15% lower last year, on average, than top 2017 wells, according to data from analytics firm FLOW Partners LLC. Meanwhile, the average well put out 6% less oil than the prior year, according to an analysis of data from analytics firm Novi Labs.

Especially in a time when progressive governments want to pressure oil and gas companies, there is almost no reason why oil companies would want to work overtime to boost production only to make it more likely that (temporary) declines in demand can cause oil prices to implode as we witnessed in 2015 and 2020.

Now, OPEC is making this situation even tougher. OPEC+ announced a production cut of more than one million barrels per day, abandoning previous assurances that it would hold supply steady.

Saudi Arabia alone pledged to reduce output by 500 thousand barrels per day, followed by Kuwait, the UAE, and Algeria.

Gary Ross, a former oil consultant who now works as a hedge fund manager at Black Gold Investors LLC, noted that OPEC+ is taking proactive measures to increase prices and free them from the grip of macro sentiment.

Starting next month, the cuts made by OPEC+ will result in a reduction of about 1.1 million barrels of crude oil per day. This figure will rise to 1.6 million barrels a day from July due to the extension of Russia’s existing supply reduction. It’s worth noting that Russia originally decided to lower production in March as a response to western sanctions resulting from its invasion of Ukraine.

While I have been a huge oil bull since 2020, I am not rooting for any of this to happen. The only reason why I buy oil equities is to protect myself. Prolonged high inflation is toxic for the entire economy (well, except for oil).

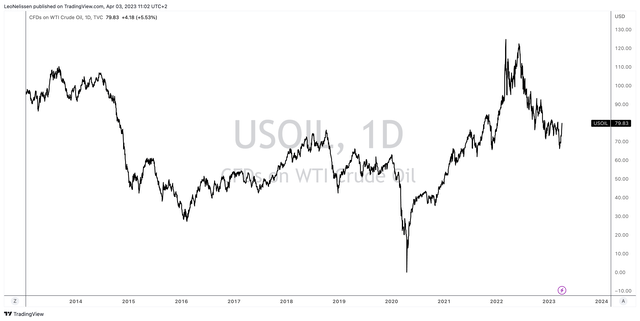

Right now, WTI is trading at $80. That is above its 2018 peak. In other words, while prices have come down a lot since the Ukraine invasion, we’re still at elevated levels.

Again, while it does make sense to cut output in an environment of rapidly slowing economic growth (and banking woes), we’re witnessing a political game.

OPEC+ knows that the United States is losing its power to boost output. OPEC cuts have a huge impact on prices. Cutting 1.1% of global supply is a big deal.

As brought to my attention by Joseph Wang, Saudi Arabia seemed to be irritated that the Biden administration ruled out buying crude oil to replenish strategic petroleum reserves. Bear in mind that the Biden admin drained these reserves to lower oil prices going into last year’s Midterm elections (that, too, was a political play).

Financial Times (via Joseph Wang)

These cuts are also a huge middle finger to the Federal Reserve, which is already in a tricky situation. The Fed needs to fight both inflation and slowing economic growth. By cutting oil production, it gets another structural headwind that it cannot combat by hiking rates – at least not without seriously hurting economic growth.

Here are some comments from major sell-side organizations (as reported by Bloomberg).

This, combined with the extension of the Russian production cuts, led the Wall Street giant to raise its Brent oil forecast to $95 a barrel for December this year from $90 earlier, and to $100 for December 2024 from $95.

Unlike during the previous OPEC+ cut in October, the momentum for global oil demand is positive amid a strong recovery in China and resilient refining margins, Goldman added. – Goldman Sachs

“Any unexpected 1 million barrel per day change in supply or demand conditions over the course of a year can impact prices between $20 and $25 per barrel,” said Francisco Blanch, head of commodity and derivatives research at Bank of America.

“OPEC is no longer afraid of a major US shale oil supply response if Brent crude oil prices trade above $80 per barrel, so cutting volumes to push oil prices higher does not carry the same risks it did five years ago,” he said. – Bank of America

“OPEC+ resumed its recently-abandoned decision to become the ‘central bankers’ of oil,” Citi analysts including Ed Morse and Francesco Martoccia said. – Citigroup

Why This Matters

We already discussed the obvious. Production cuts in a situation of tight supply are bullish. This is a political decision to hurt the United States. While we can debate the motives behind this move, it makes more sense to just deal with what we can influence – instead of speculating about things we may not find out anyway.

While I am a long-term bull, this isn’t as bullish as one might expect. At least not in the mid-term. As Goldman Sachs commodities trader Michael Kao wrote:

Oil DEMAND is notoriously INELASTIC in the short-term, but if spot prices stay high for an extended period of time – ESPECIALLY AT A TIME WHEN GLOBAL TIGHTENING IS CAUSING AGGREGATE DEMAND DESTRUCTION FOR ALL GOODS AND SERVICES – behavioral changes and substitution effects can cause longer-term DEMAND ELASTICITY.

