Summary:

- OPEN’s underwhelming FQ3’24 guidance has triggered its stock underperformance compared to its peers/wider market, despite the potential tailwinds from the Fed’s recent pivot.

- Even so, the US average mortgage rates have been moderating, with RDFN already reporting a +68% MoM in mortgage-rate locks by September 23, 2024.

- Combined with the higher mortgage-purchase applications, we believe that OPEN may generate a robust FY2025 performance, if not earlier by FQ4’24.

- Even so, with the iBuying company already reporting expensive inventory levels in FQ2’24 and guiding impacted adj EBITDA margins in FQ3’24, its reversal is likely to be prolonged indeed.

- While OPEN may be trading very attractively with robust support levels at $2s, the speculative stock is only suitable for investors with higher risk tolerance and long-term investing trajectory.

John M Lund Photography Inc

OPEN’s iBuying Investment Thesis Remains Compelling, Thanks To Its Overly Discounted Valuations

We previously covered Opendoor Technologies (NASDAQ:OPEN) in July 2024, discussing why we had reiterated our speculative Buy rating, with market sentiments likely to lift as the inflation cooled and the Fed potentially pivoting by September 2024.

With 2025 likely to bring forth higher home transactions and improved top/bottom-line performances, we believed that the stock remained a Buy for value and growth-oriented investors looking to buy the dip while riding the great upside potential.

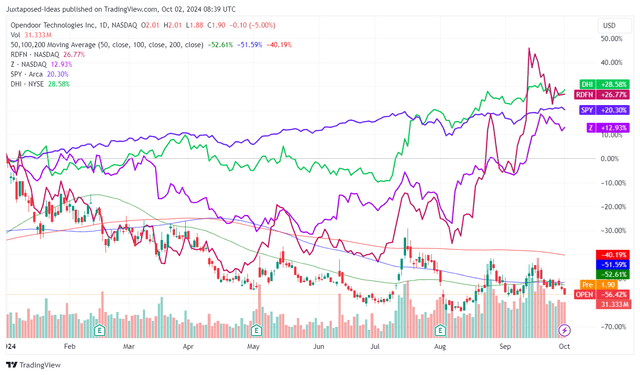

OPEN YTD Stock Price

Since then, OPEN has underperformed expectations as it traded sideways at $1s and $2s, with it seemingly left behind by the exuberant market sentiments after the Fed pivots by 50 basis points.

With the stock being the outlier compared to the recovery observed in its real estate service/home builder peers, it appears that the market needs much more convincing surrounding its intermediate-term prospects, despite the moderating borrowing cost.

For context, Realtor.com has previously reported that a third of the surveyed Americans are more likely to buy homes once mortgage rates fall below 5%, drastically improved compared to the 22% reported at below 6%.

By the time of writing, the 30Y Fixed Rate Mortgage Average in the US has already moderated to 6.08% by September 26, 2024, and the 15Y rate to 5.16%, down drastically from the peak of 7.79% and 7.03% observed on October 26, 2023, respectively.

This development may also be why the online real estate brokerage company, Redfin (RDFN), has reported a tremendous increase in mortgage-rate locks by +68% MoM on September 23, 2024.

This is on top of the mortgage-purchase applications also up by +10% MoM, as RDFN’s Homebuyer Demand Index (a measure of tours and other buying services from Redfin agents) rose drastically to the “highest level since May during the week ending September 22, 2024.”

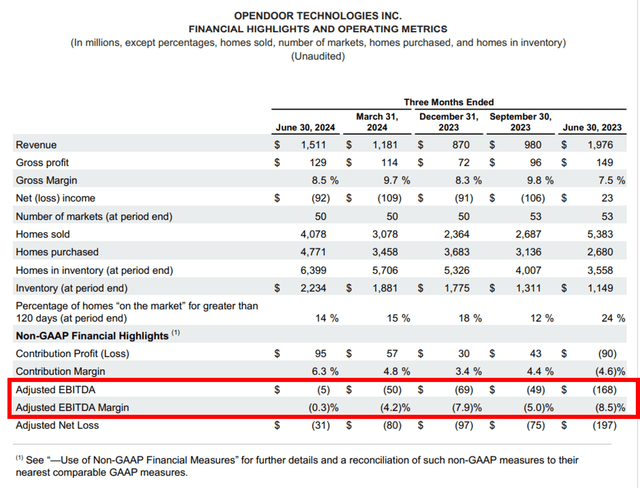

These developments may also be why we urge investors to look beyond OPEN’s supposedly underwhelming FQ3’24 guidance, with revenues of $1.25B at the midpoint (-16.6% QoQ/+27.5% YoY), contribution profit of $40M (-57.8% QoQ/-6.9% YoY), and adj EBITDA margins of -5.2% (-5.5 points QoQ/+3 YoY).