It is highly likely that these developments will cause oil prices to fall somewhere down the road. I’m sorry if that sounds vague, so let me explain what I mean by that.

By making sure that oil prices remain elevated, OPEC puts even more pressure on demand and the Fed. The Fed is likely to remain hawkish while consumers and companies reduce demand. This increases the odds that the Fed breaks something.

This could create a situation where oil prices fall in the next few months.

However, OPEC is in the higher-for-longer camp. The bigger picture is still bullish, as supply growth isn’t likely to improve. Even if demand weakens further, OPEC is more likely to keep cutting. Once demand bounces back, we have a situation of subdued supply and rising demand.

This is why I believe in a prolonged (albeit volatile) oil uptrend with a high likelihood of a prolonged period of triple-digit oil prices in the next few years.

It’s also the reason why I own Exxon.

Buying Juicy Exxon Dividends (And Buybacks!)

Between my dividend growth and trading portfolios, I have close to 20% energy exposure, which is a lot!

While it has done wonders for my income and capital gains in both 2021 and 2022, it has added significant volatility to my net worth. So, please bear that in mind before you invest a single dollar in oil stocks.

You need to be aware of what you’re buying. For example, while I expect most oil equities to rally along with oil in the years ahead, I know that I will continue to be subject to volatile (short-term) price declines.

The only reason why I decided to add volatility to my portfolio is that I like the long-term risk/reward and because my energy stocks come with good income. Due to tax reasons, I need to maintain a certain dividend yield. Buying energy allowed me to increase my average yield.

Not only that, but I expect my energy income to accelerate in the next few years, fueled by my oil thesis.

That’s why I own Exxon.

With a market cap of roughly $450 billion, Exxon is North America’s largest oil producer.

Not only that, but Exxon benefits from a number of factors.

- The long-term imbalance between oil supply and demand. This was just amplified by OPEC+.

- Structural benefits in its massive downstream business.

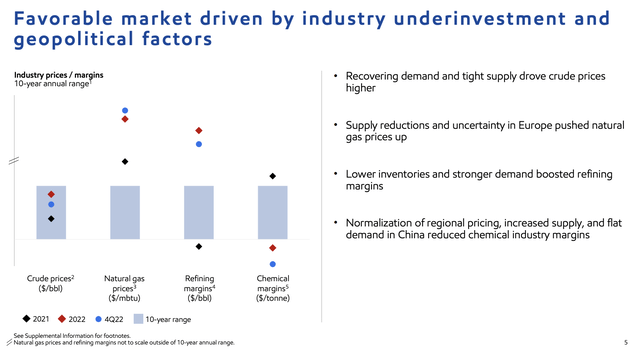

Last year, the company achieved the biggest gain in its refining margins in its long history, supported by rising demand and subdued supply growth.

Two weeks ago, Exxon commissioned the $2 billion refinery expansion at its Beaumont refinery in Texas. This expansion effectively boosted potential production by 396K barrels per day at a time when global supply remains an issue.

This is what Exxon CEO Darren Woods said in January:

I think more fundamental to refining is the shortness and with the economies picking up and with China coming out of its COVID lockdown and the economic growth there and then the view that you take on the economic impacts and how severe recessions are here this year, that’s probably going to play a much bigger role.

If demand picks up, economies continue to grow, we’re going to see that tightness manifests itself and continued higher refining margins, which I think will mean a fairly high margins this year and potentially going into 2024 as well.

Moreover, the company, which achieved a 25% return on capital employed in 2022, is aiming to boost crude oil production in the years ahead.

By 2027, the supermajor is expected to boost production by 2.2 million barrels per day, which is a huge deal. Growth is expected to be driven by its Guyana assets and the Permian Basin in the United States, which is one of the few basins capable of providing growth with somewhat subdued CapEx requirements.

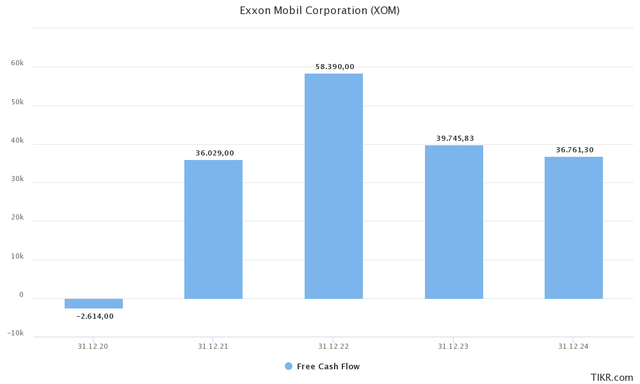

In other words, thanks to higher output and secular tailwinds in both upstream and downstream operations, the company is expected to generate $40 billion in free cash flow this year. In 2024 that number is expected to come in close to $37 billion. I believe that the company will beat these two numbers by a wide margin. Thanks to low leverage, the company is expected to distribute most of it to shareholders.

So, what do these numbers mean? $40 billion in free cash flow is roughly 9% of its market cap. This means that the company could pay a 9% dividend yield or buy back 9% of its shares this year (assuming estimates are right) without borrowing a single penny.

Needless to say, that won’t happen. However, it puts things into perspective.

The most important thing is that Exxon isn’t just capable of distributing cash, but it’s actually doing it. Last year, the company distributed $30 billion in cash. $15 billion via dividends and $15 billion via buybacks.

Moreover, the company has a $35 billion buyback program for 2023 and 2024, which will end up buying back close to 8% of shares outstanding (based on current prices).

With that said, the current dividend is $0.91 per share per quarter. This translates to $3.64 per year or 3.3% per share.

On October 28, the dividend was hiked by 3%. The five-year average annual dividend growth rate is 3.1%, which is very low.

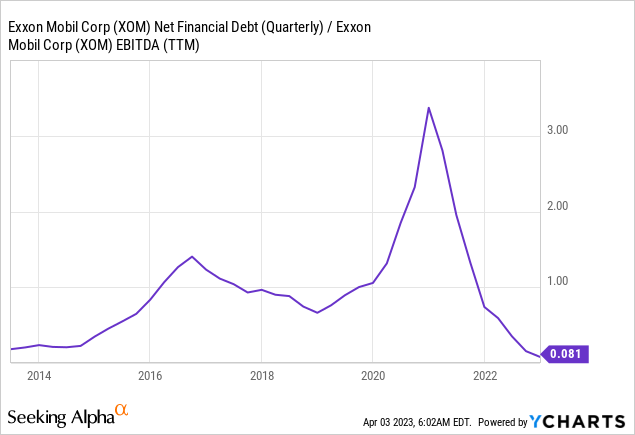

However, we need to bear in mind that Exxon did NOT cut its dividend in 2020 when the pandemic caused oil prices and refining demand to implode. It resulted in a steep increase in leverage (as visualized below). Since then, the company has reduced its debt. The company now has a net leverage ratio of roughly zero. This year, the company is on track to end up with more cash than gross debt.

In other words, the company is in an even better spot to hike its dividend going forward. Needless to say, we also need to be aware that this Exxon dividend isn’t a variable dividend. Boosting it every time oil prices are up would mean that the likelihood of dividend cuts increases too. Hence, gradual hikes are a much smarter play. After all, Exxon investors buy Exxon for its reliable dividend. There are plenty of other stocks where investors can go for sky-high dividends that will end up being cut the moment oil prices decline.

It also helps that Exxon is attractively valued.

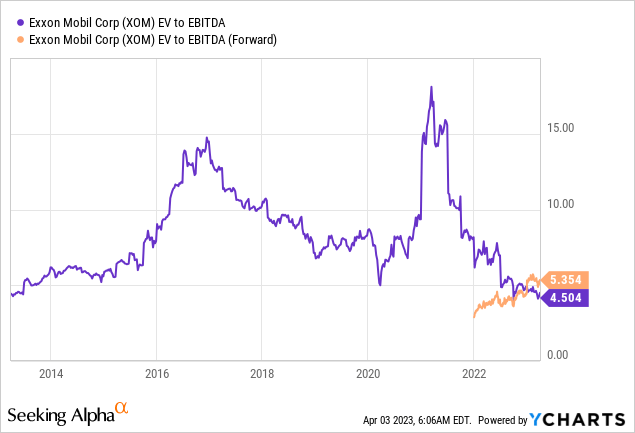

The company is trading at 5.4x NTM EBITDA, which is below a fair valuation of 7x EBITDA (according to my assessment).

Based on this context, here’s my takeaway.

Takeaway

OPEC cut production. This cut came unexpectedly, as most market participants are aware of the tight supply situation. This clearly is a political game, as it puts tremendous pressure on an already weakening global economy and the Federal Reserve, which will likely have to be more aggressive – despite the rising odds that something in the economy might break.

Hence, my long-term oil bull case is strengthened. I believe that once demand improves, we’re in for a steep oil price increase to triple digits, with a high likelihood of long-term elevated prices.

This is fantastic news for Exxon, as it has completely repaired its balance sheet, has efficient operations, and has the ability to grow output. Hence, I expect dividend growth to accelerate, boosted by even higher buybacks in the years ahead.

The stock remains undervalued and on track to rise to $150-$170 in the two to three years ahead.

However, I do not suggest that investors jump right in. The current situation isn’t very bullish in the SHORT TERM. By pressuring the Fed and further weakening demand, we’re in a situation where we could encounter severe economic weakness in the months ahead. That will likely keep oil from breaking out.

So, despite an expected rally in oil stocks, my suggestion is to buy Exxon (and its peers) on weakness only.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of XOM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Not financial advice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.