This is because FY2025 is likely to bring forth improved numbers, assuming that the residential real estate market continues to recover from September 2024 levels and the Fed embarks on a sustained rate normalization over the next few quarters.

This may be significantly aided by the iBuying company’s aggressive geographical expansions across most US states by the latest quarter while tapping into its partner agents to diversify its customer outreach through direct market listing (against selling to the iBuying platform).

On the other hand, it appears that OPEN may have also gotten way ahead of itself, based on the rather aggressive inventory levels at a higher average price of $349.11K per home in the latest quarter (+5.9% QoQ/+6.7% YoY).

This is based on FQ2’24 inventory values of $2.23B (+18.6% QoQ/+95.6% YoY) and 6.39K homes (+12.1% QoQ/+80% YoY) on the balance sheet.

While we remain optimistic about the demand recovery for residential real estate markets once the borrowing costs normalize, it is uncertain how profitable OPEN may be moving forward.

This is attributed to the narrower profit spread of 16.2% (-5.5 points MoM/-2.8 YoY) to the US Existing Home Median Sales Prices of $416.7K (-1.1% MoM/+3% YoY) by August 2024.

OPEN’s Performance Metrics

This development implies that OPEN may continue to report a mixed near-term financial/stock price performance before its bottom lines meaningfully improve, as observed in the projected sequential deterioration in its adj EBITDA margins in FQ3’24, compared to the sustained improvements observed over the past few quarters.

The Consensus Forward Estimates

This may also be why the consensus forward estimates remain mixed, with OPEN unlikely to generate any break even in FY2025 despite the projected double-digit growths in its top lines.

So, Is OPEN Stock A Buy, Sell, Or Hold?

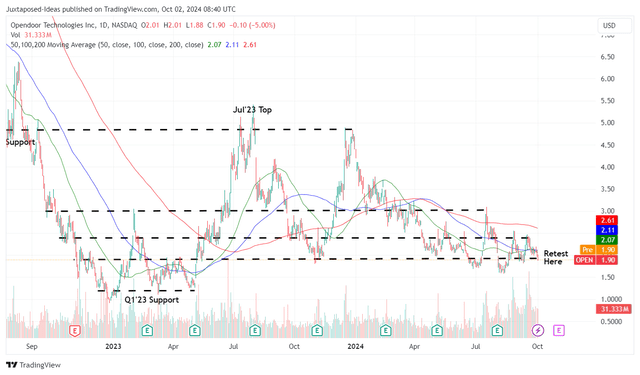

OPEN 2Y Stock Price

These developments may also be why OPEN has not been able to sustain its upward momentum thus far, as the stock continues to trade sideways below its 50/100/200-day moving averages.

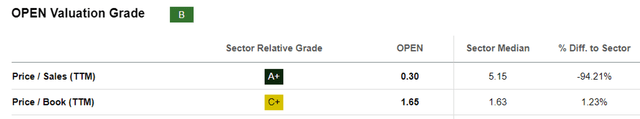

OPEN Valuations

Despite so, OPEN remains extremely cheap at TTM Price/Sales valuations of 0.30x, especially since the iBuying company is expected to record an accelerated topline growth at a CAGR of +32.6% between H1’24 annualized levels of $5.38B and the consensus FY2026 revenue estimates of $9.46B.

Even when compared to RDFN at TTM Price/Sales valuations of 1.46x, Zillow (Z) at 6.99x, and the sector median at 5.15x, it is undeniable that OPEN is compelling at current levels, with it offering interested investors with an expanded upside potential upon the reversal in its bottom-lines and market sentiments.

Based on the market capitalization of $1.41B and the consensus FY2026 revenue estimates of $9.46B, OPEN is even more compelling at an estimated FWD Price/Sales valuation of 0.14x.

Combined with the well-supported levels at $2 (albeit at penny stock levels), we believe that the bottom is already here – with it triggering an improved margin of safety for those looking to add.

As a result of its overly discounted investment thesis, we are maintaining our Buy rating for the OPEN stock here.

Risk Warning

It goes without saying that OPEN is only suitable for investors with a long-term investing trajectory, since its eventual reversal in profitability may only occur by the second half of the decade.

This implies that the stock is likely to remain volatile at penny stock levels, significantly worsened by the high short interest of 15.6% by the time of writing, up from the 13.7% observed at the start of the year and 12.6% a year ago.

At the same time, with OPEN unlikely to generate any Free Cash Flow profitability in the near term, we may also see its cash position on the balance sheet deteriorate from the $809M reported in the latest quarter (-18.2% QoQ/-24.2% YoY).

This development suggests its uncertain near-term prospects during the supposed residential real estate boom in 2025/2026, with the management likely to rely on expensive debts/asset-backed borrowings/revolving credit facilities during the ongoing cash burn.

As a result, we urge investors to size their portfolios accordingly, since OPEN is only suitable for those with a higher risk tolerance.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.